Ultrasonic Scalpel Market Size 2024-2028

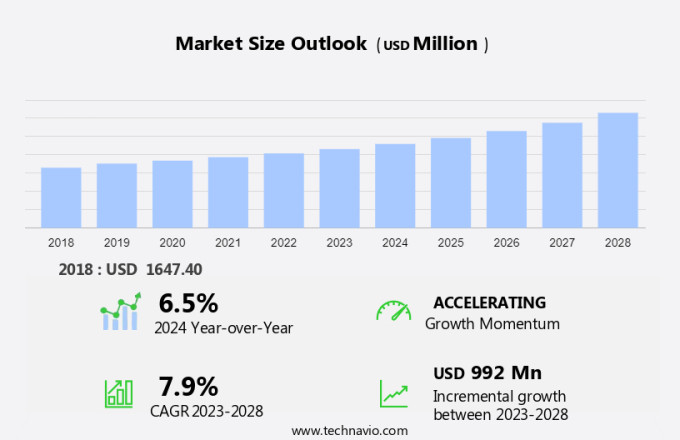

The ultrasonic scalpel market size is forecast to increase by USD 992 million, at a CAGR of 7.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for faster and safer surgical procedures. Ultrasonic scalpels offer advantages such as precise incisions, reduced thermal damage, and minimal blood loss, making them increasingly popular in various surgical applications. Furthermore, strategic partnerships among companies for the distribution of ultrasonic scalpels are on the rise, expanding their reach and accessibility to a broader customer base. However, the market faces challenges in the form of risks and complications associated with ultrasonic surgical devices. These risks include the potential for tissue damage due to improper use or calibration, as well as the high initial investment costs.

- Companies seeking to capitalize on market opportunities must focus on addressing these challenges through rigorous training programs for medical professionals and continuous innovation to reduce costs and improve safety features. In summary, the market is poised for growth, driven by the demand for advanced surgical tools, strategic partnerships, and ongoing innovation, while navigating the challenges of ensuring safety and reducing costs.

What will be the Size of the Ultrasonic Scalpel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in ultrasonic energy and its applications across various sectors. Ultrasonic energy, characterized by high-frequency acoustic waves, is at the heart of this technology. Its unique properties, including complication reduction through precise cutting and coagulation effect, make it an increasingly preferred choice in surgical procedures. Heat generation and power settings are crucial factors influencing the market's dynamics. The ability to control amplitude and vibration frequency allows for surgical precision, minimizing thermal and mechanical effects on surrounding tissues. This contributes to improved patient recovery and reduced trauma. Ultrasonic surgical devices offer numerous advantages, such as minimal invasiveness and reduced operative time.

Applications span from lesion removal and tissue dissection to nerve sparing and hemostasis control. The ongoing development of handpiece designs and waveform analysis further enhances surgical efficiency and surgical precision. Acoustic energy, a key component of ultrasonic scalpels, plays a pivotal role in tissue impedance analysis and depth control. Tissue vaporization and cell disruption are additional benefits, contributing to improved visibility during procedures. Market activities remain vibrant, with ongoing research focusing on enhancing power settings, improving cutting mechanism design, and optimizing thermal and mechanical effects for various surgical applications. The evolving nature of this market ensures continued innovation and growth.

How is this Ultrasonic Scalpel Industry segmented?

The ultrasonic scalpel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ultrasonic scalpel systems

- Ultrasonic accessories

- Ultrasonic scalpel generators

- Application

- Orthopedic surgery

- Gynecological surgery

- Ophthalmic surgery

- Urological surgery

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

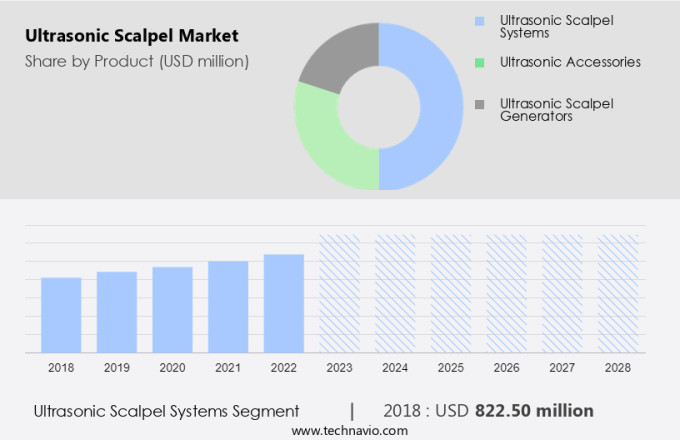

The ultrasonic scalpel systems segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to advancements in technology, particularly in the area of ultrasonic scalpel systems. These systems offer numerous benefits, including improved surgical precision, reduced trauma, and minimally invasive procedures. The ultrasonic energy transmitted through the scalpel enables precise lesion removal and coagulation effect, while amplitude control and frequency control ensure consistent cutting performance. The use of ultrasonic energy also reduces operative time and improves visibility for surgeons, allowing for better hemostasis control and tissue dissection with depth control. The handpiece design of ultrasonic scalpels facilitates nerve sparing and reduced thermal effect, enhancing patient recovery.

The latest innovations in ultrasonic scalpel technology include waveform analysis and power settings, which enable real-time monitoring of tissue impedance and tissue vaporization. This results in better surgical efficiency, improved surgical applications, and reduced complications. Moreover, the acoustic energy generated by ultrasonic scalpels can lead to cell disruption and tissue vaporization, making it an effective tool for various surgical procedures. The handpiece design and amplitude control features contribute to the scalpel's surgical precision and minimal invasiveness, ultimately improving wound healing and patient outcomes.

The Ultrasonic scalpel systems segment was valued at USD 822.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

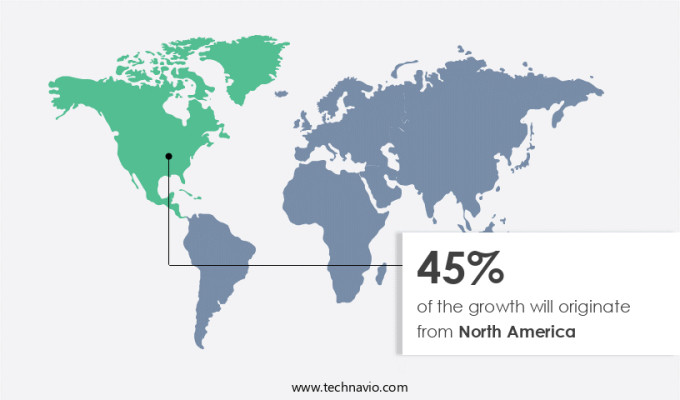

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the United States is experiencing significant growth due to the increasing prevalence of chronic diseases, such as heart disease, cancer, and diabetes. These conditions, which are the leading causes of death and disability in the country, necessitate advanced surgical tools that can enhance patient outcomes and reduce healthcare costs. Ultrasonic scalpels, with their precision cutting, coagulation effect, and nerve sparing capabilities, are increasingly being adopted for various surgical applications. Ultrasonic energy, transmitted through the handpiece, facilitates efficient tissue dissection and vaporization, while amplitude control and frequency control ensure surgical precision. Energy transmission and waveform analysis enable depth control and hemostasis, contributing to reduced operative time and complication reduction.

The handpiece design, with its minimal invasiveness, improved visibility, and reduced trauma, further enhances patient recovery. Surgical devices equipped with ultrasonic technology offer thermal and mechanical effects, contributing to tissue impedance and cell disruption. Power settings enable customization for various surgical needs, while tissue vaporization and lesion removal ensure surgical efficiency. The market's evolution is driven by the need for advanced surgical tools that can address the complexities of chronic disease management while prioritizing patient safety and well-being.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ultrasonic Scalpel Industry?

- The surge in demand for faster and safer surgical methods is the primary market driver, as advancements in technology continue to prioritize patient safety and efficiency.

- The market is witnessing notable growth due to the rising demand for minimally invasive surgical procedures and the integration of robot-assisted surgery (RAS) in various medical fields. Robot-assisted surgeries offer numerous advantages, including enhanced dexterity, improved visualization, and more precise procedures. These benefits have made RAS a preferred choice for complex surgeries in urology, gynecology, and cardiology. However, traditional ultrasonic scalpels, which are commonly used in laparoscopic surgeries, have limitations in robotic applications due to their bulky transducers. To address this challenge, advancements in ultrasonic scalpel technology have led to the development of smaller, more versatile devices. These new scalpels offer amplitude control and adjustable vibration frequency, allowing for precise blood vessel sealing and nerve sparing during lesion removal.

- The coagulation effect of ultrasonic energy transmission ensures efficient hemostasis, contributing to faster patient recovery. The cutting mechanism of ultrasonic scalpels offers a harmonious strike between the blade and tissue, minimizing thermal damage and reducing the risk of complications. Overall, the market for ultrasonic scalpels is poised for continued growth as technological advancements address the unique challenges of integrating these devices into robot-assisted surgical procedures.

What are the market trends shaping the Ultrasonic Scalpel Industry?

- The increasing number of strategic partnerships among companies for the distribution of ultrasonic scalpels represents a significant market trend. This collaboration is essential for expanding market reach and enhancing product offerings in the medical device industry.

- The market is experiencing growth through strategic collaborations among companies to expand distribution channels. In a recent development, IMPLANET, a leading medical device company, announced a partnership with SMTP Technology Co., a specialized manufacturer of high-tech medical devices, granting exclusive distribution rights for the latest generation of ultrasonic surgical scalpels in France. This ultrasonic scalpel, suitable for open, minimally invasive surgeries, and endoscopic intervertebral spine procedures, has gained marketing clearance in significant markets, including China, the European Union, and the US.

- The ultrasonic scalpel's innovative design ensures surgical safety through a cutting tip with reduced amplitude, minimizing heat generation and complication risks. Precise power settings enable surgeons to optimize operative time and maintain harmonious tissue coagulation during surgical applications. Acoustic energy from the ultrasonic scalpel facilitates precise cutting with minimal thermal spread, contributing to the growing adoption in various surgical applications.

What challenges does the Ultrasonic Scalpel Industry face during its growth?

- The ultrasonic surgical devices industry faces significant challenges due to the risks and complications associated with their use, which can hinder market growth. These risks, which include thermal injury, tissue damage, and potential for infection, necessitate rigorous research and development efforts to mitigate their impact and ensure patient safety.

- The market encounters substantial challenges due to the potential health risks and complications linked to these advanced surgical tools. The Food and Drugs Administration (FDA) in the US has identified several concerns, including infection and adverse tissue reactions, which necessitate stringent measures to ensure patient safety and device efficacy. Infection is a significant issue due to the potential for contamination if devices are not adequately sterilized or reusable components are insufficiently cleaned and sterilized between uses. Consequences of infections can range from prolonged patient recovery times to increased healthcare costs. Moreover, adverse tissue reactions can result from the utilization of non-biocompatible materials in ultrasonic scalpels.

- These reactions can manifest in various forms, including thermal and mechanical effects, which may compromise surgical precision and efficiency. To mitigate these risks, ongoing research focuses on waveform analysis, frequency control, tissue impedance, handpiece design, and other factors to enhance surgical precision, reduce trauma, and improve overall surgical efficiency.

Exclusive Customer Landscape

The ultrasonic scalpel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ultrasonic scalpel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ultrasonic scalpel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apollo Technosystems - The SoniCure SC100E ultrasonic scalpel from an unspecified company delivers advanced tissue dissection and vessel sealing capabilities for surgeons.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Technosystems

- Axon Medical Solutions

- Beijing Taktvoll Technology Co. Ltd

- Bioventus LLC

- BOWA Electronic GmbH and Co. KG

- Chongqing Xishan Science and Technology Co. Ltd.

- Double Medical Technology Inc

- Ezisurg Medical Co. Ltd

- Hangzhou Kangji Medical Instrument Ltd

- Heal Force Biomeditech Holdings Ltd.

- Hocermed Tianjin Medical Technologies Co. Ltd

- Implanet SA

- Jiangsu Qianjing Medical Equipment Co. Ltd.

- Johnson and Johnson Services Inc.

- Medtronic PLC

- Miconvey

- Nami Surgical

- Olympus Corp.

- Reach Surgical Inc.

- Surgnova

- Tonglu Kanger Medical Instrument Co. Ltd.

- Wuhan BBT Mini Invasive Medical Tech Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ultrasonic Scalpel Market

- In January 2024, Ethicon, a subsidiary of Johnson & Johnson, announced the FDA approval of its Harmonic Ace Ultrasonic Surgical Device for general laparoscopic procedures. This approval expanded the application scope of ultrasonic scalpels beyond urological procedures (Johnson & Johnson press release).

- In March 2024, Medtronic and Harmonic Surgical, a leading ultrasonic surgical instruments manufacturer, entered into a strategic collaboration to integrate Harmonic's ultrasonic surgical devices into Medtronic's robotic-assisted surgical systems. This partnership aimed to enhance the precision and efficiency of robotic surgeries (Medtronic press release).

- In May 2024, Olympus Corporation, a global medical equipment manufacturer, completed the acquisition of SterilMed, a leading provider of medical device reprocessing services. This acquisition allowed Olympus to expand its ultrasonic scalpel offerings by integrating SterilMed's advanced sterilization technologies (Olympus press release).

- In April 2025, Mermaid Medical, a Chinese ultrasonic surgical instruments manufacturer, secured a Series C funding round of USD 50 million from Sequoia China and other investors. The funds were earmarked for research and development, as well as expanding their manufacturing capabilities (Mermaid Medical press release).

Research Analyst Overview

- The market is characterized by continuous advancements in generator settings, system ergonomics, and tip configurations to enhance clinical outcomes. A troubleshooting guide and surgical technique training programs ensure seamless integration of these devices into clinical workflows. Disinfection protocols and sterilization methods maintain safety profiles, while regulatory compliance and quality assurance programs ensure device reliability. Power consumption and system components are critical performance metrics undergoing rigorous testing and calibration processes. Safety features, accessory selection, user interface, and energy delivery are essential considerations for device selection.

- Repair procedures and clinical validation are integral to device maintenance, and tissue interaction and therapeutic efficacy are key performance indicators. Safety features, clinical validation, and regulatory compliance are crucial elements of the market, driving innovation and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ultrasonic Scalpel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2024-2028 |

USD 992 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

US, Germany, Canada, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ultrasonic Scalpel Market Research and Growth Report?

- CAGR of the Ultrasonic Scalpel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ultrasonic scalpel market growth of industry companies

We can help! Our analysts can customize this ultrasonic scalpel market research report to meet your requirements.