Waterjet Cutting Machines Market Size 2025-2029

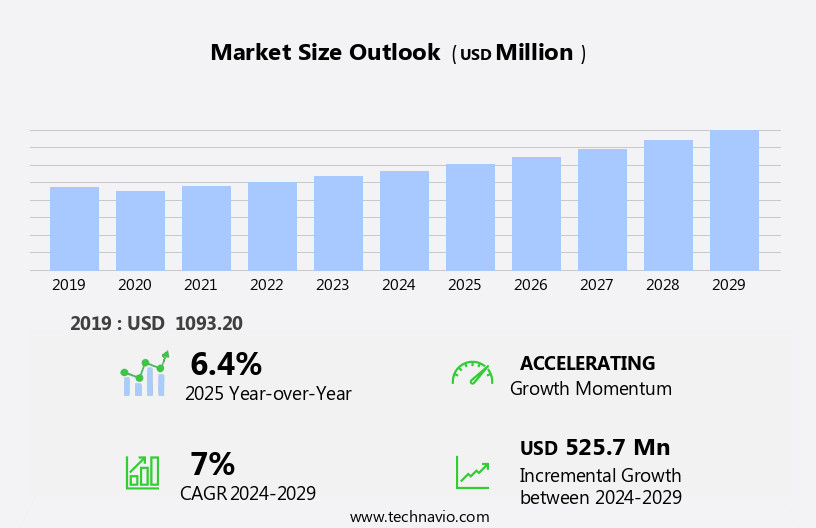

The waterjet cutting machines market size is forecast to increase by USD 525.7 million, at a CAGR of 7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for automation in metal cutting processes. This trend is particularly evident in industries such as automotive, aerospace, and construction, where precision and efficiency are key. One notable development is the growing emphasis on energy-efficient pumps in waterjet cutting machines, addressing the environmental concerns and cost savings for manufacturers. However, the high initial cost of implementing waterjet cutting technology remains a challenge for some companies, particularly smaller businesses and startups. To navigate this obstacle, potential entrants can explore partnerships, leasing options, or investing in used machines to minimize upfront costs.

- Additionally, ongoing research and development efforts in waterjet cutting technology aim to address cost concerns by improving efficiency and reducing energy consumption. Overall, the market presents opportunities for innovation and growth, particularly in the areas of automation, energy efficiency, and cost reduction. Companies that successfully navigate these challenges will be well-positioned to capitalize on the market's potential.

What will be the Size of the Waterjet Cutting Machines Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The waterjet cutting market continues to evolve, driven by ongoing advancements in technology and expanding applications across various sectors. Waterjet cutting simulation tools enable more precise and efficient design, while maintenance strategies ensure optimal performance and longevity of waterjet cutting machines. The waterjet nozzle, a crucial component, undergoes constant innovation to enhance cutting capabilities and improve material compatibility. Waterjet cutting optimization techniques and parts development contribute to increased productivity and cost savings. Patents and intellectual property continue to shape the industry, fostering competition and innovation. The future of waterjet cutting holds promise in areas such as automation, high-pressure systems, and advanced materials.

Pressure levels, cutting depth, and accuracy are key factors influencing the market's growth. Waterjet cutting applications span industries, from automotive to aerospace, construction, and manufacturing. The waterjet cutting process, with its versatility and non-contact nature, continues to attract businesses seeking efficient and precise cutting solutions. Innovation in waterjet cutting technology, including the development of new cutting heads and software, is shaping the industry landscape. Training, certifications, and safety regulations ensure a skilled workforce and high-quality output. Waterjet cutting consumables, such as abrasives and garnet, remain essential components of the process. Waterjet cutting systems and services offer customizable solutions for businesses, while regulations and standards ensure a level playing field and consumer confidence.

The market's continuous dynamism underscores its importance in various industries and its potential for future growth.

How is this Waterjet Cutting Machines Industry segmented?

The waterjet cutting machines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Metal cutting

- Glass cutting

- Stone cutting

- Others

- End-user

- Metal fabrication

- Automotive

- Electrical and electronics

- Aerospace and defense

- Others

- Type

- Abrasive

- Non-abrasive

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

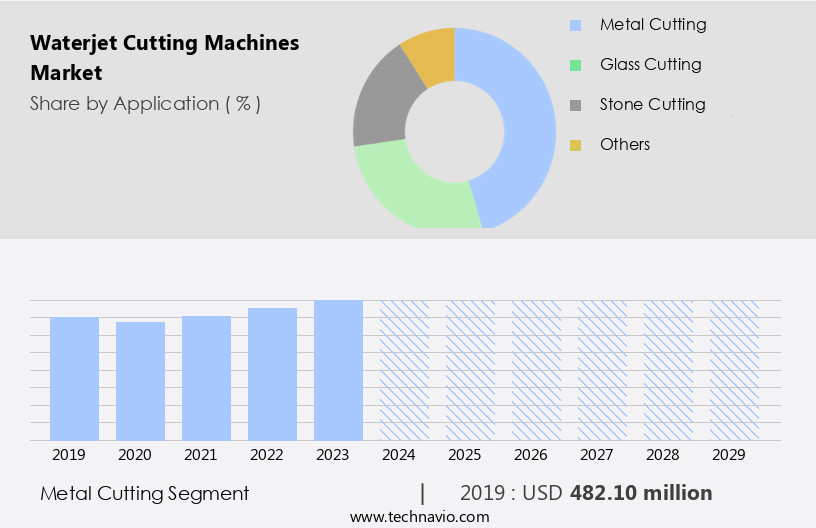

The metal cutting segment is estimated to witness significant growth during the forecast period.

Waterjet cutting technology, a non-contact, high-precision method for cutting various materials, is gaining significant traction in industries that require precise and efficient material processing. A key application of waterjet cutting is in the fabrication of components from exotic metals, such as stainless steel, titanium alloys, nickel, and cobalt, which are widely used in automotive, aerospace and defense, and electrical and electronics sectors due to their heat-resistant properties. Abrasive waterjet cutting machines, a type of waterjet cutting system, are particularly popular for metal cutting applications due to their ability to cut metals up to 200 mm in thickness with minimal material distortion.

The process involves the use of a high-pressure waterjet, typically around 60,000 psi, combined with an abrasive substance, to erode the material. This cutting method offers several advantages, including the ability to cut materials of varying hardness and composition without the need for expensive tooling or heat-affected zones. Furthermore, the small kerf size of waterjet cutting machines enables the production of tight corners and high tolerance parts, making it an attractive alternative to traditional cutting methods. Waterjet cutting innovation continues to advance, with developments in areas such as optimization, simulation, maintenance, and automation, driving increased efficiency and reducing costs.

The market for waterjet cutting machines is expected to grow, driven by the increasing demand for precision cutting and the versatility of the technology across various industries. Waterjet cutting systems also offer the added benefits of high cutting speed, safety features, and the ability to process a wide range of materials, including composites, glass, and rubber. The market for waterjet cutting consumables, such as abrasives and nozzles, is also expected to grow in tandem with the increasing adoption of waterjet cutting technology. Waterjet cutting regulations continue to evolve, with a focus on safety and environmental considerations, and training and certification programs are becoming increasingly important for operators.

Overall, the waterjet cutting industry is poised for continued growth and innovation, driven by the demand for high-precision, efficient, and versatile material processing solutions.

The Metal cutting segment was valued at USD 482.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

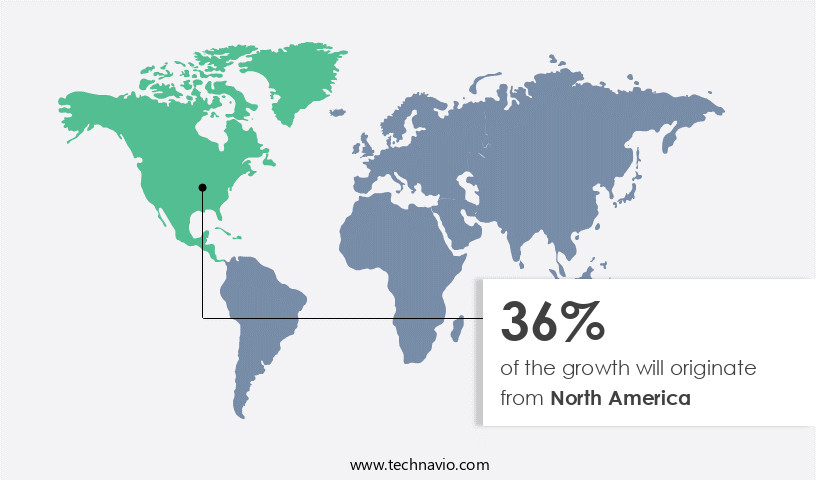

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The waterjet cutting market in North America, with the US being its largest contributor, continues to evolve with industry trends and advancements. In the maturing automotive industry, waterjet cutting technology remains a significant revenue generator. To keep pace with technological advancements, such as automation and robotics, there is a growing focus on enhancing workforce skills in the US. Apprenticeship programs, popular in Europe, are gaining traction as a means to upskill the workforce. Waterjet cutting simulation and optimization are essential components of the manufacturing process, ensuring accuracy and efficiency. Maintenance of waterjet cutting machines and replacement of parts, including nozzles, are ongoing requirements.

Patents play a crucial role in the innovation and development of waterjet cutting technology. The waterjet cutting process involves the use of high-pressure waterjets, often with abrasive materials, to cut through various materials. Waterjet cutting systems are employed across industries, including aerospace, construction, and automotive, for their precision and versatility. The waterjet cutting industry is undergoing significant development, with advancements in technology leading to improvements in cutting depth, speed, and cost-effectiveness. Training and certification programs are essential for ensuring safe and efficient operation of waterjet cutting machines. Regulations and standards, such as those related to safety and environmental concerns, are increasingly important in the industry.

Waterjet cutting consumables, including abrasives and garnet, are essential components of the process. The market for these consumables is expected to grow as the demand for waterjet cutting technology continues to increase. Research and development efforts are ongoing to improve the efficiency and sustainability of waterjet cutting technology. In conclusion, the waterjet cutting market in North America, particularly in the US, is driven by the automotive industry and the growing focus on workforce skills and technological advancements. Simulation, maintenance, optimization, patents, parts, and consumables are integral components of the market, with ongoing developments in technology leading to improvements in depth, speed, and cost-effectiveness.

Regulations and standards are essential for ensuring safe and efficient operation, while training and certification programs are crucial for workforce development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Waterjet Cutting Machines Industry?

- The significant shift towards automating metal cutting processes serves as the primary market driver.

- Waterjet cutting machines have gained significant traction in the manufacturing sector due to their versatility and ability to cut various materials with precision. The integration of waterjet cutting automation, safety features, and certification programs has streamlined the production process. Waterjet cutting accessories, such as abrasive materials and nozzles, enhance the machine's capabilities. Waterjet cutting certification ensures operators possess the necessary skills to handle these machines safely and efficiently. The focus on waterjet cutting safety is crucial, as it minimizes potential hazards, such as waterborne contaminants and noise pollution. Waterjet cutting software optimizes the production process by improving cutting speed and reducing waste.

- Research and development efforts are underway to increase waterjet cutting efficiency and cost-effectiveness. Trends in the industry include the use of robots to automate the cutting process, enabling continuous operation and reducing labor costs. Robotic waterjet machines perform cutting, cleaning, and drilling tasks using a high-pressure water stream. The intensity of the pressure varies depending on the application. The integration of waterjet cutting technology with automation and safety features has made it an indispensable tool for manufacturers seeking flexibility and personalization in their production processes.

What are the market trends shaping the Waterjet Cutting Machines Industry?

- Waterjet cutting machines are seeing an increased focus on energy efficiency, with the market trend leaning towards the development of energy-efficient pumps. This priority reflects the growing importance of sustainability and cost savings in industrial processes.

- Waterjet cutting machines have gained significant attention in various end-user industries due to the increasing production volume and the growing demand for energy-efficient equipment. Regulatory authorities worldwide are encouraging the adoption of energy-efficient machinery to reduce electricity consumption in energy-intensive industries. The International Electrotechnical Commission has implemented regulations for the use of energy-efficient motors in industrial premises. In response, companies are focusing on developing energy-efficient high-pressure pumps for waterjet cutting machines. Waterjet cutting simulation and optimization techniques are essential for improving the overall efficiency and productivity of waterjet cutting machines. These techniques help in reducing water and gas consumption, minimizing nozzle wear, and optimizing cutting speed.

- Waterjet cutting parts manufacturers are investing in research and development to introduce advanced waterjet cutting nozzles that offer higher cutting speeds, longer service life, and improved accuracy. Waterjet cutting patents play a crucial role in protecting the intellectual property rights of companies engaged in the development and manufacturing of waterjet cutting machines. These patents cover various aspects of waterjet cutting technology, including the design of waterjet cutting heads, nozzle technology, and control systems. Looking ahead, the future of waterjet cutting machines is promising, with advancements in technology and increasing demand from various end-user industries. However, the market faces challenges such as high waterjet cutting pressure requirements, the need for regular maintenance, and the high cost of waterjet cutting equipment.

- Addressing these challenges will be key to the growth and success of the waterjet cutting market.

What challenges does the Waterjet Cutting Machines Industry face during its growth?

- The high initial cost of implementation is a significant challenge that can hinder industry growth. This financial hurdle can deter potential entrants and limit expansion for existing companies, potentially stifling innovation and progress within the sector.

- Waterjet cutting machines have become a significant investment for industrial operators due to the increased cost of installing the necessary equipment, including high-pressure pumps, cutting tables, and automated systems. The waterjet cutting industry has seen continuous development and innovation in waterjet cutting technology, such as advanced waterjet cutting heads and systems, enabling deeper cutting capabilities and increased precision. However, the high capital requirement for these machines makes them economical only for large end-user industries with substantial production volumes. Consequently, the shorter payback period for these industries justifies the investment. On the other hand, small and medium-sized enterprises (SMEs) may find the high equipment cost per part negatively impacting their profitability during the initial stages due to their limited production cycles.

- Despite these challenges, waterjet cutting machines offer a better return on investment in the long run and are widely adopted in various industries for their precision, versatility, and ability to cut a wide range of materials.

Exclusive Customer Landscape

The waterjet cutting machines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the waterjet cutting machines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, waterjet cutting machines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

APW waterjet - The company specializes in providing advanced waterjet cutting solutions, featuring machines such as the APW-3020BA-A15-B-BP and APW-2010BB-A15-B-BP models. cturing, construction, and prototyping. The waterjet technology ensures minimal material distortion, resulting in high-quality finished products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- APW waterjet

- Dardi International Corp.

- ESAB Corp.

- Flow International Corp.

- Hornet Cutting Systems

- Jet Edge Inc.

- KMT Waterjet Systems Inc.

- Koike Aronson Inc.

- Metronics Technologies SLU

- OMAX Corp.

- Optomec Inc.

- Resato International BV

- SCM GROUP Spa

- STM waterjet GmbH

- Sugino Machine Ltd.

- TCI Cutting

- Tecnocut

- WARDJET

- Water Jet Sweden AB

- WAZER Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Waterjet Cutting Machines Market

- In February 2023, Omax Corporation, a leading waterjet cutting machines manufacturer, introduced the Intelli-MAX JETmachining system, integrating artificial intelligence and machine learning capabilities into their waterjet cutting technology (Omax Corporation Press Release). This innovation aims to optimize cutting parameters, reduce material waste, and enhance productivity.

- In June 2022, Trimble and Hypertherm, two major industry players, announced a strategic partnership to integrate Trimble's advanced manufacturing software with Hypertherm's waterjet cutting systems. This collaboration intends to streamline production workflows and improve overall manufacturing efficiency (Trimble Press Release).

- In March 2021, Trotec Laser, a global provider of laser and waterjet systems, announced the acquisition of WaterJet Technology, a leading waterjet cutting machines manufacturer. This acquisition strengthens Trotec's market position and expands its product portfolio, providing a broader range of solutions for various industries (Trotec Laser Press Release).

- In October 2020, the European Union approved the Horizon 2020 research and innovation program's project, named JET-Q, which focuses on developing advanced waterjet cutting technology for the aerospace industry. This initiative aims to reduce material waste, improve cutting quality, and increase productivity, ultimately contributing to the growth of the European the market (European Union Press Release).

Research Analyst Overview

- The ultra-high pressure waterjet cutting market exhibits dynamic growth, driven by the increasing adoption in various industries, including automotive, aerospace, and construction. This technology's versatility, enabling precise cuts in various materials, from metals to composites, fuels its popularity. Advancements in waterjet cutting machines' efficiency and accuracy further boost market expansion. Additionally, the rising trend towards automation and customization in manufacturing processes enhances the market's potential.

- Ultra-high pressure waterjet systems' ability to cut complex geometries and minimize material waste makes them a preferred choice for businesses seeking to optimize production processes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Waterjet Cutting Machines Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 525.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Waterjet Cutting Machines Market Research and Growth Report?

- CAGR of the Waterjet Cutting Machines industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the waterjet cutting machines market growth of industry companies

We can help! Our analysts can customize this waterjet cutting machines market research report to meet your requirements.