Surgical Apparel Market Size 2024-2028

The surgical apparel market size is forecast to increase by USD 2.3 billion, at a CAGR of 11.5% between 2023 and 2028.

- The market is characterized by three key drivers and challenges that significantly influence its dynamics. Firstly, stringent government regulations continue to shape the market landscape, ensuring the production and use of compliant surgical apparel to maintain patient safety and hygiene. Secondly, the growing distribution through various channels, including e-commerce platforms and specialized medical stores, broadens the reach of surgical apparel, catering to a wider customer base. Lastly, the fluctuating raw material prices pose a significant challenge for manufacturers, requiring them to maintain a delicate balance between costs and quality to remain competitive.

- Companies seeking to capitalize on market opportunities must stay updated with regulatory requirements and adapt to evolving distribution channels while managing the volatility of raw material prices. Effective supply chain management and strategic partnerships can help mitigate these challenges and ensure long-term success in the market.

What will be the Size of the Surgical Apparel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping its growth across various sectors. Surgical shoe covers and sizing solutions cater to infection control and ergonomic considerations, ensuring optimal comfort and functionality for healthcare professionals. Durability remains a crucial factor, with surgical apparel undergoing rigorous testing to meet AAMI standards for gown materials and labeling. Comfort is a key concern, with latex-free surgical gloves and breathable fabrics enhancing wearer experience. Infection control gowns, disposable surgical caps, and fluid-resistant gowns are essential components of sterile drape systems, protecting both patients and healthcare providers. Surgical apparel construction, including pockets, seams, and closures, is meticulously designed to optimize functionality and ease of use.

Surgical gown designs and patterns cater to diverse needs, with sterilization methods and regulations ensuring the highest standards of safety. Surgical apparel weight, fit, and drape length are essential factors, balancing protection, comfort, and ease of movement. Surgical mask filtration and bouffant caps provide additional layers of protection, ensuring a comprehensive approach to infection control. The ongoing development of surgical apparel continues to unfold, with innovation in materials, design, and functionality driving growth in this evolving market. Regulations and standards ensure that these advancements prioritize safety, comfort, and infection control, making surgical apparel a vital component of the healthcare industry.

How is this Surgical Apparel Industry segmented?

The surgical apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Disposable

- Reusable

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Type Insights

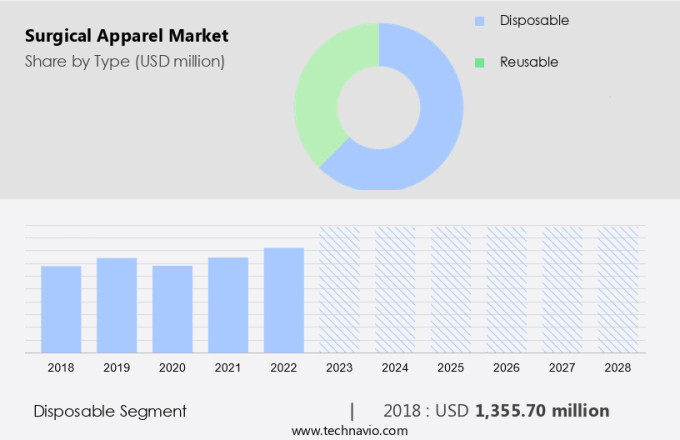

The disposable segment is estimated to witness significant growth during the forecast period.

Disposable surgical apparel, including shoe covers, sized gowns, and gloves, plays a crucial role in infection control during medical procedures in the US. The market for these products is driven by the increasing healthcare expenditure, which reached 17.3% of the GDP in 2022. Regulations from agencies like OSHA, Mine Safety and Health Administration, and the Bureau of Labor Statistics ensure the safety and health of workers, leading to a higher demand for disposable surgical apparel. Surgical apparel comes in various forms, such as infection control gowns, surgical scrub suits, and fluid-resistant gowns, each with distinct features. These include durability, comfort, labeling, and pockets.

Materials like latex-free fabrics and sterilization-compatible materials are essential for these products. Regulations mandate specifications for gown design, seams, and closures to prevent contamination. Surgical apparel testing, drape length, and cuff length are essential factors in ensuring proper protection. Breathability, weight, and fit are critical for both patient and caregiver comfort. Sterile drape systems, disposable surgical caps, and bouffant caps provide additional barriers to infection. Infection control regulations dictate the use of specific apparel for various procedures, driving the market's growth. Surgical mask filtration and gown color are also essential considerations. Fluid-resistant gowns and disposable caps are standard in many healthcare settings.

The market for surgical apparel is continually evolving, with innovations in materials, design, and testing methods. The demand for disposable surgical apparel is expected to remain strong as healthcare systems prioritize infection control and employee safety.

The Disposable segment was valued at USD 1.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

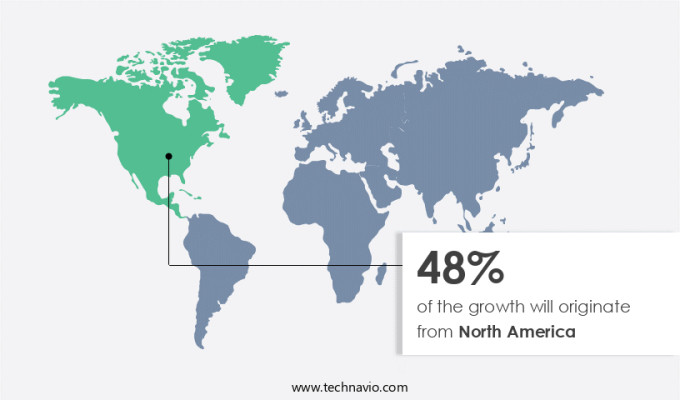

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the region's well-established healthcare infrastructure, high volume of surgeries, and stringent regulations for patient safety. The United States, in particular, dominates the market due to its advanced healthcare system, large number of hospitals and outpatient centers, and increasing surgical procedures, including elective surgeries and complex interventions. Chronic diseases and an aging population further fuel the demand for surgical apparel in North America. Key market players in the region include Cardinal Health, Medline Industries, and Ansell, which lead the market with a wide range of offerings, including surgical gowns, gloves, masks, and drapes.

Surgical apparel sizing and durability are essential considerations, with AAMI standards ensuring consistent quality and safety. Comfort is also a critical factor, with latex-free surgical gloves and a variety of surgical gown materials, colors, and constructions catering to diverse needs. Infection control gowns, sterile drape systems, and disposable surgical caps are also integral components of the market. Surgical apparel regulations, such as those related to surgical apparel length, cuffs, pockets, seams, and closures, are essential for maintaining a sterile environment during surgical procedures. Fluid-resistant gowns, breathability, and mask filtration are also essential features. Surgical gown design, sterilization, and the use of bouffant caps and protective apparel barriers further enhance the market's offerings.

The market is continuously evolving, with ongoing research and development focusing on improving surgical apparel functionality, comfort, and infection control capabilities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surgical Apparel Industry?

- Strict government regulations have emerged as the primary driving force in this market.

- In response to increasing workplace safety regulations, the demand for surgical apparel is gaining momentum. For instance, the Occupational Safety and Health Administration (OSHA) sets safety standards for various industries, including healthcare, mandating the use of appropriate protective gear in hazardous environments. Employers are required to select surgical apparel based on the tasks to be performed, conditions present, duration of use, and potential hazards. Key features of surgical apparel include breathability for comfort, filtration capabilities in surgical masks, secure closures, and ergonomic gown designs. These features ensure the protection of healthcare workers while allowing them to perform their duties efficiently.

- Moreover, surgical bouffant caps and protective apparel barriers provide an additional layer of protection against biohazards and other contaminants. Sterilization is another essential aspect of surgical apparel, ensuring the elimination of microorganisms and maintaining a clean environment. The importance of these features in surgical apparel is driving the market's growth, with a focus on continuous innovation to meet the evolving needs of the healthcare industry.

What are the market trends shaping the Surgical Apparel Industry?

- Professional trend in marketing: Growing a distribution presence through multiple channels is essential. This approach ensures expanded market reach.

- Surgical apparel, including gowns and shoe covers, is a critical component in healthcare settings for maintaining hygiene and infection control. Companies are expanding their distribution channels, selling surgical apparel through direct sales, online platforms, and retail stores. Online marketing enables companies to reach a larger audience and reduce operational costs. For instance, Amazon, IndiaMART, MedicalExpo, and Alibaba offer surgical apparel globally. DuPont de Nemours distributes its disposable surgical apparel via these e-commerce sites. Online retailers provide discounts and offers, increasing demand for surgical apparel purchases. Surgical apparel sizing and durability are essential factors for end-users. AAMI (Association for the Advancement of Medical Instrumentation) standards ensure the quality and safety of surgical gowns.

- Comfort is another crucial consideration, with latex-free surgical gloves and various gown materials catering to different user preferences. Proper labeling of surgical apparel is necessary for easy identification and efficient use. Companies prioritize these factors to meet the demands of healthcare professionals and maintain high customer satisfaction.

What challenges does the Surgical Apparel Industry face during its growth?

- The volatile pricing of raw materials used in the production of surgical apparels poses a significant challenge to the industry's growth trajectory.

- The market is subjected to fluctuating raw material prices, which pose a significant challenge for manufacturers. Surgical apparel, including gowns, masks, and scrub suits, are primarily made from materials like polypropylene, cotton, polyester, and latex. The prices of these raw materials can be volatile due to various factors such as supply chain disruptions, changes in production capacities, geopolitical tensions, and fluctuations in crude oil prices. These factors directly impact synthetic fibers like polypropylene, increasing production costs for manufacturers. In the highly competitive market, where pricing pressures are already high, these increased costs can squeeze profit margins.

- Smaller manufacturers may struggle to absorb these costs, potentially leading to product shortages or compromised quality to maintain competitive pricing. Surgical apparel construction plays a crucial role in ensuring effective infection control. Features such as pockets, length, cuffs, and drape are essential considerations in surgical apparel design. Fabric selection is another critical factor, with fabrics like polypropylene offering superior moisture-wicking properties and antimicrobial capabilities. However, the rising raw material prices can impact the availability and affordability of these advanced fabrics. Surgical apparel testing is a mandatory process to ensure product quality and safety. It includes various tests like bacterial filtration efficiency, fluid resistance, and tensile strength.

- These tests help ensure the surgical apparel meets the required standards for infection control and durability. Despite the importance of testing, the increasing production costs can lead to potential compromises, potentially risking patient safety.

Exclusive Customer Landscape

The surgical apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AD Surgical - This company specializes in providing surgical apparel, including a range of powder-free latex gloves in various sizes, adhering to industry standards for sterility.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AD Surgical

- Ansell Ltd.

- BATIST Medical AS

- Bellcross Industries Pvt. Ltd.

- Cardinal Health Inc.

- DuPont de Nemours Inc.

- Dynarex Corp.

- Exact Medical Manufacturing BV

- Foothills Industries of McDowell County Inc.

- Guardian

- Haywood Vocational Opportunities Inc.

- McKesson Corp.

- Medline Industries LP

- Molnlycke Health Care AB

- Owens and Minor Inc.

- Paul Hartmann AG

- Priontex

- Surya Textech

- Synergy Medical Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Surgical Apparel Market

- In January 2024, Stryker Corporation, a leading medical technology company, announced the launch of its new line of surgical apparel, the Stryker SafetyWear XT, featuring advanced antimicrobial technology to reduce bacterial contamination (Stryker Corporation Press Release, 2024).

- In March 2024, Twintex Group, a European textile manufacturer, entered into a strategic partnership with Medtronic, a global healthcare solutions company, to develop and supply sustainable, high-performance surgical fabrics for Medtronic's surgical apparel range (Medtronic Press Release, 2024).

- In May 2024, Halyard Health, a medical textiles company, completed the acquisition of Mölnlycke Health Care's surgical apparel business, expanding its product portfolio and market share in the surgical apparel sector (Halyard Health Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Medline Industries for its new line of surgical apparel, which includes gowns and scrubs made from a proprietary antimicrobial fabric, enhancing infection prevention in healthcare settings (Medline Industries Press Release, 2025).

Research Analyst Overview

- In the dynamic market, safety and ergonomics are paramount. Surgical apparel construction, encompassing both woven and non-woven materials, is continually evolving to meet these needs. Surgical apparel trends prioritize reusability and innovation, with manufacturers focusing on technology and textiles to enhance performance. Surgical apparel demands stringent safety guidelines and sterility assurance methods, influencing design, selection, and manufacturing processes. Surgical apparel requirements dictate rigorous standards for hygiene, packaging, and maintenance. Cost remains a significant factor, driving innovation in sustainable materials and reusable designs. Surgical apparel technology integrates advanced features for improved patient comfort and surgeon functionality.

- Surgical apparel trends emphasize ergonomics and technology, with a focus on non-woven materials for enhanced protection and ease of use. Manufacturers adhere to guidelines and standards, ensuring sterility and hygiene. Surgical apparel packaging and distribution methods prioritize convenience and efficiency. Surgical apparel innovation is transforming the industry, with a focus on sustainability, cost-effectiveness, and enhanced functionality. Manufacturers invest in research and development to create ergonomic designs and advanced textiles. Surgical apparel maintenance and laundering methods are also evolving to ensure optimal performance and longevity. Surgical apparel trends prioritize safety, ergonomics, and sustainability, with a focus on non-woven materials and advanced technology.

- Surgical apparel manufacturing processes adhere to strict guidelines and standards, ensuring hygiene and sterility. Surgical apparel performance is continually improving, with a focus on cost-effective and sustainable solutions. Surgical apparel trends reflect a growing emphasis on safety, ergonomics, and sustainability. Manufacturers are investing in innovative materials and technologies to meet these demands, while adhering to strict guidelines and standards for hygiene and sterility. Surgical apparel design and selection prioritize patient comfort and surgeon functionality, with a focus on non-woven materials and advanced textiles. Surgical apparel demand is driven by the need for safe, functional, and sustainable solutions.

- Manufacturers are responding with innovative designs and materials, focusing on ergonomics and technology to meet these demands. Surgical apparel cost remains a significant factor, driving investment in sustainable and reusable solutions. Surgical apparel trends are shaping the future of the industry, with a focus on safety, ergonomics, and sustainability. Manufacturers are investing in research and development to create advanced textiles and materials, while adhering to strict guidelines and standards for hygiene and sterility. Surgical apparel performance is continually improving, with a focus on cost-effective and sustainable solutions. Surgical apparel trends are transforming the industry, with a focus on safety, ergonomics, and sustainability.

- Manufacturers are investing in innovative materials and technologies to meet these demands, while adhering to strict guidelines and standards for hygiene and sterility. Surgical apparel design and selection prioritize patient comfort and surgeon functionality, with a focus on non-woven materials and advanced textiles. Surgical apparel trends reflect a growing emphasis on safety, ergonomics, and sustainability. Manufacturers are investing in research and development to create advanced textiles and materials, while adhering to strict guidelines and standards for hygiene and sterility. Surgical apparel performance is continually improving, with a focus on cost-effective and sustainable solutions. Surgical apparel trends are shaping the future of the industry, with a focus on safety, ergonomics, and sustainability.

- Surgical apparel trends are shaping the future of the industry, with a focus on safety, ergonomics, and sustainability. Manufacturers are investing in innovative materials and technologies to meet these demands, while adhering to strict guidelines and standards for hygiene and sterility. Surgical apparel design and selection prioritize patient comfort and surgeon functionality, with a focus on non-woven materials and advanced textiles. Surgical apparel trends are transforming the industry, with a focus on safety, ergonomics, and sustainability. Manufacturers are investing in research and development to create advanced textiles and materials, while adhering to strict guidelines and standards for hygiene and sterility.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surgical Apparel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2024-2028 |

USD 2296.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.1 |

|

Key countries |

US, Germany, Canada, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Apparel Market Research and Growth Report?

- CAGR of the Surgical Apparel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical apparel market growth of industry companies

We can help! Our analysts can customize this surgical apparel market research report to meet your requirements.