System-On-Chip Market Size 2024-2028

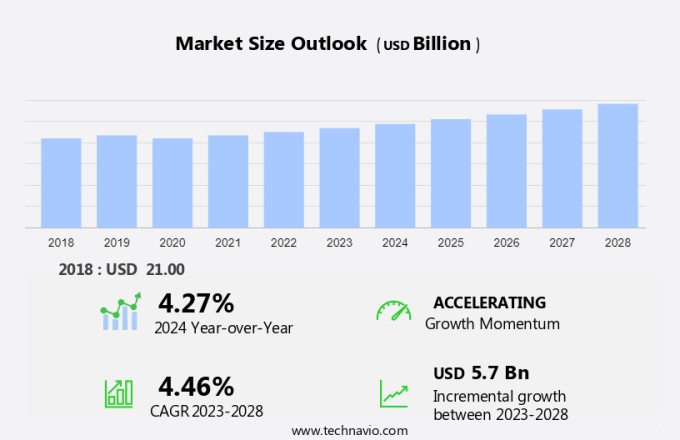

The system-on-chip market size is forecast to increase by USD 5.7 billion at a CAGR of 4.46% between 2023 and 2028. The system-on-chip (SoC) market is experiencing significant growth due to the increasing demand for power-efficient and cost-effective solutions for computing activities, signal processing, and wireless communication. Key trends include the integration of advanced processor technologies to reduce energy waste, the rise of 5G technology and the Internet of Things (IoT) driving increased investments, and the reliance of SoC companies on IP core providers. Power consumption and efficiency remain critical concerns, with the need for continuous innovation to meet the demands of AI and computing activities. As the market continues to evolve, the focus on reducing costs and improving performance will remain a top priority.

What will be the Size of the Market During the Forecast Period?

The market encompasses integrated circuits that contain all essential components of a computer or other digital system on a single chip. These components include Digital, Analog, Mixed signal, Radio frequency, CPU, System memory, Peripheral controllers, GPUs, Specialized neural networks, Radio modems, Multi-chip systems, and Power management systems. SoCs are utilized in various applications such as IT, telecommunication, laptops, Macs, iPads, database management, fraud detection systems, cybersecurity, and more. Power consumption and efficiency are critical factors in the SoC market, as energy waste leads to increased costs. Processor types range from CPUs to GPUs, and advanced features like embedded graphics and signal processing enhance their functionality. The market is dynamic, with continual advancements in technology driving innovation in areas like energy efficiency, performance, and integration of new features.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Consumer electronics

- IT and telecommunication

- Automotive

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

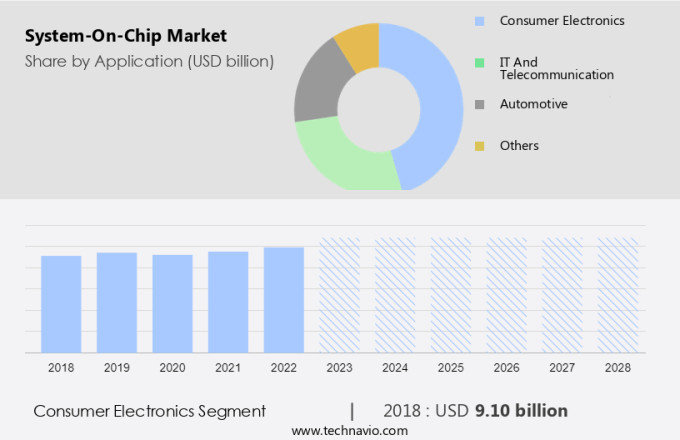

The consumer electronics segment is estimated to witness significant growth during the forecast period. The System-on-Chip (SoC) market is experiencing significant growth due to the increasing demand for power-efficient and cost-effective solutions in consumer electronics. SoCs, which integrate various components such as processors, signal processing units, wireless communication modules, and AI capabilities on a single chip, are essential for compact and scalable consumer devices. These devices include smartphones, tablets, laptops, smartwatches, gaming consoles, and home automation systems like dishwashers and smart thermostats. The integration of 5G technology and the Internet of Things (IoT) in these devices is driving the need for advanced SoCs with low power consumption and high efficiency. Energy waste is a major concern in these devices, and SoCs offer a solution by integrating various functions and reducing the overall size and complexity of the devices.

Moreover, the increasing computing activities in consumer electronics, such as AI and machine learning applications, require powerful and energy-efficient SoCs. The global consumer electronics market is projected to grow significantly during the forecast period, and the SoC market is expected to grow in tandem due to the increasing demand for compact and efficient ICs. The integration of SoCs in these devices enables manufacturers to reduce costs and improve performance while maintaining a small form factor. Therefore, the growth of the consumer electronics market will continue to fuel the growth of the SoC market in the coming years.

Get a glance at the market share of various segments Request Free Sample

The consumer electronics segment was valued at USD 9.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

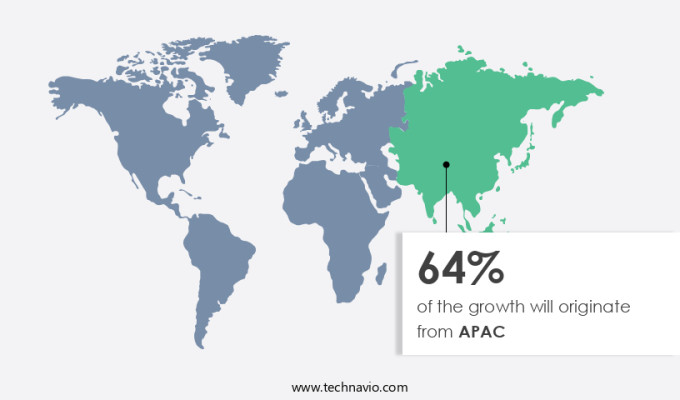

APAC is estimated to contribute 64% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The System-on-Chip (SoC) market in Asia Pacific (APAC) has experienced significant growth due to the presence of a large number of Original Equipment Manufacturers (OEMs) in the region, particularly in the consumer electronics sector. Notable OEMs include Samsung Electronics, Sony, Acer Inc., ASUSTeK Computer Inc., Xiaomi, LG Electronics, Seiko Epson Corp., Panasonic Corp., Lenovo, and OPPO. The advantage of lower manufacturing costs in APAC allows these companies to produce devices at a more affordable price compared to other regions. As a result, there is an increased availability of consumer electronics, such as laptops, tablets, smartphones, and smart wearables, including fitness bands and smartwatches, handsets, Bluetooth devices, and more, in the APAC market. Additionally, industries like aerospace and defense also utilize SoC technology for their advanced systems. This trend is expected to continue, making the SoC market in APAC a significant contributor to the global market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing adoption of SoCs in robotics is notably driving market growth. The market is experiencing significant growth due to the increasing integration of advanced technologies in various industries. In consumer electronics, the adoption of SoC technology is prevalent in smart wearables such as fitness bands and smartwatches, Bluetooth devices, and premium smartphones. The semiconductor market is also witnessing growth in the aerospace and defense sector, where SoCs are used in the development of complex systems requiring high processing power and memory. Moreover, the digital healthcare sector is leveraging SoCs for the development of medical devices and digital healthcare solutions. The Internet of Things (IoT) is another area where SoCs are extensively used due to their small form factor, low power consumption, and high processing capabilities.

Furthermore, in the telecommunications industry, the shift towards 5G and 6G networks and non-terrestrial networks is driving the demand for advanced SoCs. Companies such as Ericsson, IIVI Incorporated, GlobalFoundries, Silicon Storage Technology, and STMicroelectronics are at the forefront of developing SoCs for these applications. Furthermore, the automotive industry is witnessing a surge in the adoption of electric vehicles, leading to an increased demand for AI chips and Edge AI chips to enhance vehicle performance and safety. SoCs are integral to the design of these chips, making them a crucial component of the automotive electronics industry. In summary, the market is witnessing significant growth across various industries, including consumer electronics, healthcare, automotive, telecommunications, and military and defense. SoCs are essential in enabling advanced technologies such as 5G, AI, and robotics, making them a critical component of future technologies. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Increase in 5G investments is the key trend in the market. The market is witnessing significant growth, particularly in the area of System-on-Chip (SoC) technology, driven by the increasing adoption of 5G communication technology. With 5G's commercialization, data transfer speeds of up to 10,000 Mbps are expected. This technology is gaining traction across various industries, including consumer electronics, aerospace, defense, and digital healthcare. Investments in 5G infrastructure have been increasing rapidly, with the worldwide revenue reaching USD19.1 billion in 2021, up from USD13.7 billion in 2020. This growth is fueling the demand for advanced electronic components and modules such as 5G mm Wave antenna modules, multimode modems, base stations, and RF products.

Furthermore, to capitalize on this trend, SoC vendors like Ericsson, IIVI Incorporated, GlobalFoundries, Silicon Storage Technology, and STMicroelectronics are releasing products that support 5G technology. These SoCs cater to various application segments, including smart wearables like fitness bands and smartwatches, Bluetooth devices, premium handsets, intelligent speakers, electric vehicles, and AI and edge AI chips. Moreover, the Internet of Things (IoT) and non-terrestrial networks are also expected to contribute to the growth of the SoC market. As 5G expands beyond terrestrial networks to include 5G Compact Macro and baseband units, the demand for advanced SoCs will continue to increase. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

The dependency of SoC vendors on IP core providers is a key challenge affecting the market growth. The integration of third-party semiconductor Intellectual Property (IP) blocks into System-on-Chips (SoCs) is a complex process for semiconductor manufacturers. With technological advancements, companies with substantial financial resources are actively seeking to acquire new technologies and IP rights. However, the challenge lies in successfully integrating these IP blocks into SoCs. Design engineers face significant hurdles during this process, as the risk and complexity of IP integration increase with the number of IP blocks used. The cost of IP integration also doubles the total cost of acquiring IPs. Edge AI chips play a crucial role in various consumer electronics, including premium smartphones, intelligent speakers, and wearables.

Semiconductor manufacturers, such as Ericsson, IIVI Incorporated, and STMicroelectronics, are at the forefront of developing these advanced chips. GlobalFoundries and Silicon Storage Technology are among the IP providers supplying these manufacturers with the necessary IP blocks. The integration of these IP blocks into SoCs is a challenging task. Design engineers must ensure that the IP blocks function seamlessly with the existing SoC architecture and meet the required performance and power efficiency specifications. Additionally, the IP blocks must be compatible with the manufacturing process and the packaging technology used by the semiconductor manufacturer. The use of 5G Compact Macro and Baseband units in these SoCs further complicates the IP integration process.

Semiconductor manufacturers must ensure that the IP blocks are compatible with these advanced technologies to meet the growing demand for high-performance, low-power, and cost-effective SoCs. In conclusion, the integration of third-party semiconductor IP blocks into SoCs is a complex process that requires careful planning, expertise, and resources. Semiconductor manufacturers must work closely with IP providers to ensure successful IP integration and meet the demands of the consumer electronics market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Apple Inc. - The company offers system-on-chip that includes an M1 Ultra chip which provides 2.5TBps of bandwidth between the two dies, which allows the Ultra to be recognized as a single SoC by macOS.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Broadcom Inc.

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- Intel Corp.

- MediaTek Inc.

- Microchip Technology Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- STMicroelectronics International N.V.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The System-on-Chip (SoC) market encompasses the design, development, and integration of various functionalities onto a single semiconductor chip. This includes digital, analog, mixed signal, radio frequency, CPU, system memory, peripheral controllers, GPUs, specialized neural networks, radio modems, multi-chip systems, and power management components. SoCs are essential for energy-efficient electronic devices, such as smartphones, laptops, consumer appliances, tablets, and IT infrastructure like servers, databases, fraud detection systems, cybersecurity, and telecommunication equipment.

Furthermore, with the advent of 5G technology and the Internet of Things (IoT), the SoC market is witnessing significant growth. Multi-core technologies, embedded graphics, and AI computing activities are becoming increasingly important in SoC designs. IC manufacturers like Macs and iPads utilize advanced SoCs for enhanced performance and power efficiency. Power consumption and efficiency are critical factors in SoC design, as energy waste leads to increased costs. Signal processing and wireless communication are also key applications for SoCs, enabling faster data transfer and real-time processing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.46% |

|

Market growth 2024-2028 |

USD 5.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.27 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 64% |

|

Key countries |

China, India, US, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Analog Devices Inc., Apple Inc., Broadcom Inc., Huawei Technologies Co. Ltd., Infineon Technologies AG, Intel Corp., MediaTek Inc., Microchip Technology Inc., NVIDIA Corp., NXP Semiconductors NV, Qualcomm Inc., Samsung Electronics Co. Ltd., STMicroelectronics International N.V., Taiwan Semiconductor Manufacturing Co. Ltd., Texas Instruments Inc., and Toshiba Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch