Vaccum Lifter Market Size 2024-2028

The vaccum lifter market size is forecast to increase by USD 93.1 at a CAGR of 8.14% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The global construction industry's expansion is driving market demand, as vacuum lifters are increasingly used in this sector for handling heavy materials. Automation adoption in various industries is another growth factor, as vacuum lifters offer efficient and automated material handling solutions. However, the sluggish growth of the automotive industry may negatively impact the market, as this sector is a significant end-user. To stay competitive, market players are focusing on product innovation and technological advancements to cater to evolving customer needs. The market is expected to witness steady growth In the coming years, with increasing adoption in construction and other industries offsetting the impact of the automotive industry's downturn.

What will be the Size of the Vaccum Lifter Market During the Forecast Period?

- The market encompasses industrial vacuum lifting systems designed for handling and transporting various materials, including glass, stone, plastics, timber, and other heavy or fragile items. These systems employ vacuum-based technology, utilizing standard suction pads or specialized configurations to lift and maneuver loads with minimal manual effort. The market caters to diverse industries, with applications in the transportation, construction, and manufacturing sectors. Market dynamics are influenced by factors such as load capacity requirements, workplace safety regulations, and the increasing automation of manual material handling processes. Vacuum lifters come in various configurations, ranging from heavy-duty systems for handling large, heavy loads to light-duty models for delicate items.

- External sources suggest that the market for industrial vacuum lifting systems is expected to grow, driven by the need for increased productivity, improved workplace safety, and the ability to handle a wide range of materials with ease. Industrial supply companies continue to innovate, offering solutions that meet evolving industry needs and adhere to stringent weight requirements.

How is this Vaccum Lifter Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial manufacturing

- Construction

- Automotive

- Chemical and pharmaceutical

- Others

- Type

- Single-drive vacuum lifter

- Double-drive vacuum lifter

- Four-drive vacuum lifter

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- France

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The industrial manufacturing segment is estimated to witness significant growth during the forecast period.

Vacuum lifting systems play a significant role In the efficient material handling processes of various industries, including glass and glass processing, metal production and processing, wood and wood processing, stone and stone processing, and packaging. In the glass industry, vacuum lifters are preferred due to their ability to handle delicate and fragile glass sheets and panels without causing damage. Advanced vacuum lifters can also accommodate curved and rough surfaces, making them suitable for handling lumber and wooden furniture In the wood processing industry. These systems are essential in processing lines for wood and wood products, such as wood machining centers and door manufacturing.

Vacuum lifters offer customizable attachments, adjustable suction pressures, and manufacturing systems that cater to infrastructure and construction, flooring, and precision products industries. With the increasing automation of industries, vacuum lifting systems have become indispensable for ergonomics, workplace safety, and operational excellence. The systems are available in heavy-duty and light-duty models, featuring standard suction pads, articulating arm lifters, and customizable end effectors. Technological advancements have led to safety features, controls, sensors, and smart technology integration, making vacuum lifting systems cost-effective manufacturing processes and labor cost-reduction solutions. Additionally, these systems are designed with environmental friendliness and safety regulations in mind.

Get a glance at the Vaccum Lifter Industry report of share of various segments Request Free Sample

The industrial manufacturing segment was valued at USD 57.00 in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

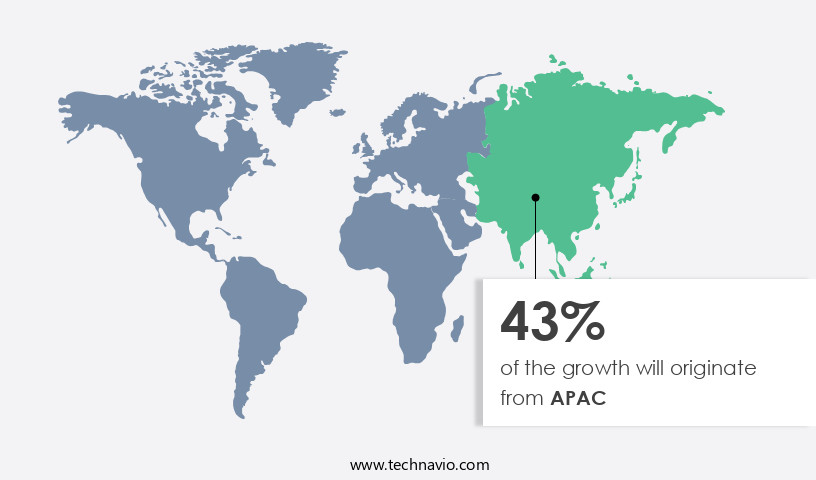

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region, characterized by its rapid industrialization and urbanization, presents a significant growth opportunity for the market. Excluding developed countries like Japan, Australia, and South Korea, most countries In the region are still developing. The economic expansion is underpinned by the rise of secondary and tertiary sector jobs, leading to a mass migration from rural to urban areas. This demographic shift is anticipated to fuel the residential and infrastructure sectors, thereby increasing the demand for vacuum lifters. These lifting systems are essential in various industries, including transportation, manufacturing, and construction, for handling materials such as glass, stone, plastics, timber, laminate, and lifting capacities ranging from light to heavy duty.

Customizable attachments and suction pressures cater to diverse applications. Vacuum lifting systems offer benefits like efficiency, ergonomics, and operational excellence, making them indispensable in industries like infrastructure and construction, flooring, and precision products. Technological advancements, safety regulations, and environmental concerns have led to the development of advanced equipment like automation systems, smart technology integration, and safety features. The vacuum lifter market is influenced by factors like raw material prices, supply chain disruptions, and labor market trends. Cost-effective manufacturing processes and vacuum-based technology have further expanded its application in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Vaccum Lifter Industry?

Growing construction activities globally is the key driver of the market.

- The market encompasses industrial products utilized for manhandling various materials, including glass, stone, plastics, timber, laminate, and more, in industries such as manufacturing systems, infrastructure and construction, and precision products. Vacuum lifters come in various lifting capacities and are customizable with attachments and suction pressures to accommodate diverse applications. These advanced equipment offer ergonomic benefits, promoting workplace safety and operational excellence. In the transportation sector, vacuum lifters are employed for handling heavy-duty and light-duty loads, with standard suction pads and customizable end effectors, like articulating arm lifters and solar panel lifters. Vacuum-based technology is increasingly being adopted for cost-effective manufacturing processes, particularly in industries undergoing automation.

- Efficiency, uniformity, accuracy, and preventive procedures are crucial factors driving the growth of the vacuum lifter market. However, raw material prices and supply chain disruptions pose challenges. Technological developments, such as smart technology integration, safety features, controls, sensors, and networking capabilities, are enhancing the capabilities of vacuum lifting systems. Safety regulations and environmentally friendly designs are essential considerations for the vacuum lifter market. The market is expected to witness significant growth in industries like flooring, steel strips, and automation, as well as In the construction of green (glass) buildings. With labor cost reduction and labor market changes, vacuum lifting systems offer a cost-effective solution for handling various materials, ensuring ergonomic factors for employee safety and wellbeing, and reducing strain and fatigue.

What are the market trends shaping the Vaccum Lifter Industry?

The adoption of automation in various industries is the upcoming market trend.

- The vacuum lifter market is experiencing significant growth due to the increasing demand for automation in industries with high labor costs and a shortage of skilled workers, particularly In the construction and manufacturing sectors. Vacuum lifters, which use suction-producing vacuum pumps to lift and transport various materials such as glass, stone, plastics, timber, laminate, and even solar panels, are becoming increasingly popular. These lifters offer customizable attachments and suction pressures, making them versatile for various applications. Manufacturing systems and infrastructure and construction industries are adopting vacuum lifting systems to enhance operational excellence, workplace safety, and ergonomics. The automation of industries, including green building construction, is driving the market for advanced vacuum lifter equipment.

- The use of vacuum lifting technology in industries like flooring, steel strips, and precision products industries results in cost-effective manufacturing processes and increased efficiency. Efficiency, ergonomics, and safety are critical factors in the market. The technology allows for uniformity and accuracy in load handling, reducing the risk of strain and fatigue for workers. Vacuum lifting systems also offer smart technology integration, preventive procedures, and maintenance schedules to ensure operational efficiency and employee safety and well-being. The vacuum lifter market is also influenced by factors such as raw material prices and supply chain disruptions. Technological developments and safety regulations are driving the market towards environmentally friendly designs and safety features.

What challenges does the Vaccum Lifter Industry face during its growth?

The sluggish growth of the automotive industry is a key challenge affecting the industry growth.

- Vacuum lifters play a crucial role in industrial manufacturing processes, particularly In the transportation sector, where they are employed for manhandling various materials such as glass, stone, plastics, timber, and laminate, and lifting heavy loads with precision. These lifters are customizable with attachments and can operate at different suction pressures to cater to varying lifting capacities. Industrial systems, infrastructure and construction, flooring, and precision products industries have significantly benefited from the automation of industries and the use of advanced equipment like vacuum lifters. Vacuum lifting systems have gained popularity due to their efficiency, ergonomics, and operational excellence. They offer workplace safety by reducing labor costs, improving handling capabilities, and minimizing the risk of strain and fatigue for workers.

- Vacuum-based technology is also cost-effective and can handle fragile items with care. However, the market dynamics are influenced by factors such as raw material prices and supply chain disruptions, which can impact the availability and cost of vacuum lifters. Technological developments and safety regulations have led to the integration of smart technology, automation advancements, and environmentally friendly designs in vacuum lifters. Customizable end effectors and articulating arm lifters are some of the advanced equipment used in industries to enhance load-handling capabilities. The market also offers both heavy-duty and light-duty lifters to cater to different industries and weight requirements.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aardwolf Industries LLC

- ACIMEX

- All Vac Industries

- ANVER Corp.

- Burgess Manufacturing Co.

- Fertema Oy

- GGR Group

- Hird Ltd.

- J. Schmalz GmbH

- Kilner Vacuumation Co. Ltd.

- Manut LM

- Movomech AB

- Piab AB

- Qingdao Sinofirst Machinery Co. Ltd.

- Righetti S.R.L.

- The Caldwell Group Inc.

- UniMove LLC

- ViaVac B.V.

- Woods Powr Grip Co. Inc.

- X Team Equipments Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vacuum lifters have become an indispensable tool in various industries, enabling the efficient and safe handling of materials such as glass, stone, plastics, timber, laminate, and other heavy and fragile items. These lifting systems utilize vacuum technology to generate suction, allowing for precise and controlled lifting and placement. The vacuum lifter market is driven by the increasing demand for automation in industries, particularly in infrastructure and construction, manufacturing systems, and precision products. The integration of vacuum lifting systems In these sectors has led to operational excellence, increased efficiency, and improved workplace safety. Vacuum lifters come in various configurations, including heavy-duty and light-duty models, with customizable attachments and end effectors to accommodate different materials and load capacities.

Moreover, the use of advanced equipment, such as articulating arm lifters and customizable end effectors, further enhances the versatility of these systems. The adoption of vacuum lifting systems is also influenced by the trend toward green buildings and the use of renewable energy sources, such as solar panels. Vacuum lifters, including those from the EU series, are increasingly being used to handle and install solar panels, making the process safer and more efficient. Technological developments in vacuum lifting systems continue to shape the market. Robotic systems and automation have become increasingly common, with sensors, controls, and networking capabilities integrated into the equipment.

Furthermore, these advancements enable real-time monitoring and preventive procedures, reducing the need for manual intervention and increasing operational efficiency. Ergonomics and employee safety are also key considerations In the vacuum lifter market. The use of vacuum lifting systems can help reduce labor costs, improve uniformity and accuracy, and minimize the risk of musculoskeletal problems and other workplace injuries. However, the vacuum lifter market is not without challenges. Raw material prices and supply chain disruptions can impact the cost-effectiveness of these systems. Additionally, safety regulations and environmental concerns continue to shape the market, with a focus on safety features, energy efficiency, and environmentally friendly designs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.14% |

|

Market Growth 2024-2028 |

USD 93.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.35 |

|

Key countries |

China, US, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vaccum Lifter Market Research and Growth Report?

- CAGR of the Vaccum Lifter industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vaccum lifter market growth of industry companies

We can help! Our analysts can customize this vaccum lifter market research report to meet your requirements.