Aerospace Parts Manufacturing Market Size 2025-2029

The aerospace parts manufacturing market size is valued to increase by USD 210.2 billion, at a CAGR of 4.4% from 2024 to 2029. Rise in demand for new commercial and defense aircraft will drive the aerospace parts manufacturing market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 51% growth during the forecast period.

- By Product - Aerostructure segment was valued at USD 448.10 billion in 2023

- By Aircraft Type - Commercial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 23.86 billion

- Market Future Opportunities: USD 210.20 billion

- CAGR : 4.4%

- North America: Largest market in 2023

Market Summary

- The market encompasses the production of components and parts used in the manufacturing of aircraft and spacecraft. This dynamic industry is driven by the rising demand for new commercial and defense aircraft and rapid technological advancements in aerospace parts manufacturing. Core technologies, such as additive manufacturing and composite materials, are revolutionizing the production process, offering benefits like reduced weight, increased durability, and improved efficiency. However, the high cost associated with aerospace parts manufacturing poses a significant challenge. According to a recent study, the global aerospace composites market is projected to reach a 20% market share by 2026.

- Regulations and regional differences also play a crucial role in shaping the market landscape. The evolving nature of the market continues to present both opportunities and challenges for key players and stakeholders.

What will be the Size of the Aerospace Parts Manufacturing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Aerospace Parts Manufacturing Market Segmented and what are the key trends of market segmentation?

The aerospace parts manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Aerostructure

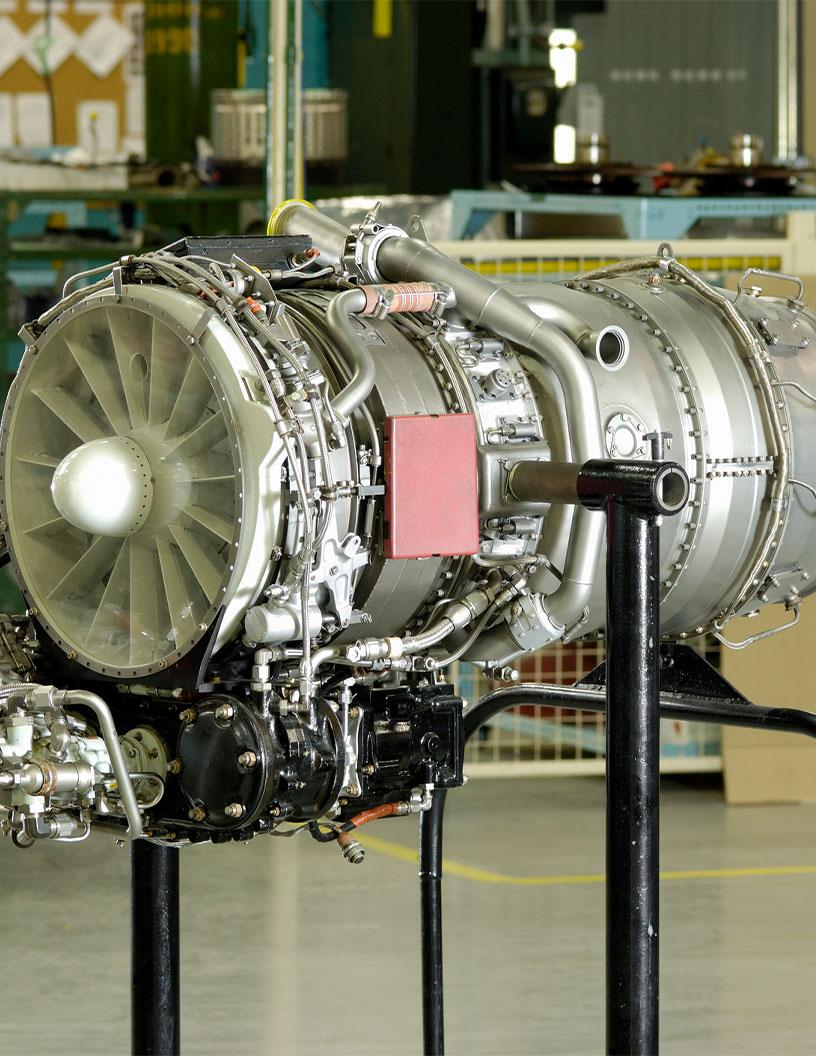

- Engine

- Avionics

- Others

- Aircraft Type

- Commercial

- Business

- Military

- Material

- Aluminum 6061-T6

- Stainless steel

- Titanium

- Method

- CNC machining

- Sheet metal fabrication

- Injection molding

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The aerostructure segment is estimated to witness significant growth during the forecast period.

The market encompasses the production of essential components for aircraft, with the aerostructure segment holding significant importance. Comprising fuselages, wings, and flight control surfaces, these elements are crucial for aircraft construction and operation. Fuselages serve as the primary structure, accommodating passengers, cargo, and critical systems. Wings generate lift and contribute to stability and maneuverability, while flight control surfaces facilitate pilot control. Currently, aluminum alloy forging and titanium fabrication methods dominate the manufacturing landscape due to their lightweight properties and high strength. Part certification standards ensure the quality and safety of these components. Corrosion resistance coatings are also vital to maintain the longevity of aerospace parts.

Computer-aided design, precision metal casting, and composite material properties are integral to the design and manufacturing process. Quality assurance metrics, production scheduling techniques, and design for manufacturing strategies ensure efficiency and accuracy. Machining tolerances, additive manufacturing applications, and structural integrity analysis are critical aspects of the manufacturing process. Predictive maintenance, surface treatment processes, and process optimization strategies enhance the overall performance and reliability of aerospace parts. Computer-aided manufacturing, aerospace-grade fasteners, robotics in manufacturing, lean manufacturing principles, and supply chain management are essential elements of the manufacturing ecosystem. Non-destructive testing, failure analysis methods, data analytics manufacturing, lightweight material selection, materials testing standards, inventory optimization strategies, and quality control procedures are crucial for maintaining the highest standards in aerospace manufacturing.

CNC machining processes and digital twin technology enable the production of intricate components with exceptional accuracy. High-temperature alloys and fatigue life prediction are essential considerations for manufacturing components that can withstand the extreme conditions of aviation. The future of aerospace parts manufacturing lies in the integration of advanced technologies, such as additive manufacturing techniques and predictive maintenance systems, to enhance production efficiency and product quality. According to recent industry reports, the adoption of advanced manufacturing technologies in the aerospace sector is expected to increase by 15%, while the implementation of lean manufacturing principles is projected to surge by 20%.

These trends reflect the industry's ongoing commitment to innovation and efficiency. The market is poised for significant growth, with a projected increase in demand for commercial and military aircraft driving production expansion. The market is expected to witness a 17% rise in output, as manufacturers adapt to the latest manufacturing technologies and processes to meet the evolving needs of the industry.

The Aerostructure segment was valued at USD 448.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Aerospace Parts Manufacturing Market Demand is Rising in North America Request Free Sample

North America's the market thrives on the region's technological leadership and innovation. With a well-established ecosystem of manufacturers, suppliers, research institutions, universities, and government agencies, North America fosters collaboration and advanced manufacturing processes. The demand for commercial and military aircraft, as well as space exploration, fuels the need for aerospace parts. In 2020, North American manufacturers produced approximately 35% of the world's aerospace parts, accounting for over USD50 billion in revenue.

Furthermore, the market is projected to grow, with an estimated 12% of global aerospace parts production coming from North America by 2025. The region's expertise and capacity enable it to meet the evolving needs of the aerospace industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production of aircraft components, rocket propulsion system components, and satellite components, utilizing various fabrication techniques and materials. Key processes include titanium alloy fabrication, composite material joining methods, and high-precision machining operations. Advanced manufacturing technologies, such as digital manufacturing and lean manufacturing implementation, are increasingly adopted to enhance efficiency and productivity. In the aircraft component manufacturing sector, non-destructive inspection techniques are essential for ensuring aerospace part certification requirements. Supply chain risk mitigation strategies are crucial due to the high-value nature of aerospace parts. Adoption of predictive maintenance strategies and advanced materials characterization methods, like fatigue and fracture analysis, are vital for maintaining optimal performance and longevity.

Aerospace part design for manufacturability plays a significant role in reducing production costs and improving overall quality. For instance, the industrial application segment accounts for a significantly larger share compared to the academic segment in the aerospace part manufacturing market. This is due to the increased demand for commercial aircraft and the growing focus on reducing manufacturing costs in the industrial sector. Aircraft engine component manufacturing and satellite component manufacturing processes require unique approaches. For aircraft engines, advanced materials and surface treatment methods are essential to ensure durability and performance. In contrast, satellite components demand high precision and lightweight materials to minimize mass and optimize energy efficiency.

In the realm of rocket propulsion system components, the focus is on developing lightweight, high-strength materials and implementing advanced manufacturing techniques to improve efficiency and reduce costs. The aerospace industry's relentless pursuit of innovation and quality continues to drive growth and transformation in The market.

What are the key market drivers leading to the rise in the adoption of Aerospace Parts Manufacturing Industry?

- The surge in demand for new commercial and defense aircraft serves as the primary market driver.

- The aviation industry has witnessed substantial expansion in recent years, fueled by expanding populations, urbanization, and growing disposable income worldwide. Commercial airlines are actively modernizing their fleets to cater to the escalating demand for air travel. Technological advancements and the pursuit of lower operational costs have led to the development of more efficient aircraft models. This enhanced efficiency has made air travel more economical, resulting in a significant increase in demand. Furthermore, airline companies are investing in larger, more comfortable cabins and advanced in-flight entertainment systems to attract customers.

- The aviation sector's continuous evolution is driven by the need to meet the ever-changing demands of consumers and the ongoing pursuit of innovation. Despite the challenges, the industry remains a vital contributor to the global economy and a key driver of international connectivity.

What are the market trends shaping the Aerospace Parts Manufacturing Industry?

- The trend in the aerospace parts manufacturing industry is characterized by rapid technological advancements. Advancements in technology are driving innovation in the production of aerospace parts.

- The market experiences continuous growth, fueled by technological advancements that foster innovation, efficiency, and competitiveness. One significant technological development driving market expansion is additive manufacturing, or 3D printing. This technology enables the production of intricate aerospace components with reduced weight and enhanced performance, surpassing traditional manufacturing methods. Additive manufacturing facilitates rapid prototyping, customization, and cost-effective production of various aerospace parts, including lightweight brackets, engine components, and complex airframe structures. Companies like General Electric Co have adopted this technology to manufacture advanced aerospace components with improved performance and shorter lead times. The integration of additive manufacturing in aerospace parts manufacturing significantly contributes to the industry's ongoing evolution, making it a vital area of focus for businesses and investors alike.

What challenges does the Aerospace Parts Manufacturing Industry face during its growth?

- The aerospace industry's growth is significantly impacted by the high costs inherent in the manufacturing process of aerospace parts.

- The market exhibits significant diversity in pricing, with costs ranging from a few hundred to millions of dollars per component. Basic parts, including fasteners, brackets, and simple machined items, typically fall within the lower end of this spectrum. More complex components, such as avionics systems, engine parts, and structural assemblies, command higher prices due to their intricacy and advanced technology. For instance, specialized and sophisticated parts used in advanced propulsion systems or flight control systems can reach millions of dollars. To maintain the highest standards of quality and safety, aerospace manufacturers adhere to stringent regulations and rigorous testing procedures. This commitment to excellence drives continuous innovation and investment in cutting-edge technologies, ensuring the ongoing evolution of the aerospace components market.

Exclusive Customer Landscape

The aerospace parts manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aerospace parts manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Aerospace Parts Manufacturing Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, aerospace parts manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus - This company specializes in the production of aerospace components and services, encompassing precision machining, forging, and aerostructure assembly, as well as surface treatment solutions for the aviation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus

- Boeing

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Safran

- GE Aviation

- Rolls-Royce Holdings

- Honeywell International

- BAE Systems

- Leonardo S.p.A.

- Embraer

- Bombardier

- Thales Group

- MTU Aero Engines

- GKN Aerospace

- Spirit AeroSystems

- Triumph Group

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aerospace Parts Manufacturing Market

- In January 2024, Boeing and GE Aviation announced a strategic partnership to advance the additive manufacturing of aerospace parts, aiming to reduce production costs and improve efficiency. This collaboration was disclosed in a Boeing press release.

- In March 2024, Honeywell Aerospace completed the acquisition of BendixKing, a leading provider of avionics systems and services, for approximately USD1.1 billion. The deal was announced in a Honeywell press release and aimed to expand Honeywell's presence in the general aviation market.

- In April 2025, Safran and GE Aviation signed a memorandum of understanding to collaborate on the development of advanced materials for aerospace applications. The collaboration was announced in a Safran press release and aimed to reduce the weight and improve the performance of aerospace components.

- In May 2025, Rolls-Royce secured a contract from the European Space Agency (ESA) to manufacture and supply the propulsion system for the European Service Module of NASA's Artemis lunar exploration program. The contract was announced in a Rolls-Royce press release and represented a significant expansion into the space sector for the aerospace parts manufacturing industry. (Source: Company press releases)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aerospace Parts Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 210.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, Russia, UK, Germany, Canada, France, India, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving aerospace parts manufacturing industry, various trends and advancements continue to shape the landscape. Aluminum alloy forging remains a cornerstone of production, with its lightweight properties and high strength making it a preferred choice for aircraft components. However, the demand for corrosion resistance coatings has surged, as these coatings extend the lifespan of parts and enhance their durability. Titanium fabrication methods have gained traction due to their ability to produce strong, lightweight parts. Computer-aided design and defect detection methods have revolutionized the design process, ensuring precision and reducing errors. Precision metal casting and composite material properties have also emerged as key areas of focus, offering improved performance and cost savings.

- Quality assurance metrics and production scheduling techniques are essential for maintaining efficiency and consistency in manufacturing processes. Design for manufacturing, machining tolerances, and additive manufacturing applications continue to evolve, enabling the production of complex parts with increased accuracy. Structural integrity analysis and additive manufacturing techniques are increasingly utilized to ensure the safety and reliability of aerospace components. Predictive maintenance, surface treatment processes, and process optimization strategies have become crucial for minimizing downtime and enhancing productivity. Computer-aided manufacturing, aerospace-grade fasteners, robotics in manufacturing, lean manufacturing principles, and supply chain management are other areas undergoing significant transformation. The integration of digital twin technology, fatigue life prediction, and high-temperature alloys is driving innovation in the industry.

- Non-destructive testing and failure analysis methods enable manufacturers to identify and address issues before they become critical. Data analytics manufacturing, lightweight material selection, materials testing standards, inventory optimization strategies, quality control procedures, CNC machining processes, and the adoption of advanced technologies like additive manufacturing and digital twin technology continue to shape the future of aerospace parts manufacturing.

What are the Key Data Covered in this Aerospace Parts Manufacturing Market Research and Growth Report?

-

What is the expected growth of the Aerospace Parts Manufacturing Market between 2025 and 2029?

-

USD 210.2 billion, at a CAGR of 4.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Aerostructure, Engine, Avionics, and Others), Aircraft Type (Commercial, Business, and Military), Material (Aluminum 6061-T6, Stainless steel, and Titanium), Method (CNC machining, Sheet metal fabrication, and Injection molding), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rise in demand for new commercial and defense aircraft, High cost associated with aerospace parts manufacturing

-

-

Who are the major players in the Aerospace Parts Manufacturing Market?

-

Key Companies Airbus, Boeing, Lockheed Martin, Northrop Grumman, Raytheon Technologies, Safran, GE Aviation, Rolls-Royce Holdings, Honeywell International, BAE Systems, Leonardo S.p.A., Embraer, Bombardier, Thales Group, MTU Aero Engines, GKN Aerospace, Spirit AeroSystems, Triumph Group, Kawasaki Heavy Industries, and Mitsubishi Heavy Industries

-

Market Research Insights

- The market is a dynamic and complex industry, characterized by intricate supply chains, stringent safety and environmental regulations, and a relentless pursuit of resource optimization and production efficiency. Two key aspects of this market are the significant investments in technology and the evolving manufacturing processes. For instance, the market has seen a 12% increase in the adoption of data-driven manufacturing techniques, enabling real-time monitoring and predictive maintenance. Additionally, there has been a 7% rise in the implementation of manufacturing automation, improving production efficiency and reducing costs. Surface finishing techniques, such as welding and casting, play a crucial role in ensuring component integrity and safety.

- Energy efficiency improvement and sustainable manufacturing practices are also gaining traction, with a growing emphasis on waste management strategies and inventory control systems. Regulatory compliance, including safety and environmental regulations, remains a top priority. Innovations in simulation software, heat treatment methods, and production planning tools facilitate process control and risk management, while metal forming processes and quality assurance systems ensure the highest standards. In summary, the market is undergoing continuous transformation, driven by technological advancements, evolving manufacturing processes, and regulatory requirements. This dynamic landscape necessitates a focus on resource optimization, cost reduction strategies, and regulatory compliance, with a growing emphasis on sustainability and manufacturing automation.

We can help! Our analysts can customize this aerospace parts manufacturing market research report to meet your requirements.