Surgical Microscope Market Size 2024-2028

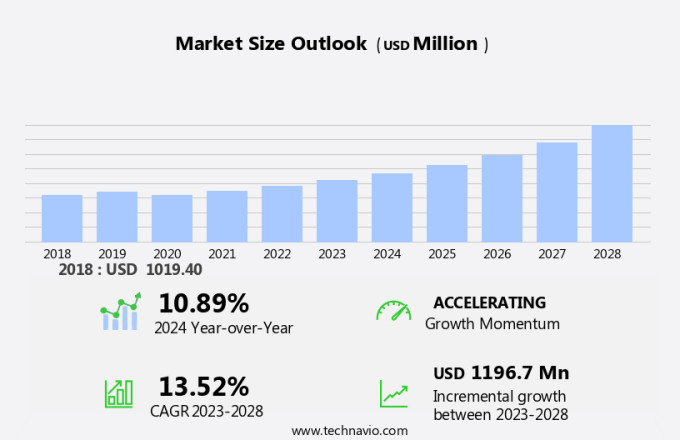

The surgical microscope market size is forecast to increase by USD 1.2 billion, at a CAGR of 13.52% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing number of cataract surgeries in ambulatory settings. The shift towards outpatient facilities for ophthalmic procedures is a key trend, as it offers cost savings and improved patient convenience. Additionally, the market is experiencing a surge in mergers and acquisitions among companies, reflecting the competitive landscape's consolidation. However, the market faces challenges, including the risk of burns caused by high-power illumination features in surgical microscopes.

- Manufacturers must address this issue by investing in advanced medical technologies to ensure user safety while maintaining the microscopes' efficacy and precision. To capitalize on market opportunities and navigate challenges effectively, companies should focus on innovation, strategic partnerships, and regulatory compliance.

What will be the Size of the Surgical Microscope Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Integration of micromanipulators enhances precision and control in minimally invasive surgeries. Ocular lenses offer improved depth of field, enabling surgeons to maintain a clear view during procedures. Stereo vision and LED illumination facilitate 3D imaging, enhancing the surgeon's perception of the surgical site. High-definition output, image stitching, and digital zoom provide enhanced visualization, while real-time imaging ensures immediate feedback. Coaxial illumination and image sensor work in unison to optimize lighting and image quality. Video recording systems enable documentation and analysis of surgical procedures.

Field of view and image processing technologies expand the scope of surgical interventions. Fluorescence imaging and focus adjustment offer enhanced visualization of tissue structures. Haptic feedback and ergonomic design ensure surgeon comfort and control. Remote control and foot pedal control add convenience and flexibility. Optical magnification and surgical navigation systems enable more accurate and precise interventions. Integrated cameras and microscope stands ensure a sterile environment and compatibility with various surgical instruments. The ongoing unfolding of these market activities shapes the surgical microscope landscape, offering new possibilities and opportunities for innovation.

How is this Surgical Microscope Industry segmented?

The surgical microscope industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Opthalmology

- Neurosurgery and spine surgery

- ENT

- Plastic and reconstructive surgeries

- Others

- End-user

- Hospitals

- ASCs

- Geography

- North America

- US

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

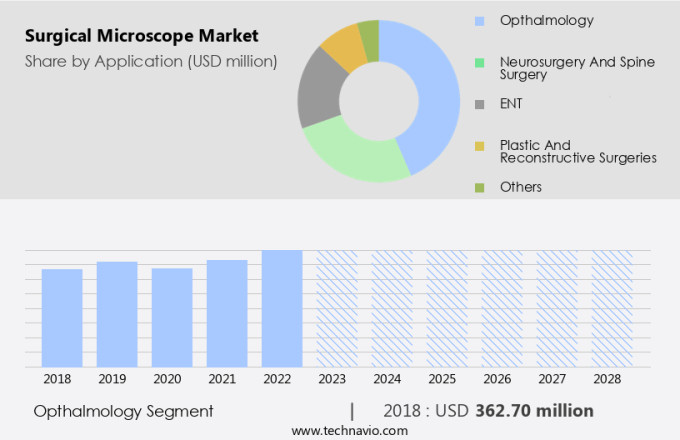

The opthalmology segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable growth, particularly in the ophthalmology segment, due to technological innovations revolutionizing healthcare services. Advanced features such as objective lenses, camera ports, depth of field, stereo vision, LED illumination, 3D imaging, zoom control, surgical illumination, haptic feedback, ergonomic design, remote control, high-definition output, image stitching, digital zoom, real-time imaging, endoscopic adapters, micromanipulator integration, ocular lenses, image resolution, coaxial illumination, image sensor, video recording system, field of view, image processing, fluorescence imaging, focus adjustment, foot pedal control, optical magnification, surgical navigation, integrated camera, microscope stand, and sterile environment compatibility are enhancing diagnostic precision and treatment effectiveness in ophthalmology.

The aging population, increasing awareness of eye diseases, and the prevalence of conditions like cataracts further fuel market expansion. According to the World Health Organization, approximately 2.2 billion people had near or distance vision impairments worldwide in 2023, with uncorrected refractive errors and cataracts being the primary causes.

The Opthalmology segment was valued at USD 362.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

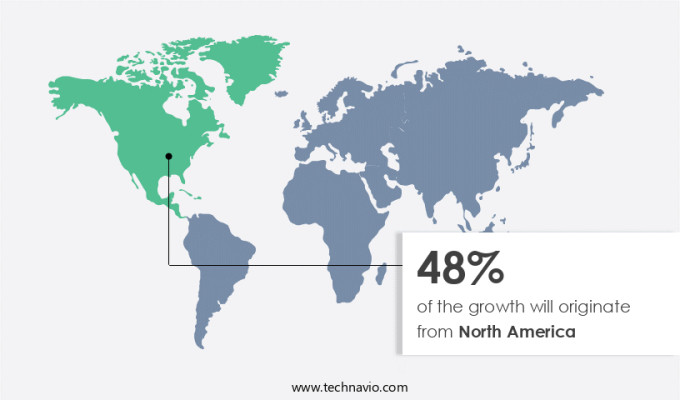

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with North America leading the way in 2023. Factors contributing to this expansion include the increasing number of new product launches, the growing presence of both regional and global companies, and substantial research funding from government and non-profit organizations. In the US, institutions like the National Institutes of Health (NIH) invest heavily in medical research, with around USD45 billion allocated in 2022. Advancements in technology are also propelling market growth. Surgical microscopes now incorporate features such as high-definition output, real-time imaging, and digital zoom, enhancing the overall surgical experience. Ergonomic designs, remote control, and haptic feedback ensure surgeon comfort and precision.

Integrated cameras, microscope stands, and sterile environment compatibility are essential for maintaining optimal surgical conditions. Moreover, the integration of advanced technologies like fluorescence imaging, surgical navigation, and micromanipulator systems is revolutionizing the field. Coaxial illumination, image processing, and image resolution are critical components that ensure clear and accurate visualization during surgical procedures. Endoscopic adapters and ocular lenses expand the microscope's versatility, making it an indispensable tool for various medical applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surgical Microscope Industry?

- The increasing prevalence of cataract surgeries being performed in ambulatory settings is the primary market driver. This trend is significant in the healthcare industry, as more patients opt for outpatient cataract procedures due to their convenience, cost-effectiveness, and improved post-surgical care. This shift towards ambulatory care is transforming the cataract surgery market landscape.

- The market is experiencing significant growth due to the increasing number of high-volume surgeries being performed in ambulatory settings. Cataract surgeries and tonsillectomies are among the most common procedures carried out in these facilities. According to Organisation for Economic Co-operation and Development (OECD) data from 2023, over 94% of cataract surgeries and 40% of tonsillectomies in OECD countries are conducted in ambulatory surgery centers (ASCs). This trend is driven by the convenience and cost-effectiveness of same-day surgeries. Advancements in surgical microscope technology have also contributed to the market's growth. Objective lenses with high magnification capabilities, camera ports for image capture, and LED illumination systems provide superior depth of field and stereo vision for enhanced 3D imaging during surgeries.

- Zoom control features offer surgeons greater precision and flexibility during procedures. Surgical illumination systems provide optimal lighting conditions for clear visualization, ensuring harmonious and immersive surgical environments. These factors have emphasized the importance of surgical microscopes in modern surgical practices.

What are the market trends shaping the Surgical Microscope Industry?

- Market trends indicate an escalating number of mergers and acquisitions among companies. This trend is a reflection of the dynamic business landscape, as companies continually seek strategic growth opportunities.

- The market is experiencing significant growth due to strategic mergers and acquisitions among companies. These business strategies enable companies to expand their distribution channels and enhance their product offerings. For instance, in June 2023, Olympus Corp acquired Odin Vision to advance AI-driven diagnosis and treatment for chronic diseases, utilizing surgical microscopes to improve medical specialties like endoscopy. Similarly, in April 2022, Carl Zeiss acquired Kogent Surgical, LLC and Katalyst Surgical, LLC, manufacturers of surgical instruments, to strengthen its position as a solution provider in the market. Advancements in technology are also driving market growth.

- For example, haptic feedback, ergonomic design, remote control, high-definition output, image stitching, digital zoom, real-time imaging, and endoscopic adapters are becoming increasingly popular features in surgical microscopes. These features improve surgical precision, enhance the surgeon's experience, and provide better patient outcomes. Moreover, the integration of advanced technologies like augmented reality and virtual reality in surgical microscopes is expected to revolutionize the field of minimally invasive surgeries. These technologies provide surgeons with a more immersive and harmonious surgical environment, enabling them to perform complex procedures with greater ease and accuracy. In conclusion, the market is poised for significant growth due to strategic mergers and acquisitions and technological advancements.

- Companies are focusing on improving their product portfolios and distribution channels to cater to the increasing demand for advanced surgical microscopes. The integration of advanced technologies like haptic feedback, ergonomic design, and augmented reality is expected to further drive market growth.

What challenges does the Surgical Microscope Industry face during its growth?

- The high-power illumination in surgical microscopes, which can cause burns, poses a significant challenge to the growth of the industry. This issue, arising from the intense light emission, necessitates continuous research and development efforts to ensure patient safety and advancements in surgical technology.

- Surgical microscopes are essential tools in various medical procedures, offering enhanced visualization for surgeons. However, they present challenges related to light management, specifically the risk of tissue burns and ocular surface damage. These issues are particularly relevant in lengthy surgeries, such as those in ENT, hand, and plastic surgery. Tissue burns can result from the intense light source required for clear visualization, which may lead to patient injury. Additionally, prolonged exposure to light can cause phototoxicity of the ocular surface and tear film, impairing ocular cell functionality. Despite advancements in light management features, including spot size and working distance, surgical microscopes continue to pose these risks, even with newer models.

- The integration of micromanipulators, high-definition ocular lenses, and advanced image resolution systems, such as coaxial illumination, image sensors, video recording systems, and image processing, have been implemented to improve surgical precision and visual clarity. These features can mitigate some of the challenges associated with surgical microscopes, but ongoing research and development efforts are necessary to further minimize risks and optimize patient safety.

Exclusive Customer Landscape

The surgical microscope market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical microscope market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical microscope market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACCU SCOPE Inc. - This company specializes in providing advanced surgical microscopes, including the ACCU SCOPE stereo microscope model, enhancing surgical precision and visual clarity for medical professionals worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCU SCOPE Inc.

- Alcon Inc.

- Alltion Instrument Co. Ltd.

- ARI Medical Technology Co. Ltd.

- BMS Microscopes b.v.

- Carl Zeiss AG

- Chammed Co. Ltd.

- Danaher Corp.

- Gem Optical Instruments Industries

- Global Surgical Corp.

- Huvitz Co. Ltd.

- Inami and Co. Ltd.

- Karl Kaps GmbH and Co. KG

- Metall Zug AG

- MITAKA KOHKI Co. Ltd.

- Olympus Corp.

- Seiler Instrument and Manufacturing Co. Inc.

- Synaptive Medical Inc.

- Takagi Seiko Co. Ltd.

- Topcon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Surgical Microscope Market

- In January 2024, Carl Zeiss Meditec AG, a leading player in the market, announced the launch of its new microscope model, M680 Surgical Microscope, featuring advanced imaging technology and ergonomic design (Carl Zeiss Meditec AG press release).

- In March 2024, Leica Microsystems, another key player, entered into a strategic partnership with a major hospital chain in Asia to provide customized microscope solutions, enhancing its market presence in the region (Leica Microsystems press release).

- In April 2024, KARL STORZ GmbH & Co. KG, a significant player, secured a major contract from a leading European hospital group to supply surgical microscopes and related equipment, expanding its customer base in Europe (KARL STORZ GmbH & Co. KG press release).

- In May 2025, Olympus Corporation, a prominent player, received regulatory approval from the US Food and Drug Administration (FDA) for its new surgical microscope model, OM-1000, featuring advanced imaging technology and enhanced ergonomics (Olympus Corporation press release).

Research Analyst Overview

- The market encompasses advanced imaging systems that enhance operator comfort and precision during surgical procedures. Key features include microscope accessories such as image stabilization, digital microscopy, and 3D visualization. These technologies enable surgeons to achieve superior image quality through advanced optics, brightness control, contrast adjustment, and HD video output. Integrated displays and fiber optics facilitate real-time image enhancement and video capture. Mobile microscopes offer flexibility in surgical workflows, while surgical imaging systems with ocular magnification and surgical visualization provide unparalleled precision.

- Lighting intensity and lens magnification are crucial factors in ensuring optimal surgical conditions. Surgical microscopes with advanced optics and integrated display systems streamline the surgical process, contributing to the market's growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surgical Microscope Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.52% |

|

Market growth 2024-2028 |

USD 1196.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.89 |

|

Key countries |

US, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Microscope Market Research and Growth Report?

- CAGR of the Surgical Microscope industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical microscope market growth of industry companies

We can help! Our analysts can customize this surgical microscope market research report to meet your requirements.