Vehicle License Plate Market Size 2025-2029

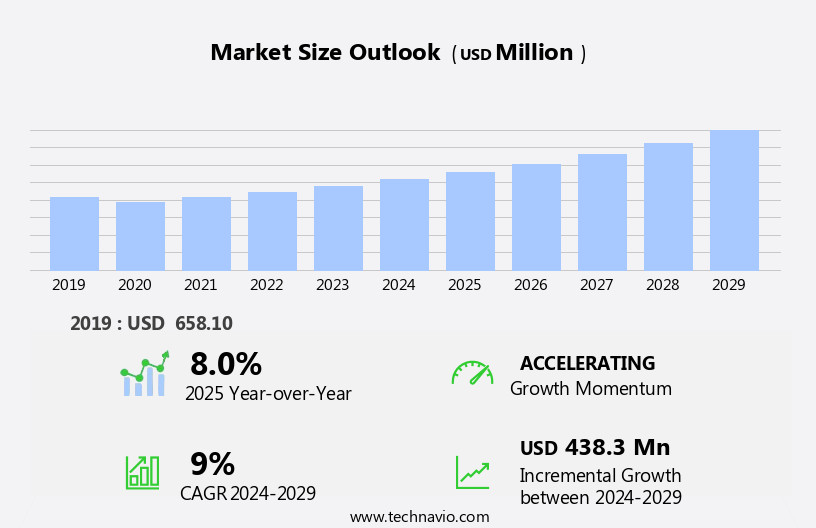

The vehicle license plate market size is forecast to increase by USD 438.3 million, at a CAGR of 9% between 2024 and 2029.

- The market is witnessing significant developments, with the trend toward standardization of license plate sizes gaining momentum. This uniformity in plate dimensions is facilitating the integration of advanced technologies such as Radio Frequency Identification (RFID). The adoption of RFID-based license plates is on the rise, offering enhanced security features and streamlined vehicle tracking. However, the market faces challenges in the form of stringent regulations governing the issuance of license plates. These restrictions can hinder market growth, necessitating careful navigation by market participants.

- Companies seeking to capitalize on the opportunities presented by this market should focus on innovations that cater to the demand for advanced security features and compliance with standardization efforts. Meanwhile, navigating regulatory hurdles will be crucial for maintaining a competitive edge.

What will be the Size of the Vehicle License Plate Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the expanding applications across various sectors. Traffic management systems utilize high-resolution cameras and infrared illumination for plate detection, enabling real-time processing and edge computing for efficient congestion control. Compliance regulations mandate stringent data security measures, ensuring data privacy and accuracy rates in license plate data acquisition. Fleet management solutions integrate machine learning algorithms and optical character recognition for vehicle identification and tracking, enhancing operational efficiency. Law enforcement agencies employ image analysis and deep learning techniques for pattern recognition, improving enforcement automation and false positive rate reduction.

Software development in license plate recognition systems incorporates API integration, data analytics, and database management for effective data storage and retrieval. Neural networks and industry standards streamline system deployment and integration, ensuring seamless access control and hardware integration. Plate detection and number plate scanning are essential components of parking management and toll collection systems, enhancing revenue generation and customer experience. Ongoing research in computer vision and character recognition further refines the technology, enabling new applications and improving overall performance. The market's continuous dynamism is evident in the evolving patterns of license plate recognition systems, with a focus on accuracy, efficiency, and compliance.

The integration of advanced technologies such as machine learning, real-time processing, and edge computing ensures the market remains at the forefront of innovation.

How is this Vehicle License Plate Industry segmented?

The vehicle license plate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- OEM

- Aftermarket

- Vehicle Type

- PC

- LCV

- HCV

- Electric vehicles

- Material

- Aluminum

- Steel

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

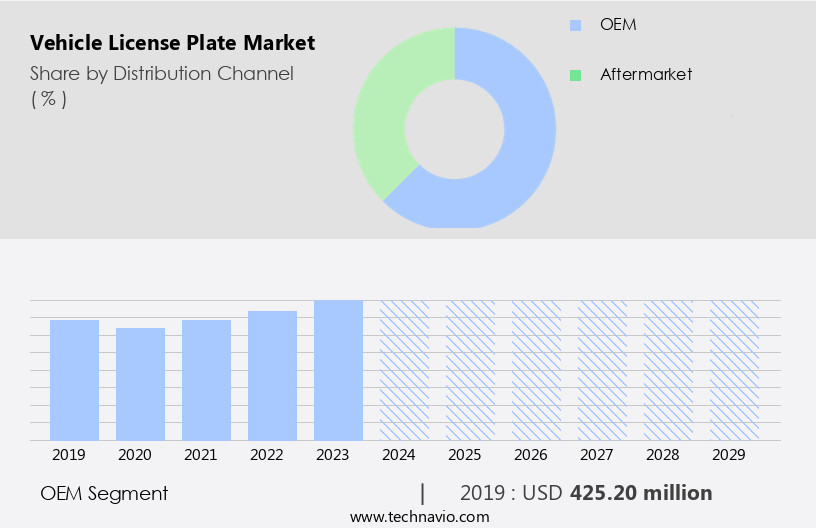

The oem segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities, including border control, data acquisition, pattern recognition, security systems, data storage, vehicle identification, high-resolution cameras, support services, image analysis, deep learning, law enforcement, data security, accuracy rates, license plate data, traffic management, infrared illumination, real-time processing, edge computing, compliance regulations, fleet management, machine learning, system deployment, optical character recognition, false positive rate, vehicle tracking, number plate scanning, congestion control, software development, computer vision, false negative rate, API integration, accident prevention, vehicle registration, data privacy, hardware integration, plate detection, enforcement automation, license plate recognition, camera systems, parking management, data analytics, image processing, toll collection, cloud computing, database management, system integration, compliance monitoring, maintenance services, character recognition, traffic monitoring, database integration, neural networks, industry standards, access control, and led lighting.

In the distribution channel segment, Original Equipment Manufacturers (OEMs) play a significant role. OEMs are companies that manufacture vehicles or vehicle components and supply them directly to automotive manufacturers. They provide pre-installed license plate frames or mounting systems to vehicle manufacturers, ensuring seamless integration and adherence to industry quality and regulatory standards. This trend will propel the growth of the OEM segment in The market. Vehicle manufacturers install the license plates during the assembly process, creating a cohesive design and meeting regulatory requirements. By partnering with OEMs, license plate manufacturers strengthen their market presence and cater to the evolving demands of the automotive industry.

The OEM segment was valued at USD 425.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

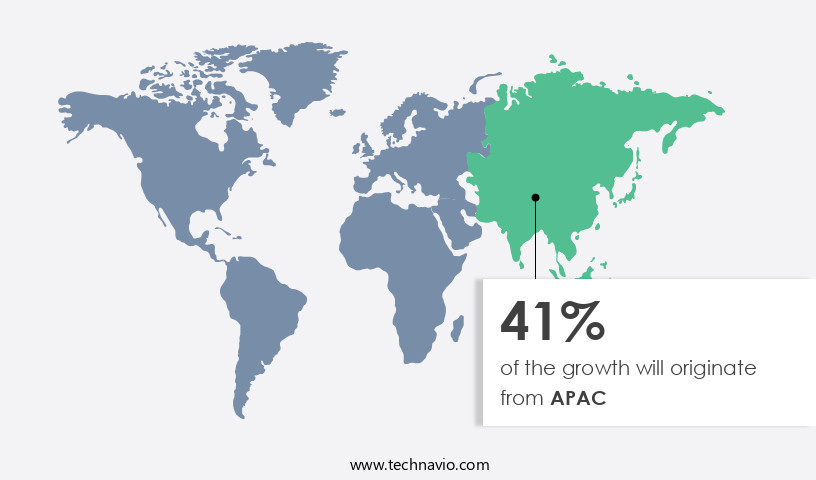

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic global market, Advanced License Plate Recognition (ALPR) technology has emerged as a crucial component in various sectors, including border control, law enforcement, traffic management, and fleet management. This technology encompasses data acquisition, pattern recognition, security systems, data storage, vehicle identification, high-resolution cameras, support services, image analysis, deep learning, and data privacy. APAC, a region of significant economic growth, is a major contributor to this market. With increased purchasing power due to rising per-capita income, automobile sales have surged. Simultaneously, governments in APAC have invested heavily in infrastructure and industrial development, fueling the demand for commercial vehicles.

ALPR technology plays a pivotal role in ensuring compliance with regulations, enabling real-time processing, edge computing, and system integration. Machine learning and computer vision facilitate plate detection, character recognition, and number plate scanning. Moreover, deep learning neural networks enhance false positive and false negative rate reduction, ensuring accuracy in vehicle tracking and number plate recognition. The market trends extend to parking management, toll collection, and accident prevention, with cloud computing and database management providing scalability and accessibility. Compliance monitoring, maintenance services, and access control further strengthen the market's growth, adhering to industry standards. In summary, the ALPR market is experiencing substantial growth in APAC, driven by economic development and increased automobile sales.

The technology's integration into various sectors, including law enforcement and traffic management, further bolsters its significance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Vehicle License Plate Industry?

- The increasing uniformity of license plate dimensions is a significant market trend, driving industry growth.

- In the early 20th century, license plates came in various sizes due to jurisdictional differences, necessitating custom-made plates for each location. This inefficiency led to the standardization of license plate sizes in the 1950s through collaborations between the global automotive market and governments and international organizations. Standardization resulted in cost savings through economies of scale, making the production of uniform-sized plates more efficient and cost-effective. Modern license plates serve not only as a means of vehicle identification but also as a crucial component of border control and security systems. Advanced technologies such as high-resolution cameras, pattern recognition, data acquisition, and image analysis are integrated into these systems to ensure accuracy and security.

- Deep learning algorithms and data storage capabilities enable law enforcement agencies to access and analyze vast amounts of license plate data for investigative purposes. Data security is a significant concern in the context of license plate data, and robust security systems are employed to protect the confidentiality and integrity of this information. Support services are also essential to ensure the smooth functioning of these systems, including regular updates, maintenance, and troubleshooting. Overall, the standardization of license plates and the integration of advanced technologies have transformed vehicle identification from a manual process into a sophisticated, data-driven system that enhances border control, security, and law enforcement efforts.

What are the market trends shaping the Vehicle License Plate Industry?

- RFID technology is increasingly being adopted for license plates, marking a significant market trend. This innovation offers enhanced security and convenience through contactless identification.

- Electronic license plates, equipped with Radio Frequency Identification (RFID) technology, are revolutionizing vehicle identification and traffic management. Replacing traditional RFID tags attached to windshields, these advanced plates offer tamper-proof registration, enhanced security, and automated processes. RFID technology enables quick and contactless identification of vehicles, streamlining toll collection, parking management, and access control. Seamless toll collection allows vehicles with RFID-enabled plates to pass through toll booths without stopping, thereby increasing traffic flow and reducing congestion on roads. Moreover, these plates support real-time processing, edge computing, and optical character recognition for number plate scanning. Machine learning algorithms help minimize false positive rates and ensure accurate vehicle tracking.

- Compliance with regulations is ensured through automated updates, ensuring fleet management remains efficient and effective. In conclusion, RFID-enabled electronic license plates offer numerous benefits for traffic management, fleet management, and access control. Their integration with advanced technologies like real-time processing, edge computing, and machine learning ensures accurate, efficient, and secure vehicle identification and management.

What challenges does the Vehicle License Plate Industry face during its growth?

- The restriction on issuing license plates poses a significant challenge to the industry's growth trajectory. This regulatory hurdle can limit the expansion of the market and hinder the industry from reaching its full potential.

- In the realm of advanced transportation management, license plate recognition technology has emerged as a critical tool for vehicle registration, parking management, and accident prevention. This computer vision technology uses image processing and data analytics to detect and read license plates from camera systems. Its integration with APIs and hardware enables real-time enforcement automation and data privacy protection. The false negative rate, a crucial metric in license plate recognition, measures the percentage of incorrectly identified plates. Continuous advancements in image processing and machine learning algorithms are reducing this rate, ensuring greater accuracy and reliability. This technology's applications extend beyond vehicle registration and parking management.

- It plays a pivotal role in accident prevention by providing law enforcement agencies with critical information for investigations. Moreover, data analytics derived from license plate recognition systems can offer valuable insights into traffic patterns and trends, contributing to urban planning and infrastructure development. As the demand for efficient transportation management and data-driven insights grows, the integration of license plate recognition technology with other systems, such as parking management and data analytics platforms, is becoming increasingly important. This harmonious fusion of technology is transforming the way governments and businesses manage their transportation infrastructure, ensuring a more efficient, secure, and data-driven future.

Exclusive Customer Landscape

The vehicle license plate market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vehicle license plate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vehicle license plate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in innovative vehicle license plate solutions, including digital and direct fulfillment options. These advanced plates enhance security and convenience through features such as real-time registration information and automated renewals. By streamlining the license plate process, we improve efficiency and reduce the need for manual updates. Our commitment to cutting-edge technology ensures that our clients benefit from the most advanced license plate solutions on the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Asahi Kasei Corp.

- Bestplate Limited

- EHA Hoffmann International GmBH

- Erich Utsch AG

- Fuwong License Plate

- GibPlates

- Godawari Techno Solution Pvt. Ltd.

- Hills Numberplates Ltd.

- Jepson and Co. Ltd.

- LC Security Equipment Co. Ltd.

- Muschard Schildertechnik

- ORBIZ

- ReviverMx Inc.

- Rosmerta Technologies Ltd

- SPM Systems Sp. zo.o. Sp. k.

- The Waldale Irwin Hodson Group

- TONNJES E.A.S.T. INFRASTRUKTUR INVEST GmbH

- UTAL Sp. z o.o

- Yarya Sekur

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vehicle License Plate Market

- In February 2023, the German company, Körber AG, announced the acquisition of Interogo Holding AG, a leading global provider of license plate recognition technology (LPR). This strategic move is expected to expand Körber's digital network technology portfolio and strengthen its position in the global market for Automatic Number Plate Recognition (ANPR) systems (BusinessWire).

- In May 2024, HID Global, a renowned provider of trusted identity solutions, launched its new vehicle identification platform, "HID Trusted Tag Services." This innovative solution integrates advanced RFID and NFC technologies with license plate recognition capabilities, enabling seamless access control and real-time vehicle identification for parking, tolling, and law enforcement applications (BusinessWire).

- In October 2024, the European Union (EU) introduced new regulations on license plates, mandating the use of standardized size, font, and material for all EU member states. This initiative aims to improve cross-border recognition and enforcement of traffic regulations (European Commission).

- In January 2025, the Chinese automotive technology company, Horizon Robotics, unveiled its latest AI-powered license plate recognition system, "HorizonAuto PlateID." The system boasts a recognition accuracy rate of over 99.9% and can process up to 120 plates per second, significantly outperforming traditional systems (Horizon Robotics Press Release).

Research Analyst Overview

- The market encompasses a range of technologies and applications, from plate database management and verification to plate illumination and design. Plate management systems ensure the accuracy and efficiency of plate data, while plate verification algorithms enhance security by confirming plate numbers against official records. Plate illumination techniques improve plate visibility in various lighting conditions, and plate design considerations prioritize legibility and durability. Plate contrast and background issues can impact recognition accuracy, necessitating normalization and filtering techniques. Plate formats and materials vary across jurisdictions, requiring adaptable recognition algorithms. Plate ethics and privacy concerns call for stringent data handling and access protocols.

- Plate segmentation and localization algorithms enable precise plate recognition, while plate reporting and tracking systems facilitate real-time monitoring and analytics. Plate matching and integration with other systems streamline processes and enhance operational efficiency. Plate standards and classification systems ensure consistency and interoperability, while plate fonts and orientation can influence recognition accuracy. Plate recognition algorithms continue to evolve, incorporating advanced machine learning techniques to improve performance and adapt to changing plate designs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vehicle License Plate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 438.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Japan, India, Germany, Canada, South Korea, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vehicle License Plate Market Research and Growth Report?

- CAGR of the Vehicle License Plate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vehicle license plate market growth of industry companies

We can help! Our analysts can customize this vehicle license plate market research report to meet your requirements.