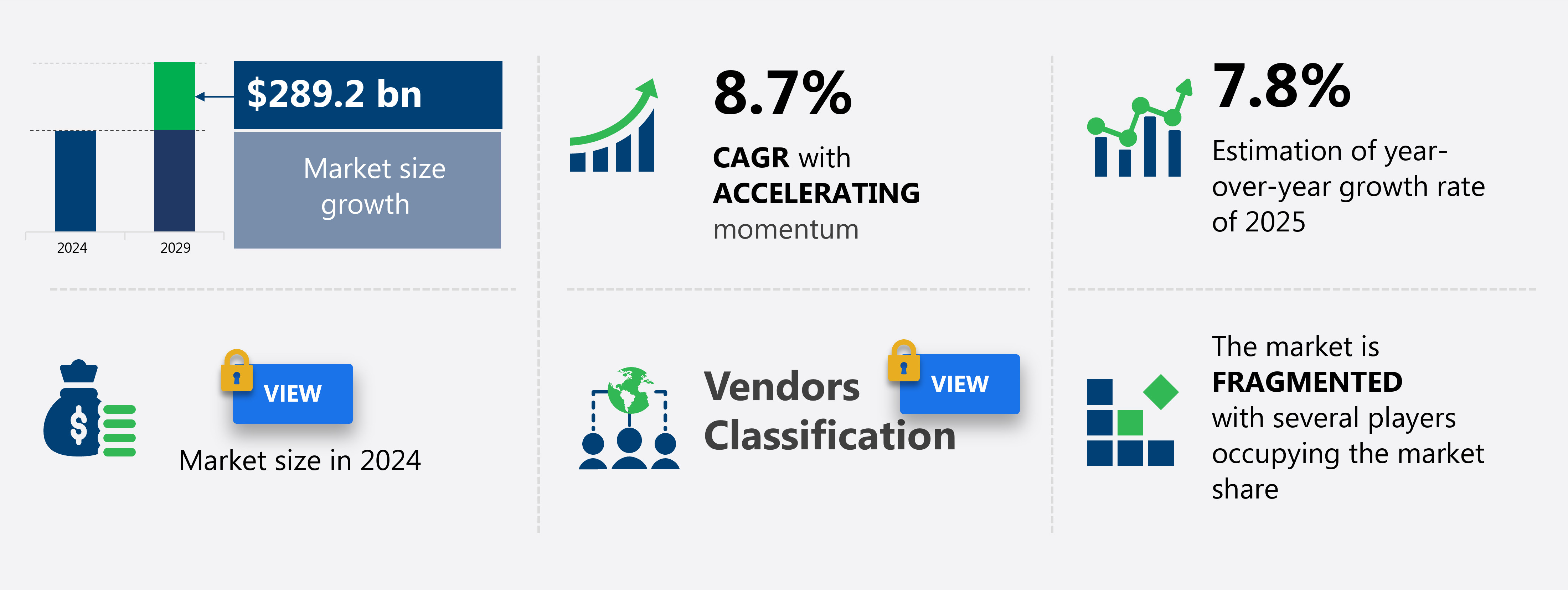

US B2C E-Commerce Market Size 2025-2029

The US B2C e-commerce market size is valued to increase USD 289.2 billion, at a CAGR of 8.7% from 2024 to 2029. Rise in online spending and smartphone penetration will drive the US B2C e-commerce market.

Major Market Trends & Insights

- By Type - B2C retailers segment was valued at USD 191.90 billion in 2022

- By Application - Consumer electronics and home appliances segment accounted for the largest market revenue share in 2022

- CAGR from 2024 to 2029: 8.7%

Market Summary

- The B2C E-Commerce Market in the US continues to evolve, driven by the rising trend of online spending and increasing smartphone penetration. US e-commerce sales are projected to reach USD 863.4 billion by 2023, representing a significant market expansion. Core technologies and applications, such as artificial intelligence and augmented reality, are transforming the shopping experience, while service types and product categories, including food delivery and subscription services, are gaining popularity. The emergence of omnichannel retailing is blurring the lines between online and offline shopping, offering consumers seamless experiences.

- However, logistics management remains a critical challenge, leading to high overhead costs. Regulations, such as data privacy laws, also impact the market dynamics. Staying updated on these evolving trends and patterns is essential for businesses aiming to succeed in the US B2C E-Commerce Market.

What will be the Size of the US B2C E-Commerce Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

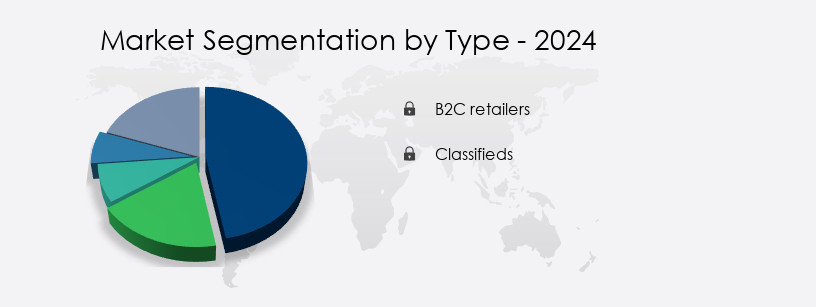

How is the B2C E-Commerce in US Market Segmented ?

The B2C e-commerce in US industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- B2C retailers

- Classifieds

- Application

- Consumer electronics and home appliances

- Apparel and accessories

- Personal care

- Others

- Platform

- Multi-brand

- Single-brand

- Consumer Segment

- Millennials

- Gen Z

- Baby Boomers

- Families

- Platform Type

- Online Marketplaces

- Brand Websites

- Social Commerce

- Delivery Format

- Standard Shipping

- Same-Day Delivery

- Subscription-Based

- Geography

- North America

- US

- North America

By Type Insights

The B2C retailers segment is estimated to witness significant growth during the forecast period.

The B2C e-commerce market in the US continues to evolve, driven by increasing retail sales and the preference for secure online transactions. According to recent data, e-commerce sales accounted for over 16% of total retail sales in 2020, a figure that is expected to reach 22% by 2024. To attract and retain customers, B2C companies employ various strategies, including conversion rate optimization, digital marketing, and personalization. These efforts result in substantial website traffic, with an average shopping cart abandonment rate of 69.57%. Effective customer relationship management is crucial, with tools like CRM systems, email marketing automation, and customer loyalty programs helping to foster long-term relationships.

E-commerce platforms and inventory management systems streamline operations, while search engine optimization and social media marketing boost website visibility. Mobile commerce and mobile app development cater to the growing number of mobile users, and influencer marketing, content marketing, and affiliate marketing expand reach. Security remains a priority, with e-commerce security measures, fraud detection systems, and data analytics dashboards ensuring a safe and efficient shopping experience. Pricing strategies, user experience design, and search advertising further enhance the customer journey. Ultimately, the focus on improving the overall shopping experience and supply chain efficiency drives growth in the B2C e-commerce market.

The B2C retailers segment was valued at USD 191.90 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving B2C e-commerce landscape of the US market, businesses are constantly seeking innovative strategies to optimize their online retail customer journey and enhance conversion rates. Website design plays a pivotal role in this process, with effective email marketing automation strategies complementing the digital marketing efforts. Measuring return on investment (ROI) from these initiatives is crucial, necessitating ecommerce platform integration with payment gateways. Mobile shopping experience is a significant focus area, with optimizations aimed at improving customer service through chatbots and reducing shopping cart abandonment. Successful loyalty programs, based on customer segmentation data analysis, personalize user experience recommendations and encourage repeat purchases.

Social media engagement is another critical component, with effective management of online product reviews and targeted advertising essential for maintaining a positive brand image. E-commerce website security best practices are non-negotiable, as data breaches can significantly impact customer trust. Supply chain efficiency improvements, content marketing, and influencer marketing campaigns are other essential strategies for staying competitive. According to market intelligence, more than 70% of new product developments in the US B2C e-commerce sector focus on enhancing the mobile shopping experience, reflecting its growing importance. This shift underscores the need for businesses to prioritize mobile optimization and invest in advanced technologies to cater to evolving consumer preferences.

The US B2C e-commerce market continues to expand rapidly, driven by evolving consumer expectations, digital innovation, and intense competition. A key component of optimizing this digital ecosystem lies in online retail customer journey mapping, which helps businesses understand every stage of user interaction—from awareness to conversion and post-purchase engagement. Mapping this journey allows retailers to identify pain points and opportunities for improvement. One such opportunity is enhancing the impact website design conversion rates. Clean layouts, intuitive navigation, fast load times, and responsive design are proven to influence user behavior and directly affect the likelihood of completing a purchase.

A critical performance metric in the digital space is measuring return on investment digital marketing. Accurately attributing revenue to campaigns—whether via search ads, email marketing, or influencer partnerships—enables businesses to allocate resources efficiently and scale what works. Backend integration is also essential to providing a seamless experience. ecommerce platform integration payment gateways ensures secure, fast, and convenient transactions, which is especially important as digital wallets and one-click checkouts become standard.

With mobile usage surpassing desktop in online shopping, optimizing mobile shopping experience has become a top priority. Mobile-optimized interfaces, simplified navigation, and accelerated mobile pages (AMP) are central to reducing bounce rates and increasing mobile conversions. Customer service remains a key differentiator. Many brands are now improving customer service chatbots to provide 24/7 assistance, automate FAQs, and escalate complex queries to human agents when needed—all contributing to better user satisfaction and retention.

Another significant challenge in the US B2C e-commerce market is cart abandonment. Effective strategies reducing shopping cart abandonment include exit-intent popups, limited-time offers, simplified checkout processes, and timely email reminders. To build long-term customer relationships, businesses are implementing successful loyalty programs that reward repeat purchases, offer personalized discounts, and encourage customer referrals. These programs can increase lifetime value and reduce churn.

Data-driven decision-making is at the core of digital success. Analyzing customer segmentation data helps identify high-value user groups, tailor marketing efforts, and refine product offerings to suit specific demographic or behavioral traits. One of the most impactful tactics in personalization is personalizing user experience recommendations. Using AI and browsing history, brands can deliver curated product suggestions that improve conversion rates and user engagement.

Finally, leveraging social media engagement has become indispensable for reaching younger consumers and fostering brand loyalty. From influencer collaborations to user-generated content campaigns, social platforms are powerful tools for driving traffic and creating authentic brand connections. As the US B2C e-commerce market matures, success will hinge on how well businesses integrate technology, data, and human-centric design to create seamless, personalized, and efficient online shopping experiences.

What are the key market drivers leading to the rise in the adoption of B2C E-Commerce in US Industry?

- The concurrent increase in online spending and smartphone penetration serves as the primary catalyst for market growth.

- The B2C e-commerce market in the US has experienced significant growth, fueled by the increasing Internet penetration and the shift of consumers towards online platforms. As of January 2024, there were approximately 331.1 million active Internet users in the US, a substantial increase from previous years. This trend has been further boosted by the rise in social media usage, with 239 million active users. The convenience of shopping online through smart devices, such as desktops, laptops, and tablets, has gained popularity due to the larger, more tangible interfaces that facilitate the decision-making process. The emergence of m-commerce has also upgraded purchase and delivery options, making online shopping more accessible and efficient.

- The adoption of tablets, in particular, has seen a surge due to their suitability for online purchasing. The number of active tablet users in the US has grown steadily, reaching 112.5 million in January 2024. This shift towards digital shopping channels is a continuous and evolving trend, shaping the future of retail across various sectors.

What are the market trends shaping the B2C E-Commerce in US Industry?

- The emergence of omnichannel retailing represents a significant market trend. This approach allows consumers to shop seamlessly across multiple channels, including brick-and-mortar stores and online platforms.

- Omnichannel retailing represents a dynamic market trend, merging offline and online sales channels for manufacturers. The online sector encompasses company websites and prominent e-commerce platforms. Consumers increasingly seek product information and new releases online, prompting companies to view the digital platform as an extension, rather than a replacement, for physical storefronts. This strategy broadens business reach and enhances brand visibility.

- Moreover, online presence enables sales expansion beyond geographical constraints. Companies leverage this approach to cater to consumers' evolving shopping habits and capitalize on the convenience and accessibility of the digital marketplace.

What challenges does the B2C E-Commerce in US Industry face during its growth?

- The escalating importance of logistics management, which often results in substantial overhead costs, poses a significant challenge to the growth of the industry.

- Inefficiencies in logistics management pose significant challenges for the B2C e-commerce sector in the US. These issues, including the absence of accurate postal addresses and intricate delivery routing, can lead to increased overhead costs for e-commerce companies, eroding their profit margins. Moreover, subpar delivery services can negatively impact brand image, potentially reducing customer bases for US-based online retailers. International e-commerce enterprises operating from the US face substantial losses due to these complications.

- To mitigate these challenges, companies employ a large workforce to enhance delivery services, thereby increasing labor expenses. It is crucial for e-commerce businesses to address these logistical hurdles to maintain competitiveness and customer satisfaction.

Exclusive Technavio Analysis on Customer Landscape

The US B2C e-commerce market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the US B2C e-commerce market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of B2C E-Commerce in US Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, US B2C e-commerce market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company specializes in Business-to-Consumer e-commerce, providing a range of gaming headsets including the BENGOO G9000 model compatible with PS4, PC, Xbox One, PS5, and controllers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- ASOS Plc

- Bed Bath and Beyond Inc.

- Best Buy Co. Inc.

- Costco Wholesale Corp.

- eBay Inc.

- Etsy Inc.

- Inter IKEA Holding B.V.

- Kohls Inc

- Lowes Co. Inc.

- Macys Inc.

- Poshmark Inc.

- Target Corp.

- The Gap Inc.

- The Home Depot Inc.

- The Kroger Co.

- Walmart Inc.

- Wayfair Inc.

- Williams-Sonoma, Inc.

- Zara

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in B2C E-Commerce Market In US

- In January 2024, Amazon announced the acquisition of Primary Bio, a Boston-based startup specializing in AI-powered vitamin and supplement recommendations, marking a significant foray into the health and wellness sector for the e-commerce giant (Amazon press release).

- In March 2024, Walmart and Microsoft entered into a strategic partnership to strengthen their respective e-commerce offerings. Microsoft would provide Walmart with its cloud technology, enabling the retailer to improve its online shopping experience and better compete with Amazon (Microsoft and Walmart press releases).

- In May 2024, Target Corporation revealed a USD 1 billion investment in its digital capabilities, including its e-commerce platform and digital marketing efforts, aiming to boost its online sales and better compete with major players in the US e-commerce market (Target press release).

- In February 2025, Shopify, a leading e-commerce platform, received approval from the US Securities and Exchange Commission (SEC) for its proposed secondary offering of common shares, raising approximately USD 2.5 billion to fund future growth initiatives (Shopify SEC filing).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled US B2C E-Commerce Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 289.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The B2C e-commerce market in the US continues to evolve, with key trends shaping its dynamic landscape. One notable development is the increasing importance of return processing, ensuring seamless customer experiences and minimizing potential losses. Customer Relationship Management (CRM) systems have become essential, enabling personalized interactions and fostering long-term customer relationships. Payment gateway integration remains a crucial aspect, allowing businesses to accept various payment methods and currencies, enhancing convenience and flexibility. Conversion rate optimization and digital marketing strategies are increasingly prioritized, with website traffic a significant focus. Shopping cart abandonment rates persist as a challenge, necessitating continuous efforts to improve user experience and streamline the checkout process.

- E-commerce security is paramount, with robust fraud detection systems and data analytics dashboards essential for mitigating risks and maintaining customer trust. E-commerce platforms and inventory management systems facilitate efficient operations, while personalization strategies and customer segmentation enable targeted marketing efforts. Supply chain efficiency is a critical concern, with mobile commerce, influencer marketing, and social media marketing driving growth. Website usability, search engine optimization, and content marketing strategies contribute to increased online retail sales. Affiliate marketing, email marketing automation, and search advertising are essential marketing tools, while mobile app development and customer acquisition cost remain key considerations.

- Pricing strategies and user experience design play significant roles in customer loyalty and retention. Product recommendations, customer loyalty programs, order fulfillment processes, and online advertising further enhance the e-commerce experience. Overall, the US B2C e-commerce market is characterized by continuous innovation and adaptation to meet evolving customer needs and preferences.

What are the Key Data Covered in this US B2C E-Commerce Market Research and Growth Report?

-

What is the expected growth of the US B2C E-Commerce Market between 2025 and 2029?

-

USD 289.2 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (B2C retailers and Classifieds), Application (Consumer electronics and home appliances, Apparel and accessories, Personal care, and Others), Platform (Multi-brand and Single-brand), Consumer Segment (Millennials, Gen Z, Baby Boomers, and Families), Platform Type (Online Marketplaces, Brand Websites, and Social Commerce), and Delivery Format (Standard Shipping, Same-Day Delivery, and Subscription-Based)

-

-

Which regions are analyzed in the report?

-

US

-

-

What are the key growth drivers and market challenges?

-

Rise in online spending and smartphone penetration, Criticality of logistics management leading to high overhead costs

-

-

Who are the major players in the B2C E-Commerce Market in US?

-

Key Companies Amazon.com Inc., ASOS Plc, Bed Bath and Beyond Inc., Best Buy Co. Inc., Costco Wholesale Corp., eBay Inc., Etsy Inc., Inter IKEA Holding B.V., Kohls Inc, Lowes Co. Inc., Macys Inc., Poshmark Inc., Target Corp., The Gap Inc., The Home Depot Inc., The Kroger Co., Walmart Inc., Wayfair Inc., Williams-Sonoma, Inc., and Zara

-

Market Research Insights

- The B2C e-commerce market in the US continues to evolve, with sales conversion funnels becoming increasingly complex. In 2020, e-commerce sales accounted for 14.1% of total retail sales, representing a significant increase from 11.3% in 2015. This growth can be attributed to various factors, including the integration of live chat support, social commerce, and data-driven marketing strategies. Moreover, the role of e-commerce analytics in optimizing customer experience and driving sales growth is becoming increasingly crucial. For instance, product catalog management, cross-selling strategies, and upselling strategies are essential components of data-driven marketing efforts. A/B testing and customer lifetime value analysis enable businesses to make informed decisions regarding website design, pricing, and promotional campaigns.

- Effective brand building through user interface design and customer feedback management is another critical aspect of the B2C e-commerce landscape. Logistics optimization, order management software, and price elasticity analysis are essential tools for managing the intricacies of e-commerce operations. As the market becomes more competitive, businesses must leverage these strategies to enhance customer retention, improve online reputation management, and execute successful omnichannel marketing campaigns. Market basket analysis and promotional campaigns further aid in understanding customer behavior and driving sales growth.

We can help! Our analysts can customize this US B2C e-commerce market research report to meet your requirements.