US Sexual Wellness Market Size 2024-2028

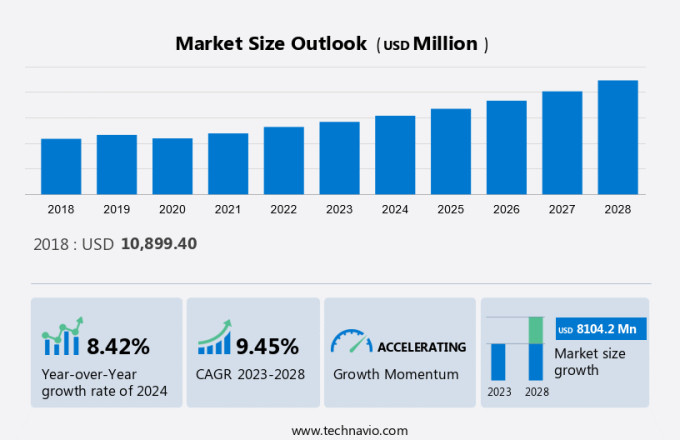

The US sexual wellness market size is projected to increase by USD 8.10 billion, at a CAGR of 9.45% between 2023 and 2028. The market's expansion is contingent upon several key factors, including the increasing therapeutic applications of sex wellness products, growing focus on sexually transmitted disease treatment, evolving consumer perspectives, and the accessibility of sex wellness items via online platforms. As these products garner recognition for their therapeutic benefits beyond mere pleasure, consumer perceptions are shifting, fueling demand. The convenience and privacy offered by online availability further accelerate market growth, enabling consumers to explore and purchase goods such as sex toys discreetly. This market comprises a diverse range of products designed to promote sexual health and pleasure. Key product categories include contraceptives, HIV prevention methods, lubricants (such as water-based lubricant), condoms, and sex toys (including adult vibrators and rubber penises). This evolving perception, coupled with easy online access, not only broadens market reach but also encourages innovation and diversification in sex wellness offerings, catering to a wider array of consumer needs and preferences.

What will be the Size of the US Sexual Wellness Market During the Forecast Period?

To learn more about this US sexual wellness market report, Request free sample

US Sexual Wellness Market Segmentation

The US sexual wellness market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Product Outlook

- Sex toys

- Condoms

- Erotic lingerie

- Personal lubricants

- Others

- End-user Outlook

- Men

- Women

- LGBT community

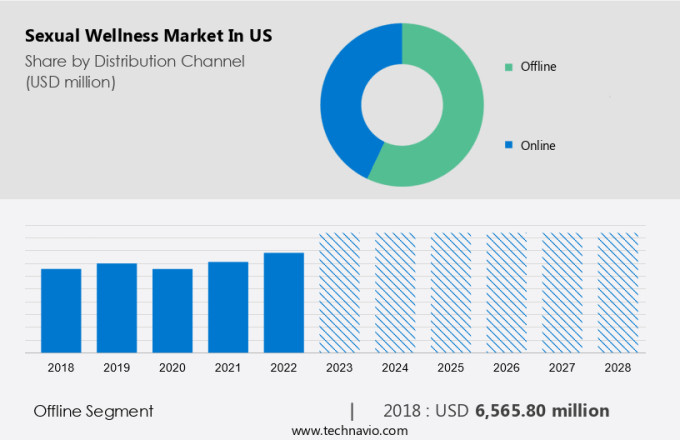

By Distribution Channel

The market share growth by the offline segment will be significant during the forecast period. Offline stores include the retail and specialty stores segment, which includes adult toy stores, supermarkets and hypermarkets, and other retailers. When purchasing sexual wellness products from supermarkets, chemists, and adult toy stores as well as online sex toys, end-users can take advice from professional sales personnel before making the purchase. This will increase their awareness about the safe use of sexual wellness products. Retailers of sexual wellness products also focus on expanding their sales by participating in sex toy expos. Such initiatives by retailers to increase the sales of sexual wellness products will drive US sexual wellness market growth during the forecast period.

The offline segment showed a gradual increase in market share with USD 6.57 billion in 2018 and continued to grow by 2022. The number of people visiting offline stores is increasing significantly as companies provide accurate information to consumers. Some stores also provide special assistance to customers who require guidance on purchasing and using sexual wellness products such as adult vibrators. For instance, Boink Boutique provides its subscribers with a box of pre-selected sex toys, lubricants, and other adult products every month. Furthermore, our report provides a brief analysis of the historical and forecast market share and their segments along with the reasons for growth from 2018 to 2028. The growth of this segment is primarily attributed to the increasing adoption of sexual wellness products in the US, which is driven by an increase in the demand for sexual wellness products in the US.

By End User

The availability of male sexual wellness products, such as sex toys and condoms, is driving the growth of the global sexual wellness market. Men experiencing erectile dysfunction can benefit from options like penis rings, pumps, and constriction bands. The increase in ED cases in the US presents a growing opportunity for the market. Erection rings are a popular choice for achieving penile tightness and satisfactory intercourse, with online stores being a preferred purchase option. This leads to an increased customer base and contributes to the growth of the erection rings market.

US Sexual Wellness Market Dynamics

The market is driven by various factors, including the childbearing population, societal attitudes towards sexuality, and the rise of sex-positive movements. Retail channels for these products include mass merchandisers, retail pharmacies, e-commerce, and door-to-door sales. The market is also influenced by homosexuality and the LGBTQ+ community. Awareness campaigns and advocacy efforts have played a significant role in increasing acceptance of sexual wellness products. The market for these products has seen demand, particularly among millennials. The market is expected to continue growing due to increasing awareness and acceptance of sexually transmitted infections and the importance of sexual health.

Key Market Driver

The increasing use of sexual wellness products for therapeutic purposes is driving the Market share. Women face issues like vaginal dryness, muscle variations, and hormonal imbalances affecting vaginal moisture levels. Surgeries and advanced technology are costly, leading to a demand for sex wellness goods as alternatives.

Moreover, doctors recommend sex toys like vibrators to relax vaginal muscles, while goods like IUDs have resolved conditions like endometriosis. Female sex toys also help increase arousal, relieve stress, and manage hormonal changes, making them popular for stress relief. This trend is expected to positively impact US sexual wellness market growth.

Significant Market Trends

The increase in the popularity of female condoms is a key trend driving the market. More and more women are choosing condoms that cater to their needs, creating a significant demand for such goods. Female condoms offer a pre-intercourse option that is especially beneficial for sex workers facing condom refusal. They also serve as an excellent alternative to hormonal methods of pregnancy prevention, which may not suit everyone. In addition, for some couples, female condoms may be a safer and more pleasurable option.

Moreover, several factors will contribute to the growth of female condoms in the future, including the implementation of comprehensive female condom programs, effective family planning, and HIV prevention programs. Research has shown that the use of female condoms has increased protected sex levels globally and reduced the incidence of STIs. This trend is expected to have a positive impact on the demand for sex wellness goods in the years to come and drive US sexual wellness market growth.

Major Market Challenge

An increase in side effects is a major challenge in the market. Though sexual wellness products are being accepted increasingly, consumers are concerned about the side effects of these products. The raw materials and ingredients such as rubber, plastic, latex, and nitrile used in these goods must be scrutinized as they come in direct contact with sensitive/intimate areas of the skin. This makes the skin more prone to reactions such as pain, irritation, numbness, and inflammation/swelling. Sex toys such as adult vibrators directly come in contact with the skin in intimate areas.

Moreover, some sex toys may cause severe burns, itching, and other health complications. Many of these products contain harmful toxins and chemicals, such as phthalates and parabens, which are sometimes directly absorbed into the bloodstream. These chemicals are linked mainly to congenital disabilities, endocrine disorders, and sperm damage. Lubricants also contain chemical components that can increase the risk of STDs. Chemicals such as phthalates damage the epithelial cells lining the vagina and rectum. Therefore, questions regarding the safety of these goods are being raised by consumers. This has created an inhibition and a negative image of sex wellness goods in the US, which can significantly hamper the sales of these products and impede US sexual wellness market growth.

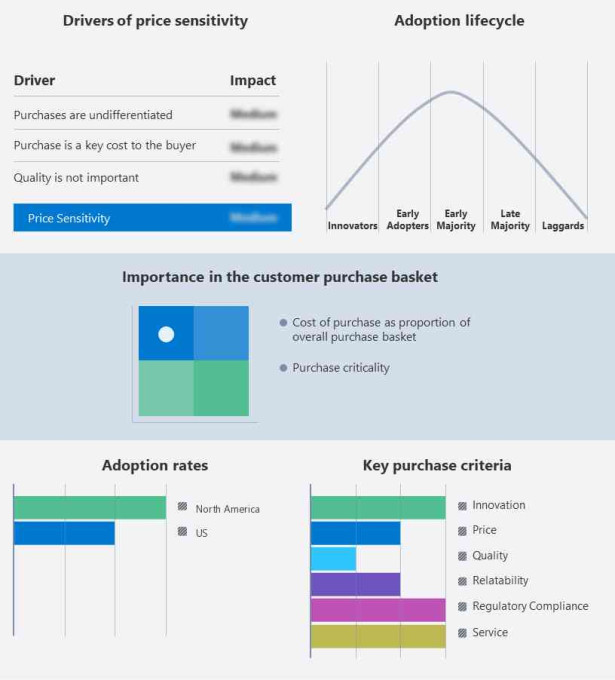

Customer Landscape

The US sexual wellness market research report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the US sexual wellness market forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

US Sexual Wellness Market Companies

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Luvu Brands Inc. - The company offers sexual wellness products.

The US sexual wellness market report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- PHC Inc.

- Ansell Ltd.

- Church and Dwight Co. Inc.

- Dame Products Inc.

- GLYDE

- Good Clean Love Inc.

- HYTTO PTE. Ltd.

- JIMMYJANE

- KESSEL medintim GmbH

- LELOi AB

- Lovehoney Group Ltd.

- Lovelife Toys

- Pure Romance

- Reckitt Benckiser Group PLC

- Sagami Rubber Industries Co. Ltd.

- Veru Inc.

- WOW Tech International GmbH

Qualitative and quantitative market growth analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In November 2024, Trojan launched a new line of eco-friendly condoms made from sustainable materials, catering to the increasing demand for environmentally conscious sexual wellness products. The brand's move aligns with the growing trend of sustainability in the personal care and wellness sectors.

-

In October 2024, LELO introduced an innovative app-controlled vibrator that allows users to customize their experience remotely, offering both a high-tech and personalized approach to sexual wellness. This launch aims to appeal to tech-savvy consumers looking for more interactive and intimate product experiences.

-

In September 2024, Bayer announced the expansion of its sexual wellness portfolio with the launch of a new line of intimate lubricants designed for sensitive skin. The products are marketed as hypoallergenic and dermatologist-tested, responding to growing consumer demand for gentle and non-irritating sexual health products.

-

In August 2024, Danone acquired a leading US-based sexual wellness brand specializing in organic, plant-based lubricants. The acquisition is part of Danone's strategy to expand its presence in the health and wellness market, particularly by tapping into the rapidly growing segment of natural and organic personal care products.

Market Analyst Overview

The US sexual wellness market is a growing industry, encompassing a range of products that cater to the diverse needs of individuals and societies. This market includes HIV prevention methods like contraceptives, as well as pleasure-enhancing items such as sex toys and lubricants. The childbearing population plays a significant role in this market, with the NYC Health Department reporting an increasing trend in sexually active individuals. Homosexuality and sex-positive movements have also influenced the market's growth.

A range of sexual health and wellness products are available, including condoms, water-based and silicone-based personal lubricants, adult vibrators, and rubber penises. Retailers, mass merchandisers, retail pharmacies, health education solution providers, and e-commerce platforms have played a significant role in making these products accessible to the target population. Societal attitudes towards sexual health and wellness are evolving, with increased awareness and acceptance. This market is no longer just about preventing Sexually Transmitted Infections (STIs) like HIV but also about enhancing pleasure and intimacy. STDs, including HIV infection, remain significant health concerns, prompting increased attention from manufacturing companies and retail grocery stores.

Social marketing, utilizing social media and advertisement strategies, is a crucial approach to raising awareness and promoting products related to medical issues such as erectile dysfunction (ED) and other psychological disorders. Investment in social marketing efforts aims to improve public understanding and access to necessary medications. Moreover, addressing the impact of hectic schedules and aging on health, including depression, chronic illness, and sleep problems, underscores the need for comprehensive women's empowerment and education on product types. Effective marketing strategies and retail shops play a key role in supporting women's empowerment and managing testosterone and related health concerns, ultimately contributing to better health outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 8.10 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ann Summers Ltd., Ansell Ltd., Bijoux Indiscrets SL, Church and Dwight Co. Inc., Dame Products Inc., GLYDE, Good Clean Love Inc., HYTTO PTE. Ltd., JIMMYJANE, KESSEL medintim GmbH, LELOi AB, Lovehoney Group Ltd., Lovelife Toys, Luvu Brands Inc., PHC Inc., Pure Romance, Reckitt Benckiser Group Plc, Sagami Rubber Industries Co. Ltd., Veru Inc., and WOW Tech International GmbH |

|

Market dynamics |

Parent market analysis, Market research and growth, Market forecasting, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our US sexual wellness market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Buy Full Report and Discover more

What are the Key Data Covered in this US Sexual Wellness Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028.

- Precise estimation of the size of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market industry across US

- Thorough market growth and forecasting analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market report analysis of factors that will challenge the growth of market players

We can help! Our analysts can customize this US sexual wellness market research and growth report to meet your requirements. Get in touch