Warehouse Drums And Barrels Market Size 2024-2028

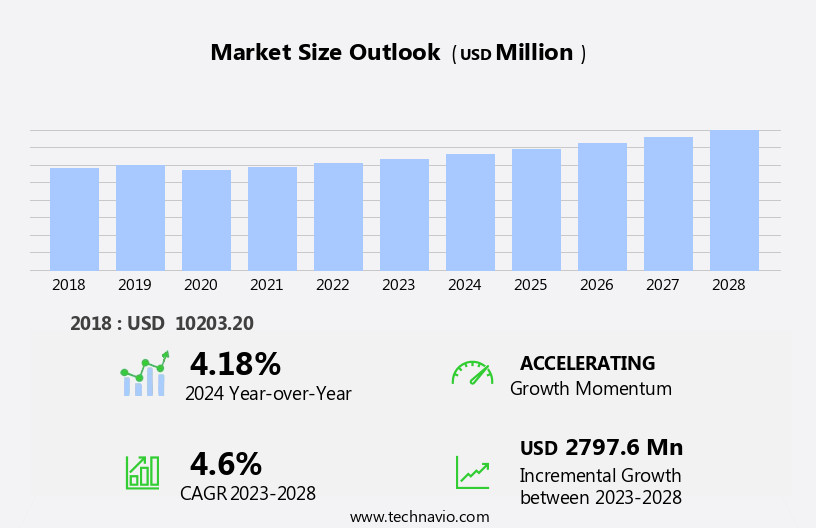

The warehouse drums and barrels market size is forecast to increase by USD 2.8 billion at a CAGR of 4.6% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing globalization of trade and the rise of multistoried warehouse storage solutions. International commerce is expanding, leading to a surge in demand for efficient and cost-effective storage solutions, including drums and barrels. This trend is further fueled by the growing competition among companies, pushing innovation and price competitiveness. However, regulatory hurdles and supply chain inconsistencies present challenges that require careful navigation. Regulatory compliance, particularly in relation to material safety and transportation regulations, can impact adoption and increase costs. Supply chain complexities, including sourcing raw materials and ensuring timely delivery, can temper growth potential.

- To capitalize on market opportunities and navigate challenges effectively, companies must focus on innovation, operational efficiency, and regulatory compliance. Strategic partnerships and collaborations can also help mitigate supply chain risks and strengthen market position. In summary, the market is poised for growth, with opportunities arising from international trade expansion and the increasing adoption of multistoried warehouse solutions. However, companies must navigate regulatory hurdles and supply chain complexities to succeed in this competitive landscape.

What will be the Size of the Warehouse Drums And Barrels Market during the forecast period?

- The market encompasses a diverse range of products, including tight head drums, composite drums, fiberboard drums, corrugated drums, and various steel drums such as stainless steel, galvanized, closed top, and intermediate bulk containers (IBCs). These drums serve essential functions in the logistics and manufacturing sectors, requiring effective management throughout their lifecycle. Drum disposal programs and recycling initiatives play a significant role in the market, ensuring sustainability and reducing environmental impact. Drum liners, made from various materials like high-density polyethylene and UN-rated liners, are subject to strict regulations, including DOT regulations and UN ratings. Drum venting systems, air filtration, and sealing are crucial components in maintaining drum containment and preventing spills.

- Drum liner removal and installation systems, as well as drum liner systems and venting systems, facilitate efficient drum handling and reduce downtime. The drum value chain involves various stakeholders, from manufacturers and suppliers to end-users and recyclers. Market trends include the increasing adoption of composite drums and the development of drum sustainability initiatives. Drum dunnage, leak detection, and leakproof technologies also contribute to the overall market growth. Market dynamics are influenced by factors such as changing regulations, technological advancements, and evolving customer demands. For instance, the demand for open top drums and IBCs has grown due to their versatility and ease of handling.

- Overall, the drum market remains dynamic, with continuous innovation and adaptation to meet the evolving needs of businesses.

How is this Warehouse Drums And Barrels Industry segmented?

The warehouse drums and barrels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Chemicals

- Petroleum products

- Food products

- Paint and solvents

- Others

- Material

- Steel

- Plastic

- Fiber

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Application Insights

The chemicals segment is estimated to witness significant growth during the forecast period.

The market caters to various industries, with the chemical industry being a significant end-user due to the storage of raw materials and intermediates for producing end products such as fertilizers, plastics, and synthetic rubber. The market's growth is primarily fueled by the increasing demand for specialty chemicals worldwide, which have diverse applications in construction, textiles, and other sectors. Specialty chemicals include foaming agents, curing compounds, adhesives, cosmetic additives, food additives, agrochemicals, polymers, and construction chemicals. APAC holds a substantial share of the market due to the rapid industrialization in countries like China, India, South Korea, and Taiwan.

Drums and barrels are essential for storing and transporting a wide range of products, including chemicals, food, pharmaceuticals, and industrial materials. Drum inventory management, drum reusability, and drum warehousing are crucial aspects of the market. Solid storage, drum lifting equipment, and drum distribution systems facilitate efficient handling and transportation. Drum cleaning, drum transportation regulations, and drum labeling ensure product safety and traceability. Drum specifications, such as drum dimensions, materials, and certifications, impact the market. Sustainability and environmental regulations are driving the demand for eco-friendly drum solutions. Drum recycling, drum disposal, and drum robotics are essential for minimizing waste and optimizing supply chain management.

The agriculture industry relies on industrial barrels for storing and transporting agricultural products. Drum liners, drum emptying, and drum repair ensure the longevity of these drums. Bulk storage, drum testing, and drum inspection maintain drum quality and safety. The manufacturing industry utilizes various types of drums, including steel drums, fiber drums, open head drums, and closed head drums, for storing and handling different materials. Drum capacity, drum pressure relief, and drum handling equipment cater to the industry's specific requirements. The waste management industry uses drums for hazardous materials storage and transportation. Drum certifications, drum logistics, and drum manufacturing ensure compliance with regulations and industry standards.

In summary, the market is dynamic and diverse, catering to various industries and applications. Efficient drum management, safety regulations, and sustainability are key trends driving the market's growth.

The Chemicals segment was valued at USD 3.99 billion in 2018 and showed a gradual increase during the forecast period.

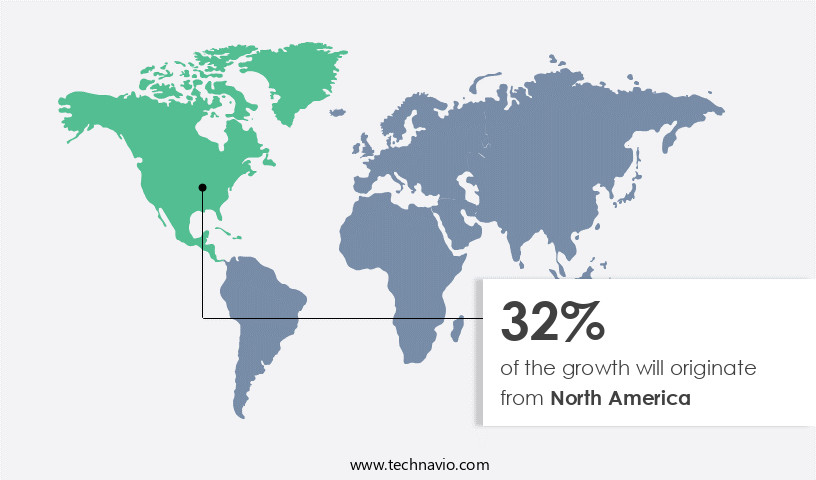

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic US market, warehouse drums and barrels play a pivotal role in various industries, including agriculture and manufacturing. The demand for these drums is driven by their versatility and functionality in handling and storing liquids and bulk materials. Tight head drums, a popular choice for their sealability, are essential for industrial packaging and drum inventory management. Lined drums, offering protection against chemical reactions, are prevalent in chemical storage. Reusability is a significant trend, with drum repair and recycling gaining traction. Drum warehousing solutions, such as solid storage and drum stacking equipment, ensure efficient use of space.

Drum lifting equipment facilitates safe handling, while drum transportation regulations govern the movement of drums. Drum volume and capacity vary, catering to diverse applications, from small fiber drums to large industrial drums. Drum safety regulations and environmental concerns influence the use of materials like plastic and steel, as well as the implementation of drum certifications and sustainability practices. Drum logistics and distribution are crucial, with drum tracking, labeling, and RFID technology enabling seamless supply chain management. Drum cleaning, inspection, and testing ensure product quality and compliance with regulations. Drum design and certifications are essential for various industries, including hazardous materials storage and handling.

The agriculture industry relies on bulk storage and drum emptying, while the waste management industry focuses on drum disposal and recycling. Bulk packaging and drum filling systems streamline manufacturing processes. Drum robotics and automation enhance efficiency and safety. The US the market is a vital component of various industries, with trends including eco-friendly materials, automation, and regulatory compliance shaping its future.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Warehouse Drums And Barrels market drivers leading to the rise in the adoption of Industry?

- The escalating trend in international trade serves as the primary catalyst for market growth.

- The global market for warehouse drums and barrels is experiencing significant growth due to the increasing demand for industrial chemicals, particularly specialty and petrochemicals. This trend is driven by the expanding economies of countries like India and China, where the manufacturing industry is witnessing a surge in production to meet the rising demand from various end-user sectors. APAC is a major contributor to the global production and consumption of chemical products, owing to the presence of a large number of chemical manufacturers and their end-users. The demand for drum logistics and drum transportation solutions is increasing as a result of the need for efficient and reliable storage and handling of industrial chemicals.

- Drum durability and compliance with drum regulations are crucial factors influencing the market's growth. Fiber drums have gained popularity due to their superior strength and ability to handle hazardous materials. Drum manufacturing companies are focusing on innovation, offering drum automation, drum dispensing systems, and drum handling solutions to meet the evolving needs of the industry. Drum capacity, drum pressure relief, and drum dispensing systems are essential features that manufacturers consider when producing drums for industrial applications. The market for storage barrels and closed head drums is expected to grow as industries seek reliable and efficient solutions for hazardous materials storage.

- Drum handling and drum packaging solutions are also essential to ensure the safe and efficient transportation and handling of industrial chemicals.

What are the Warehouse Drums And Barrels market trends shaping the Industry?

- The rise of multistoried warehouse storage is an emerging market trend, signifying a significant shift towards vertical expansion in logistics and supply chain management. This trend is driven by the increasing demand for efficient space utilization and the need to accommodate larger inventory volumes in urban areas with limited land availability.

- The market is experiencing significant growth due to the increasing demand for efficient and effective storage solutions in various industries. Drums and barrels are essential for the proper handling and transportation of liquids and powders, making them indispensable in sectors such as food and beverage, pharmaceuticals, and chemicals. Drum inventory management is a crucial aspect of this market, with the focus on drum reusability and drum safety regulations. Drum warehousing requires solid storage solutions, and drum lifting equipment is essential for safe and efficient handling. Drum distribution and transportation regulations are stringent to ensure compliance with industrial packaging and safety standards.

- Drum volume and drum applications vary widely, from food-grade lined drums to industrial-strength solid drums. Drum tracking, drum labeling, and drum traceability are essential for maintaining accurate inventory and ensuring product quality. Plastic drums are increasingly popular due to their durability, ease of cleaning, and versatility. Compliance regulations for drum safety and environmental impact are driving innovation in drum design and manufacturing. The market is expected to continue growing as businesses seek to optimize their warehouse operations and meet the demands of their customers for faster delivery times.

How does Warehouse Drums And Barrels market faces challenges face during its growth?

- The intensifying competition amongst companies poses a significant challenge to the expansion and growth of the industry.

- The market experiences dynamic competition among regional and international players, with factors such as acquisitions, expansions, and marketing shaping the competitive landscape. The presence of numerous companies results in intense price competition, potentially impacting profit margins and leading to the exit of smaller businesses. Additionally, companies operating globally face foreign exchange risks due to fluctuating currencies. Drum manufacturers focus on innovation in areas like drum RFID, drum pumps, drum closures, drum inspection, and drum robotics to enhance their offerings and maintain drum quality, bulk storage, and bulk packaging solutions that comply with industrial regulations and environmental standards.

- Drum testing, drum repair, drum disposal, and drum stacking equipment are also essential components of the market. The agriculture industry is a significant consumer of industrial barrels and drums, making it a crucial market segment. Overall, the market requires effective supply chain management and continuous compliance with drum regulations to ensure longevity and customer satisfaction.

Exclusive Customer Landscape

The warehouse drums and barrels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the warehouse drums and barrels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, warehouse drums and barrels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aramsco Inc. - The company specializes in providing a comprehensive range of warehouse containers, including steel drums.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aramsco Inc.

- BASCO Inc.

- Bronstein Container Co. Inc.

- BWAY Corp.

- East India Drums and Barrels Mfg Pvt. Ltd.

- EBKContainers

- E-con Packaging Pvt. Ltd.

- Feldman Industries Inc.

- Greif Inc.

- ITP Packaging Ltd.

- Jakacki Bag and Barrel Inc.

- MVM Pack Holding AG

- Myers Container

- Rahway Steel Drum Co. Inc.

- REMCON Plastics Inc.

- SCHUTZ GmbH and Co. KGaA

- Sharda Containers

- Tank Holding Corp.

- Time Technoplast Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Warehouse Drums And Barrels Market

- In February 2023, Sealed Air Corporation, a leading global provider of packaging solutions, introduced its new Cryovac EasyPull drum liners. These liners are designed to improve product protection and reduce labor costs for customers in the food and beverage industries (Sealed Air Corporation Press Release, 2023).

- In October 2024, LyondellBasell Industries N.V., a leading plastics and chemical company, announced a strategic partnership with Schaefer Systems International, a global supplier of warehouse and production solutions. The collaboration aims to develop and commercialize innovative, sustainable drum and barrel solutions for various industries (LyondellBasell Industries N.V. Press Release, 2024).

- In March 2025, Greif, Inc., a global leader in industrial packaging products and services, completed the acquisition of the European and Latin American operations of the barrel and drum division of CHEP, a global pallet and container pooling company. This acquisition significantly expanded Greif's presence in the European and Latin American markets (Greif, Inc. Press Release, 2025).

- In July 2025, Sig Combibloc, a Swiss company specializing in aseptic carton packaging, launched a new range of lightweight, stackable, and sustainable barrels for the food and beverage industry. These barrels are designed to reduce transportation costs and carbon emissions while maintaining product quality (Sig Combibloc Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the diverse demands of various industries such as agriculture, manufacturing, and waste management. Tight head drums and drum inventory management are crucial for ensuring efficient production and minimizing losses in the manufacturing sector. Lined drums enable the safe transport and storage of hazardous materials, while drum reusability reduces waste and lowers costs. Drum warehousing and solid storage solutions facilitate effective liquid storage, ensuring product quality and safety. Drum lifting equipment streamlines the handling process, enhancing productivity and reducing labor costs. Drum distribution networks ensure timely delivery, while drum cleaning and transportation regulations maintain compliance and safety.

Drum volume and drum applications vary widely, from industrial packaging and drum labeling to drum tracking and drum traceability. Plastic drums offer sustainability benefits, while drum compliance regulations ensure adherence to environmental and safety standards. Drum safety regulations and drum safety measures are essential to prevent accidents and protect workers. Industrial barrels and drum specifications cater to the unique requirements of different industries, with drum materials, drum design, and drum certifications ensuring product durability and reliability. Drum recycling and drum disposal solutions minimize waste and promote sustainability. Drum robotics, drum automation, and drum logistics optimize supply chain management, reducing costs and improving efficiency.

Drum inspection, drum repair, and drum testing ensure product quality and extend drum longevity. The ongoing unfolding of market activities and evolving patterns underscore the dynamic nature of the market.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Warehouse Drums And Barrels Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 2797.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Key countries |

US, China, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Warehouse Drums And Barrels Market Research and Growth Report?

- CAGR of the Warehouse Drums And Barrels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the warehouse drums and barrels market growth of industry companies

We can help! Our analysts can customize this warehouse drums and barrels market research report to meet your requirements.