US Lead acid Battery Market for ESS Size 2023-2027

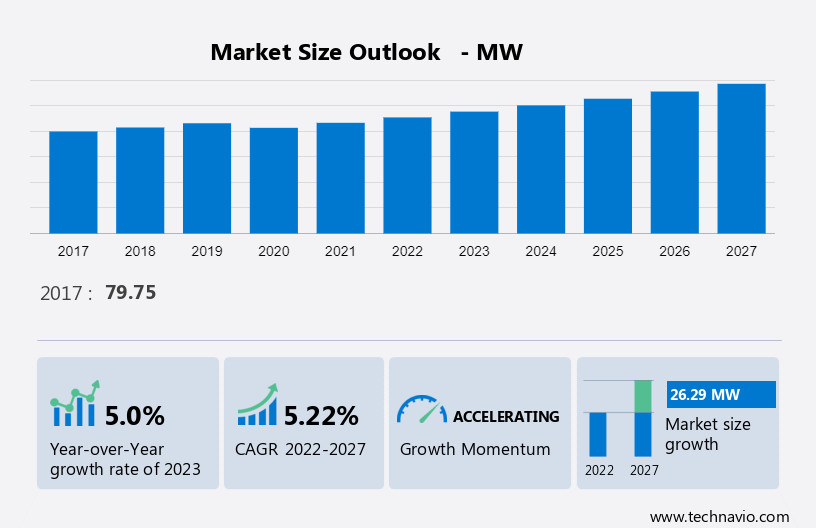

The US lead acid battery for ESS market size is forecast to increase by USD 26.29 MW at a CAGR of 5.22% between 2022 and 2027.

- The lead acid battery market in the US is driven by the cost-competitive nature of lead acid batteries as energy storage solutions. With the increasing focus on renewable energy generation and the need to store excess energy, the demand for lead acid batteries is on the rise. However, the market faces challenges such as the limited usage capacity of lead acid batteries compared to other advanced battery technologies. Despite this, the market is expected to grow steadily due to the affordability and reliability of lead acid batteries. The increasing adoption of renewable energy sources and the need for energy storage solutions to ensure grid stability are key factors contributing to the market growth.

Additionally, the availability of government incentives for renewable energy projects is further boosting the market. Overall, the lead acid battery market in the US is poised for growth, with opportunities arising from the renewable energy sector and the need for cost-effective energy storage solutions.

What will be the Size of the US Lead acid Battery for ESS Market during the Forecast Period?

To learn more about the market report, Request Free Sample

- The lead acid battery market in the US is a significant sector, driven by the demand for reliable and cost-effective energy storage solutions. The market is characterized by a focus on quality, safety, and performance, with VRLA (Valve Regulated Lead Acid) batteries gaining popularity due to their maintenance-free design. Motives for usage span from power backup in UPS systems and telecommunications to automotive applications and renewable energy storage. Certification and regulatory compliance are essential factors, with batteries undergoing rigorous testing and maintenance to ensure reliability and safety. The sector is witnessing innovation in materials, charging technology, and life extension methods, aiming to enhance energy density, efficiency, and sustainability.

The market's growth is influenced by the increasing usage of lead acid batteries in stationary applications, such as renewable energy integration, and the automotive industry's shift towards electric and hybrid vehicles. The disposal and recycling of lead acid batteries are also crucial aspects, with efforts being made to minimize environmental impact and maximize resource utilization. Despite competition from emerging technologies like lithium-ion batteries, the lead acid battery market's resilience is underpinned by its proven track record, cost-effectiveness, and the vast existing infrastructure for manufacturing, distribution, and maintenance.

How is this US ESS Lead acid Battery Industry segmented and which is the largest segment?

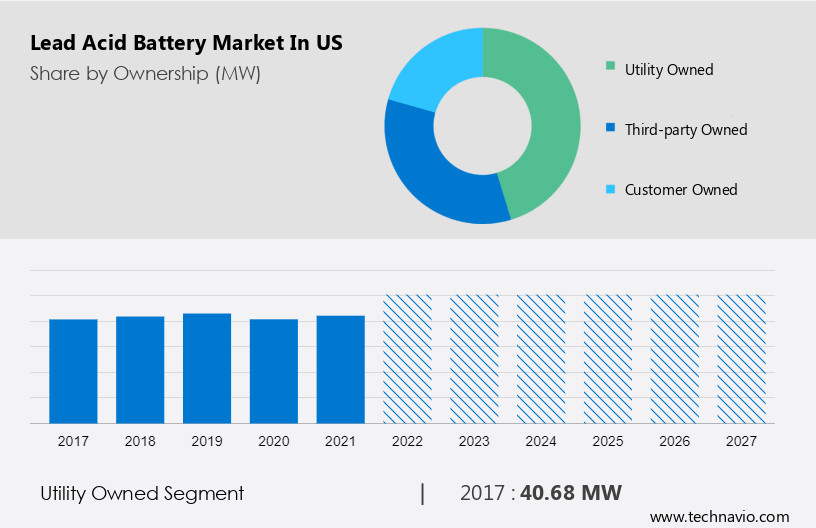

The ESS lead acid battery in US industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD MW" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Ownership

- Utility owned

- Third-party owned

- Customer owned

- Technology

- Basic

- Advanced

- Geography

- US

By Ownership Insights

- The Utility owned segment is estimated to witness significant growth during the forecast period.

Lead acid batteries have been a popular choice for Energy Storage Systems (ESS) in the US due to their affordability, high efficiency, and long-standing technology. Owned primarily by utility companies, these batteries store excess energy during periods of low demand and release it during times of high demand, contributing to grid stability. Lead acid batteries' reliability is a significant advantage, given their extensive use in the energy sector for over a century. Their cost-effectiveness, compared to other energy storage solutions like lithium-ion batteries, adds to their appeal. Research institutions and corporate offices also employ lead acid batteries for motive applications, such as forklifts and golf carts, due to their low self-discharge rate.

In healthcare facilities, these batteries are used in emergency power backup systems, ensuring uninterrupted power supply during power outages.

Get a glance at the lead acid battery in US industry share of various segments Request Free Sample

The Utility owned segment accounted for USD 40.68 MW in 2017 and showed a gradual increase during the forecast period.

Market Dynamics

Our lead acid battery market in US researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US ESS for Lead acid Battery Industry?

Cost-competitive energy storage solutions is the key driver of the market.

- Lead acid batteries, a long-standing technology, continue to dominate the energy storage sector in the US due to their affordability and versatility. These batteries have found applications in various industries, such as transportation, banking, and healthcare, among others. In the transportation industry, they power electric vehicles and serve as backup power in automotive equipment and motorcycles. In the energy sector, lead acid batteries are utilized for stationary applications, off-grid power generation, and as backup power systems in corporate offices and educational institutions. The transportation sector, particularly the automotive industry, has been a significant contributor to the demand for lead acid batteries.

These batteries are used for starting, lighting, and ignition systems in conventional vehicles. In the automotive equipment sector, they are employed for motive power in material handling equipment and other applications. Lead acid batteries have several advantages that make them an attractive option for energy storage. They have a relatively low self-discharge rate, which means they can maintain their charge for extended periods. They also have a long shelf life and can be recharged multiple times, making them a cost-effective solution for energy storage. The design of lead acid batteries has evolved over the years, with advancements in electrode design, conductivity, and charging methods.

For instance, Absorbed Glass Mat (AGM) batteries offer improved performance and longer cycle life compared to traditional flooded lead acid batteries. Calcium-alloy grids and multi-stage charging methods have also contributed to the improved performance and longevity of lead acid batteries. Despite their advantages, lead acid batteries do have some limitations. They have a higher maintenance cost compared to other battery technologies, such as lithium-ion batteries. Terminal corrosion and vibration can also affect their performance and lifespan. However, these challenges are being addressed through ongoing research and development efforts by various institutions and corporations. Lead acid batteries also have applications in the healthcare sector, where they are used for emergency power backup systems and in medical equipment.

In the oil and gas industry, they are used for UPS systems and as backup power in offshore installations. Lead acid batteries continue to be a popular choice for energy storage in the US due to their affordability, reliability, and versatility. While they have some limitations, ongoing research and development efforts are addressing these challenges, making lead acid batteries an attractive option for various applications, including transportation, energy storage, and backup power systems.

What are the market trends shaping the US ESS for Lead acid Battery Industry?

Increase in renewable energy generation target is the upcoming trend in the market.

- The lead acid battery market in the US is experiencing steady growth, particularly in the sectors of energy storage solutions (ESS) and transportation. This growth is driven by the country's commitment to increasing renewable energy generation to 25% by 2025, which necessitates the deployment of more ESS. Lead acid batteries, known for their efficiency, cost-effectiveness, and reliability, are a popular choice for ESS. In the transportation industry, lead acid batteries are used extensively in automotive applications, including starting, lighting, and ignition systems. They are also utilized in automotive equipment, motorcycles, and industrial vehicles for motive power. In the banking and financial sectors, lead acid batteries are used for UPS systems and backup power in corporate offices.

Lead acid batteries are also widely used in stationary applications such as telecommunications, healthcare, educational institutes, and off-grid power generation. The batteries' long shelf life, low maintenance costs, and high discharge rates make them an ideal choice for these applications. The lead acid battery market in the US is characterized by continuous research and development to improve battery performance. This includes advancements in electrode design, conductivity, pulse charging, and hardware components. Carbon additives and multi-stage charging techniques are also being used to enhance battery life and cycle life. Despite their advantages, lead acid batteries do face challenges such as terminal corrosion, self-discharge rate, and vibration.

However, ongoing research and innovation in the industry are addressing these challenges, ensuring the continued popularity of lead acid batteries in various applications.

What challenges does US Lead acid Battery for ESS Industry face during the growth?

Limited usage capacity of lead acid battery is a key challenge affecting the market growth.

- The ESS for lead acid battery market in the US has witnessed significant growth in various sectors, including transportation, banking, energy storage, and off-grid power generation. However, the battery's finite usage capacity is a critical challenge that necessitates careful consideration. The lead acid battery's chemistry is the primary cause of this limitation. During discharge, the battery undergoes a chemical reaction between lead plates and sulfuric acid, resulting in the formation of lead sulfate on the plates. This buildup reduces the battery's capacity and ultimately leads to failure. Moreover, the battery's usage capacity is influenced by its operating conditions. Terminal corrosion, vibration, and self-discharge rate can all impact battery performance.

In the transportation industry, lead acid batteries are widely used for starting, lighting, and ignition systems in automobiles and motorcycles. In the automotive sales sector, these batteries are also used in automotive equipment and motive power applications. In the banking and financial services sector, lead acid batteries are used in UPS systems to ensure uninterrupted power supply to critical operations. In the energy storage sector, these batteries are used for stationary applications, such as renewable energy integration and peak shaving. In the healthcare sector, lead acid batteries are used in emergency power backup systems, while educational institutes use them for powering emergency lighting and signage.

The battery's shelf life and maintenance costs are essential factors that influence its adoption in various applications. Factors such as electrode design, conductivity, pulse charging, and hardware components can all impact battery performance and lifespan. The use of carbon additives, multi-stage charging, and calcium-alloy grids can help improve battery cycle life and discharge rates. Lead acid batteries are also used in various industrial applications, such as in telecommunications, oil and gas exploration, and mining. In the oil industry, these batteries are used for off-grid power generation, while in the mining sector, they are used for powering mining equipment and transportation vehicles.

Emission standards continue to evolve, driving the need for more efficient and environmentally friendly battery technologies. However, lead acid batteries remain a cost-effective and reliable solution for various applications, making them a popular choice despite their limitations. The lead acid battery market in the US is diverse and dynamic, with applications ranging from transportation to energy storage and off-grid power generation. While the battery's finite usage capacity is a challenge, advancements in battery design and technology continue to address these issues, ensuring the continued relevance of lead acid batteries in various industries.

Exclusive Customer Landscape

The lead acid battery market in US market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

A123 Systems LLC - Our company provides a range of lead acid batteries for the US market, including the TEL-HT lead-absorbed glass mat (AGM) battery, the broadline BBA pure battery, and the Valve Regulated Lead Acid (VRLA) battery. These high-performing batteries cater to various applications and industries, ensuring reliability and efficiency for our customers.

The market research and growth report includes detailed analyses of the competitive landscape of the lead acid battery market in US industry and information about key companies, including:

- A123 Systems LLC

- Concorde Battery Corp.

- Crown Equipment Corp.

- East Penn Manufacturing Co. Inc.

- Energizer Holdings Inc.

- EnerSys

- Exide Industries Ltd.

- Hawker Powersource Inc.

- Power Sonic Corp.

- Scotts Emergency Lighting and Power Generation Inc.

- Surrette Battery Co. Ltd.

- Teledyne Technologies Inc.

- Trojan Battery Co. LLC

- U.S. Battery Manufacturing Co.

- UPS Battery Center Ltd.

- Wirtz Mfg Co. Inc.

- AtBatt Inc.

- C and D Technologies Inc.

- Robert Bosch GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

An In-depth Analysis Lead acid batteries have been a mainstay in various industries for decades due to their reliability, affordability, and versatility. This article aims to provide a comprehensive understanding of the lead acid battery market, focusing on its key aspects and market dynamics. Lead acid batteries are widely used in various applications, including lighting, transportation, banking, energy storage, automotive sales, and more. In the transportation industry, they are essential for starting internal combustion engines and powering electric vehicles. In the banking sector, they provide backup power for ATMs and data centers.

In the energy storage segment, they are used for off-grid power generation and UPS systems. The lead acid battery market is influenced by several factors. One critical factor is terminal corrosion, which can reduce battery performance and lifespan. To mitigate this issue, manufacturers have developed various designs, such as Absorbed Glass Mat (AGM) and Vented Lead Acid (VRLA) batteries, which offer improved corrosion resistance and longer cycle life. Another essential factor is the self-discharge rate, which refers to the amount of charge lost over time when a battery is not in use. This rate can significantly impact the overall cost of ownership, as batteries require frequent recharging.

To address this issue, research institutions and corporate offices have been exploring new electrode designs, carbon additives, and pulse charging techniques to improve battery efficiency and reduce self-discharge rates. The lead acid battery market is also influenced by various industries and applications. For instance, in the automotive sector, lead acid batteries are used for starting, lighting, and ignition systems. In the automotive equipment market, they are used for motive power in forklifts and other industrial vehicles. In the healthcare sector, they are used for powering medical equipment. In educational institutes, they are used for backup power in laboratories and computer rooms.

The lead acid battery market is subject to various regulations, such as emission standards, which can impact battery design and manufacturing. For instance, the automotive industry is subject to stringent emission standards, which have led to the development of advanced lead acid batteries with improved efficiency and reduced environmental impact. Lead acid batteries are also used in various off-grid power generation applications, such as renewable energy systems. In this context, the batteries' shelf life, maintenance costs, and cycle life are critical factors. Flooded lead acid batteries, which require regular maintenance, have been largely replaced by maintenance-free AGM and VRLA batteries, which offer longer cycle life and reduced maintenance costs.

The lead acid battery market is also influenced by the design and composition of the batteries' hardware components, such as the lead plates, separators, and electrolyte. For instance, calcium-alloy grids have been developed to improve battery performance and cycle life. The lead acid battery market is a dynamic and complex ecosystem, influenced by various factors, applications, and regulations. Understanding these factors is essential for businesses and individuals looking to optimize their use of lead acid batteries and make informed purchasing decisions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

122 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.22% |

|

Market growth 2023-2027 |

26.29 MW |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

5.0 |

|

Regional analysis |

US |

|

Performing market contribution |

North America at 100% |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A123 Systems LLC, Concorde Battery Corp., Crown Equipment Corp., East Penn Manufacturing Co. Inc., Energizer Holdings Inc., EnerSys, Exide Industries Ltd., Hawker Powersource Inc., Power Sonic Corp., Scotts Emergency Lighting and Power Generation Inc., Surrette Battery Co. Ltd., Teledyne Technologies Inc., Trojan Battery Co. LLC, U.S. Battery Manufacturing Co., UPS Battery Center Ltd., Wirtz Mfg Co. Inc., AtBatt Inc., C and D Technologies Inc., and Robert Bosch GmbH |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the lead acid battery market in US industry growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch