US Cannabis Market Size 2025-2029

The US cannabis market size is forecast to increase by USD 141.48 billion at a CAGR of 37.1% between 2024 and 2029.

- The US cannabis market is experiencing significant growth, driven by the expanding millennial population in key markets and increasing investment in research and production of medical marijuana. This demographic shift, coupled with growing acceptance of cannabis for medicinal purposes, presents a substantial opportunity for market expansion. From soothing medical treatments to trendy recreational products, cannabis is weaving its way into the fabric of American life, transforming healthcare, leisure, and local economies. However, challenges persist, including accessibility issues and high prices associated with medical cannabis. These obstacles necessitate strategic planning and innovation from industry players to effectively cater to consumer needs and maintain competitiveness.

- Companies seeking to capitalize on market opportunities must navigate these challenges, ensuring regulatory compliance and offering competitive pricing and accessibility solutions. By addressing these factors, businesses can effectively position themselves in the dynamic and evolving cannabis market landscape.

What will be the size of the US Cannabis Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The cannabis market in the US is experiencing significant market dynamics and trends, with various entities playing crucial roles. Environmental impact is a pressing concern, as the industry explores sustainable practices, such as water management and energy efficiency, to minimize its carbon footprint. Economic impact is substantial, with tax revenue generation and job creation being key drivers. Regulatory challenges persist, as legal frameworks evolve, addressing issues like intellectual property, data analytics, and drug abuse prevention. Product safety and consumer safety are paramount, with rigorous testing for addictive substances and contaminants. Yield optimization and nutrient solutions are essential for maximizing profits, while cannabis accessories, including dab rigs and vaporizers, cater to diverse consumer preferences.

- Waste management and public health concerns are also critical, as the industry navigates the complexities of the legal framework, grey market, and public opinion. Social equity initiatives aim to address historical injustices and promote community impact. Trichome analysis and legalization debates continue, as the industry strives for product standardization and consumer trust. Regulatory compliance, product safety, and sustainability are essential for navigating the evolving cannabis market landscape.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

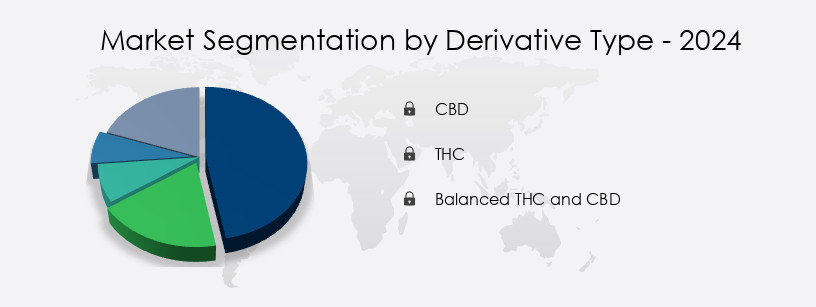

- Derivative Type

- CBD

- THC

- Balanced THC and CBD

- Product

- Medical

- Recreational

- Source

- Marijuana

- Hemp

- Cultivation Type

- Indoor Cultivation

- Outdoor Cultivation

- Greenhouse Cultivation

- Distribution Channel

- Dispensaries

- Online

- Geography

- North America

- US

- North America

By Derivative Type Insights

The cbd segment is estimated to witness significant growth during the forecast period.

The CBD segment in the US cannabis market is expected to remain dominant due to the federal legality of hemp-derived CBD oil. This trend is driven by relaxing government norms regarding CBD usage in most states and at the federal level. As of 2024, states like Georgia and Indiana allow hemp-derived CBD oil for medicinal purposes, with Georgia permitting oil containing up to 5% THC for specific medical conditions, and Indiana allowing its use as long as it contains less than 0.3% THC. Quality control and compliance regulations are crucial in the cannabis industry, with potency testing, heavy metal testing, microbial testing, and pesticide testing being essential for ensuring consumer safety.

Extraction methods, such as supercritical fluid extraction and CO2 extraction, play a significant role in the production of CBD isolate, broad-spectrum CBD, and THC oil. Brand development and marketing strategies are essential for businesses looking to succeed in the competitive cannabis market, with product labeling, inventory management, and consumer perception being key factors. The cannabis market encompasses various product offerings, including cannabis edibles, cannabis concentrates, and cannabis cultivation methods like soil cultivation, outdoor growing, and indoor growing. Organic cannabis and child-resistant packaging are also important considerations for businesses. Despite the evolving market trends, federal regulations continue to pose challenges for the cannabis industry.

Cannabis tourism and drying and curing techniques are additional aspects of the market. The cannabis market caters to various medical conditions, including sleep disorders, anxiety relief, pain management, and epilepsy treatment. The market's dynamics are influenced by ongoing research and pharmaceutical applications. Supply chain management and distribution channels are also crucial for businesses looking to thrive in the cannabis industry.

The CBD segment was valued at USD 8.76 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The US Cannabis Market is experiencing significant expansion, as evidenced by its growing cannabis market size US and dynamic US cannabis market trends. The ongoing cannabis legalization US efforts are fueling demand for both recreational cannabis US and medical cannabis US, profoundly shaping the cannabis industry US. Consumers are increasingly diverse in their preferences, driving growth in segments like cannabis edibles US, cannabis vape market US, and traditional cannabis flower US. While the CBD market US navigates evolving regulations, the broader cannabis market forecast US remains positive. Companies are investing heavily in advanced cannabis cultivation US and cannabis processing US techniques to meet demand, leading to the rise of prominent cannabis brands US. The expansion of dispensaries US and focus on social equity cannabis US initiatives further define the market landscape, despite complex cannabis regulations US for THC products US.

What are the US Cannabis Market market drivers leading to the rise in adoption of the Industry?

- The increasing millennial demographic significantly influences the cannabis market in key regions, serving as the primary growth driver.

- The cannabis market in the US has witnessed significant growth, particularly in the consumption of cannabis products for medicinal purposes among millennials. According to the National Survey on Drug Use and Health (NSDUH) from 2023, approximately 8.3 million adolescents aged 12 to 17, representing 31.9% of this demographic, received mental health treatment in the past year. Furthermore, among the 4.5 million adolescents who experienced a major depressive episode (MDE) in the same year, a substantial number sought mental health treatment. To cater to this growing demand, companies are focusing on various extraction methods such as supercritical fluid extraction and CO2 extraction to produce CBD isolate and broad-spectrum CBD.

- Quality control and brand development are crucial aspects of marketing strategies in this industry, with compliance regulations being a top priority. Effective supply chain management and soil cultivation practices are essential for maintaining the consistency and purity of cannabis products. Hash oil and other concentrates have gained popularity, leading to the development of various distribution channels. State regulations continue to evolve, requiring companies to stay updated and adapt to the changing landscape. In conclusion, the cannabis market in the US is experiencing substantial growth, driven by the increasing number of adolescents seeking mental health treatment and the popularity of cannabis products among millennials.

- Companies are focusing on various strategies, including extraction methods, quality control, brand development, and compliance regulations, to cater to this market. Effective supply chain management and distribution channels are also crucial for success.

What are the US Cannabis Market market trends shaping the Industry?

- The allocation of additional resources for the research and production of medical marijuana represents a significant market trend. This sector is experiencing considerable growth due to increasing funding.

- The legalization of medical marijuana in the US has opened up new avenues for research and development in the cannabis industry. The National Institute on Drug Abuse (NIDA) is one such organization that has been actively funding research in this area. For the fiscal year 2024, NIDA has requested approximately USD1.663 billion for various research initiatives, including studies related to cannabis and its medicinal uses. This funding level is consistent with the previous years, reflecting the growing importance of this area of research. The increasing consumption of medical marijuana in the US has led to a greater focus on product quality and safety.

- As a result, there is a growing demand for potency testing, heavy metal testing, microbial testing, and CBD oil. Retail dispensaries are also emphasizing product labeling and harvesting techniques to ensure the highest standards of quality. Extraction methods, such as live resin, are gaining popularity due to their ability to preserve the plants terpenes and cannabinoids, providing enhanced therapeutic benefits. Companies are investing in research and development to innovate and expand their product offerings, which is expected to drive the growth of the cannabis market during the forecast period.

How does US Cannabis Market market faces challenges face during its growth?

- The growth of the medical cannabis industry is hindered by accessibility issues and exorbitant prices, which pose significant challenges for both patients seeking relief and industry expansion.

- Medical cannabis consumption in the US has grown significantly, with many states legalizing its use for medical purposes. However, accessibility remains a challenge for some consumers, as it is not covered by insurance or sold at local pharmacies. Instead, patients must visit licensed dispensaries to purchase medical cannabis in a controlled and legal environment. Dispensaries maintain detailed records of inventory, including strains, THC oil, full-spectrum CBD, and cannabis edibles. They also ensure compliance with federal regulations, such as pesticide testing, ethanol and solvent extraction, and pharmaceutical applications.

- Consumer perception is crucial, and dispensaries prioritize providing a harmonious and immersive shopping experience. Medical research continues to uncover potential benefits for pain management and other health conditions. As the market evolves, understanding inventory management and staying informed about the latest research are essential for dispensary success.

Exclusive US Cannabis Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurora Cannabis Inc.

- Canopy Growth Corporation

- Charlotte's Web Holdings, Inc.

- Cresco Labs Inc.

- Cronos Group Inc.

- Curaleaf Holdings, Inc.

- CV Sciences, Inc.

- Glass House Brands Inc.

- Green Thumb Industries Inc.

- Innovative Industrial Properties, Inc.

- Jazz Pharmaceuticals plc

- Medical Marijuana, Inc.

- NuLeaf Naturals, LLC

- Organigram Holdings Inc.

- TerrAscend Corp.

- The Valens Company Inc.

- Tilray Brands, Inc.

- Trulieve Cannabis Corp.

- Verano Holdings Corp.

- Village Farms International, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cannabis Market In US

- In January 2024, Curaleaf Holdings, a leading US cannabis company, announced the acquisition of Grassroots Harvest, a Midwest cannabis operator, for approximately USD875 million. This strategic move expanded Curaleaf's footprint to 23 states, making it one of the largest multi-state cannabis operators in the US (Curaleaf Press Release).

- In March 2024, Tilray, a global cannabis and hemp company, partnered with Anheuser-Busch InBev, the world's largest brewer, to research non-alcoholic cannabis beverages. This collaboration marked a significant step towards the potential entry of major beverage companies into the cannabis market (Tilray Press Release).

- In April 2025, Trulieve Cannabis Corp., a Florida-based cannabis company, raised USD300 million through a senior secured notes offering. The funds were earmarked for the expansion of its operations, including the construction of new cultivation and processing facilities (Trulieve Press Release).

- In May 2025, New York State Governor Kathy Hochul signed the Marijuana Regulation and Taxation Act, legalizing adult-use cannabis in New York. This marked a significant regulatory approval, making New York the 16th state in the US to legalize recreational cannabis use (Governor's Press Office).

Research Analyst Overview

The cannabis market in the US continues to evolve, with dynamic market dynamics shaping various sectors. Potency testing is a crucial aspect of ensuring product quality and consumer safety, with methods such as supercritical fluid extraction and CO2 extraction gaining popularity for their efficiency and purity. Recreational cannabis use is on the rise, with sleep disorders being one of the common conditions consumers seek relief for. Heavy metal testing and microbial testing are essential components of quality control in the industry, ensuring the safety and efficacy of CBD oil and other cannabis products. Extraction methods, including ethanol extraction and solvent extraction, play a significant role in product development and brand differentiation.

Nausea relief and pain management are among the medical applications of cannabis, with medical cannabis and cannabis edibles gaining traction in the market. Retail dispensaries employ product labeling and child-resistant packaging to meet compliance regulations and cater to consumer perception. Harvesting techniques, such as outdoor growing and indoor growing, influence the potency and quality of cannabis, with organic cannabis gaining popularity for its health benefits. The cannabis industry's supply chain management is intricate, with distribution channels and inventory management being critical components. Medical research and pharmaceutical applications of cannabis are ongoing, with potential treatments for epilepsy, anxiety relief, and pain management.

Federal regulations continue to evolve, impacting the industry's growth and innovation. Cannabis cultivation techniques, including breeding programs, drying and curing, and cannabis tourism, contribute to the market's continuous dynamism.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cannabis Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.1% |

|

Market growth 2025-2029 |

USD 141.48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch