Microbial Agricultural Inoculants Market Size 2025-2029

The microbial agricultural inoculants market size is forecast to increase by USD 303.2 million at a CAGR of 7.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. With increasing concerns over the use of chemical fertilizers and pesticides in agriculture, there is a rising demand for more sustainable and eco-friendly alternatives. Organic farming, which relies on the use of microbial inoculants to enhance soil health and crop productivity, is gaining popularity. The adoption of these eco-friendly alternatives to synthetic fertilizers and herbicides is expected to fuel market growth. However, one challenge facing the market is the lack of awareness among farmers about the benefits of using microbial agricultural inoculants. Despite this, the market is expected to continue growing as more farmers become educated about the advantages of these products for sustainable agriculture. In the US and North America, the trend towards sustainable farming practices and the growing demand for organic produce are driving the market for microbial agricultural inoculants.

What will be the Size of the Microbial Agricultural Inoculants Market During the Forecast Period?

- Microbial agricultural inoculants have emerged as a significant trend in modern farming, enhancing crop nutrition and protection. These inoculants, derived from beneficial bacteria and fungi, play a crucial role in seed and soil inoculation for various commercial crops, including grains and cereals, pulses and oilseeds, fruits and vegetables, and commercial crops. By fostering a symbiotic relationship with crops, these inoculants boost agricultural productivity and contribute to food security. Bacterial inoculants, specifically, are used for seed coating and foliar application in cereals, while soil inoculants are employed for a wide range of crops. Agriculturists leverage these products to augment crop yields, reduce the reliance on chemical fertilizers, and enhance crop preservation.

- Moreover, microbial-based products are increasingly popular in organic farmland, where the use of synthetic chemicals is restricted. The market encompasses a diverse range of applications, from grains and cereals to fruits and vegetables, compound feed, and feed grains. The market's growth is driven by the demand for sustainable farming techniques, the need for crop preservation, and the desire to improve livestock health through the use of beneficial microorganisms. As the global population continues to grow, the role of microbial agricultural inoculants in enhancing agricultural productivity and ensuring food security becomes increasingly vital.

How is this market segmented and which is the largest segment?

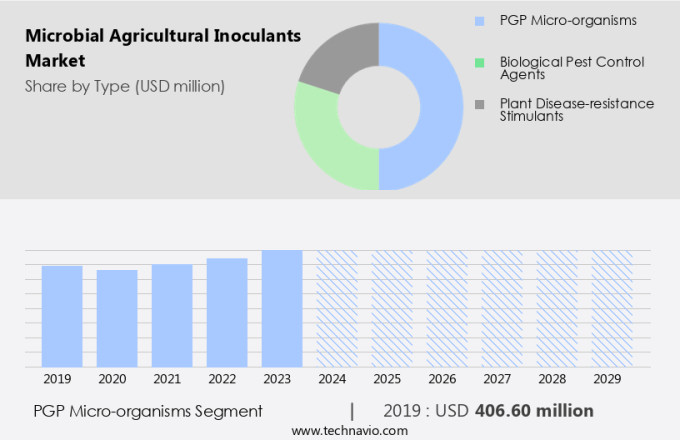

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- PGP micro-organisms

- Biological pest control agents

- Plant disease-resistance stimulants

- Application

- Seed inoculation

- Soil inoculation

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

- The PGP micro-organisms segment is estimated to witness significant growth during the forecast period.

Microbial agricultural inoculants, specifically plant growth promoting (PGP) microorganisms, play a significant role in the global agricultural sector. These beneficial microbes enhance plant health, promote nutrient absorption, and boost crop productivity through symbiotic relationships with plants. Notable examples include nitrogen-fixing bacteria, such as Rhizobium and Bradyrhizobium species, which colonize the root nodules of leguminous plants like soybeans and peas, converting atmospheric nitrogen into a usable form. This process, known as nitrogen fixation, reduces the reliance on synthetic nitrogen fertilizers, thereby minimizing environmental pollution and supporting sustainable farming practices. Additionally, PGP microorganisms aid in mitigating soil acidity, combating toxic compounds, and improving soil structure.

Get a glance at the market report of share of various segments Request Free Sample

The PGP micro-organisms segment was valued at USD 406.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for microbial agricultural inoculants is experiencing notable growth, primarily driven by the increasing demand for organic farm products and regulatory restrictions on chemical fertilizers. The US dominates this market, with significant usage in cereal and grain cultivation. The ban on chemical pesticides and fertilizers in Canada is further propelling market expansion. Consumer interest in organic products is on the rise in North America due to urbanization and increased household income. Microbial agricultural inoculants contribute to agricultural productivity by enhancing plant development, reducing diseases, and increasing output. Moreover, their eco-friendly nature aligns with the industry's shift towards environmentally sustainable practices.

Market Dynamics

Our microbial agricultural inoculants market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Microbial Agricultural Inoculants Market?

Rising concerns over the use of chemical fertilizers and pesticides in agriculture are the key driver of the market.

- Microbial agricultural inoculants, comprising biofertilizers, bioherbicides, and biopesticides, are gaining prominence in the agricultural sector as alternatives to synthetic fertilizers and chemical inputs such as pesticides, herbicides, and fungicides. These inoculants leverage the power of beneficial bacteria and fungi to improve crop nutrition, enhance plant health, and reduce the need for chemical interventions. Grains and cereals, pulses and oilseeds, commercial crops, fruits, and vegetables are among the farm products that benefit from microbial inoculants. By promoting nutrient availability, enhancing soil fertility, and improving soil acidity, these inoculants contribute to balanced plant nutrition. Nitrogen-fixing bacteria, such as Bradyrhizobium japonicum, play a crucial role in soybean cultivation. Microbial inoculants also offer disease reduction and output increase, making them essential for sustainable farming practices. They minimize the environmental footprint by reducing the use of synthetic fertilizers and toxic compounds, such as hydrochloride and sulfuric radicals.

- Moreover, they help in preserving crops and improving the shelf life of farm products. Organic farming and aquaculture, organic cultivation, and conventional farming all benefit from microbial agricultural inoculants. They play a significant role in promoting plant growth, improving soil mass, and reducing the reliance on chemical inputs. Seed coating, foliar application, and seedling nutrition are some of the application methods for these inoculants. The shift towards microbial-based products in agriculture is driven by the need for food security, environmental protection, and human health. Microbial agricultural inoculants offer a sustainable solution for farmers, enabling them to increase agricultural productivity while minimizing the risks associated with chemical inputs. However, a lack of awareness and understanding of these products may hinder their widespread adoption. In conclusion, microbial agricultural inoculants are a promising solution for the agriculture industry, offering benefits in terms of crop nutrition, plant health, and environmental sustainability. By reducing the reliance on chemical inputs and promoting sustainable farming practices, these inoculants contribute to improved food security, enhanced human health, and a reduced environmental impact.

What are the market trends shaping the Microbial Agricultural Inoculants Market?

The rising popularity of organic farming is the upcoming trend in the market.

- Organic farming is gaining traction in the agriculture industry due to growing concerns over the health and environmental implications of conventional farming practices. The shift towards organic farming involves the use of microbial agricultural inoculants, such as biofertilizers, bioherbicides, and biopesticides, which are derived from beneficial microorganisms like bacteria and fungi. These inoculants enhance crop nutrition and protection by improving soil fertility, increasing nutrient availability, and reducing the need for synthetic fertilizers and chemical inputs like fertilizers, pesticides, and herbicides. Crops such as grains and cereals, pulses and oilseeds, commercial crops, fruits, and vegetables can benefit from microbial inoculants.

- Moreover, seed inoculation and soil inoculation are common methods used to apply these inoculants. For instance, nitrogen-fixing bacteria like Bradyrhizobium japonicum can be used to inoculate soybeans, thereby increasing crop yields and reducing the environmental footprint. Microbial inoculants also play a crucial role in organic farming techniques, such as organic cultivation and organic solutions, which promote balanced plant nutrition, plant health improvement, and disease reduction. Farmers can use microbial inoculants to improve the shelf life of their produce and ensure food security. Additionally, these inoculants can be used in animal feed, such as compound feed and feed grains, to improve livestock health and productivity.

- Despite the numerous benefits of microbial agricultural inoculants, their use is not yet widespread due to a lack of awareness and the high cost of production. However, with ongoing research and development, novel formulations and strain selection are being introduced to make these inoculants more accessible and affordable to farmers. Microbial inoculants offer a sustainable farming practice that reduces the use of toxic compounds like acid radicals, hydrochloride, and sulfuric radicals, found in synthetic fertilizers. Moreover, they help in the preservation of crops and the protection of the environment by reducing the need for chemical inputs and minimizing the risk of food contamination. In conclusion, microbial agricultural inoculants are a vital component of organic farming, offering numerous benefits to farmers, consumers, and the environment. As the demand for organic farm products continues to grow, the market for microbial agricultural inoculants is expected to expand significantly.

What challenges does Microbial Agricultural Inoculants Market face during the growth?

Lack of awareness of microbial agricultural inoculants among farmers is a key challenge affecting the market growth.

- The market holds promise for enhancing crop nutrition and protection through the use of beneficial bacteria and fungi. These inoculants can promote plant growth, improve soil health, and reduce the need for synthetic fertilizers and chemical inputs such as pesticides, herbicides, and toxic compounds. The market includes applications in grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and organic farming and aquaculture. Microbial inoculants offer several advantages over conventional farming practices. For instance, they can increase nutrient availability, reduce diseases, and minimize the environmental impact of farming. Nitrogen-fixing bacteria like Bradyrhizobium japonicum can improve soil fertility and enhance soybean production.

- Moreover, biofertilizers, bioherbicides, and biopesticides can promote balanced plant nutrition and reduce the need for chemical inputs. However, the market growth is hindered by a lack of awareness among farmers and stakeholders. In many regions, farmers rely on traditional practices and may not be fully aware of the benefits of microbial inoculants. This can limit the adoption of these products, particularly in developing regions where smallholder farmers dominate the agriculture sector. Additionally, the high cost of some microbial inoculants and the need for proper application techniques can be barriers to entry for some farmers. Despite these challenges, the market for microbial agricultural inoculants is expected to grow as farmers and stakeholders become more aware of their benefits.

- The development of novel formulations and the increasing focus on sustainable farming practices are expected to drive market growth. Farmers and agriculturalists can benefit from the use of microbial inoculants by increasing crop yields, improving plant health, and reducing the environmental footprint of farming. In conclusion, the market offers significant potential for enhancing crop productivity and sustainability. However, the lack of awareness among farmers and stakeholders, high costs, and the need for proper application techniques are some of the challenges that need to be addressed to fully realize the potential of these products. With the increasing focus on sustainable farming practices and the development of novel formulations, the market for microbial agricultural inoculants is expected to grow in the coming years.

Exclusive Customer Landscape

The microbial agricultural inoculants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AquaBella Organic Solutions LLC - The company provides advanced microbial agricultural solutions through the use of inoculants, specifically Poncho Votivo bioseeds and Votivo prime. Poncho Votivo bioseeds consist of Bacillus microbials, while Votivo prime comprises Bacillus firmus microbials.

The microbial agricultural inoculants market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AquaBella Organic Solutions LLC

- BASF SE

- Bayer AG

- BIO CAT Inc.

- Bioceres Crop Solutions Corp.

- Corteva Inc.

- Evogene Ltd.

- Groundwork BioAg

- Hello Nature Inc.

- IAB Investigaciones y Aplicaciones Biotecnologicas

- Imex Agro

- Kemin Industries Inc.

- Lallemand Inc.

- Mycorrhizal Applications

- New Edge Microbials Pty Ltd.

- Novozymes AS

- Premier Tech Ltd.

- Queensland Agricultural Seeds

- Soil Technologies Corp.

- Verdesian Life Sciences LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Microbial inoculants have emerged as a promising solution in modern agriculture, offering sustainable and eco-friendly alternatives to traditional chemical inputs. These beneficial microorganisms, including bacteria and fungi, play a crucial role in enhancing crop productivity, improving plant health, and safeguarding the environment. Microbial inoculants are applied to crops through various methods, such as seed inoculation and soil inoculation. Seed inoculation involves coating seeds with beneficial microbes before planting, ensuring the young plants get an immediate boost in growth. Soil inoculation, on the other hand, introduces microbes directly into the soil to improve its fertility and promote plant growth. Grains and cereals, pulses and oilseeds, commercial crops, fruits, and vegetables all benefit from microbial inoculants. These inoculants enhance nutrient availability, promote plant development, and reduce diseases. By improving the health of the crops, microbial inoculants contribute to increased output and higher-quality farm products. The agricultural industry has long relied on chemical inputs like fertilizers, pesticides, and herbicides to maintain crop productivity.

However, the overuse of these synthetic products has led to concerns regarding food contamination, human health, and environmental impact. Microbial inoculants offer a more sustainable and environmentally friendly alternative, as they promote balanced plant nutrition and reduce the need for synthetic fertilizers. Soil acidity, poor-quality crops, and recalcitrant compounds in the soil can hinder plant growth. Microbial inoculants help address these challenges by producing acid radicals, such as hydrochloride and sulfuric radicals, which improve soil conditions. Additionally, these microorganisms help break down toxic compounds, making the soil more hospitable for plant growth. Microbial inoculants also play a role in farming techniques for livestock and organic farming. For instance, bacterial inoculants can be used in compound feed and feed grains to improve livestock health and productivity. In organic farming, microbial inoculants contribute to organic cultivation by promoting soil fertility and improving plant health.

Moreover, the use of microbial inoculants offers numerous benefits, including crop preservation, disease reduction, and output increase. These advantages not only contribute to the growth of the agricultural industry but also help protect the environment by reducing the environmental footprint. Furthermore, microbial-based products offer a more sustainable and eco-friendly alternative to traditional chemical inputs. Despite the numerous benefits, the adoption of microbial inoculants remains limited due to a lack of awareness among farmers and agriculturalists. As the agricultural community continues to explore sustainable farming practices, the use of microbial inoculants is expected to gain momentum. In conclusion, microbial inoculants represent a significant step forward in sustainable agriculture. By promoting balanced plant nutrition, improving soil health, and reducing the need for synthetic inputs, these beneficial microorganisms contribute to increased agricultural productivity and environmental protection. As awareness of their benefits grows, microbial inoculants are poised to play an increasingly important role in the agricultural industry.

|

Microbial Agricultural Inoculants Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2025-2029 |

USD 303.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, UK, Canada, Germany, China, France, Japan, Italy, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch