Transparent Plastic Market Size 2024-2028

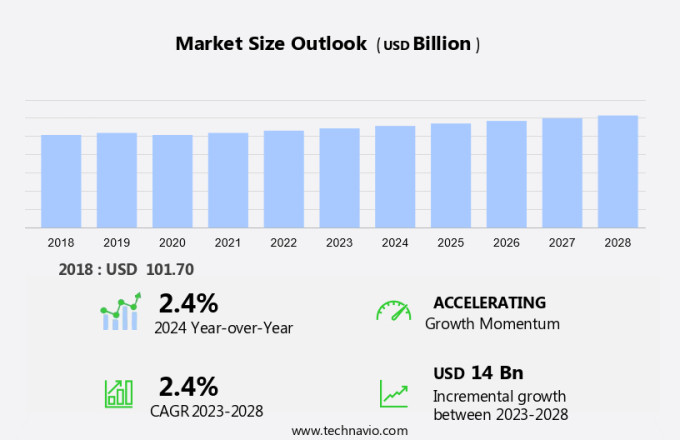

The transparent plastic market size is forecast to increase by USD 14 billion at a CAGR of 2.4% between 2023 and 2028.

- The market is experiencing significant growth due to various driving factors. One key trend is the increasing demand from the packaging industry, particularly for greenhouses and food packaging applications. Another factor is the growing emphasis on sustainability and eco-friendly materials, leading to the popularity of bio-based transparent plastics. Furthermore, the automotive industry is witnessing a shift towards electric vehicles (EVs), which require lightweight and durable materials for components such as headlights and body parts. The rigid and flexible segments of the market are expected to grow at a steady pace, driven by these trends. However, the market also faces challenges, including the issue of plastic waste and the need for effective waste management solutions. To address this, research and development efforts are focused on improving the recyclability and biodegradability of transparent plastics.

What will be the Size of the Market During the Forecast Period?

- Transparent plastics, a vital segment of the plastics industry, continue to gain traction in various sectors due to their unique properties. These plastics offer advantages such as impact resistance, weather resistance, and transparency, making them suitable for numerous applications. Polyethylene Terephthalate (PET), Polycarbonate, Acrylic, and Polytetrafluoroethylene (PTFE) are the primary types of transparent plastics. PET, also known as Polyethylene Terephthalate, is widely used in the production of eyewear lenses, protective barriers, and packaging for food products. Its excellent barrier properties make it a popular choice for flexible packaging applications. Polycarbonate, known for its high impact resistance, is used in various industries, including construction and electronics. Acrylic, another type of transparent plastic, is commonly used in the production of eyewear lenses, greenhouses, and signage. PTFE, with its superior weather resistance, is used in various applications, such as in the production of non-stick cookware and protective coatings. Transparent plastics find extensive use in the production of eyewear lenses, protective barriers, and greenhouses. In the eyewear industry, these plastics offer excellent clarity and durability, making them ideal for producing high-quality lenses. In the construction industry, transparent plastics are used as protective barriers, offering weather resistance and impact resistance. In the agriculture sector, greenhouses made of transparent plastics enable efficient cultivation by allowing sunlight to penetrate while protecting crops from harsh weather conditions.

- Packaged food products and flexible packaging are significant applications for transparent plastics. The use of transparent plastics in food packaging ensures the preservation of food quality and freshness while maintaining transparency, allowing consumers to see the product inside. Flexible packaging, made from transparent plastics, offers advantages such as lightweight, easy handling, and cost-effectiveness. Commodity resins, such as PET and polypropylene, are the primary raw materials used in the production of transparent plastics. The prices of these raw materials can significantly impact the transparent plastics market. Rigid transparent plastics, including PET and polycarbonate, are used in applications where high impact resistance and durability are required.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Flexible

- Rigid

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

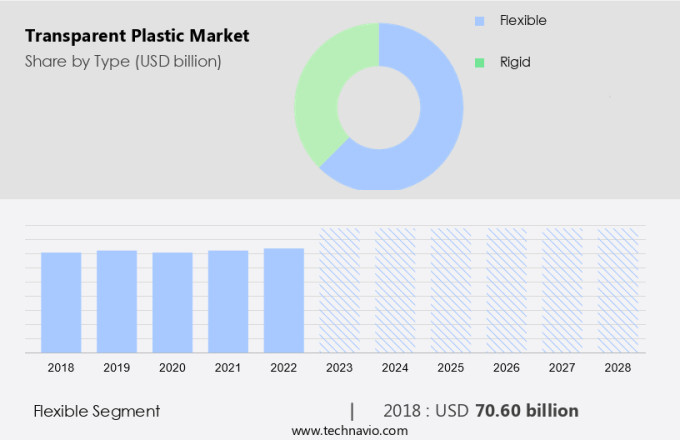

- The flexible segment is estimated to witness significant growth during the forecast period.

The flexible segment of The market is experiencing notable expansion due to its rising demand in numerous industries. This trend is particularly prominent in sectors such as packaging, automotive, and electronics, where there is a growing preference for adaptable and lightweight materials. One of the primary materials driving this growth is polytetrafluoroethylene (PTFE), renowned for its superior flexibility and durability. Flexible transparent plastics have gained significant traction due to their affordability, sustainability, and aesthetic appeal. Their ease of printing makes them an excellent choice for packaging applications that necessitate clear labeling. The versatility of these plastics is a significant draw for manufacturers aiming to cater to consumer preferences for both functionality and visual appeal.

Further, in the realm of consumer goods, particularly packaged food products, the adoption of flexible transparent plastics is on the rise. Similarly, in the electronics industry, these plastics are increasingly being utilized in the production of flexible packaging and components. Another key player in this market is Polyethylene Terephthalate (PET), which offers excellent clarity, strength, and resistance to moisture and oxygen. The market is expected to continue its growth trajectory, fueled by the increasing demand for lightweight, flexible, and visually appealing materials across various industries.

Get a glance at the market report of share of various segments Request Free Sample

The flexible segment was valued at USD 70.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

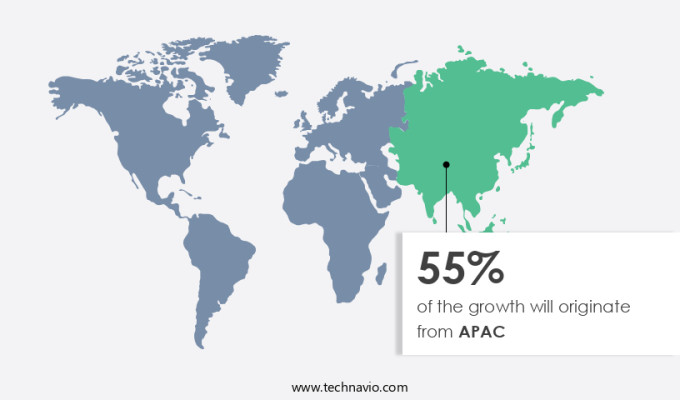

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Transparent plastics play a vital role in various industries such as construction, electronics, food packaging, healthcare, electric vehicles, and bioplastics. The global market for transparent plastics is witnessing significant growth, with the APAC region leading the charge. Rapid industrialization and urbanization in this region have fueled the demand for transparent plastics, particularly in sectors like packaging, automotive, food and beverages, chemicals, and pharmaceuticals. China is a major consumer and producer of transparent plastics, leveraging its extensive manufacturing capabilities to meet both domestic and export demands. India is also emerging as a significant player, with government initiatives aimed at strengthening the recycling industry and promoting sustainable materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Transparent Plastic Market ?

Rising demand from packaging industry is the key driver of the market.

- The market is experiencing notable expansion due to the escalating demand from the packaging sector. This trend is predominantly driven by the growing preference for lightweight, resilient, and aesthetically pleasing packaging solutions in various industries, with food and beverage applications being a major focus. Transparent plastics, including PET, offer desirable properties such as moisture barrier, corrosion resistance, and microorganism repellency, which collectively contribute to extended product shelf life. Moreover, the burgeoning e-commerce industry is fueling the need for vital packaging that guarantees product safety during transit. Clear packaging not only enables consumers to inspect the product but also boosts brand visibility on retail shelves, making it a popular choice among manufacturers.

What are the market trends shaping the Transparent Plastic Market?

Growing emphasis on sustainability and eco-friendly materials is the upcoming trend in the market.

- The market is experiencing significant transformation due to the increasing focus on sustainability and eco-friendly materials. With growing consumer awareness of environmental concerns, there is a surging demand for sustainable alternatives to traditional plastics. This trend is driving manufacturers to innovate and adopt more sustainable practices, contributing to the market's positive growth trajectory. One of the most notable developments is the emergence of bio-based transparent plastics. Derived from renewable resources, these materials provide similar properties to conventional plastics while being more environmentally friendly. The acceptance of bio-based options is gaining momentum due to both consumer preferences and regulatory support aimed at reducing plastic waste.

- In the automotive industry, bio-based transparent plastics are being used in applications such as greenhouses and automotive headlights. Additionally, the rise of electric vehicles (EVs) is further fueling the demand for sustainable plastics. Both rigid and flexible segments of the market are expected to benefit from this trend during the forecast period.

What challenges does Transparent Plastic Market face during the growth?

Growing concern over environmental pollution is a key challenge affecting the market growth.

- The market encompasses various types of clear plastics, including polyethylene terephthalate (PET) and Polycarbonate. These plastics are extensively used in producing eyewear lenses and protective barriers due to their superior impact resistance and weather resistance. However, the increasing environmental concerns have brought the market under scrutiny. As the negative consequences of plastic waste on ecosystems gain more attention, there is a growing demand for sustainable practices. Regulatory bodies and consumers are advocating for eco-friendly alternatives to traditional plastics. The longevity of plastics, which does not allow them to decompose naturally, is a significant contributor to environmental degradation. One of the most pressing environmental issues is the impact of plastic pollution on marine life.

- Marine species often mistake transparent plastic debris for food, leading to health complications or even death. For instance, sea turtles frequently consume PET and Polycarbonate materials that resemble jellyfish, causing severe health consequences. In conclusion, the market faces mounting pressure to adopt sustainable practices due to the detrimental effects of plastic pollution on the environment, particularly marine life.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Asahi Kasei Corp.

- BASF SE

- Chimei Corp.

- Covestro AG

- Denka Co. Ltd.

- Dow Inc.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Evonik Industries AG

- INEOS Group Holdings S.A.

- Lanxess AG

- LG Chem Ltd.

- LyondellBasell Industries Holdings BV

- Poonam Plastic Industries

- PPG Industries Inc.

- Saudi Basic Industries Corp.

- Solvay SA

- Teijin Ltd.

- Trinseo PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various types of clear plastics, including polyethylene terephthalate (PET), polycarbonate, and polyvinyl chloride (PVC), among others. PET, also known as polyester, is widely used in producing eyewear lenses and protective barriers due to its excellent impact and weather resistance. Polycarbonate is another popular choice for applications requiring high impact resistance, such as automotive headlights and protective shields. Transparent plastics are integral to numerous industries, including greenhouses, automotive, electronics, building and construction, electrical and electronics, consumer goods, and medical devices. PET and PVC are commonly used in packaging applications, particularly for food products and flexible packaging. polytetrafluoroethylene (PTFE) is known for its excellent barrier properties and is often used in coating applications.

Additionally, the market is influenced by factors such as raw material prices, crude oil price volatility, and the increasing demand for lightweight materials in industries like electric vehicles (EVs) and construction. The market is also witnessing a shift towards bio-based transparent plastics, which offer enhanced sustainability and reduced carbon footprint. The use of these plastics in various applications, from flexible packaging to medical devices, is expected to grow significantly in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.4% |

|

Market growth 2024-2028 |

USD 14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.4 |

|

Key countries |

China, US, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch