Sustainable Fabrics Market Size 2025-2029

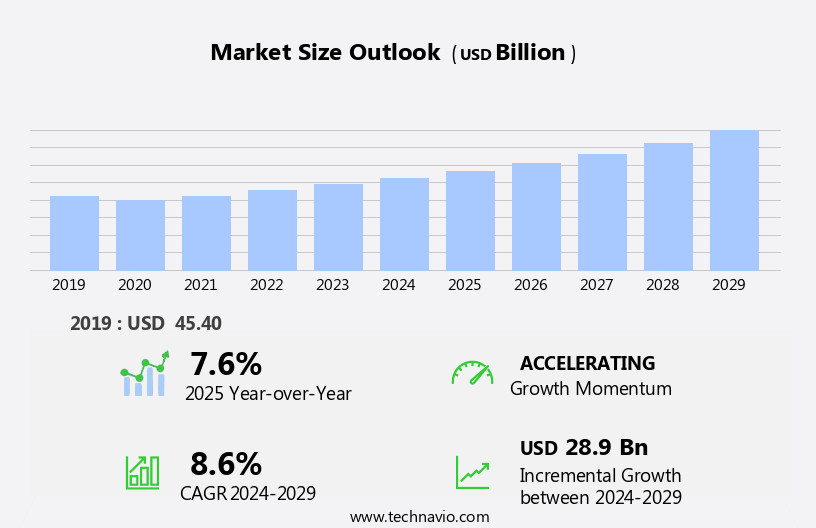

The sustainable fabrics market size is forecast to increase by USD 28.9 billion, at a CAGR of 8.6% between 2024 and 2029.

- The market is driven by the surging demand for eco-friendly textiles, particularly in medical textiles, where the use of sustainable fabrics is crucial for patient safety and environmental consciousness. This trend is fueled by the increasing awareness of the negative impact of conventional textiles on the environment and human health. However, the high costs associated with sustainable fabrics pose a significant challenge for market growth. These fabrics, often made from biodegradable and natural fibers, require substantial resources and energy to produce, resulting in higher production costs.

- Companies seeking to capitalize on this market must navigate these cost challenges through innovative production methods and strategic partnerships. Additionally, collaboration with stakeholders across the value chain, from raw material suppliers to retailers, can help reduce costs and improve sustainability. Overall, the market presents a compelling opportunity for businesses committed to creating eco-friendly textiles that meet the growing demand for sustainable solutions.

What will be the Size of the Sustainable Fabrics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 in the full report Request Free Sample

The market continues to evolve, driven by increasing consumer awareness and demand for eco-friendly textiles. Fabric certification schemes, such as GOTS and Oeko-Tex, ensure ethical sourcing and production processes. Energy efficiency is a key focus, with innovations in dyeing processes and finishing treatments reducing water footprints. Vegan leather and plant-based fibers are gaining popularity, while technical textiles, including performance fabrics and medical textiles, offer solutions for various sectors. Upcycled materials and closed-loop systems are integral to the circular economy, reducing textile waste. Recycled polyester and mechanical recycling are essential for minimizing carbon footprints. Fiber modification, including antimicrobial properties and moisture wicking, enhances fabric performance.

Industrial textiles, automotive textiles, and home furnishings all benefit from these sustainable advancements. The market's ongoing dynamism is reflected in the development of new applications, such as smart fabrics and flame retardant fabrics, as well as advancements in textile waste management and water conservation. The integration of ethical sourcing, recycled materials, and sustainable production methods continues to shape the market.

How is this Sustainable Fabrics Industry segmented?

The sustainable fabrics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

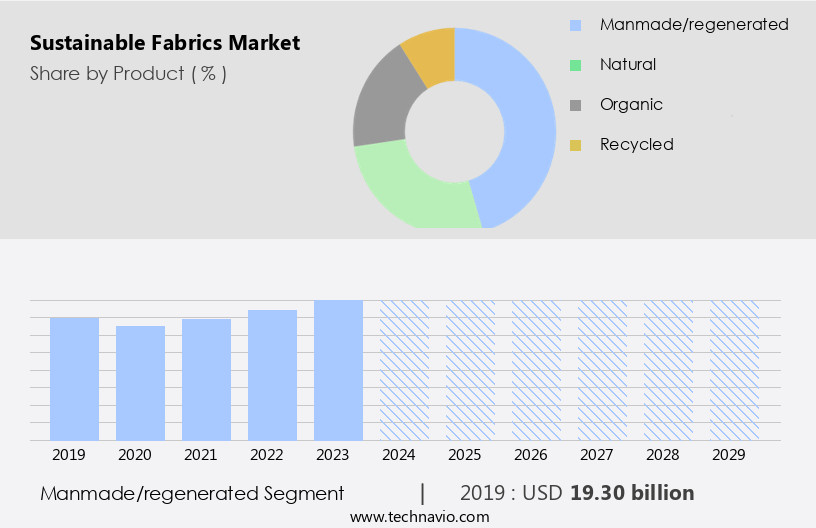

- Product

- Manmade/regenerated

- Natural

- Organic

- Recycled

- Application

- Textiles/apparel

- Household and furnishing

- Medical

- Others

- Distribution Channel

- Indirect channel

- Direct channel

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The manmade/regenerated segment is estimated to witness significant growth during the forecast period.

The textile industry is evolving to address environmental concerns, with a focus on sustainable fabrics. Recycled nylon, derived from post-consumer waste, is gaining popularity for its reduced carbon footprint. Supply chain transparency is essential, and companies are disclosing their sourcing practices to ensure ethical and sustainable production. Bio-based materials, such as regenerated fibers from plant cellulose, offer softness and infinite recyclability. Dyeing processes are being optimized for water conservation, while antimicrobial properties are integrated to reduce chemical use. Technical textiles, including flame retardant fabrics, are being manufactured with closed-loop systems to minimize waste. Plant-based fibers, like organic cotton, are certified under fair trade and energy-efficient production methods.

Performance fabrics, such as vegan leather and upcycled materials, are being used in home furnishings, automotive textiles, and medical textiles. Fiber modification and chemical recycling are key to reducing the industry's water footprint and carbon emissions. Smart fabrics with moisture wicking and UV protection are also in demand, as are industrial textiles for their durability and quality control. The circular economy is driving innovation in textile manufacturing, with a focus on product lifecycle assessment and textile waste management.

The Manmade/regenerated segment was valued at USD 19.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

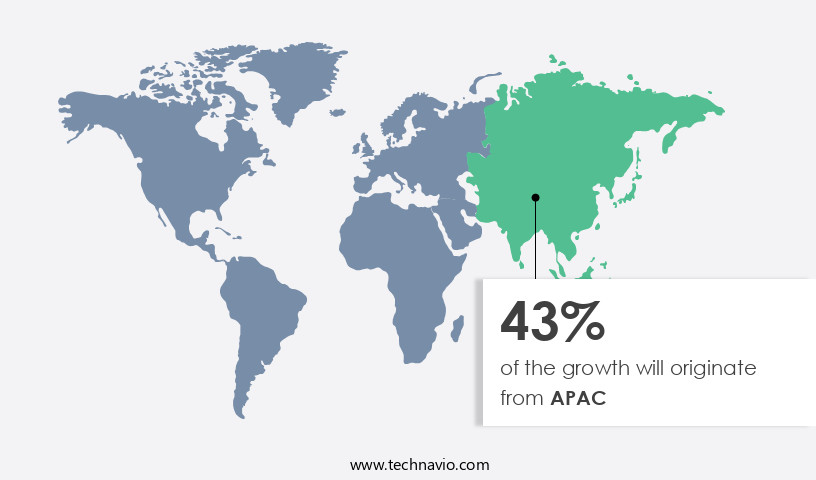

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, which accounted for the largest market share in 2024. Consumers and businesses in APAC are increasingly conscious of the environment, leading to a higher demand for sustainable textiles manufacturing and fabrics. The fashion and apparel industry in APAC, being one of the largest in the world, is a significant contributor to this trend. Sustainable fabrics, including recycled nylon, bio-based materials, and upcycled textiles, are gaining popularity due to their eco-friendly and ethical production methods. Textile manufacturing in APAC, with India being a major hub, is focusing on the development of sustainable fabrics.

These include flame retardant fabrics, leather alternatives, and technical textiles, which offer antimicrobial properties, moisture wicking, and UV protection. Closed-loop systems and mechanical recycling are being adopted to reduce textile waste and promote a circular economy. Bio-based fibers, such as organic cotton, are being used to minimize the carbon footprint of textile production. Finishing treatments, such as fair trade certifications and energy efficiency, are also essential considerations in the production of sustainable fabrics. Performance fabrics, medical textiles, and automotive textiles are other sectors that are increasingly adopting sustainable fabrics due to their durability, functionality, and environmental benefits.

The use of recycled polyester and plant-based fibers in the production of sustainable fabrics is on the rise. Dyeing processes are being optimized to minimize water usage and reduce the environmental impact. Smart fabrics, with features like product lifecycle assessment and quality control, are also gaining traction in the market. Overall, the market is evolving to meet the growing demand for eco-friendly and ethical textiles and fabrics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as consumers become increasingly conscious of the environmental impact of their clothing choices. This shift towards eco-friendly textiles is driving innovation in the industry, with manufacturers exploring a range of sustainable fabric options. These include organic cotton, hemp fiber , linen, bamboo, Tencel, and recycled polyester. Each fabric offers unique benefits, such as biodegradability, reduced water usage, and lower carbon footprints. Sustainable fabrics are also gaining popularity for their durability and comfort. Brands are investing in research and development to improve production processes and reduce waste. Consumers are responding positively, with demand for sustainable fabrics driving market growth. The future of the market looks bright, as it aligns with consumer values and addresses environmental concerns.

What are the key market drivers leading to the rise in the adoption of Sustainable Fabrics Industry?

- The significant demand for sustainable fabrics is a primary factor fueling market growth in the medical textiles sector.

- Sustainable fabrics, derived from organic and natural fibers, have gained prominence in various industries due to their eco-friendliness and health benefits. In the healthcare sector, these fabrics are preferred over synthetic materials due to their reduced likelihood of causing allergies or skin sensitivity, which can be attributed to the absence of harsh finishing treatments. The healthcare industry generates substantial waste, particularly from single-use textile products like surgical gowns and drapes. Sustainable fabrics, such as organic cotton, hemp, and bamboo, are cultivated using minimal pesticides and chemical fertilizers, thereby contributing to decreased environmental pollution and ecosystem harm. Furthermore, the adoption of sustainable fabrics with biodegradable or compostable properties can significantly reduce the environmental impact of medical waste disposal.

- The automotive industry also utilizes sustainable fabrics, particularly in the production of automotive textiles, to minimize carbon footprint and promote a circular economy. Fiber modification techniques, including the use of plant-based fibers and leather alternatives, are increasingly popular in the fashion industry as well. Overall, the shift towards sustainable fabrics is a harmonious and immersive approach to reducing waste, preserving the environment, and promoting healthier alternatives.

What are the market trends shaping the Sustainable Fabrics Industry?

- The market is witnessing a growing demand for biodegradable and natural fibers due to increasing environmental consciousness. This trend is expected to continue as consumers seek sustainable alternatives to traditional fibers.

- The market is witnessing significant growth due to increasing consumer awareness and concern for the environmental impact of the textile industry. Natural and biodegradable fibers, such as organic cotton, hemp, and Tencel, are gaining popularity as eco-friendly alternatives to synthetic and non-biodegradable fibers. These fibers require fewer chemicals and pesticides in their production, which appeals to environmentally conscious consumers. Additionally, natural fibers are sourced from renewable resources, making them a sustainable choice for those concerned about resource depletion. Moreover, the use of fabric certification, energy efficiency, recycled polyester, upcycled materials, vegan leather, and medical textiles is on the rise.

- These trends prioritize ethical sourcing, textile waste management, and water conservation. For instance, recycled polyester is made from post-consumer plastic waste, reducing the need for new petroleum extraction. Upcycled materials are repurposed from pre-consumer waste, minimizing textile waste. Performance fabrics, which offer durability, moisture-wicking, and UV protection, are also gaining traction due to their versatility and sustainability. The integration of these trends in the textile industry is expected to drive market growth and cater to the evolving demands of consumers.

What challenges does the Sustainable Fabrics Industry face during its growth?

- The escalating costs linked to sustainable fabrics pose a significant challenge to the textile industry's growth trajectory.

- Sustainable fabrics, produced using eco-friendly and ethical methods, have gained prominence in the fashion and textiles industry despite their higher production costs. These methods encompass organic farming practices, water-efficient dyeing processes, and fair labor standards. The use of superior quality materials and advanced manufacturing techniques results in durable and long-lasting fabrics. However, the initial investment for sustainable fabrics can be substantial due to the increased cost of production. Moreover, the availability of sustainable materials can be limited, particularly when they are sourced from specific regions or produced in small quantities. This scarcity can further add to the expense.

- Sustainable fabrics offer various benefits, such as moisture wicking, UV protection, and smart fabric functionality. Product lifecycle assessments ensure that the environmental impact of these fabrics is minimized throughout their entire life cycle. Quality control measures are essential to maintain the integrity of sustainable fabrics and meet consumer expectations. Industrial textiles, including sustainable fabrics, are subject to rigorous testing and certification processes to ensure compliance with industry standards.

Exclusive Customer Landscape

The sustainable fabrics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sustainable fabrics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sustainable fabrics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anuprerna Artisan Alliance Pvt. Ltd. - The company specializes in eco-friendly textile solutions through its Bluesign brand. This initiative encompasses the production of sustainable fabrics utilizing responsible textile chemicals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anuprerna Artisan Alliance Pvt. Ltd.

- Bluesign Technologies AG

- China Bambro Textile Co. Ltd.

- Elevate Textiles Inc.

- Five P venture India Pvt. Ltd.

- Hyosung TNC Corp.

- JCraftEco

- Lenzing AG

- Lululemon Athletica Inc.

- Mittal Traders

- Modern Crew

- MycoWorks

- Net Paradigm India Pvt. Ltd.

- Rawganique USA

- Shanghai Tenbro Bamboo Textile Co. Ltd.

- Siyaram Silk Mills Ltd.

- Symphony Fabrics

- Teijin Ltd.

- The Yarn Guru India Inc.

- Vivify Textiles

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sustainable Fabrics Market

- In January 2024, Patagonia, a leading outdoor clothing company, announced the launch of its new line of 100% renewable synthetic insulation, made from plant-based materials, marking a significant stride in sustainable fabric innovation (Patagonia Press Release).

- In March 2024, Adidas and Stella McCartney, two major fashion brands, joined forces to expand their partnership, focusing on creating more sustainable fabrics and reducing their carbon footprint (Adidas Press Release).

- In April 2025, Lululemon Athletica, the Canadian-origin athletic apparel company, raised USD300 million in a senior secured notes offering to invest in research and development of sustainable fabrics and expand its production capacity (Lululemon Securities Filing).

- In May 2025, the European Union passed the Sustainable Textiles Regulation, which sets strict rules for the use of hazardous chemicals in textiles and mandates a 40% reduction in greenhouse gas emissions by 2030, driving the demand for sustainable fabrics in the region (European Parliament Press Release).

Research Analyst Overview

- The market is experiencing significant activity and trends, driven by consumer demand for eco-friendly textiles. Water treatment and energy saving technologies are key focus areas, with innovations in water recycling and solar-powered manufacturing gaining traction. Digital printing and sublimation printing are popular techniques for reducing water usage and waste in the production process. Abrasion resistance and durability testing are crucial for ensuring the longevity of sustainable fabrics, while brand awareness and fiber analysis are essential for textile innovation. Sewing techniques and garment construction are also undergoing advancements to minimize waste and improve sustainability standards. Recycling technologies and textile design are at the forefront of the industry, with a focus on pilling resistance, colorfastness testing, and fabric finishing techniques.

- Sustainability standards and life cycle assessment are critical factors in raw material sourcing and environmental impact assessment. Supply chain management and textile testing are essential for maintaining transparency and ensuring compliance with sustainability regulations. Embellishment techniques and printing methods, such as screen printing and heat transfer, are also evolving to become more sustainable. Overall, the market is dynamic and innovative, with a strong focus on reducing waste, improving energy efficiency, and enhancing fabric strength.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sustainable Fabrics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.6% |

|

Market growth 2025-2029 |

USD 28.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, China, Japan, India, UK, Germany, Canada, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sustainable Fabrics Market Research and Growth Report?

- CAGR of the Sustainable Fabrics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sustainable fabrics market growth of industry companies

We can help! Our analysts can customize this sustainable fabrics market research report to meet your requirements.