True Wireless Stereo Earbuds Market Size 2025-2029

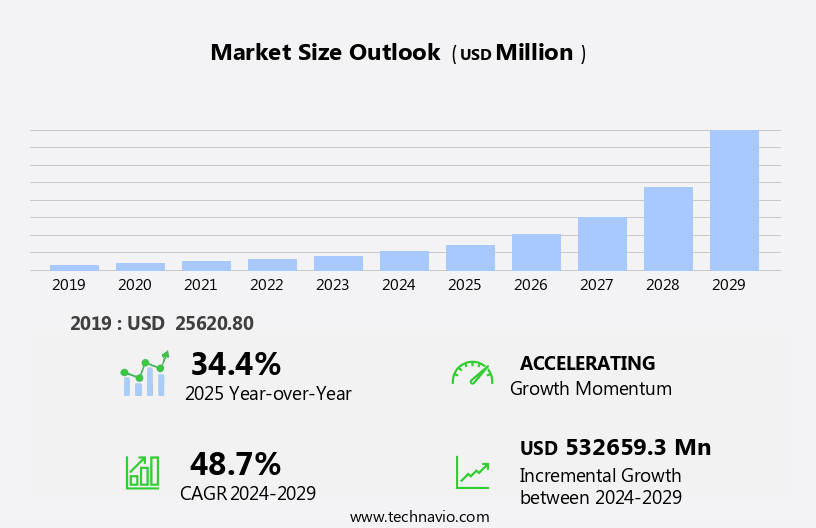

The true wireless stereo (TWS) earbuds market size is forecast to increase by USD 532.66 billion, at a CAGR of 48.7% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing penetration of smart devices such as smartphones, laptops, tablets, and gaming consoles. The convenience offered by wireless connectivity and the ability to use TWS earbuds for various applications including video games, music, and hearing aids, have made them a popular choice among consumers. However, concerns regarding battery life and the potential health hazards associated with prolonged use, such as ear infections and hearing damage, may hinder market growth. The integration of advanced sensors, including microphones and accelerometers, adds to the functionality of TWS earbuds, enabling features such as voice commands and fitness tracking. As consumer electronics continue to evolve, TWS earbuds are expected to become an essential accessory for multimedia and communication needs.

What will be the Size of the True Wireless Stereo (TWS) Earbuds Market During the Forecast Period?

- The market continues to experience strong growth, fueled by advancements in Bluetooth technology and consumer demand for wireless audio solutions. TWS earbuds offer several advantages over traditional wired earphones, including freedom of movement, improved sound quality, and seamless integration with various audio sources such as smartphones, MP3 players, tablets, and even hearing aid devices. These compact wireless accessories are equipped with sensors, microchips, and advanced noise cancellation technology, enabling users to enjoy high-quality audio in various environments. The market is characterized by continuous innovation, with new features such as long-lasting batteries, customizable controls, and sleek, ergonomic designs.

- TWS earbuds are increasingly becoming the preferred choice for consumers seeking a convenient audio experience, making this an exciting and dynamic market to watch. TWS earbuds eliminate the need for cords, offering a clutter-free listening experience. They come with built-in microphones and controls, allowing users to take calls, adjust volume, and skip tracks without reaching for their devices. With continuous advancements in technology, TWS earbuds are poised to revolutionize the way we consume audio, offering unparalleled convenience and functionality.

How is this True Wireless Stereo (TWS) Earbuds Industry segmented and which is the largest segment?

The true wireless stereo (TWS) earbuds industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Price Range

- Below USD 100

- USD 100-199

- Over USD 200

- Distribution Channel

- Online

- Offline

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Price Range Insights

- The below USD 100 segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2024, with the segment under USD 100 holding the largest market share. Economical earbuds in this category are popular due to their basic features and affordability. The increasing adoption of entry-level TWS earbuds, such as Samsung Galaxy Buds FE and Sony WF-C500, is driving market growth. Sensors and microchips are integral components of these earbuds, enabling features like noise reduction and mic controls. TWS earbuds are compatible with various audio sources, including MP3 players, tablets, and smart devices. Brands like Jabra, Noise, Baseus, Xiaomi, boAt, PTron, and Apple's AirPods dominate the market.

Ergonomic designs ensure ease of usage and comfort for consumers. Battery life and bluetooth connectivity are essential considerations for wireless earbuds. The market for TWS earbuds continues to expand, catering to various consumer needs, including sports enthusiasts, health and fitness enthusiasts, and gamers. Online stores and e-commerce platforms are major retail channels for these wireless accessories.

Get a glance at the True Wireless Stereo (TWS) Earbuds Industry report of share of various segments Request Free Sample

The below USD 100 segment was valued at USD 11.72 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

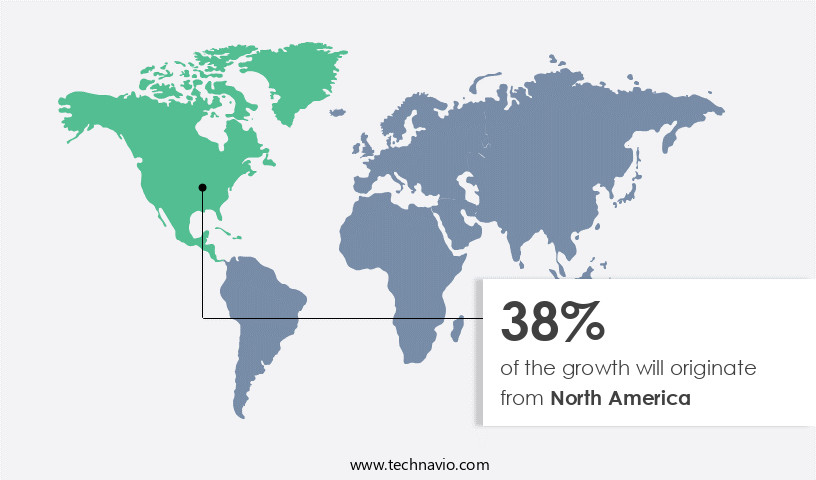

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is expected to lead the global market through 2024. Major contributors to this growth include the US, Canada, and Mexico. Despite the saturation of the consumer electronics industry in the Americas, the increasing popularity of fitness and sports TWS earbuds will continue driving market expansion. The region's high adoption rate of TWS earbuds can be attributed to technological advancements and ergonomic designs, offering ease of usage, comfort, and long battery lives. TWS earbuds are compatible with various audio sources, including MP3 players, tablets, and smartphones, as well as media players, laptops, personal computers, gaming consoles, and wearable technology. Bluetooth technology enables wireless connectivity, eliminating the need for cords or physical connections. Brands offer premium wireless earphones in various price bands, making them accessible to a wide consumer base. However, the market faces challenges from counterfeit goods in grey markets.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of True Wireless Stereo (TWS) Earbuds Industry?

The growing penetration of smart devices is the key driver of the market.

- True Wireless Stereo (TWS) earbuds, also known as In-Ear Monitors (IEMs), have gained significant popularity as wireless accessories for various media sources, including MP3 players, tablets, and smartphones. These earbuds use Bluetooth technology for connectivity, eliminating the need for cords. They are equipped with sensors and microchips, offering features such as noise reduction, echo cancellation, and mic and control functions. Brands like Jabra, Noise, Baseus, Xiaomi, boAt, PTron, and Apple's AirPods dominate the market. The increasing use of smart devices, such as laptops, personal computers, gaming consoles, and wearable technology, is fueling the demand for wireless earbuds. Developing regions, including APAC, the Middle East, Africa, and South America, are witnessing substantial growth in the adoption of smart devices.

- Economic growth, rising literacy rates, and increasing purchasing power are key factors driving this trend. China and India, with their large smartphone markets, are experiencing rapid growth in the sector. Consumers across various industries, including sports enthusiasts, health and fitness, and gaming, benefit from the ease of usage, ergonomic designs, and comfort offered by true wireless earbuds. With advancements in Bluetooth chips and battery technology, these earbuds offer extended battery lives, making them a convenient and portable alternative to traditional headphones. Despite the growing market, it is essential to be cautious of counterfeit goods and ensure the purchase of genuine earbuds from reputable brands and online stores.

What are the market trends shaping the True Wireless Stereo (TWS) Earbuds Industry?

High convenience offered by wireless technology is the upcoming market trend.

- True Wireless Stereo (TWS) earbuds, a type of In-Ear Monitors (IEMs) that operate without wires, have gained significant traction in the consumer electronics market. These earbuds use Bluetooth technology and advanced sensors, microchips, and microphones to deliver high-quality audio and seamless connectivity. The market's growth can be attributed to the increasing popularity of wireless accessories and the abandonment of physical connections in consumer gadgets such as smartphones, MP3 players, tablets, and laptops.

- It offers ease of usage, ergonomic designs, and comfort, making them ideal for various applications, including gaming, sports, health and fitness, smart devices, and video game consoles. The long battery lives, noise-canceling, and echo reduction features further enhance their appeal. However, the market also faces challenges such as counterfeit goods in grey marketplaces, which may impact the price band and consumer trust. Overall, the market is expected to continue growing due to the increasing demand for wireless, portable headphones and the convenience they offer.

What challenges does the True Wireless Stereo (TWS) Earbuds Industry face during its growth?

Perceived health hazards pertaining to true wireless stereo earbuds is a key challenge affecting the industry growth.

- True Wireless Stereo (TWS) earbuds have gained significant traction in the market due to the increasing preference for wire-free listening and the widespread use of smartphones. These earbuds utilize Bluetooth technology for connectivity, enabling users to enjoy high-quality audio from various media sources such as MP3 players, tablets, laptops, personal computers, and video game consoles, without the constraint of cords. It consists of sensors and microchips that offer features like noise reduction, echo cancellation, and controls for the mic and music. Brands like Jabra, Noise, Baseus, Xiaomi, boAt, PTron, and Apple's AirPods dominate the market. However, concerns regarding potential health hazards due to the electromagnetic fields generated by Bluetooth chips persist.

- Despite this, the convenience, ease of usage, and ergonomic designs of make them a popular choice among consumers in various sectors, including sports enthusiasts, health and fitness enthusiasts, and gamers. With advancements in technology, battery lives continue to improve, making these wireless accessories a practical and portable alternative to traditional headphones. However, the market also faces challenges from counterfeit goods and the presence of grey marketplaces, which can impact the overall consumer experience and brand reputation.

Exclusive Customer Landscape

The true wireless stereo (TWS) earbuds market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the true wireless stereo (TWS) earbuds market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, true wireless stereo (TWS) earbuds market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The company offers true wireless stereo earbuds such as AirPods 3rd generation with MagSafe charging case, AirPods 2nd generation, and AirPods Max.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bose Corp.

- Bowers and Wilkins

- Crossbeats

- GN Store Nord AS

- Grado Labs Inc.

- Imagine Marketing Pvt. Ltd.

- JVCKENWOOD Corp.

- Koninklijke Philips NV

- Logitech International SA

- Marshall Group AB

- Matrics Inc.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Shure Inc.

- Skullcandy Inc.

- Sony Group Corp.

- Titan Co. Ltd.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

True Wireless Stereo (TWS) earbuds have revolutionized the way we consume audio, offering a wireless and convenient listening experience. These devices, also known as In-Ear Monitors (IEMs) or wireless earphones, have gained significant traction in the consumer electronics market due to their portability, ease of usage, and advanced features. It consists of two separate earbuds, each containing sensors, microchips, and other essential components. These components enable features such as touch controls, voice assistants, and noise reduction. The earbuds connect to each other and to an audio source, such as a smartphone, tablet, or MP3 player, via Bluetooth technology.

Further, the market has seen a rise in growth due to the increasing popularity of wireless accessories and the demand for more portable and convenient listening solutions. The market is driven by various factors, including the proliferation of Bluetooth technology, the rise of smart devices, and the growing trend of health and fitness. They are not limited to entertainment purposes. They are also popular among sports enthusiasts and gaming communities due to their ergonomic designs and comfort. The absence of physical connections makes them an ideal choice for active individuals who require a hands-free experience. The market is highly competitive, with numerous brands and accessory manufacturers vying for market share.

In addition, some of the key players in the market include those that offer premium wireless earphones with advanced features such as noise-canceling, echo reduction, and long battery lives. Others focus on affordability and cater to the mid-range and budget segments. Counterfeit goods and grey marketplaces pose a challenge to the market. Consumers must exercise caution when purchasing these devices to ensure they are authentic and meet safety standards. The price band varies widely, from budget options to high-end premium models. The internet and online stores have made it easier for consumers to access a wide range of options and compare prices and features.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 48.7% |

|

Market Growth 2025-2029 |

USD 532.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

34.4 |

|

Key countries |

US, UK, China, Canada, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this True Wireless Stereo (TWS) Earbuds Market Research and Growth Report?

- CAGR of the True Wireless Stereo (TWS) Earbuds industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the true wireless stereo (TWS) earbuds market growth of industry companies

We can help! Our analysts can customize this true wireless stereo (TWS) earbuds market research report to meet your requirements.