Traffic Safety Products Market Size 2025-2029

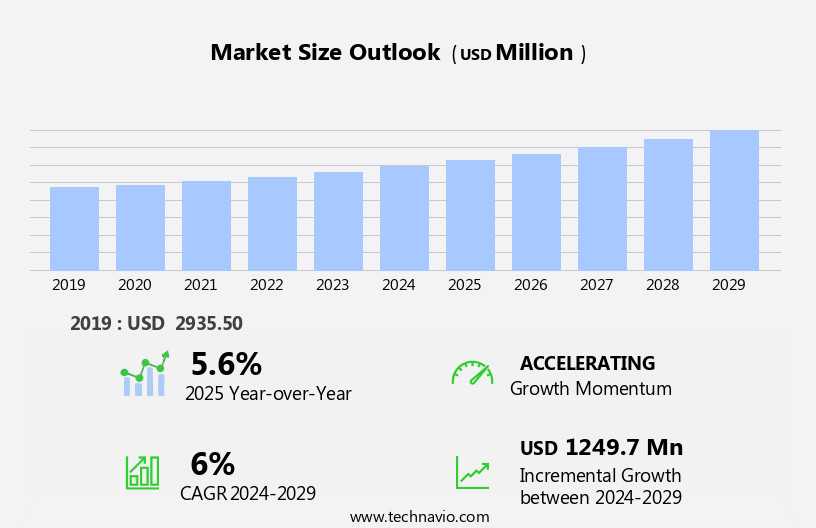

The traffic safety products market size is forecast to increase by USD 1.25 billion at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prioritization of road infrastructure development worldwide. Governments and private entities are investing heavily in improving road networks, leading to a heightened demand for traffic safety solutions. Moreover, the shift towards eco-friendly and recycled materials in traffic safety product manufacturing is gaining momentum, aligning with global sustainability initiatives. However, challenges persist in this market. Regulatory hurdles impact adoption, as various standards and certifications are required for traffic safety products to be approved and sold in different regions. Additionally, supply chain inconsistencies temper growth potential due to the complex nature of sourcing raw materials and ensuring timely delivery to meet market demands.

- Despite these challenges, companies can capitalize on opportunities by focusing on regulatory compliance and building robust supply chain networks to address these issues effectively. By staying informed of regulatory changes and collaborating with reliable suppliers, businesses can differentiate themselves and thrive in the market.

What will be the Size of the Traffic Safety Products Market during the forecast period?

- In the dynamic US market for road safety products, essential businesses prioritize ensuring the safety of their commuting workforce and the public. Road accidents, involving pedestrians and essential workers, remain a significant concern, leading to fatalities and potential business disruptions. Autonomous vehicles and advanced traffic management solutions, such as radar and digital services, are gaining traction as essential components of road safety. Public security agencies also leverage the latest technologies, including drones and surveillance systems, to enhance traffic enforcement and discipline.

- Urbanization and motorization contribute to increased traffic at intersections, necessitating continuous improvement in road infrastructure and traffic management. Developing economies and the freight system further boost the market's growth. New technologies, consulting, and training services cater to the evolving needs of transport operators, addressing speeding-related crashes and ensuring overall road safety.

How is this Traffic Safety Products Industry segmented?

The traffic safety products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Traffic vests and rainwear

- Tube delineators

- Traffic cones

- Traffic barricades

- Others

- End-user

- Municipal

- Industrial and commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

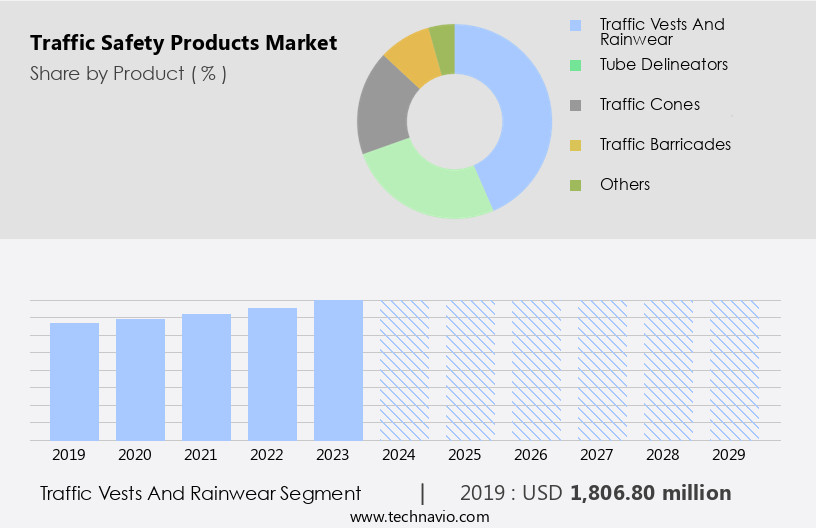

The traffic vests and rainwear segment is estimated to witness significant growth during the forecast period.

Commuter safety is a significant concern in the US, with traffic discipline being a crucial aspect of reducing road accidents. Road infrastructure plays a vital role in ensuring safety, and traffic accidents continue to be a persistent issue. Enforcement measures, such as radar technology and speed cameras, are employed to deter speeding-related crashes. The latest technologies, including AI, computer vision, and IoT sensors, are being integrated into traffic management solutions to enhance surveillance and incident detection. Professional services, including consulting and training, are essential for implementing effective road safety systems. Fatalities among cyclists, pedestrians, and passengers have been a concern, particularly in urban roads and megacities.

Drones and ALPR/ANPR systems are being used to monitor cyclist movement and pedestrian fatalities, while railroad crossing safety and bus lane enforcement are crucial for reducing accidents. Developing economies are investing in road safety solutions to mitigate the risk of accidents at intersections and on highways. Security spending on traffic management systems is on the rise, driven by the increasing traffic volume and the need for intelligent transportation systems. New technologies, such as autonomous vehicles and virtual reality, are transforming the transportation landscape. Digitalization and cybersecurity are essential considerations for transport operators and safety authorities. Big Data and granular data analysis are being used to optimize business operations and improve response times to road traffic incidents.

Essential workers, including construction personnel, are using non-invasive measuring systems and safety vests to ensure their safety. The use of AI and connected commercial vehicles is also increasing to improve safety and efficiency in the freight system. The National Safety Council provides road safety data and incident detection systems to help reduce accidents and fatalities. Protocols and specifications for traffic enforcement and bus lane enforcement are being established to ensure uniformity and effectiveness. Health conditions and disability are also being considered in the design of road safety systems to cater to all road users. The use of simulation technology for training and support and maintenance of traffic management systems is essential for ensuring their optimal performance.

Nationally binding mandates and transport demand are driving the market for road safety products and services.

The Traffic vests and rainwear segment was valued at USD 1.81 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

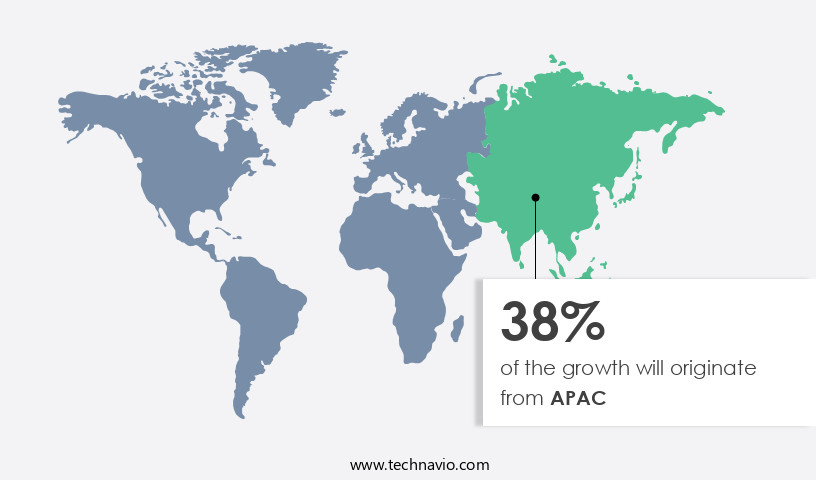

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic and evolving landscape of transportation, the Asia Pacific region presents significant market opportunities for traffic safety products. With population growth and increasing per capita income, there's a surging demand for vehicles, making China, Japan, and India among the world's top vehicle-producing nations. This expanding fleet has led to increased traffic volume and congestion, necessitating infrastructure improvements. Road construction projects, such as China's Chengdu-Lanzhou High-Speed Railway, are underway not only to enhance rail connectivity but also to expand road networks. These developments underscore the importance of road safety solutions. Cyclists, pedestrians, and other road users share the roads with motor vehicles, increasing the risk of accidents at intersections and on urban roads.

To mitigate these risks, governments invest in surveillance systems, enforcement technologies, and professional services. Radar, AI, and computer vision technologies are integrated into cameras and sensors to detect and respond to traffic violations, accidents, and incidents in real-time. New technologies like drones, ALPR/ANPR, and IoT sensors are employed to monitor and manage traffic flow. Consulting and training services help transport operators optimize their business operations and ensure compliance with nationally binding mandates. The freight system and essential workers' safety are prioritized with bus lane enforcement and railroad crossing safety systems. The digitalization of traffic management solutions, including virtual reality simulators and digital services, further enhances safety and efficiency.

The market for road safety products encompasses a diverse range of offerings, from hardware components to software and services, catering to the unique needs of various stakeholders.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Traffic Safety Products market drivers leading to the rise in the adoption of Industry?

- The primary catalyst for market growth is the heightened prioritization of road infrastructure development.

- The transportation sector holds a substantial contribution to the economy of various countries. With the growing population and expanding industrial sector, the demand for efficient and swift road transportation is escalating. The rise in motorization, including the increasing number of passenger cars and motorcyclists, contributes to traffic congestion. This issue is further compounded by the expansion of the tourism industry, leading to increased pedestrian movement and potential revenue losses due to congestion-related delays. To mitigate these challenges, the market is witnessing significant growth. IoT sensors, computing technology, and Big Data are being integrated into traffic management solutions to monitor road incidents and improve safety procedures.

- Virtual reality and digital services are also being utilized to enhance driver training and pedestrian awareness. Intelligent transportation systems, including autonomous vehicles and smart cities, are expected to revolutionize the transportation sector. These advanced technologies can help reduce motorcyclist and pedestrian fatalities by providing real-time traffic information, optimizing traffic flow, and improving overall road safety. Safety authorities are increasingly relying on back-office systems and social media to gather data and analyze trends. This data is then used to improve business operations and develop targeted safety campaigns. The integration of computing technology and sensors in traffic safety products is enabling the collection of valuable data, which can be used to optimize traffic management and enhance overall safety.

What are the Traffic Safety Products market trends shaping the Industry?

- The production of traffic safety products utilizing eco-friendly and recycled materials is currently a significant market trend. This sustainable approach to manufacturing is gaining popularity due to increasing environmental consciousness and the potential for reduced waste.

- Traffic safety is a critical aspect of commuter safety and public security, especially in light of increasing road fatalities due to traffic accidents. To enhance traffic discipline and ensure the safety of pedestrians, cyclists, and other road users, various traffic safety products are in use. These products include radar systems for enforcement, external flash units, and drones for surveillance. However, there is a growing focus on eco-friendliness in traffic safety product manufacturing. As environmental concerns escalate, companies are developing traffic safety products using eco-friendly or recycled materials. For instance, PVC and rubber, commonly used in traffic safety products, are being replaced with sustainable alternatives.

- Some manufacturers are using recycled rubber from waste tires as a raw material for producing traffic safety components such as cones, barricades, and delineators. Avery Dennison is one such company offering sustainable solutions for traffic sign production. With stringent environmental safety policies being implemented worldwide, the adoption of eco-friendly traffic safety products is expected to increase. This shift not only addresses environmental concerns but also aligns with the broader trend of reducing speeding-related crashes and improving road safety, particularly at intersections. Additionally, consulting and training services play a vital role in ensuring the effective implementation and utilization of these new technologies in the freight system.

How does Traffic Safety Products market faces challenges face during its growth?

- The absence of adequate road safety awareness poses a significant challenge to the expansion of the industry.

- Inadequate road safety standards and insufficient infrastructure development in underdeveloped and developing countries continue to pose significant risks for both cyclist and vehicle movements on urban roads. The absence of proper policies and subsequent low spending on security measures contributes to a high incidence of accidents and road traffic incidents. According to recent data, approximately one-third of Africa's population lacks easy access to all-season roads, while the figure is about two-thirds in other developing countries. This lack of infrastructure development, coupled with inadequate policy formulation, restricts investments in advanced road safety solutions such as AI-driven speed and red light enforcement systems, simulators for training transport operators, and connected commercial vehicles.

- As a result, the number of multi-vehicle crashes remains high, leading to substantial fatalities and injuries. To mitigate these risks, nationally binding mandates for road safety infrastructure and consistent policy formulation are essential to ensure the systematic mainstreaming of road safety solutions and reduce the risk of accidents.

Exclusive Customer Landscape

The traffic safety products market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the traffic safety products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, traffic safety products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in traffic safety solutions, providing innovative conspicuity markings, pavement markings, and reflective panels. Our offerings enhance roadway safety through improved visibility, ensuring optimal performance under various lighting conditions. These products are essential for ensuring the safety of road users and infrastructure. The company's commitment to research and development drives the creation of advanced traffic safety solutions that meet the evolving needs of transportation systems worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Avery Dennison Corp.

- Brady Corp.

- Conduent Inc.

- eTrans Solutions Pvt Ltd.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Jenoptik AG

- Kapsch TrafficCom AG

- Lindsay Corp.

- RoadSafe Traffic Systems Inc.

- Saferoad Holding AS

- Shenzhen LuMing Traffic Equipment Co. Ltd.

- SWARCO AG

- Teledyne Technologies Inc.

- Traffic Technologies Ltd.

- Valmont Industries Inc.

- Vectus Industries Ltd.

- Verra Mobility Corp.

- WW Grainger Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Traffic Safety Products Market

- In January 2024, leading traffic safety products manufacturer, Hesco Bastion, introduced its innovative Intelligent Transportation System (ITS), integrating advanced technologies such as artificial intelligence and machine learning to enhance road safety and traffic management (Hesco Bastion Press Release, 2024).

- In March 2025, global safety glass manufacturer, Asahi Glass Co. (AGC), announced a strategic partnership with ride-hailing giant, Uber Technologies, to develop and deploy advanced windshields with integrated sensors and safety features, aiming to reduce accidents and improve user experience (AGC Press Release, 2025).

- In July 2025, Magna International, a leading automotive supplier, completed the acquisition of Vision Technologies Systems, a pioneer in advanced driver assistance systems (ADAS), further expanding Magna's portfolio and enhancing its position in the traffic safety market (Magna International Press Release, 2025).

- In October 2025, the European Union (EU) unveiled its new 'Vision Zero' road safety strategy, aiming to eliminate all road fatalities and serious injuries by 2050. This initiative includes significant investments in research, development, and deployment of advanced traffic safety technologies (European Commission Press Release, 2025).

Research Analyst Overview

Traffic safety is a dynamic and evolving market, with ongoing efforts to improve commuter safety and discipline on roadways. The integration of advanced technologies and professional services plays a significant role in this continuous development. Road infrastructure remains a crucial component of traffic safety, with a focus on reducing traffic accidents and enhancing the overall safety of all road users. Radar technology and the latest surveillance systems, such as drones and cameras, are essential tools for enforcing traffic laws and ensuring adherence to speed limits. These technologies are increasingly being integrated with AI and computer vision capabilities to improve incident detection and response times.

Professional services, including consulting and training, are also vital in the traffic safety market. These services help transport operators optimize their operations, reduce the risk of accidents, and ensure compliance with nationally binding mandates. New technologies, such as connected commercial vehicles and IoT sensors, are transforming the freight system, making it more efficient and safer. The traffic safety market is not limited to cars and buses but also encompasses cyclists, pedestrians, and railroad crossing safety. Cyclist movement and pedestrian fatalities are significant concerns, with the development of new technologies, such as external flash units and ALPR/ANPR systems, aimed at improving safety for these vulnerable road users.

The role of public security and safety authorities is essential in the traffic safety market. They are responsible for implementing protocols and procedures to ensure the safety of passengers and reduce the number of accidents. Cybersecurity is also a growing concern, with the increasing digitization of traffic management solutions and the use of AI and virtual reality in traffic management and training. The traffic safety market is not limited to developed economies but is also a priority in developing economies, where the need for improved infrastructure and enforcement is particularly acute. The market is also influenced by urbanization, with a focus on traffic management solutions for megacities and intelligent transportation systems for urban roads.

The market for traffic safety products is diverse, with a range of hardware components, software, and back-office systems available. These products cater to various applications, including speed enforcement, red light enforcement, multi-vehicle crashes, and incident detection systems. The market is also influenced by travel behavior, transport demand, and the sources of revenue, with big data and AI playing an increasingly significant role in traffic management and analysis. The traffic safety market is a dynamic and evolving one, with ongoing developments in technology, regulations, and user behavior. The market is influenced by various factors, including health conditions, disability, motorization, and social media.

The market is also shaped by the assumptions and procedures of safety authorities and the business operations of transport operators. The integration of digitalization, non-invasive measuring systems, and autonomous vehicles is transforming the market, with a focus on improving safety, reducing accidents, and enhancing the overall efficiency of the transport system.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Traffic Safety Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 1249.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

China, US, Japan, Canada, Germany, South Korea, India, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Traffic Safety Products Market Research and Growth Report?

- CAGR of the Traffic Safety Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the traffic safety products market growth of industry companies

We can help! Our analysts can customize this traffic safety products market research report to meet your requirements.