Wheat Protein Market Size 2024-2028

The wheat protein market size is forecast to increase by USD 885.9 million, at a CAGR of 4.82% between 2023 and 2028.

- The market is experiencing significant growth due to the rising trend of veganism and vegetarianism, fueled by the increasing health consciousness and ethical concerns among consumers. This shift in dietary preferences is driving the demand for plant-based protein sources, with wheat protein emerging as a popular alternative to animal-derived proteins. Additionally, the convenience of online shopping has enabled easier access to these products, further expanding their reach. However, the market faces challenges as well. The presence of substitutes, such as soy and pea proteins, poses a threat to the growth of the market. These alternatives have been established in the market for a longer time and enjoy a larger consumer base.

- To capitalize on opportunities and navigate challenges effectively, companies in the market need to focus on product innovation, pricing strategies, and expanding their distribution networks. By addressing these challenges and leveraging the growing demand for plant-based proteins, market participants can tap into the significant potential of the market.

What will be the Size of the Wheat Protein Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications and dynamic market dynamics. Wheat proteins, derived from various extraction methods such as alkaline extraction and solvent extraction, play a pivotal role in pasta production, enhancing dough strength and ensuring optimal texture. In the functional food sector, these proteins serve as vital ingredients, contributing to the development of protein-fortified foods. Protein purification techniques, including protein hydrolysis and enzymatic hydrolysis, have emerged as crucial processes to enhance the functional properties of wheat proteins. These methods enable the production of protein isolates, concentrates, and hydrolysates, which exhibit superior foaming properties, emulsifying abilities, and improved nutritional value.

Wheat proteins' versatility extends to the bakery sector, where they contribute to superior bread making quality and improved texture in various baked goods. Additionally, they find applications in confectionery, contributing to texture improvement and viscosity modification. Sustainability remains a key focus in the market, with wheat proteins emerging as a viable and sustainable protein source. The ongoing research and development in protein modification aim to enhance the nutritional value, water binding capacity, and digestibility of wheat proteins. The market's continuous evolution is further highlighted by the expanding applications in sectors such as meat analogue production and plant-based protein alternatives.

The functional properties of wheat proteins, including their gelation properties and amino acid profile, make them an attractive alternative to traditional animal-derived proteins. In summary, the market is characterized by its dynamic nature, with ongoing research and development driving the evolution of protein extraction methods, functional properties, and applications across various sectors. The focus on sustainability and nutritional value further underscores the market's continuous growth and innovation.

How is this Wheat Protein Industry segmented?

The wheat protein industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Wheat gluten

- Wheat protein isolate

- Textured wheat protein

- Others

- Distribution Channel

- B2B

- Supermarkets and Hypermarkets

- Online Retail

- Health Food Stores

- End-User

- Food Manufacturers

- Fitness Industry

- Household

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Indonesia

- Malaysia

- South Korea

- Thailand

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

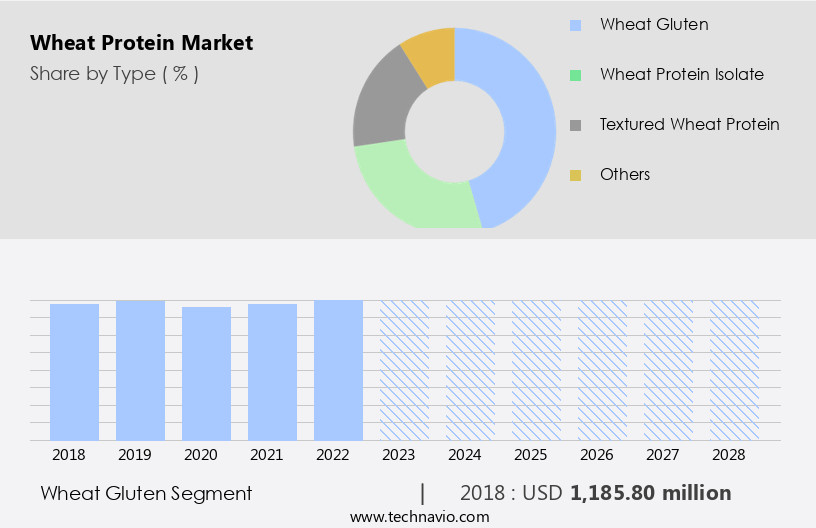

The wheat gluten segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with wheat gluten being the largest segment. Wheat gluten, a co-product of wheat flour, is utilized to enhance bread-making properties due to its rheological advantages. The increasing preference for plant-based alternatives to meat and soy, coupled with the growing awareness of vegan and vegetarian diets, is fueling the demand for wheat gluten. Furthermore, the trend toward high-protein diets and changing lifestyles is anticipated to propel the expansion of the wheat gluten segment in the global market. Functional food ingredients derived from wheat protein, such as isolates, concentrates, and hydrolysates, are gaining popularity due to their water binding capacity, amino acid profile, emulsifying properties, and texture improvement capabilities.

These proteins are extensively used in bakery applications, confectionery, pasta production, and meat analogue production. Protein modification techniques like alkaline extraction, enzymatic hydrolysis, and solvent extraction are employed to enhance the functionality and nutritional value of wheat proteins. Sustainable protein sources like wheat protein are increasingly being adopted due to their gelation properties and viscosity modification capabilities, making them suitable for various food applications. Despite some concerns regarding wheat protein allergenicity, advancements in protein purification and enrichment methods are addressing these issues, ensuring the continued growth of the market.

The Wheat gluten segment was valued at USD 1185.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

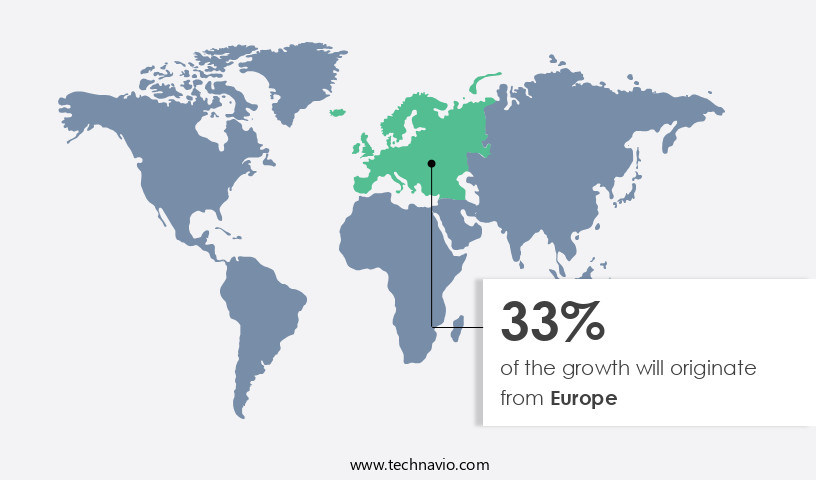

Europe is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market holds the largest share in The market, driven by the food and beverage industry's continuous growth. The increasing preference for wheat protein as a healthier alternative to whey protein, fueled by the rising demand for plant-based diets and the growing vegan population, significantly contributes to this market expansion. Furthermore, the region's increasing disposable income and urbanization are anticipated to boost the market's growth during the forecast period. Wheat protein's functional properties, such as foaming, emulsifying, and water binding, make it an essential ingredient in various food applications, including bakery products, pasta, and confectionery. The protein's nutritional value, including essential amino acids and a favorable amino acid profile, adds to its appeal.

Protein extraction methods, such as alkaline extraction, solvent extraction, and enzymatic hydrolysis, are used to obtain wheat protein isolate, concentrate, and hydrolysate. These protein forms cater to diverse applications, including food fortification, meat analogue production, and texture improvement. Sustainability is a significant trend in the market, with an increasing focus on using sustainable protein sources. Wheat protein's production through methods like alkaline extraction and enzymatic hydrolysis is considered more sustainable compared to animal-derived protein sources. Wheat protein's gelation and dough strengthening properties make it suitable for bread making and bakery applications. Its viscosity modification and protein functionality are also essential in various food applications.

Despite its numerous benefits, wheat protein allergenicity is a concern for some consumers, leading to the development of gluten-free wheat protein alternatives. In conclusion, the North American the market's growth is fueled by the increasing demand for plant-based proteins, rising disposable income, and urbanization. The functional properties and nutritional value of wheat protein make it a versatile ingredient in various food applications, catering to diverse consumer preferences. The market's focus on sustainability and the development of gluten-free alternatives further enhance its growth potential.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global wheat protein market size and forecast projects growth, driven by wheat protein market trends 2024-2028. B2B wheat protein supply solutions leverage advanced protein extraction technologies for quality. Wheat protein market growth opportunities 2025 include wheat protein for plant-based foods and gluten-based protein products, meeting demand. Wheat protein supply chain software optimizes operations, while wheat protein market competitive analysis highlights key suppliers. Sustainable wheat protein practices align with eco-friendly protein trends. Wheat protein regulations 2024-2028 shapes wheat protein demand in Europe 2025. High-purity wheat protein solutions and premium wheat protein insights boost adoption. Wheat protein for baking and customized protein formulations target niches. Wheat protein market challenges and solutions address allergen concerns, with direct procurement strategies for wheat protein and wheat protein pricing optimization enhancing profitability. Data-driven wheat protein analytics and plant-based protein trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Wheat Protein Industry?

- The vegan population's continued growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing popularity of plant-based diets, particularly among millennials in various regions, including the US and Canada. Consumers are recognizing the health benefits of vegan diets, leading to an increase in the number of individuals adopting this lifestyle. Wheat protein, with its excellent water binding capacity, wheat protein digestibility, and functionality, plays a crucial role in various applications, including meat analogue production, viscosity modification, protein enrichment, and texture improvement.

- The versatility of wheat protein makes it an ideal alternative to animal-derived proteins in various food industries. The trend towards plant-based diets is expected to continue, driving the demand for wheat protein in the forecast period.

What are the market trends shaping the Wheat Protein Industry?

- The increasing prevalence of online shopping represents a significant market trend in today's business landscape. This shift towards e-commerce is mandatory for businesses aiming to stay competitive and reach a wider audience.

- The market has experienced substantial growth in the last decade, driven by the increasing popularity of wheat protein as a functional food ingredient and the rise of online distribution channels. E-commerce platforms enable consumers to access a diverse range of wheat protein-based products from regional and international brands, fueling the demand for wheat protein in various food applications. The global proliferation of smartphones and the subsequent increase in the number of e-commerce companies have further boosted the market's growth. Major online retailers, such as Amazon.Com and eBay Inc., are significant players in the global market for wheat protein-based products.

- Wheat protein is extracted using methods such as alkaline extraction, solvent extraction, and enzymatic hydrolysis, which undergo protein purification to enhance their functional properties, including dough strength, foaming abilities, and sustainability. These properties make wheat protein an attractive alternative to animal-derived proteins in various food industries, including pasta production. As a result, the market for wheat protein is expected to continue its growth trajectory in the coming years.

What challenges does the Wheat Protein Industry face during its growth?

- The presence of substitutes poses a significant challenge to the industry's growth, as it increases competition and puts pressure on companies to innovate and differentiate themselves in order to maintain market share.

- The market faces challenges due to the availability of alternative proteins. Wheat gluten, a primary application of wheat protein, has common substitutes such as high gluten flour, bread flour, xanthan gum, eggs, and protein powder. The increasing preference for plant-based proteins, including pea, rice, pulse, canola, flax, and chia, poses a significant threat to the market. The growing intolerance towards gluten among consumers has also reduced the demand for wheat proteins.

- These alternatives offer similar gelation properties and bread making quality in bakery applications, making them viable substitutes. Consequently, The market may experience restrained growth during the forecast period.

Exclusive Customer Landscape

The wheat protein market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wheat protein market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wheat protein market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - This company specializes in producing wheat protein, including wheat protein powder, to address formulation challenges in the meat alternative industry. Their offerings ensure high-quality, plant-based solutions for consumers seeking sustainable, protein-rich alternatives to animal products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Ardent Mills LLC

- Cargill Inc.

- Crespel and Deiters GmbH and Co. KG

- CropEnergies AG

- Ezaki Glico Co. Ltd.

- Farmers Mill Ltd.

- General Mills Inc.

- Hodgson Mill

- Kerry Group Plc

- Kroner Starke GmbH

- Manildra Flour Mills Pty. Ltd.

- Mennel Milling

- MGP Ingredients Inc.

- Nutra Healthcare Pvt. Ltd.

- Roquette Freres SA

- Sudzucker AG

- Tate and Lyle PLC

- Tereos Participations

- The Scoular Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wheat Protein Market

- In January 2024, Archer Daniels Midland Company (ADM) announced the expansion of its wheat protein production capacity at its Decatur, Illinois, facility. This development aimed to meet the growing demand for plant-based proteins and followed the successful launch of ADM's textured wheat protein, Protexxtra, in 2023 (ADM press release, 2024).

- In March 2024, DuPont Nutrition & Biosciences and Danish food company, Orkla, entered into a strategic partnership to develop and commercialize plant-based protein ingredients. This collaboration focused on leveraging DuPont's expertise in plant protein production and Orkla's market presence in Europe (DuPont press release, 2024).

- In May 2024, Cargill completed the acquisition of RUAG's food and nutrition business, which included its wheat protein production capabilities. This acquisition expanded Cargill's portfolio of plant-based proteins and strengthened its position in the European market (Cargill press release, 2024).

- In April 2025, Ingredion Incorporated received regulatory approval from the European Commission for its new wheat protein ingredient, Vitepro S20. This approval marked the first commercial approval for a textured wheat protein in Europe, further solidifying Ingredion's position as a leading player in The market (Ingredion press release, 2025).

Research Analyst Overview

- The market is characterized by ongoing research and development in the analysis of protein interactions and rheological properties. Chromatographic analysis and electrophoresis techniques are utilized for protein quantification and fractionation, providing insights into protein-carbohydrate and protein-lipid interactions. Immunological methods and mass spectrometry aid in identifying specific proteins and ensuring regulatory compliance. Non-gluten wheat proteins are gaining attention due to their potential in food processing technology and novel food applications. Consumer acceptance is influenced by nutritional labeling, flavor profile, and sensory attributes.

- Shear thinning behavior and protein denaturation are critical factors in thermal processing effects, while color characteristics and oxidative stability are essential for maintaining quality control. Regulatory compliance and storage stability are crucial aspects of the market, with ingredient labeling and spectroscopic analysis playing a role in ensuring transparency and accuracy. Market trends include exploring the mouthfeel properties and exploring new applications for wheat proteins.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wheat Protein Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.82% |

|

Market growth 2024-2028 |

USD 885.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.34 |

|

Key countries |

US, Malaysia, Indonesia, Germany, UK, South Korea, France, Canada, Brazil, Thailand, UAE, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wheat Protein Market Research and Growth Report?

- CAGR of the Wheat Protein industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wheat protein market growth of industry companies

We can help! Our analysts can customize this wheat protein market research report to meet your requirements.