US Biochar Market Size 2024-2028

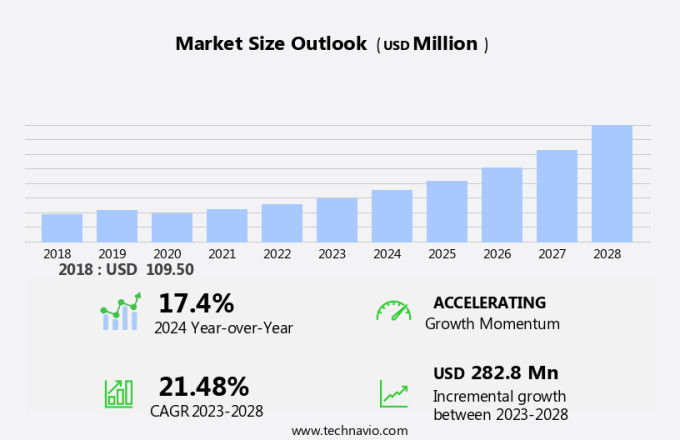

The US biochar market size is forecast to increase by USD 282.8 million, at a CAGR of 21.48% between 2023 and 2028. The market is driven by the increasing demand for soil improvement and the shift towards organic farming. This market is witnessing significant growth due to the recognition of biochar as an effective solution for enhancing soil fertility and reducing greenhouse gas emissions. The raw materials used in the production of biochar include agricultural waste, wood waste, forest waste, and animal manure. Technological advancements and application analysis in the power generation segment are also contributing to the market's expansion. However, a lack of awareness and understanding of biochar among farmers and consumers poses a challenge to market growth. Environmental awareness and the need for sustainable agricultural practices are expected to fuel the demand for biochar in the coming years.

Market Analysis

The market is witnessing significant growth due to the increasing focus on climate change mitigation and sustainable agricultural practices. Biochar, a carbon-rich material derived from the thermal decomposition of biomass in a low-oxygen environment, offers several environmental benefits. Biochar production processes include pyrolysis and gasification. These processes convert various feedstocks, such as agricultural waste, wood waste, forest waste, and animal manure, into biochar. The use of these waste materials for biochar production not only reduces the amount of waste but also contributes to environmental awareness and the circular economy. The agricultural segment is a major consumer of biochar in the US. Biochar's ability to improve soil quality makes it an essential component of climate-friendly agriculture. It enhances soil porosity, reducing soil water loss and increasing water retention capacity. Moreover, biochar's high surface area and cation exchange capacity improve soil fertility and nutrient availability. The livestock segment is another significant consumer of biochar in the US. Biochar's application in livestock farming helps reduce greenhouse gas emissions by improving manure management and reducing the need for chemical fertilizers. Additionally, biochar's use in water treatment and biogas production further expands its applications.

Biochar's role in carbon sequestration is a crucial factor driving its market growth. Biochar's high carbon content and long-term stability make it an effective carbon sink, helping to mitigate carbon emissions and reduce the overall carbon footprint. The World Bank's support for biochar research and implementation in developing countries is expected to boost the US biochar market. The organization's focus on sustainable agriculture and climate change mitigation initiatives is likely to increase the demand for biochar as a climate-friendly solution. Organic food producers in the US are also adopting biochar as a sustainable farming practice. Biochar's ability to improve soil health and fertility aligns with the organic farming industry's focus on sustainable and environmentally friendly practices. The market is experiencing steady growth due to the increasing focus on sustainable agriculture, carbon emissions reduction, and environmental awareness. The versatility of biochar and its ability to address various environmental challenges make it a promising solution for the future.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Pyrolysis

- Gasification

- Others

- Application

- Farming

- Power generation

- Industrial and others

- Geography

- US

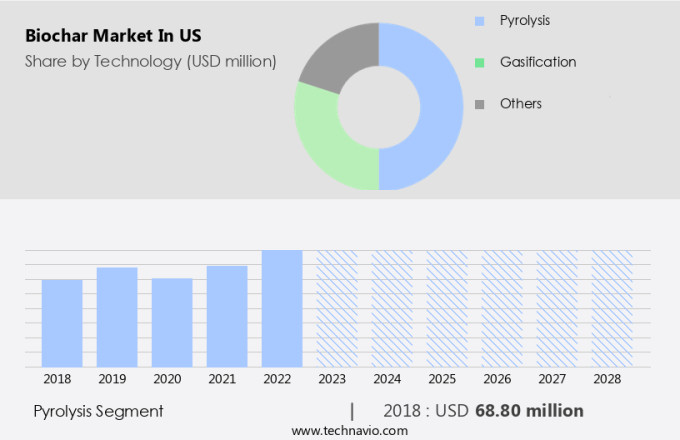

By Technology Insights

The Pyrolysis segment is estimated to witness significant growth during the forecast period. Biochar, a charcoal-like substance derived from the pyrolysis process, has emerged as a sustainable solution for managing various types of organic waste in the US. Pyrolysis is a thermal decomposition technique that converts organic materials, such as agricultural waste, wood waste, forest waste, and animal manure, into biochar, bio-oil, and syngas. The power generation segment is also exploring the use of biochar as a fuel for generating electricity. Pyrolysis technology for biochar production is gaining traction due to its potential environmental benefits. This process involves heating organic materials in the absence or limited supply of oxygen at high temperatures to prevent complete combustion. The resulting biochar can be utilized as a soil amendment and carbon sequestration tool. The US biochar market is witnessing significant growth due to the increasing environmental awareness and the availability of abundant organic waste. Various types of raw materials, including agricultural waste, wood waste, forest waste, and animal manure, can be converted into biochar using pyrolysis technology.

Get a glance at the market share of various segments Request Free Sample

The pyrolysis segment was valued at USD 68.80 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing need for soil improvement is the key driver of the market. Biochar, derived from the pyrolysis or gasification of biomass such as agricultural waste, wood waste, forest waste, animal manure, and other organic materials, is gaining popularity in the US market due to its environmental benefits and agricultural applications. The increasing concern for climate change and carbon emissions reduction has led to a rise in the adoption of climate-friendly agriculture practices, with biochar being a key component. The agriculture segment, including livestock farming, is the largest consumer of biochar, using it for soil amendments and crop nutrition. The technology segment, including pyrolysis and hydrothermal carbonization, is witnessing significant growth due to its ability to produce high-quality biochar.

Moreover, the market is driven by the demand for sustainable soil improvement solutions, reducing the reliance on chemical fertilizers and pesticides. Biochar enhances soil health by improving water retention, soil porosity, and soil acidity, thereby increasing crop yield and productivity. The technology analysis and application analysis of biochar reveal its potential use in various sectors, including power generation, water treatment, and organic food production. The use of biochar in cooking stoves and biogas production is also on the rise. The environmental awareness and concern for sustainable practices have led to an increase in the use of biochar in agriculture, livestock farming, and forestry.

Market Trends

The inclination toward organic farming is the upcoming trend in the market. The market is witnessing significant growth due to its environmental benefits and various applications. Biochar is produced through processes such as pyrolysis and gasification of biomass, including agricultural waste, wood waste, forest waste, and animal manure. This process not only reduces carbon emissions, contributing to mitigating climate change, but also provides a sustainable solution for managing waste. The agriculture segment is a major consumer of biochar, as it improves soil health by increasing porosity and nutrient-holding capacity. It acts as a carbon sink, sequestering carbon for extended periods, reducing the need for synthetic fertilizers and pesticides. In livestock farming, biochar application improves crop nutrition and reduces methane emissions from animal manure.

Also, biochar finds applications in power generation through electricity generation and biogas production. The technology segment includes various methods such as pyrolysis, hydrothermal carbonization, acid hydrolysis, and charcoal production. The use of biochar in water treatment, organic food production, and biogas production further expands its market potential. Environmental awareness and the shift towards climate-friendly agriculture are driving the demand for biochar. The EU Commission and various international organizations have recognized its potential in sustainable agriculture and forestry management. The use of biochar can help mitigate deforestation by reducing the demand for wood pellets and charcoal from timber manufacturers.

Market Challenge

Lack of awareness and understanding of biochar is a key challenge affecting the market growth. The Biochar market in the US is gaining traction due to its potential benefits in various sectors, including agriculture, livestock farming, and power generation. Biochar is produced through processes such as pyrolysis and gasification of biomass, including agricultural waste, wood waste, forest waste, animal manure, and other organic materials. This process helps reduce carbon emissions and mitigate climate change. Despite its advantages, the Biochar market in the US faces challenges due to limited awareness and understanding of the technology among the public, policymakers, and certain agricultural communities. Biochar is a relatively new concept, and educational outreach and public awareness campaigns focused specifically on the substance are lacking.

This lack of awareness hampers the growth of the Biochar market in the US, as potential users remain uninformed about its benefits, such as improving soil fertility, increasing crop yields, and reducing greenhouse gas emissions. The Biochar market in the US has significant potential in agriculture, with applications in crop nutrition, soil improvement, and water retention. In the livestock segment, Biochar can be used as a sustainable alternative to traditional fossil fuel-based fertilizers. In the power generation sector, Biochar can be used for electricity generation and carbon sequestration. Technology analysis and application analysis reveal that hydrothermal carbonization and acid hydrolysis are emerging technologies in the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

High Plains Biochar LLC: The company offers biochar such as premium pine feedstock biochar.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALL Power Labs

- Aries Clean Technologies LLC

- Avello Bioenergy Inc.

- Biochar Now LLC

- Biochar Supreme LLC

- Bioforcetech Corp.

- Blue Sky Biochar

- Carbo Culture co

- Coaltec Energy USA

- Ecotone Inc.

- Glanris Biocarbon Biochar

- Karr Group

- Lewis Bamboo

- Oregon Biochar Solutions

- Pacific Biochar Benefit Corp.

- Seneca Farms Biochar LLC

- Vermont Biochar

- V-Grid Energy Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Biochar, derived from the process of pyrolysis or gasification of biomass, is a carbon-rich product that offers climate-friendly solutions for various industries. This carbon-neutral technology helps reduce carbon emissions, contributing to mitigating climate change. The agriculture segment benefits from biochar's application in enhancing soil quality by improving porosity, water retention, and reducing greenhouse gases. Biomass waste, including agricultural waste, forest waste, animal manure, and wood waste, can be transformed into biochar. The power generation segment also leverages biochar for electricity generation, while the EU Commission supports its use as a sustainable alternative to fossil fuels. The technology analysis reveals that pyrolysis, hydrothermal carbonization, and acid hydrolysis are popular methods for producing biochar.

In addition, biochar's application extends to agriculture, where it improves soil health, enhances crop nutrition, and reduces the need for chemical fertilizers. In livestock farming, it aids in managing manure and improving animal health. Additionally, biochar is used in water treatment, biogas production, and even as a substitute for charcoal in cooking stoves. Environmental awareness is driving the demand for organic food and sustainable practices, making biochar an attractive solution for farmers and manufacturers. The World Bank and other organizations support the adoption of this technology to combat deforestation and reduce timber manufacturing reliance. Stay updated on the latest trends and historical data in the technology and application analysis of biochar.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

116 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.48% |

|

Market Growth 2024-2028 |

USD 282.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.4 |

|

Key companies profiled |

ALL Power Labs , Aries Clean Technologies LLC, Avello Bioenergy Inc., Biochar Now LLC, Biochar Supreme LLC, Bioforcetech Corp., Blue Sky Biochar, Carbo Culture co, Coaltec Energy USA, Ecotone Inc., Glanris Biocarbon Biochar, High Plains Biochar LLC, Karr Group, Lewis Bamboo, Oregon Biochar Solutions, Pacific Biochar Benefit Corp., Seneca Farms Biochar LLC, Vermont Biochar, and V-Grid Energy Systems Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch