Turkey Aluminum Manufacturing Market Size 2025-2029

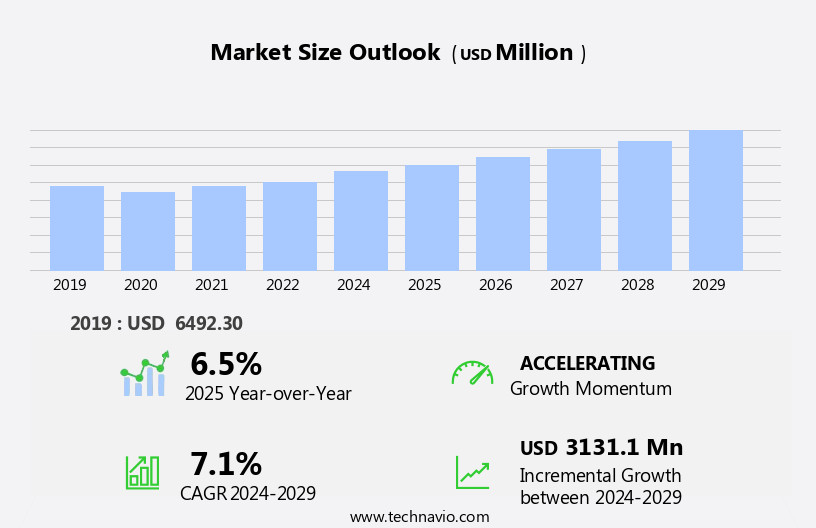

The Turkey aluminum manufacturing market size is forecast to increase by USD 3.13 billion at a CAGR of 7.1% between 2024 and 2029.

- The Aluminum Manufacturing Market is experiencing significant growth driven by the increasing demand for lightweight vehicles and the growing importance of secondary aluminum. Lightweight vehicles are gaining popularity due to their fuel efficiency and environmental benefits, leading to increased demand for aluminum in the automotive industry. Additionally, secondary aluminum, which is recycled aluminum, is becoming increasingly important due to its sustainability and cost-effectiveness. However, the market is not without challenges. Raw material costs, particularly for bauxite and aluminum oxide, have been rising due to supply chain disruptions and geopolitical tensions.

- These factors can impact the profitability of aluminum manufacturers and may require them to explore alternative sourcing strategies or seek cost savings through operational efficiencies. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on optimizing their supply chains, exploring new markets for secondary aluminum, and investing in research and development to improve production processes and product offerings.

What will be the size of the Turkey Aluminum Manufacturing Market during the forecast period?

- The aluminum manufacturing market encompasses various processes, including smelting, refining, fabrication, recycling, and finishing, to produce aluminum and its alloys. This dynamic industry is driven by innovation and research, leading to advancements in aluminum composites, alloys development, and technology. The market's size is significant, with a global demand that continues to grow due to aluminum's versatility and lightweight properties. Aluminum's wide range of applications, from transportation to construction, packaging, and aerospace, fuels the market's expansion. Sustainability is a key trend, with increasing focus on aluminum's circular economy, carbon footprint reduction, and environmental impact mitigation. The aluminum industry is also characterized by a supply chain, logistics, standardization, safety, and a strong focus on digitalization and automation.

- Associations, trade shows, conferences, publications, databases, software, and technology solutions play essential roles in fostering knowledge exchange, collaboration, and market growth. The aluminum market's future direction is shaped by continuous innovation, industry trends, and the evolving needs of various sectors, ensuring its relevance and importance in the global manufacturing landscape.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

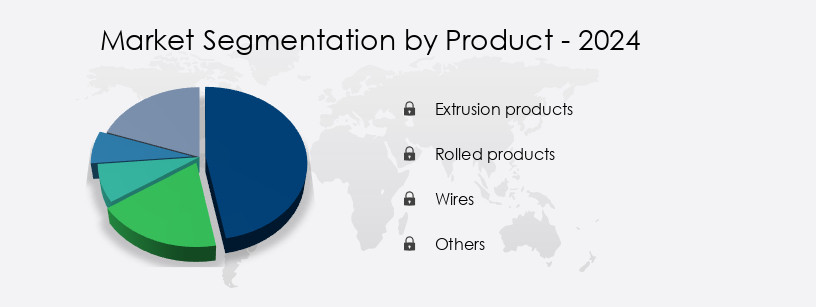

- Product

- Extrusion products

- Rolled products

- Wires

- Others

- End-user

- Automotive and transportation

- Building and construction

- Packaging

- Machinery and equipment

- Others

- Geography

- Turkey

By Product Insights

The extrusion products segment is estimated to witness significant growth during the forecast period. The aluminum manufacturing market is witnessing substantial growth worldwide, fueled by technological advancements and escalating demand from various sectors, particularly consumer goods. Aluminum alloys, including sheet metal and aluminum foil, are increasingly preferred for their energy efficiency, lightweight properties, corrosion resistance, and high strength. Manufacturers are leveraging innovations such as heat treatment, powder metallurgy, additive manufacturing, and 3D printing to optimize processes and enhance product quality. Digital manufacturing techniques, including process optimization and supply chain management, are also gaining traction to streamline production and improve product design. Material science continues to evolve, with advancements in primary and secondary aluminum production leading to the development of aerospace-grade, automotive-grade, and architectural-grade aluminum.

Surface finishing techniques like powder coating and thermal spraying are used to enhance durability and appearance. Modern manufacturing methods, such as CNC machining, laser cutting, and waterjet cutting, enable manufacturers to produce precise and intricate aluminum components. Quality control measures ensure consistent product quality and customer satisfaction. Both established and emerging players in the aluminum manufacturing industry are investing in research and development to stay competitive and meet the evolving demands of their clients. This continuous innovation is driving the growth of the global aluminum manufacturing market.

Get a glance at the market share of various segments Request Free Sample

The Extrusion products segment was valued at USD 2537.10 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Turkey Aluminum Manufacturing Market?

- Increasing demand for lightweight vehicles is the key driver of the market. The global aluminum market has experienced significant growth due to the increasing demand for lightweight materials in various industries. Aluminum, identified as a versatile and second most-used material after steel, is gaining popularity for its use in sectors such as building and construction, electrical, machinery, automotive, transportation, and others. Stringent global regulations, including those set by the US Department of Transportation and the Environmental Protection Agency (EPA), have driven the demand for aluminum in manufacturing, particularly in Turkey. These regulations aim to reduce overall vehicle weight and improve fuel efficiency, making aluminum an attractive option for automakers. The material's lightweight properties and its ability to conduct electricity make it an ideal choice for numerous applications. The aluminum manufacturing market is expected to continue its growth trajectory, driven by the increasing demand for sustainable and lightweight materials across various industries.

- The Aluminum Manufacturing Market in Turkey is driven by aluminum smelting, aluminum refining, and aluminum fabrication processes. Aluminum processing and aluminum finishing ensure high-quality outputs. Focus on aluminum recycling addresses aluminum waste and promotes aluminum sustainability. Aluminum substitution and aluminum alloys development are key innovations. Aluminum research and aluminum innovation drive advancements in aluminum industry trends. Aluminum market analysis highlights aluminum price trends and aluminum supply chain dynamics. Efficient aluminum logistics and aluminum standardization ensure safety and quality. Aluminum safety and reducing aluminum carbon footprint mitigate aluminum environmental impact. The aluminum circular economy is supported by aluminum industry associations, aluminum trade shows, aluminum conferences, aluminum publications, and aluminum databases, fostering growth and collaboration.

What are the market trends shaping the Turkey Aluminum Manufacturing Market?

- The growing importance of secondary aluminum is the upcoming trend in the market. Aluminum, a versatile and recyclable metal, is derived from both primary and secondary sources. Secondary aluminum, which accounts for a significant portion of the market, is obtained from recycled materials such as end-of-life products. The recycling process involves extracting aluminum from waste materials using techniques like laser-induced breakdown spectroscopy (LIBS) and color sorting. These methods help separate aluminum from other materials and alloys, as well as remove contaminants to enhance the quality and value of the scrap. The secondary production process for aluminum is energy-efficient, consuming 92% less energy compared to primary production.

- This makes aluminum scrap a valuable commodity. Approximately 90.55% of aluminum can be recycled at the end of a product's life, contributing to its sustainability and reducing the need for primary production. By employing advanced recycling technologies, the aluminum industry ensures the efficient use of resources and minimizes environmental impact.

What challenges does Turkey Aluminum Manufacturing Market face during its growth?

- Rising raw material costs and supply chain disruptions is a key challenge affecting the market growth. The aluminum manufacturing market faces significant challenges from rising raw material costs, primarily driven by increasing prices for alumina and bauxite. As of early 2025, these price hikes are attributed to supply constraints in major producing regions like China and Australia, as well as higher energy costs impacting refining processes. For manufacturers heavily reliant on imported raw materials, such as those in Turkey, these increased costs translate directly to production expenses, potentially squeezing profit margins.

- Furthermore, supply chain disruptions compound the issue, with logistical bottlenecks and geopolitical tensions contributing to unsteady material flows into affected markets. Companies must navigate these challenges by either absorbing the costs or passing them on to customers, which could impact competitiveness in price-sensitive markets.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AKPA ALUMINYUM TIC AS - The company offers aluminum extrusion profiles which are designed to be used in making interior design elements, guide rails, paneling, furniture, sheds, and trailers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albaksan Alasimli Bakir

- Alko Aluminum

- Almesan Aluminyum Sanayi ve Ticaret AS

- Altim Aluminyum San Ve Tic Ltd Sti

- Arslan Aluminyum AS

- Assan Aluminyum Sanayi ve Ticaret A.S.

- Bor Aluminyum

- BURAK ALUMINYUM SANAYI VE TICARET AS

- Caliskan Aluminum Accessories

- Cansan Aluminum

- Dogus Kalp

- Eti Aluminyum

- Hisar Celik Dokum Sanayi ve Ticaret AS

- KOLAS ALUMINYUM AS

- Ozeren Aluminum

- Ozgenc Makina

- SEPA

- Teknik Aluminum

- Tuna Aluminum

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aluminum alloys have gained significant traction in various industries due to their unique properties, making them a preferred choice for manufacturing a wide range of products. The versatility of aluminum alloys is evident in their application across consumer goods, energy efficiency, and lightweight materials. The demand for aluminum alloys is driven by their inherent advantages, such as corrosion resistance, high strength, and heat treatment capabilities. These properties make aluminum alloys an ideal substitute for traditional materials, particularly in industries that require lightweight yet strong components. The manufacturing process for aluminum alloys involves several techniques, including sheet metal processing, powder metallurgy, and additive manufacturing.

In sheet metal stamping processing, aluminum alloys are rolled or extruded to produce flat sheets, plates, or other shapes. These processed aluminum alloys are then used to manufacture various consumer goods, such as packaging materials, construction components, and automotive parts. Powder metallurgy and additive manufacturing techniques have also gained popularity in the aluminum alloys market. Powder metallurgy involves the production of aluminum powders, which are then consolidated under high pressure and temperature to form dense, high-performance components. Additive manufacturing, on the other hand, uses 3D printing technology to create complex geometries and structures, offering significant advantages in terms of design freedom and material optimization.

The manufacturing process for aluminum alloys is not limited to these techniques alone. Other processes, such as surface finishing, CNC machining, laser cutting, and waterjet cutting, are also commonly used to produce high-quality aluminum components. Quality control measures are implemented throughout the manufacturing process to ensure the consistent production of high-quality aluminum alloys. The aluminum alloys market is characterized by continuous innovation and process optimization. Advancements in material science have led to the development of new alloys with enhanced properties, while digital manufacturing techniques have streamlined the production process and improved supply chain management. The aerospace, automotive, and architectural industries are major consumers of aluminum alloys due to their high-performance requirements.

Aerospace-grade aluminum alloys are used in the production of aircraft components due to their high strength-to-weight ratio and excellent corrosion resistance. Automotive-grade aluminum alloys are used in the manufacturing of lightweight car parts, such as engine blocks and body panels. Architectural-grade aluminum alloys are used in the construction industry for their durability and aesthetic appeal. The aluminum alloys market is a dynamic and innovative industry that continues to evolve with advancements in material science, manufacturing processes, and digital technologies. The versatility of aluminum alloys, coupled with their unique properties, makes them a preferred choice for various industries, including aerospace, automotive, and construction.

The manufacturing process for aluminum alloys involves several techniques, including sheet metal processing, powder metallurgy, additive manufacturing, and various finishing processes. Continuous innovation and process optimization are key drivers in the aluminum alloys market, ensuring the production of high-quality components that meet the evolving needs of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 3.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Turkey

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch