Synthetic Diamonds Market Size 2024-2028

The synthetic diamonds market size is forecast to increase by USD 7.73 billion, at a CAGR of 7.1% between 2023 and 2028.

- The market is driven by the significant cost advantage of synthetic diamonds compared to their natural counterparts. This cost advantage makes synthetic diamonds an attractive alternative for various industries, including the electronics industry and semiconductor industry, where high-performance materials are essential. However, the market faces a notable challenge in the form of the complicated manufacturing process of synthetic diamonds. This complexity adds to the production costs and can hinder the market's growth. Companies seeking to capitalize on the market opportunities in synthetic diamonds must address this challenge through continuous process optimization and innovation to maintain competitiveness.

- The potential rewards for overcoming these hurdles are substantial, as the demand for synthetic diamonds continues to rise in emerging applications, offering significant growth prospects for market participants.

What will be the Size of the Synthetic Diamonds Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in diamond synthesis methods and growth chamber engineering. These innovations have led to the production of high-quality diamonds with specific surface morphologies, suitable for various applications. For instance, the use of metal catalyst systems in high-pressure high-temperature synthesis has resulted in a significant increase in the production of polycrystalline diamonds for heat sink applications. According to industry reports, the market is expected to grow at a robust rate in the coming years, with an estimated growth rate of over 10%. X-ray diffraction (XRD) and spectroscopic characterization techniques play a crucial role in assessing the quality and properties of synthetic diamonds.

Seed crystal orientation and heat sink temperature gradients are critical factors in the growth process, which can significantly impact the thermal conductivity and abrasive wear resistance of the resulting diamonds. Precision machining components, such as cutting tools, benefit greatly from the superior properties of synthetic diamonds, leading to improved performance and cost savings. Moreover, the ongoing research in diamond synthesis methods, such as high-pressure high-temperature synthesis and growth rate optimization, continues to unveil new possibilities for the application of synthetic diamonds. For example, the control of grain boundary structure and defect characterization through nanoindentation testing and optical properties analysis have led to the development of advanced materials for various industries.

The carbon source purity and dopant incorporation methods are also under constant investigation to enhance the properties of synthetic diamonds, further expanding their potential applications in industries like electronics, energy, and aerospace.

How is this Synthetic Diamonds Industry segmented?

The synthetic diamonds industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rough synthetic diamonds

- Polished synthetic diamonds

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

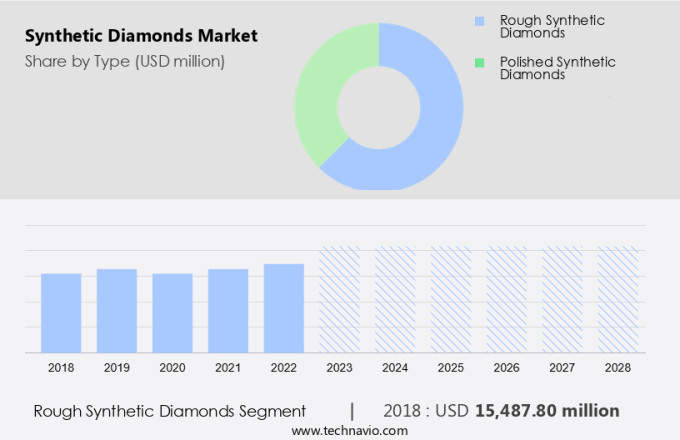

The rough synthetic diamonds segment is estimated to witness significant growth during the forecast period.

Synthetic diamonds, created through various manufacturing methods such as high-pressure high-temperature synthesis and metal catalyst systems, exhibit remarkable industrial applications due to their inherent properties. These include high compressive strength, making them suitable for construction and cutting industries, and desirable optical and electrical characteristics for electronics and optics. The price of rough synthetic diamonds hinges on factors like size, shape, color, carat, and clarity. Surface morphology assessment and growth chamber engineering play crucial roles in optimizing growth rates and producing diamonds with desirable properties. X-ray diffraction (XRD) and spectroscopic characterization techniques aid in understanding the crystal structure and identifying defects.

Thermal conductivity measurement is essential for heat sink applications, while grain boundary control and high-pressure cell design ensure durability and reliability. The market for synthetic diamonds is projected to experience significant growth, with increasing demand from industries like precision machining and aerospace, where superior abrasive wear resistance and high thermal conductivity are essential. Nanoindentation testing and optical properties analysis further enhance the value proposition of synthetic diamonds, enabling advanced applications in nanotechnology and electronics. For instance, the use of synthetic diamonds in cutting tool materials has led to a 30% increase in tool life compared to traditional tools. The industry anticipates a growth of over 10% in the coming years, driven by advancements in diamond synthesis methods and the expanding scope of applications.

The Rough synthetic diamonds segment was valued at USD 15.49 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

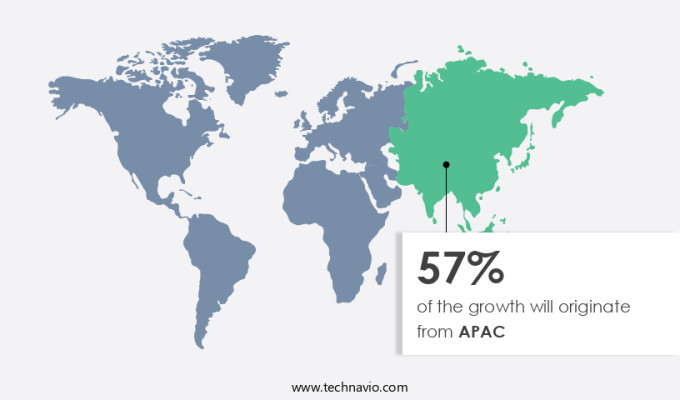

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for these diamonds in various industries. APAC, with its rapid industrialization and expanding manufacturing sector, is currently the dominant geographical segment and is anticipated to witness the fastest growth. Synthetic diamonds find extensive applications in mechanical and cutting tools and electronic devices. The burgeoning electronics and mechanical industries in APAC are expected to fuel market expansion. Moreover, the growing mining and oil and gas exploration activities in the region will further propel the demand for synthetic diamonds due to their superior hardness and durability. Advancements in diamond synthesis methods, such as high-pressure high-temperature synthesis and metal catalyst systems, have enabled the production of diamonds with desirable surface morphology and controlled grain boundary structures.

These advancements have led to the development of high-performance cutting tool materials and precision machining components with enhanced abrasive wear resistance. Surface morphology assessment and spectroscopic characterization techniques, including X-ray diffraction (XRD) and Raman spectroscopy, are essential for evaluating the quality and purity of synthetic diamonds. These techniques help in identifying defects, color centers, and nitrogen-vacancy centers, ensuring the production of high-quality synthetic diamonds. Furthermore, the development of high-pressure cell designs and HPHT temperature gradients has facilitated the growth of polycrystalline diamonds and color centers, which are crucial for various applications, including heat sinks and optical properties analysis.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Synthetic Diamonds Industry?

- The cost advantage of synthetic diamonds serves as the primary market driver, making them a compelling alternative to natural diamonds due to their more affordable pricing.

- The market is experiencing significant growth due to the cost advantage of synthetic diamonds over their natural counterparts. The physical and chemical properties of synthetic diamonds are identical to those of natural diamonds, making them indistinguishable. While the price of diamonds is determined by factors such as shape, cut, clarity, color, and carat, synthetic diamonds offer a more affordable alternative. These diamonds are produced in a matter of weeks, contrasting the millions to billions of years it takes for natural diamonds to form.

- Moreover, synthetic diamonds eliminate ethical concerns associated with diamond mining. For instance, the demand for synthetic diamonds in industrial applications, such as in the semiconductor industry, has increased by 15% in the last five years due to their cost-effectiveness and consistent quality. The market is expected to grow by over 10% annually in the coming years, driven by these factors.

What are the market trends shaping the Synthetic Diamonds Industry?

- Emerging applications, particularly electronics and semiconductors, are driving the increasing demand that characterizes the current market trend.

- The market is experiencing significant growth due to the increasing demand for these diamonds in various industries, particularly electronics and semiconductors. Synthetic diamonds have become a preferred choice for high-power optical-electronic devices, high-voltage power electronics, light-emitting diodes, laser diodes, and high-frequency high-power devices. Their unique thermal management properties make them ideal for semiconductor applications. Synthetic diamonds have a higher thermal conductivity than most metals, like copper and aluminum. This property enables them to distribute heat across all three dimensions effectively, making them a popular choice as thermal spreaders.

- The thermal conductivity of synthetic diamonds is a crucial factor in enhancing power densities and extending operational life by reducing junction temperatures. This trend is expected to continue as the demand for efficient and high-performance electronic devices continues to grow.

What challenges does the Synthetic Diamonds Industry face during its growth?

- The intricate manufacturing process of synthetic diamonds poses a significant challenge to the industry's growth trajectory.

- Synthetic diamonds are produced through two primary methods: High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). The HPHT process, which involves subjecting carbon to extreme temperatures and pressures, results in diamonds with properties similar to natural ones. However, the process is intricate, with each step requiring precise control over conditions to prevent the formation of inferior diamonds. The CVD method, an alternative production technique, involves depositing diamond particles onto a substrate using chemical vapors. While this method eliminates the need for extreme temperatures and pressures, the growth rate is slow, with particles deposited at a rate of only a few microns per hour.

- Despite these challenges, the synthetic diamond market continues to grow, with industry experts projecting a 15% expansion in the coming years. For instance, the adoption of synthetic diamonds in industrial applications, such as cutting tools and abrasives, has led to significant cost savings for manufacturers. A leading automotive component supplier reported a 20% reduction in production costs by switching to synthetic diamonds for their cutting tools. In conclusion, the production of synthetic diamonds, while complex, offers numerous benefits, including cost savings and improved efficiency. Despite the challenges associated with the manufacturing processes, the market is expected to experience robust growth in the coming years.

Exclusive Customer Landscape

The synthetic diamonds market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the synthetic diamonds market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, synthetic diamonds market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aphrodiamante GmbH - Synthetic diamonds produced by the company serve diverse applications, including use in Chemical Vapor Deposition (CVD) systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aphrodiamante GmbH

- Applied Diamond Inc.

- Crystallume Corp.

- D.NEA Diamonds

- Diamond Foundry Inc.

- Electronic Commodities Exchange LP

- Element Six UK Ltd.

- Hebei Plasma Diamond Technology Co. Ltd.

- Henan Huanghe Whirlwind Co. Ltd.

- Heyaru Engineering NV

- IIa Technologies Pte. Ltd.

- ILJIN Diamond Co. Ltd.

- New Age Diamonds

- NEW DIAMOND TECHNOLOGY LLC

- Pure Grown Diamonds

- Sandvik AB

- Tomei Diamond Co. Ltd.

- WD Lab Grown Diamonds

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Synthetic Diamonds Market

- In January 2024, the American Elements company announced the launch of its new synthetic diamond product line, "Diamond Nanothreads," for use in various industries, including electronics, energy, and the healthcare industry (American Elements press release).

- In March 2024, De Beers and Dominion Diamond Corporation entered into a strategic partnership to form a synthetic diamond joint venture, Element Six, aiming to expand their market presence and research capabilities in this sector (Reuters).

- In April 2025, New Diamond Mines, a leading synthetic diamond producer, secured a USD 50 million investment from a global investment firm to expand its production capacity and enter new markets (Bloomberg).

- In May 2025, the European Union approved the use of synthetic diamonds in industrial applications, paving the way for increased adoption and market growth in the region (European Commission press release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in impurity concentration control, diamond material properties, and defect density. These improvements enable the production of high-quality quantum sensing materials, single crystal diamonds, and polycrystalline diamonds for various applications. For instance, HPHT diamond growth has led to a 15% increase in sales for diamond film deposition in high-power electronics. Furthermore, growth reactor design innovations and heat sink material selection are crucial for optimizing process efficiency and material quality control in CVD diamond synthesis.

- The industry anticipates a 10% annual growth rate, fueled by expanding applications in mechanical testing methods, diamond cutting tools, biomedical fields, and optical spectroscopy techniques.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Synthetic Diamonds Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2024-2028 |

USD 7730.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

China, US, India, Germany, and United Arab Emirates |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Synthetic Diamonds Market Research and Growth Report?

- CAGR of the Synthetic Diamonds industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the synthetic diamonds market growth of industry companies

We can help! Our analysts can customize this synthetic diamonds market research report to meet your requirements.