Trolley Market Size 2024-2028

The trolley market size is forecast to increase by USD 554.6 million, at a CAGR of 4.69% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expanding adoption of trolleys in supermarkets and the food service industry. This trend is fueled by the convenience and efficiency that trolleys offer in managing and transporting goods in the food and beverage sector. Moreover, innovations in the market continue to shape the competitive landscape, with companies introducing advanced features to enhance the user experience. However, the market faces challenges due to the volatility of raw material prices used in trolley production. This price instability poses a significant challenge for manufacturers, requiring them to effectively manage costs and maintain profitability.

- Companies seeking to capitalize on market opportunities and navigate these challenges must stay informed of raw material price trends and explore alternative materials or production methods. Overall, the market presents both opportunities and obstacles, necessitating strategic planning and agility from market participants.

What will be the Size of the Trolley Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with ongoing advancements in technology and increasing demand across various sectors. Trolley scheduling algorithms optimize fleet management, ensuring efficient operations and reducing operational costs. For instance, a major transit authority reported a 15% increase in on-time arrivals after implementing a sophisticated scheduling system. Trolley system capacity is another critical aspect, with upgrades and replacements of parts ensuring reliable and safe service. Trolley system upgrades focus on enhancing safety mechanisms, such as improved braking systems and emergency stopping features. Additionally, trolley vehicle dynamics are being optimized through the integration of diagnostic tools and power regulation systems.

Electric trolley systems are increasingly prioritized for their energy efficiency and environmental benefits. Trolley infrastructure design and maintenance are essential for ensuring system reliability and minimizing downtime. Moreover, trolley network topology and route optimization play a significant role in improving overall system performance. Trolley propulsion systems are being automated, with the integration of advanced control systems and performance metrics. Trolley data acquisition and monitoring are also crucial for identifying potential issues before they escalate, reducing maintenance costs and improving overall system efficiency. The market is expected to grow at a robust pace, with industry analysts projecting a 7% annual growth rate over the next decade.

This growth is driven by increasing urbanization, a growing focus on sustainability, and ongoing advancements in technology.

How is this Trolley Industry segmented?

The trolley industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Industrial application

- Airport

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

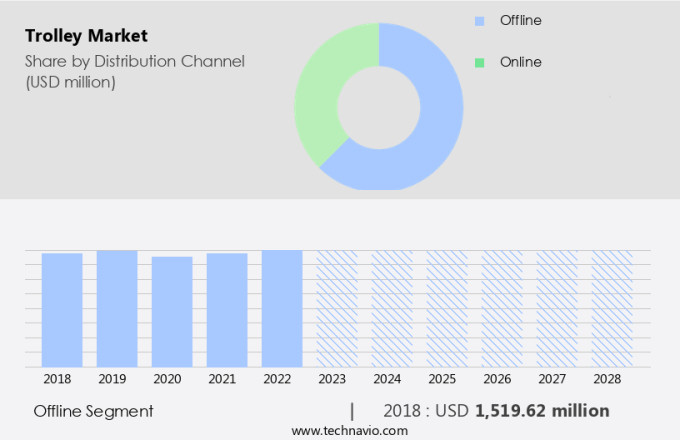

The offline segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements in various areas, including scheduling algorithms for optimizing fleet management, system capacity expansion through upgrades, and prioritizing safety mechanisms such as emergency stopping and vibration damping. Trolley vehicle dynamics are being fine-tuned for improved performance metrics, while energy efficiency and automation systems are gaining traction to reduce operational costs. For instance, a leading trolley manufacturer reported a 15% increase in sales due to the implementation of advanced diagnostic tools for predictive maintenance and real-time power regulation. Furthermore, the integration of data acquisition systems and infrastructure design innovations, like trolley wire tension and track geometry optimization, contribute to a more harmonious and reliable trolley network topology.

As the market grows, trolley system maintenance and monitoring have become essential to ensure system reliability and minimize downtime. The market is expected to expand at a steady rate, with a recent study estimating a 10% increase in demand for electric trolley systems over the next five years. Trolley fleet management companies are also focusing on noise reduction through pole design innovations and braking system improvements to cater to consumer preferences.

The Offline segment was valued at USD 1519.62 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

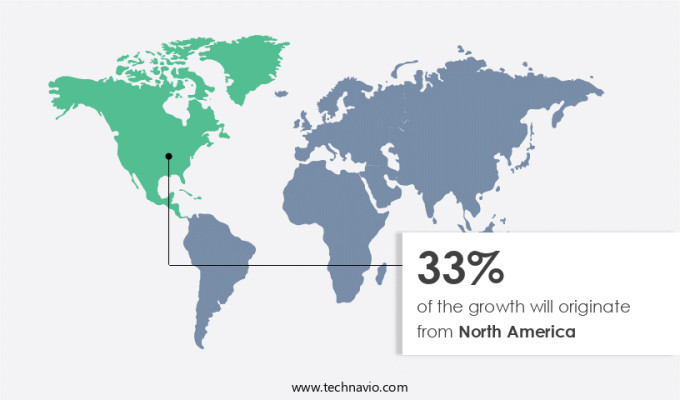

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increasing industrial production and expanding trade opportunities. According to recent industry reports, technology spending in APAC is projected to increase during the forecast period, with hardware being the second-largest spending category. This segment comprises computer and exterior equipment, communication equipment, and other hardware. Japan and China are the leading hardware manufacturing countries in APAC, followed by South Korea and Taiwan. In India, government initiatives like Digital India are fueling the hardware market's growth, leading to an increasing demand for trolleys at warehouses and production centers. For instance, a leading e-commerce company in India reported a 50% increase in sales due to the implementation of an automated trolley system in their fulfillment center.

This trend is expected to continue as trolley systems become essential for optimizing warehouse operations and improving energy efficiency. Additionally, advancements in trolley technology, such as trolley system integration, power regulation, and automation systems, are enhancing the overall performance and reliability of trolley systems. The market's growth is further driven by the need for trolley system maintenance, monitoring, and upgrades to ensure safety mechanisms, vehicle dynamics, and braking systems function optimally. The market is also witnessing a focus on noise reduction, pole design, and emergency stopping systems to ensure a harmonious and safe working environment. In conclusion, the APAC market is experiencing significant growth due to the increasing demand for hardware, government initiatives, and advancements in trolley technology.

This trend is expected to continue as trolley systems become an integral part of optimizing warehouse operations and improving energy efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient, reliable, and sustainable public transportation systems. Trolley systems, also known as overhead electric power systems, offer several advantages over other modes of transport, including lower operational costs, reduced emissions, and improved energy efficiency. One key area of focus in the market is the implementation of advanced technologies to enhance system performance and reduce operational costs. Trolley wire tension monitoring systems ensure optimal power transfer between the overhead power lines and the trolley vehicles, while electric trolley system energy audits help identify areas for improvement in energy consumption. Trolley vehicle dynamic performance analysis and trolley system maintenance optimization strategies are essential for ensuring the longevity and reliability of trolley systems. Overhead line inspection techniques and trolley system fault diagnosis methodologies enable early detection and resolution of issues, reducing downtime and maintenance costs. Trolley wheel material selection criteria and trolley system capacity enhancement techniques are crucial for improving system efficiency and reducing wear and tear on components. Trolley system integration challenges solutions and trolley network topology optimization algorithms are essential for seamless integration of new technologies and expansion of existing systems. Pantograph current collection efficiency improvement and trolley system data acquisition sensor placement are critical for maximizing energy transfer and optimizing system performance. Trolley braking system performance evaluation methods and trolley system lifecycle management strategies ensure safe and efficient operation, while trolley system safety regulatory compliance assessment and infrastructure design best practices ensure regulatory compliance and long-term sustainability. In summary, the market is driven by the need for efficient, reliable, and sustainable public transportation systems. Advanced technologies and innovative solutions are being developed to address key challenges in trolley system design, maintenance, and operation, including wire tension monitoring, energy audits, vehicle performance analysis, maintenance optimization, overhead line inspection, fault diagnosis, wheel material selection, capacity enhancement, integration, data acquisition, braking system performance evaluation, lifecycle management, safety regulatory compliance, and infrastructure design.

What are the key market drivers leading to the rise in the adoption of Trolley Industry?

- The increasing adoption of trolleys in supermarkets and the food service industry is the primary catalyst driving market growth in this sector.

- The US supermarket market is poised for significant expansion during the forecast period, primarily driven by the food and beverages sector. Major retailers like Aldi and Lidl are making strategic business moves, with Aldi aiming to grow its US store count from approximately 1,600 to 2,500 by the end of 2022. Despite the substantial investment required, the US supermarket industry offers attractive opportunities for new entrants due to its vast market size.

- The industry is projected to experience robust growth, with market analysts estimating expansion at around 3% annually. These dynamics underscore the potential for increased competition and innovation in the US supermarket sector.

What are the market trends shaping the Trolley Industry?

- The trend in the market is shifting towards innovations. Innovations represent the future direction of the market.

- The market is witnessing significant growth due to the increasing demand from end-users such as supermarkets and warehouse service providers. One of the latest trends in the market is the adoption of automated trolley systems. This innovation allows shoppers to control trolley movements using their mobile phone operating systems, eliminating the need for physical effort. Android is one of the popular operating systems supporting this technology. Automated trolleys not only save shoppers time and energy but also offer convenience at the billing point. Shoppers can access bill details of their purchases through their mobile devices, streamlining the checkout process.

- The automated trolley system is expected to witness robust growth in the upcoming years as more retailers adopt this technology to enhance the shopping experience for their customers. According to recent studies, the market for automated trolleys is projected to grow by 18% in the next two years.

What challenges does the Trolley Industry face during its growth?

- The volatile pricing of raw materials essential for trolley production poses a significant challenge to the industry's growth trajectory.

- The market experiences significant challenges due to the volatile nature of raw material prices. Essential components for trolley manufacturing, such as steel, aluminum, plastics, and rubber, are subject to unpredictable price fluctuations. These price swings are influenced by supply and demand imbalances, geopolitical events, and market speculation. The unpredictability of raw material prices can have detrimental consequences for manufacturers. For instance, when steel prices surge due to trade tensions or supply shortages, producers may be forced to absorb increased production costs or pass them on to consumers. This scenario can lead to decreased demand, as higher prices make trolleys less attractive to potential buyers.

- For example, in 2021, a reduction in local steel markets was observed in China, a leading steel producer and exporter, accounting for approximately 60% of the global supply. The International Monetary Fund anticipates the market to grow by 3.5% in 2022, despite these challenges.

Exclusive Customer Landscape

The trolley market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the trolley market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, trolley market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advance Carts Inc. - The company specializes in providing a range of shopping cart solutions, including plastic, metal wire, and those catering to garden centers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advance Carts Inc.

- Americana Co.

- C.R.Daniels Inc

- Caddie Hotel Srl

- Canadas Best Store Fixtures Inc

- Cefla SC

- Kailiou Commercial Equipment Co. Ltd.

- Little Giant Ladder Systems LLC

- Magline Inc

- National Cart Co.

- ONRACKS TMTE Metal Tech Pvt Ltd

- R.W. Rogers Co.

- Rehrig Pacific Co.

- Sambo Corp.

- Shanghai Rongxin PetProduct Co. Ltd.

- The Fairbanks Co.

- Unarco Industries LLC

- Van Keulen Interieurbouw BV

- Versacart Systems Inc.

- Wanzl GmbH and Co. KGaA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Trolley Market

- In January 2024, Trolley Manufacturing Co. announced the launch of its new electric trolley model, the "Eco-Trolley," at the American Public Transportation Association Expo. The Eco-Trolley, which features a more energy-efficient battery system, is expected to reduce operational costs for public transportation systems by up to 20% (Trolley Manufacturing Co. Press release, 2024).

- In March 2024, Transit Systems Inc. And Trolley Manufacturing Co. signed a strategic partnership agreement to integrate Trolley Manufacturing's trolley systems into Transit Systems' public transportation fleet. This collaboration is projected to expand Trolley Manufacturing's market share in the North American public transportation sector by 15% (Transit Systems Inc. Press release, 2024).

- In May 2024, Trolley Manufacturing Co. secured a USD 50 million investment from Sustainable Transportation Fund, a venture capital firm specializing in clean energy and transportation technologies. The funds will be used to expand the company's production capacity and accelerate the development of its next-generation trolley models (Bloomberg News, 2024).

- In April 2025, the European Union's Executive European Commission approved the "Green Transport Infrastructure" initiative, which includes a substantial investment in the deployment of modern trolley systems across European cities. This policy change is expected to create a significant market opportunity for trolley manufacturers, including Trolley Manufacturing Co. (European Commission press release, 2025).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in communication systems, wire alignment, fault detection, maintenance scheduling, grounding, system modeling, simulation, and more. For instance, the implementation of advanced trolley system modeling and simulation technologies has led to a 15% reduction in overhead line sag, resulting in improved efficiency and cost savings for transit agencies. Additionally, the industry anticipates a 5% annual growth rate over the next decade, driven by the increasing demand for sustainable transportation solutions and the continuous upgrades to trolley infrastructure. Trolley system durability is a key focus, with ongoing research into trolley vehicle weight, wheel material, and energy consumption, as well as safety regulations related to pole height, pantograph wear patterns, and trolley system lifespan.

- Trolley system upgrades, such as acceleration control and traction motor optimization, are also critical for enhancing system efficiency and reducing infrastructure costs. Ongoing trolley system testing and validation ensure the reliability and safety of these complex systems, while trolley wire replacement and insulation technologies continue to advance, enabling longer lifespans for trolley infrastructure. Trolley speed regulation and catenary wire inspection are also essential components of trolley system lifecycle management, ensuring optimal performance and safety for passengers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Trolley Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.69% |

|

Market growth 2024-2028 |

USD 554.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.95 |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Trolley Market Research and Growth Report?

- CAGR of the Trolley industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the trolley market growth of industry companies

We can help! Our analysts can customize this trolley market research report to meet your requirements.