Whipping Cream Market Size 2024-2028

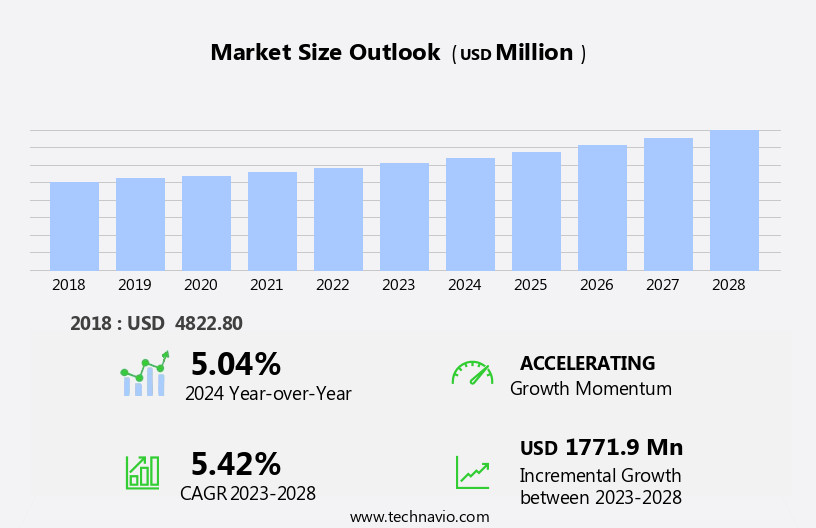

The whipping cream market size is forecast to increase by USD 1.77 billion, at a CAGR of 5.42% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing number of cafes and the rising demand for organic whipping cream. These trends reflect the evolving consumer preference for premium and healthier dairy products. However, the market faces challenges, including the growing incidence of lactose intolerance, which poses a significant obstacle to market expansion. Producers must innovate to cater to this segment by developing lactose-free or low-lactose whipping cream alternatives. Despite this, the market is expected to continue its growth trajectory, fueled by the versatility of whipping cream in various applications, including cakes, sauces, and baked goods.

- This strategic response will enable companies to tap into the untapped potential of the lactose-intolerant population while maintaining market competitiveness. Overall, the market presents a compelling growth opportunity for businesses that can effectively address consumer demands and navigate the challenges presented by lactose intolerance.

What will be the Size of the Whipping Cream Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its growth and applications across various sectors. The continuous unfolding of market activities is influenced by numerous factors, including sensory evaluation parameters, emulsifier selection, antioxidant preservation methods, and viscosity and stability. These factors are interconnected, with processing temperature effects and ingredient sourcing criteria impacting flavor compound interaction and sensory attribute profiling. Packaging material selection plays a crucial role in maintaining storage temperature stability and inhibiting microbial growth. Churning process efficiency and homogenization process optimization are essential for producing consistent whipped cream with desirable texture and aeration. The sweetener type influence on whipping cream's taste profile and shelf life extension is a significant consideration.

Stabilizer functionality, protein denaturation prevention, and overrun percentage optimization are also critical aspects of ensuring product quality and consistency. Foam structure analysis, fat content measurement, and emulsion stability testing are essential for understanding the complex interplay of whipping cream's components. Cream aging techniques and fat crystallization control further contribute to the evolving nature of this market.

How is this Whipping Cream Industry segmented?

The whipping cream industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Dairy-based

- Non-dairy-based

- Application

- Bakery & Confectionery

- Dairy Products

- Desserts

- Beverages

- Savory Dishes

- Fat Content

- High Fat

- Low Fat

- Fat-Free

- Form

- Aerosol Can

- Liquid

- Powder

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

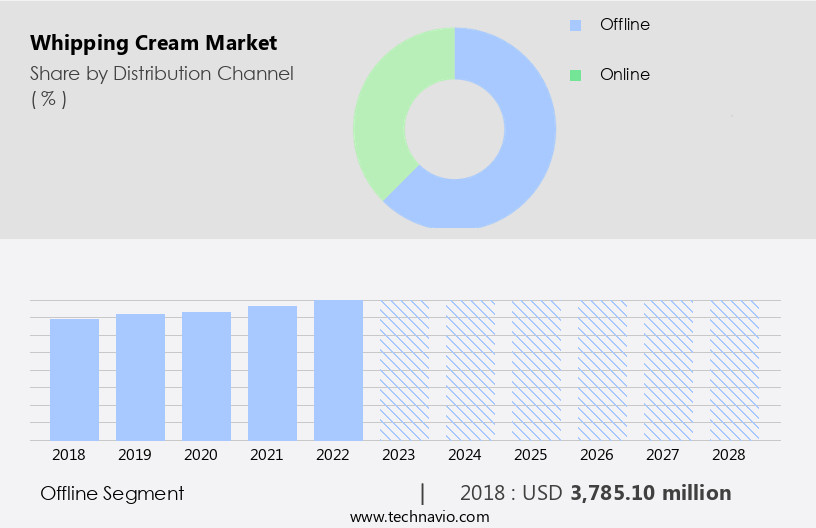

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The offline the market is a substantial segment in the food industry, encompassing a diverse range of products to cater to various consumer preferences. Supermarkets, hypermarkets, and specialty stores remain pivotal players in this market, offering consumers the opportunity for direct product evaluation before purchase. The tactile and sensory experience of shopping in a physical environment is particularly crucial for whipping cream, as consumers often prioritize visual inspection to ensure product quality. Brand reputation and consumer trust are essential factors influencing the offline the market. Well-established retail chains with long-standing brand names contribute significantly to the market's growth.

The selection of emulsifiers and antioxidant preservation methods is crucial to maintain viscosity and stability, ensuring a desirable whipped cream texture. Microbial contamination risk is a critical concern, necessitating rigorous quality control testing and product consistency evaluation. Air incorporation methods, such as churning and homogenization, play a vital role in achieving the desired overrun percentage and whipping time. Whipping cream density, fat content, and emulsion stability testing are essential factors in ensuring product quality. Shelf life extension and stabilizer functionality are essential considerations to maintain dairy protein stability and prevent protein denaturation. Packaging material impact and microbial growth inhibition are essential factors in maintaining product quality and safety.

Flavor compound interaction and sensory attribute profiling are crucial in creating a harmonious balance of taste and texture. Fat crystallization control and foam structure analysis are essential to ensure the desired whipped cream texture and consistency.

The Offline segment was valued at USD 3.79 billion in 2018 and showed a gradual increase during the forecast period.

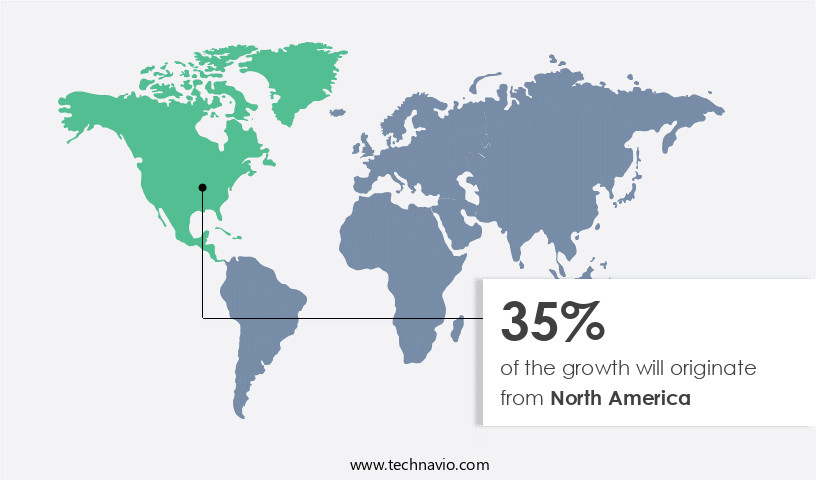

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic US market, whipping cream continues to be a preferred topping for various food applications, particularly in bakery products and specialty coffee. With an increasing number of coffee shops and the popularity of bakery items, the demand for whipping cream is anticipated to thrive. Globally, the US and Canada lead the market due to their high demand for coffee and over 25,000 chain specialty coffee shops. To cater to health-conscious consumers, companies are introducing fat-free whipping cream options. Emulsifiers are crucial in whipping cream production, ensuring desirable viscosity and stability. Antioxidant preservation methods are essential to maintain product quality and extend shelf life.

Microbial contamination risk necessitates rigorous quality control testing and product consistency evaluation. Air incorporation methods and storage temperature stability impact whipping cream's texture and density. Processing temperature effects and ingredient sourcing criteria influence protein denaturation prevention and dairy protein stability. Flavor compound interaction and sensory attribute profiling are critical for optimizing consumer satisfaction. Packaging material impact and microbial growth inhibition techniques ensure product safety and freshness. Churning process efficiency, sweetener type influence, and homogenization process are key factors for producing consistent, high-quality whipping cream. Fat crystallization control and emulsion stability testing are essential for maintaining optimal product characteristics.

Market Dynamics

The global whipping cream market is experiencing dynamic shifts, driven by evolving whipping cream market trends and a rising preference for diverse options. While dairy whipping cream remains a staple, the burgeoning demand for non-dairy whipping cream and plant-based whipping cream underscores a significant consumer shift towards vegan alternatives. The convenience of aerosol whipping cream and the extended shelf life of UHT whipping cream are key market drivers. Various whipping cream applications span from confectionery, where bakery whipping cream is essential, to beverages and savory dishes. The heavy whipping cream segment continues to dominate in traditional uses, but organic whipping cream and clean label whipping cream are gaining traction. This robust whipping cream industry growth is attracting numerous whipping cream manufacturers aiming to capture a larger whipping cream market share with innovative products like liquid whipping cream and specialized professional whipping cream.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Whipping Cream Industry?

- The proliferation of cafes serves as the primary catalyst for market growth.

- The market experiences growth due to its extensive application in foodservice industries, particularly in cafes and coffee shops. The popularity of whipped cream in beverages such as coffee, milkshakes, iced teas, hot chocolate, and various pastries and desserts has led to an increase in demand. The expanding urban population and the rise of white-collar workers have contributed to the growth of foodservice establishments, including cafes and coffee shops. Leading chains like Starbucks, Costa Coffee, and Dunkin Brands are expanding globally, fueled by diverse consumer preferences for high-quality coffee. In the production of whipping cream, sensory evaluation parameters such as taste, aroma, texture, and appearance play a significant role.

- Emulsifier selection is crucial for achieving desirable viscosity and stability, while antioxidant preservation methods help maintain product quality. Microbial contamination risk is a concern, necessitating quality control testing and product consistency evaluation. Air incorporation methods, such as whipping or aeration, are essential for creating the characteristic light and fluffy texture of whipped cream.

What are the market trends shaping the Whipping Cream Industry?

- The increasing preference for organic products is evident in the market, with whipping cream being no exception. The demand for organic whipping cream is on the rise and is expected to continue as a notable trend in the industry.

- The market is driven by the increasing preference for natural and organic products, with organic whipping cream being a key contributor to market growth. Consumers are increasingly conscious of the food they consume and are seeking to reduce their intake of products containing chemical pesticides and fertilizers. To meet this demand, organic whipping cream is produced using raw materials that are organically sourced, ensuring the absence of synthetic additives. The production process of organic whipping cream involves careful consideration of storage temperature stability and processing temperature effects to preserve the product's quality. The flavor compounds in whipping cream can interact with packaging materials, affecting sensory attributes, and therefore, the choice of packaging material is crucial.

- Moreover, microbial growth inhibition is a critical factor in ensuring the safety and shelf life of the product. Efficiency in the churning process is essential to maintain the desired texture and consistency of whipping cream. The market dynamics of whipping cream are influenced by various factors, including ingredient sourcing criteria, flavor compound interaction, sensory attribute profiling, packaging material impact, and microbial growth inhibition. These factors collectively contribute to the market's growth and development.

What challenges does the Whipping Cream Industry face during its growth?

- Lactose intolerance, which is on the rise and poses a significant challenge, hinders the growth of the industry.

- The market experiences significant growth due to the increasing prevalence of lactose intolerance and food allergies. Lactose intolerance, a condition where the body cannot digest lactose, affects over 90% of East Asian people and a substantial portion of the population in other ethnicities. This condition limits the consumption of dairy products, leading to a surge in demand for lactose-free alternatives. Food allergies, including lactose intolerance, have reportedly increased by 18% in the US over the last decade. To cater to this demand, the whipping cream industry has responded by producing lactose-free options. These products undergo homogenization, a process that reduces the size of fat globules, ensuring a smoother texture and better mixing properties.

- Stabilizers and sweeteners are often added to prevent protein denaturation during whipping, extending the shelf life and optimizing the overrun percentage. The optimization of whipping time is crucial to achieving the desired texture and consistency. The functionality of these additives is essential in maintaining the product's quality and enhancing its taste profile.

Exclusive Customer Landscape

The whipping cream market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the whipping cream market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, whipping cream market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agropur Dairy Cooperative - This company specializes in the development and distribution of innovative sports products, leveraging advanced technology and materials to enhance athlete performance and consumer experience. Their offerings cater to various sports and fitness activities, setting industry standards for quality and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Arla Foods amba

- Bakels Worldwide

- Borden Dairy Company

- Cabot Creamery

- Califia Farms LLC

- Conagra Brands Inc.

- Dairy Farmers of America Inc.

- DMK Deutsches Milchkontor GmbH

- Gay Lea Foods Co operative Ltd.

- Granarolo S.P.A.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hanan Products Co. Inc.

- Land O lakes Inc.

- Natures Charm

- Palsgaard AS

- Rich Products Corp.

- Royal FrieslandCampina NV

- Tatua Co operative Dairy Co. Ltd.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Whipping Cream Market

- In January 2024, Fischer & Company, a leading dairy processor, introduced a new line of organic whipping cream in response to increasing consumer demand for natural and organic food products (Fischer & Company Press Release).

- In March 2024, Danone and Lactalis, two major players in the global dairy industry, announced a strategic partnership to jointly invest in research and development for innovative whipping cream products, aiming to expand their market shares (Bloomberg).

- In May 2024, Dairy Farmers of America, the largest dairy cooperative in the United States, completed the acquisition of a significant stake in a European whipping cream manufacturer, significantly expanding its presence in the global market (Dairy Farmers of America Press Release).

- In February 2025, the European Commission approved a new regulation to reduce the saturated fat content in whipping cream, setting a maximum limit of 18% by weight (European Commission Press Release). This regulatory change is expected to influence the production and marketing strategies of whipping cream manufacturers in Europe.

Research Analyst Overview

- In the dynamic market, shelf-life prediction models play a crucial role in ensuring product consistency and quality. Understanding the intricacies of whipping cream formulation and foam stability mechanisms is essential for cost-effective processing and process scalability assessment. Flavor release kinetics and quality assurance protocols are key factors in enhancing consumer satisfaction. Production efficiency analysis and waste reduction strategies are critical for optimizing processes and reducing costs. Chemical composition analysis, product standardization methods, and yield optimization techniques are essential for maintaining consistency and meeting consumer expectations. Ingredient interaction effects, rheological properties, and microbial load assessment are crucial in developing innovative whipping cream formulations.

- Sensory descriptive analysis and packaging design considerations are vital in appealing to consumers' preferences. Furthermore, understanding fat globule aggregation and ingredient substitution effects can lead to novel ingredient applications and sustainable sourcing practices. Protein network formation and optimal whipping parameters are essential in achieving the desired texture and consistency. By implementing process optimization strategies and assessing the impact of various factors, whipping cream manufacturers can stay competitive in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Whipping Cream Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.42% |

|

Market growth 2024-2028 |

USD 1771.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.04 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Whipping Cream Market Research and Growth Report?

- CAGR of the Whipping Cream industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the whipping cream market growth of industry companies

We can help! Our analysts can customize this whipping cream market research report to meet your requirements.