Turboprop Engine Market Size 2024-2028

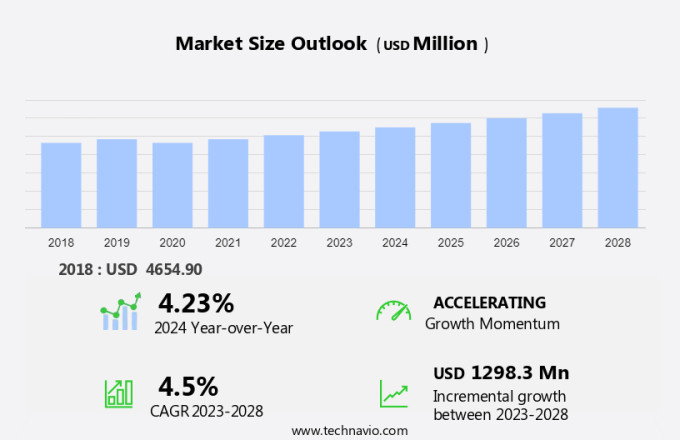

The turboprop engine market size is forecast to increase by USD 1.3 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increase in aircraft deliveries and advancements in engine technologies. These factors are leading to improved fuel efficiency and reduced emissions, making turboprop engines an attractive option for regional and commuter aircraft. The aviation industry's focus on sustainability and environmental impact has led to significant advancements in turboprop engine technology. However, high production costs and delays in engine deliveries pose challenges to market growth. Manufacturers are addressing these challenges through innovation and collaboration with suppliers to streamline production processes and reduce lead times. The market is expected to continue its upward trajectory, driven by these trends and the growing demand for more fuel-efficient and environmentally friendly aircraft engines.

What will be the Size of the Market During the Forecast Period?

- Turboprop engines have been a mainstay in both the airline sector and military sector for decades, providing power to turboprop aircraft for short-distance travel and low-altitude flying. These engines offer several advantages over other transportation methods, particularly in areas with minimal airstrip space and high passenger traffic in air travel. Turboprop engines, a type of turbine engine, operate by using a propeller to propel an aircraft forward. The engine's intake system draws in air, which is then compressed by the compressor. The compressed air is mixed with fuel and ignited in the combustor, producing combustion gases. The high-pressure gases then pass through the reduction gearbox before exiting through the turbine and propelling nozzle.

- Next-generation turboprop engines are increasingly gaining popularity due to their fuel efficiency and reduced fuel consumption. In the airline sector, turboprop engines are often used for short-haul flights, offering passengers a more comfortable experience due to their ability to fly at lower altitudes. In the military sector, turboprop engines provide the power needed for various military and defense applications. Despite their advantages, turboprop engines face competition from turbojet engines, which offer higher speeds and longer ranges. However, the unique capabilities of turboprop engines make them an essential part of the aviation industry. The market continues to grow, driven by the increasing demand for fuel-efficient and cost-effective transportation solutions.

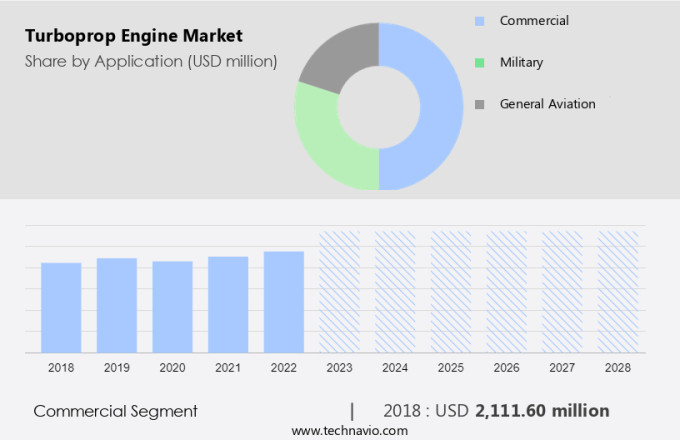

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Military

- General aviation

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

- The commercial segment is estimated to witness significant growth during the forecast period.

Turboprop engines have been a popular choice for military aviation and commercial aircraft, particularly for short-haul routes, cargo transport, and special missions. These engines offer several advantages over jet engines, including better cabin comfort due to lower cabin noise levels, and improved power-to-weight ratio and fuel efficiency. However, the design, including the intake, reduction gearbox, compressor, and combustor, can generate significant noise. To address this issue, redesigned engine nacelles and unique coatings have been implemented to reduce noise levels.

Military applications, such as reconnaissance and cargo transport, continue to utilize it for their ability to operate from short runways and provide better performance on takeoff and landing. Emissions have become a critical concern in commercial aircraft design, and they offer a more environmentally friendly alternative to jet engines, making them a viable option for green air transportation. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 2.11 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is driven by the expanding aviation industry, particularly in North America, where demand for commercial aircraft is increasing due to growing air travel and fleet replacement needs. The recovery of the US economy post-recession has significantly boosted domestic air travel, leading to increased production by aircraft engine Original Equipment Manufacturers (OEMs). To maintain a high level of service and meet customer demands, these OEMs are investing in expanding their facilities and developing comprehensive global Maintenance, Repair, and Overhaul (MRO) networks. The focus on providing top-tier maintenance services and timely repairs is essential for ensuring the airworthiness of turboprop engines, particularly in applications such as military aviation, short-haul routes, and air cargo, which require reliable and efficient engines. Additionally, the trend towards green air transportation is driving innovation in turboprop engine technology, including unique coatings and engine components, to reduce emissions and improve fuel efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of the Turboprop Engine Market?

An increase in aircraft deliveries is the key driver of the market.

- Turboprop engines continue to play a significant role in the airline sector, particularly for short-distance travel and low-altitude flying. These engines offer cost-effective solutions for operators, providing better fuel efficiency and lower emissions compared to jet engines. The military sector also relies heavily on turboprop engines for military aircraft used in transport, surveillance, maritime patrol, and special missions. The aviation industry is witnessing a shift towards next-generation engines, with unique materials such as titanium alloys and ceramics being used to reduce weight and improve complex engine components. Hybrid-electric and all-electric propulsion systems are also gaining traction in the market, offering a green alternative to traditional turboprop engines.

- As the demand for air travel continues to rise, small-scale airports and short-haul routes require aircraft that can operate efficiently on minimal airstrip space. Turboprop aircraft, such as Diamond Aircraft's DART-750 aircraft and Epic Aircraft's E1000, offer advantages in this regard. Despite the benefits of turboprop engines, fuel costs remain a concern for operators. However, the use of advanced technologies and materials is expected to offset these costs over the long term. MRO facilities, parts suppliers, and service centers play a crucial role in maintaining the airworthiness of turboprop engines and reducing repair costs. The military sector is also upgrading its fleets to meet emissions standards and improve performance.

What are the market trends shaping the Turboprop Engine Market?

Advancements in aircraft engine technologies is the upcoming trend in the market.

- The market in the aviation industry is experiencing significant growth due to the increasing demand for cost-effective and fuel-efficient engines, particularly in the airline sector. Passenger traffic continues to rise, leading to an increase in short-distance travel and the need for transportation methods that minimize airstrip space. Turboprop engines, with their ability to provide low-altitude flying and better cabin comfort, are becoming increasingly popular. In the military sector, next-generation engines are being developed to enhance military aircraft capabilities for reconnaissance, cargo transport, special missions, and surveillance. Military organizations are upgrading their fleets to meet emissions standards and reduce noise levels.

- The defense sector also utilizes turboprop engines for maritime patrol purposes and other military applications. The aviation industry is under pressure to reduce carbon emissions and move towards net-zero carbon emissions. Turboprop engines, with their unique materials such as titanium alloys and ceramics, offer a green alternative. However, the complexity of engine components and maintenance and repair costs can be a challenge. The market dynamics are influenced by competition, fuel costs, and the environmental impact of emissions. Commercial aviation, regional routes, and oil wells are significant consumers of turboprop engines. Hybrid systems, including electric/hybrid engines, are gaining popularity due to their potential to deliver improved efficiency and in-flight safety.

What challenges does the Turboprop Engine Market face during its growth?

High production costs and delays in engine deliveries is a key challenge affecting the market growth.

- The market in the airline sector faces challenges due to increasing production costs and engine delivery delays. The rising costs are attributed to the high price of raw materials, advanced technology requirements, and labor shortages, putting a strain on companies' financial resources. These expenses make it difficult to maintain profitability and competitive pricing in the market. Concurrently, engine deliveries are being delayed due to supply chain disruptions and production bottlenecks. Essential components are often delayed, resulting in extended lead times and difficulty meeting customer demands and contractual obligations. These delays negatively impact customer satisfaction and potentially harm the company's reputation and financial stability.

- In the military sector, there is a growing demand for next-generation engines for short-distance travel, low-altitude flying, and specialized military applications such as reconnaissance, cargo transport, and special missions. Turboprop aircraft manufacturers like Diamond Aircraft and their DART-750 aircraft, with its carbon fiber tandem design, cater to this need. The aviation industry is also focusing on reducing fuel costs and carbon emissions by investing in cost-effective engines, green alternative materials like titanium alloys and ceramics, and advanced engine components. Military organizations are upgrading their fleets to meet emissions standards and improve performance, with companies like AVIC producing engines like the WJ-9 turboprop engine for the Xian MA700.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Tractor Inc.

- Airbus SE

- Avions de Transport Regional GIE

- DAHER

- Embrear SA

- General Electric Co.

- Honeywell International Inc.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- PBS Group AS

- PIAGGIO AERO INDUSTRIES S.p.A.

- Pilatus Aircraft Ltd.

- Piper Aircraft Inc.

- Pratt and Whitney

- Rolls Royce Holdings Plc

- Safran SA

- Textron Inc.

- Viking Air Ltd.

- Williams International Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to gain momentum as an essential component in the aviation industry, serving both the airline sector and military organizations. Turboprop engines offer numerous advantages, making them a preferred choice for short-distance travel, low-altitude flying, and minimal airstrip space requirements. In the realm of air travel, turboprop engines play a significant role in catering to passenger traffic through various transportation methods. Air travel remains a popular choice for individuals and businesses, and turboprop aircraft, such as Diamond Aircraft's DA42 and DART-750, provide cost-effective solutions for short-haul routes.

Moreover, these aircraft are designed with advanced materials like all-carbon fiber tandem wings and next-generation engines, ensuring optimal fuel efficiency and reduced maintenance costs. The military sector also heavily relies on turboprop engines for various applications, including surveillance, maritime patrol, and cargo transport. Military organizations often require aircraft that can operate from small-scale airports and offer minimal noise levels, making turboprop engines an ideal choice. These engines are also used in military trainer aircraft, providing essential training for pilots and crews. General aviation is another sector that benefits from turboprop engines due to their cost-effectiveness and versatility. Fuel costs have long been a concern for aviation operators, and turboprop engines offer a more economical solution compared to their jet counterparts.

Additionally, the ongoing trend towards green air transportation has led to the development of turboprop engines with lower carbon emissions and the potential for net-zero carbon emissions. The aviation industry is constantly evolving, with a focus on using unique materials like titanium alloys and ceramics in engine components. These materials contribute to the engines' durability and weight reduction, enhancing their overall performance. Moreover, the integration of hybrid-electric and all-electric propulsion systems is paving the way for more sustainable aviation solutions. Military aviation also benefits from the advancements in turboprop engine technology. Military aircraft, such as those used for reconnaissance, cargo transport, and special missions, require high power-to-weight ratios and fuel efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 1.3 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch