Tower Crane Market Size 2025-2029

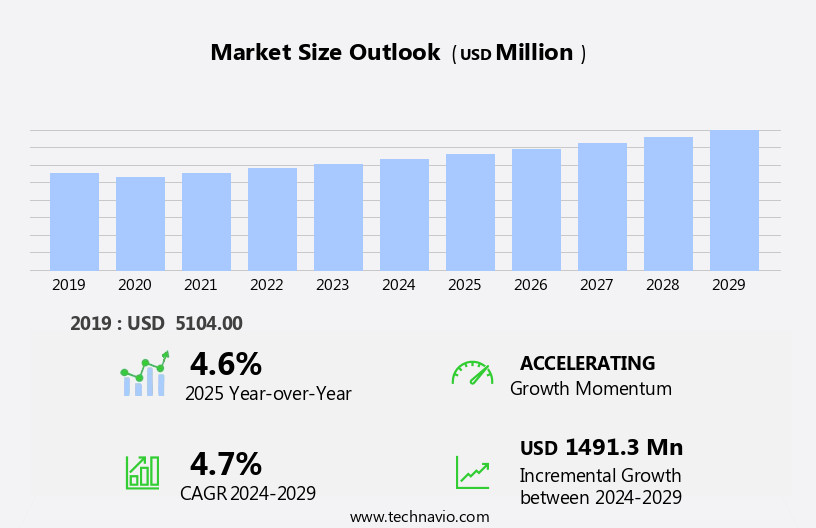

The tower crane market size is forecast to increase by USD 1.49 billion at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for high-rise buildings in urban areas. This trend is particularly noticeable in emerging economies where infrastructure development is a priority. A key innovation fueling market expansion is the introduction of luffing jib tower cranes, which offer increased flexibility and efficiency in construction projects. However, the market faces challenges as well. The construction industry is extremely volatile, with project timelines and budgets often subject to change. Regulatory hurdles impact adoption, as strict safety regulations and complex approval processes can delay projects and increase costs.

- Moreover, the market is experiencing significant growth due to the increasing demand for high-rise buildings and the introduction of luffing jib tower cranes. The construction industry in North America is known for its extreme volatility, which presents both opportunities and challenges for the market participants. Supply chain inconsistencies also temper growth potential, as the availability of key components and raw materials can fluctuate, leading to production delays and supply shortages. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on supply chain resilience, regulatory compliance, and innovation to stay competitive.

What will be the Size of the Tower Crane Market during the forecast period?

- In the dynamic market, fuel consumption and load balancing are critical factors influencing operational efficiency. Proper site layout ensures structural integrity, while material selection and project scheduling impact service life. Stability analysis and lifting plans are essential for crane operation protocols, and remote troubleshooting enhances performance optimization. Crane design considerations include wind speed limitations, ground bearing capacity, and working radius. Fault diagnostics, emission standards, and welding techniques contribute to accident prevention.

- Tower cranes, including hammerhead and slewing unit variants, are essential for lifting and positioning concrete slabs, steel beams, and other construction materials at great heights. Crane inspection, performance optimization, and data analytics are crucial for ensuring crane design and crane control systems operate at optimal levels. Boom angle, crane assembly, and human error are additional factors affecting crane performance. Environmental regulations and operator fatigue also play significant roles in the market.

How is this Tower Crane Industry segmented?

The tower crane industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Infrastructure

- Residential

- Commercial

- Type

- Hammerhead tower cranes

- Luffing tower cranes

- Self-erecting tower cranes

- Capacity

- Up to 5 tons

- 5-10 tons

- 11-16 tons

- 17-25 tons

- Above 25 tons

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

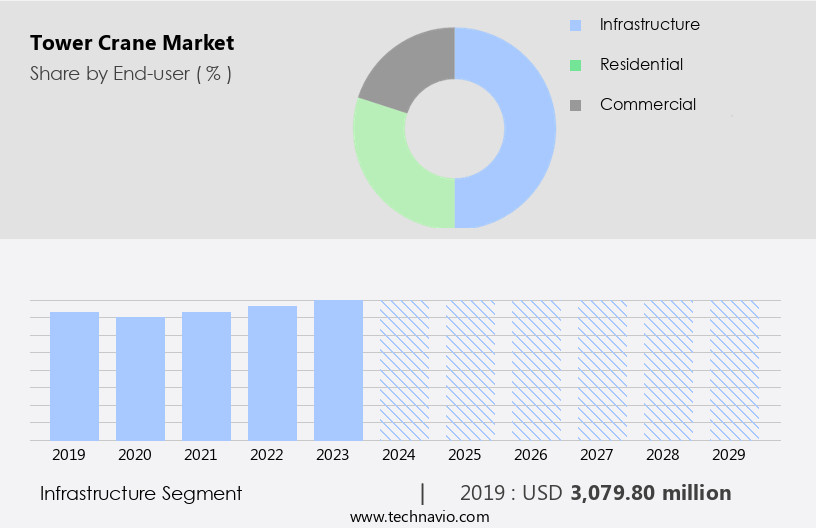

The infrastructure segment is estimated to witness significant growth during the forecast period. The market experienced growth in 2024, fueled by substantial investments in infrastructure development projects worldwide. Asia-Pacific led the market, accounting for a considerable share due to urbanization and large-scale construction initiatives in countries like China, India, Indonesia, and Vietnam. China, in particular, contributed significantly with its focus on high-rise buildings and urban infrastructure, including the Hainan Power Grid expansion and new projects in Wuhan. The Middle East also witnessed increasing demand for tower cranes, driven by ambitious projects such as the development of NEOM city in Saudi Arabia and the ongoing construction of the Riyadh Metro. Maintenance services played a crucial role in ensuring the optimal performance of tower cranes, particularly in heavy-duty construction and heavy lifting applications.

Diesel engines and electric drives were common power sources, while load moment limiters ensured safe lifting capacities. Boom lengths varied depending on project requirements, and remote monitoring and control systems enabled efficient material handling and improved worksite safety. IoT integration allowed for predictive maintenance, ensuring cranes were always in top condition. Mining operations also relied on tower cranes for material handling and lifting heavy loads. Safety regulations were strictly enforced, with operator training and crane certification mandatory for ensuring crane safety. The rental market provided flexibility for construction projects, offering various crane models such as mobile cranes, crawler cranes, telescopic boom cranes, and fixed cranes.

Crane safety features like anti-collision systems and outrigger systems ensured worksite safety. Wind energy projects and power plants also utilized tower cranes for infrastructure development. Hydraulic systems and slewing speeds were essential considerations for these applications. Bridge construction projects required cranes with long jib lengths, while hammerhead cranes and luffing jib cranes were ideal for projects with limited space. Overall, the market continued to evolve, adapting to the diverse needs of various industries.

The Infrastructure segment was valued at USD 3.08 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

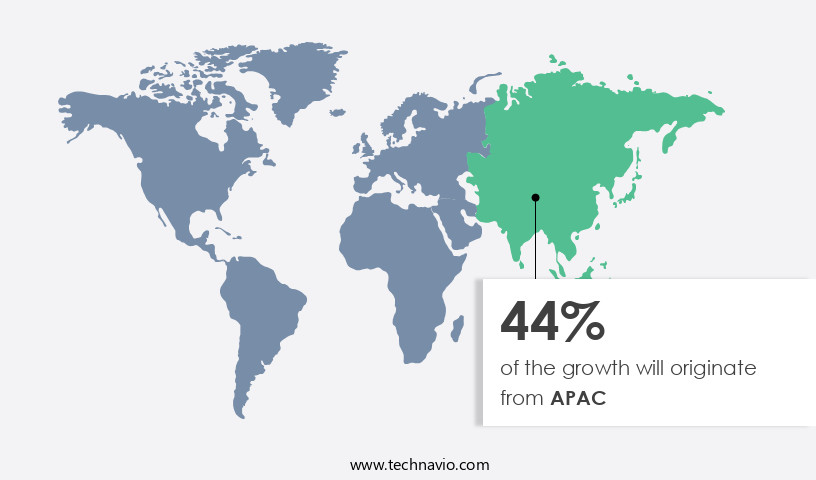

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced significant activity in 2023, with Asia Pacific leading the charge due to escalating demand from the construction and mining industries. Infrastructure development, driven by government and private investments, has been a major catalyst in this region's growth. Rapid urbanization in countries like India, Indonesia, and Malaysia is fueling the construction of smart cities, efficient transportation networks, healthcare facilities, and smart grids, bolstering market expansion. Companies are focusing on innovation, introducing advanced solutions such as power lift systems and Effi-Plus systems, which optimize operational efficiency by enhancing speed and load capacity. These technological advancements have attracted major international manufacturers to the region, capitalizing on the high demand and low production costs.

In the construction sector, tower cranes are essential for heavy lifting and high-rise building projects. Mining operations rely on these cranes for material handling and remote control operations. Safety regulations mandate the use of load moment limiters, anti-collision systems, and operator training to ensure crane safety. The rental market is also thriving, providing flexible solutions for various projects, including bridge construction, wind energy, and industrial plants. Tower cranes come in various types, such as telescopic boom cranes, crawler cranes, mobile cranes, hammerhead cranes, and luffing jib cranes, each catering to specific lifting requirements. Predictive maintenance and IoT integration are increasingly important in maintaining crane performance and worksite safety.

The used crane market offers cost-effective alternatives for businesses seeking to minimize capital expenditures. Regardless of the type or application, tower cranes play a crucial role in heavy duty construction and heavy lifting projects, contributing to the market's continued growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Tower Crane market drivers leading to the rise in the adoption of Industry?

- The swell in demand for high-rise buildings serves as the primary catalyst for market growth. The construction industry's reliance on tower cranes is on the rise, particularly in regions experiencing urbanization and population growth, most notably Asia and Africa. According to the United Nations, urban populations could increase by an additional 2.5 billion by 2050, leading to a swell in demand for high-rise buildings. These structures, which offer an effective and economical solution to accommodation, necessitate the use of tower cranes for their construction in compact spaces. Tower cranes come in various configurations, including diesel engine and electric drive models, each offering unique advantages. For instance, diesel engine cranes provide power independence and mobility, while electric drive cranes offer energy efficiency and lower emissions.

- Moreover, advanced features such as load moment limiters, remote monitoring, material handling systems, and remote control have become essential for optimizing crane performance and ensuring safety. The integration of Internet of Things (IoT) technology is also transforming the market, enabling real-time data collection and analysis, predictive maintenance services, and improved operational efficiency. Mining operations have also adopted tower cranes for their material handling needs, further expanding the market's scope. With the increasing demand for high-rise buildings and the continuous advancement of technology, the market is poised for growth.

What are the Tower Crane market trends shaping the Industry?

- Luffing jib tower cranes are gaining increasing popularity in the construction industry, representing a significant market trend. This crane type offers enhanced versatility and efficiency through its ability to adjust the jib length and direction, making it an attractive option for complex projects. Luffing jib tower cranes are essential equipment in large-scale projects, particularly for constructing high-rise buildings and installing industrial equipment. These cranes offer significant advantages, including high lifting capacity, precise landing accuracy, and enhanced safety features. Designed for urban construction sites, luffing jib tower cranes provide extended reach and the flexibility to maneuver in confined spaces. The increasing demand for infrastructure development and wind energy projects drives the market for these cranes, as they can work efficiently in synchronization with multiple cranes on the same site. Safety regulations and operator training are critical considerations in the luffing jib market.

- Crane safety is paramount, and advanced safety features, such as anti-collision systems, are becoming increasingly important. Predictive maintenance technologies are also gaining popularity to ensure optimal crane performance and prevent downtime. The used crane market is another segment that is growing in importance, providing cost-effective solutions for businesses. Overall, the market for luffing jib tower cranes is driven by the need for high-performance, safe, and efficient lifting solutions in various industries.

How does Tower Crane market faces challenges face during its growth?

- The volatile nature of the construction industry poses a significant challenge to its growth. With inherent risks such as economic fluctuations, regulatory changes, and project uncertainties, the industry requires robust strategies and expertise to mitigate these challenges and ensure sustainable growth. The market is experiencing significant growth due to various factors, including the increasing demand for heavy lifting in industrial plants and heavy duty construction projects. The market is driven by the need for increased lifting capacity and height, which tower cranes provide efficiently. Mobile cranes and slewing cranes, including telescopic boom cranes, are popular choices due to their versatility and flexibility. Despite the market's expansion, challenges persist, such as the high initial investment costs and the shortage of skilled labor. Moreover, economic uncertainties and fluctuating oil prices can impact construction activities and investment decisions.

- The rental market for tower cranes is also gaining traction as a cost-effective solution for businesses. Innovations in crane technology, such as remote operation and IoT integration, are improving efficiency and safety, making tower cranes increasingly attractive for construction projects. The Asia-Pacific region leads the market due to its rapid urbanization and infrastructure development, particularly in countries like China, India, Indonesia, and Vietnam. The market is experiencing growth due to the increasing demand for heavy lifting and the advancements in crane technology. Despite challenges, the market is expected to continue expanding, driven by the need for efficient and safe lifting solutions in industrial and construction projects.

Exclusive Customer Landscape

The tower crane market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tower crane market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tower crane market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Action Construction Equipment Ltd. - The company offers tower cranes that are rugged, dependable and cost effective for big civil costruction and erection jobs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Action Construction Equipment Ltd.

- Fangyuan Group Co. Ltd.

- FMGru srl

- Hyundai Everdigm Corp.

- Konecranes

- Liebherr International AG

- Linden Comansa S.L.

- Muhibbah Engineering M Bhd.

- Raimondi Cranes SpA

- Sany Group

- Shandong Dahan Construction Machinery Co. Ltd.

- Sichuan Construction Machinery Group Co. Ltd.

- Terex Corp.

- The Manitowoc Co. Inc.

- Toppower General Trading LLC

- WOLFFKRAN International AG

- Xuzhou Construction Machinery Group Co. Ltd.

- Yongmao Construction Machinery Co. Ltd.

- Zhejiang Huba Construction Machinery Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tower Crane Market

- In February 2024, Terex Corporation, a leading tower crane manufacturer, introduced its new generation of green and efficient tower cranes, the Terex EC-H 180 and EC-H 210, at the Bauma trade fair in Munich, Germany (Terex Corporation Press Release, 2024). These cranes boast advanced energy recovery systems and reduced emissions, aligning with the growing industry focus on sustainability.

- In July 2025, Sany Heavy Industry and Liebherr Group, two major tower crane manufacturers, announced a strategic partnership to jointly develop and produce tower cranes for the Chinese market (Sany Heavy Industry Press Release, 2025). This collaboration aims to leverage both companies' strengths, enhancing their market presence and product offerings in China.

- In October 2024, Manitowoc Crane Group, a global crane manufacturer, completed the acquisition of National Crane, a leading US-based crane manufacturer, for approximately USD325 million (Manitowoc Crane Group Press Release, 2024). This acquisition expanded Manitowoc's product portfolio and market reach, positioning it as a stronger competitor in the market.

- In March 2025, the European Union passed new regulations on tower crane safety, requiring all cranes to be equipped with advanced safety systems and regular inspections (European Parliament Press Release, 2025). These regulations aim to prevent accidents and improve overall safety in the construction industry, driving demand for technologically advanced tower cranes.

Research Analyst Overview

The market continues to evolve, driven by the dynamic needs of various sectors. In the realm of material handling, the demand for cranes with high hoist speeds and extended boom lengths persists, particularly in high-rise building construction. Operator training and safety regulations are paramount, ensuring the workforce is adept at handling complex crane systems. Predictive maintenance and IoT integration are revolutionizing crane operations, enabling real-time monitoring and remote control. Wind energy and infrastructure development sectors are major adopters, with a focus on crane safety and anti-collision systems. The used crane market thrives on the continuous turnover of construction projects, offering cost-effective solutions for heavy duty construction and heavy lifting tasks.

Mobile cranes, slewing speed, and telescopic boom cranes are popular choices for industrial plants and power generation projects. Crane certification, lifting capacity, and lifting height are crucial factors in the rental market, where flexibility and versatility are key. Crawler cranes, jib length, and outrigger systems cater to the diverse needs of construction projects, from bridge construction to mining operations. The market's dynamism extends to crane technologies, with advancements in diesel engines, electric drives, and hydraulic systems. Crane safety remains a top priority, with ongoing developments in load moment limiters and anti-collision systems. In the ever-evolving landscape of crane applications, the market continues to unfold, adapting to the unique demands of each sector.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tower Crane Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 1.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

China, US, Canada, Japan, India, South Korea, Saudi Arabia, Australia, Germany, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tower Crane Market Research and Growth Report?

- CAGR of the Tower Crane industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tower crane market growth and forecasting

We can help! Our analysts can customize this tower crane market research report to meet your requirements.