Emulsifier Market Size 2024-2028

The emulsifier market size is forecast to increase by USD 2.93 billion at a CAGR of 6.3% between 2023 and 2028.

- The market is experiencing significant growth due to key trends such as the increasing demand from the bakery and confectionery segments. This trend is driven by the rising consumption of baked goods and confectionery products in various regions, particularly in emerging economies. Additionally, emulsifiers are increasingly being used In these industries to improve product texture, shelf life, and stability. However, the market growth is also being influenced by stringent government regulations on using emulsifiers in food and beverage products. These regulations aim to ensure food safety and quality, which is a crucial factor for consumers. Despite these challenges, the market is expected to continue its growth trajectory due to the increasing demand for convenient and healthy food options, as well as the ongoing research and development In the emulsifier industry.

What will be the Size of the Emulsifier Market During the Forecast Period?

- The market encompasses a range of ingredients used in processed food, beverages, health and wellness products, cosmetics, and personal care items to improve texture, enhance sensory characteristics, and facilitate the blending of oil and water-based components. Emulsifiers, such as mono- and diglycerides, fatty acids, and lecithin derived from agricultural products like palm oil and soybeans, play a crucial role in various industries.

- Consumer trends, including the demand for convenience food, premium products, and clean-label alternatives, drive market growth. Natural food emulsifiers, derived from plant-based sources, are gaining popularity due to their multifunctional attributes and alignment with health-conscious consumer preferences. Low-fat food and weight gain products also contribute to the market's expansion. Animal-derived emulsifiers face challenges due to increasing veganism and ethical concerns. Emulsifiers offer benefits in food additives, texture enhancement, fat reduction, and sensory characteristics, making them indispensable in various industries.

How is this Emulsifier Industry segmented and which is the largest segment?

The emulsifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverage

- Personal care

- Pharmaceuticals

- Industrials

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- Europe

By End-user Insights

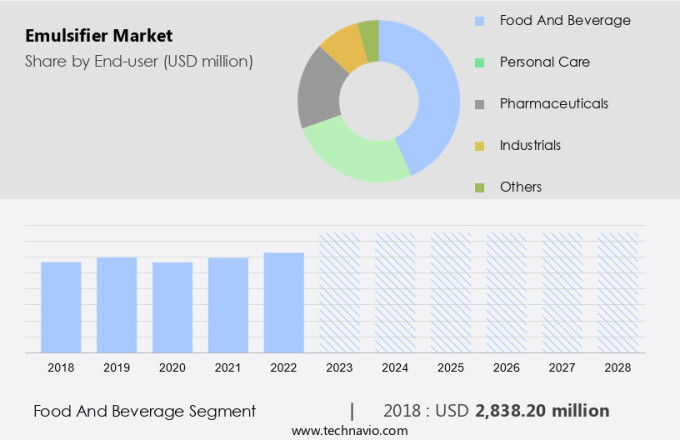

- The food and beverage segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth In the food and beverage sector in 2023, driven by its extensive usage in various applications. Emulsifiers are essential in this industry, particularly for bakeries and confectionery, dairy products, convenience foods, and alcoholic beverages manufacturers. Their primary function is to provide a smooth and thick consistency to food products, enhancing their sensory appeal. Natural emulsifiers, such as plant-derived lecithin, are popular choices due to their health benefits and clean-label criteria. In the food industry, lecithin is commonly used in bakery products, margarine, cakes, cookies, and chocolate, and can be identified on food labels under the symbol 'E322.

Furthermore, the convenience food industry's fast-paced lifestyle and nutritional value focus have further boosted the demand for emulsifiers. Additionally, consumer preferences for health-conscious food options, natural ingredients, and alternatives to synthetic additives have fueled the market's growth. Emulsifiers' multifunctional attributes, such as stabilization properties, shelf-life extension, nutrient delivery, and texture enhancement, make them indispensable In the food and beverage sector.

Get a glance at the Emulsifier Industry report of share of various segments Request Free Sample

The food and beverage segment was valued at USD 2.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

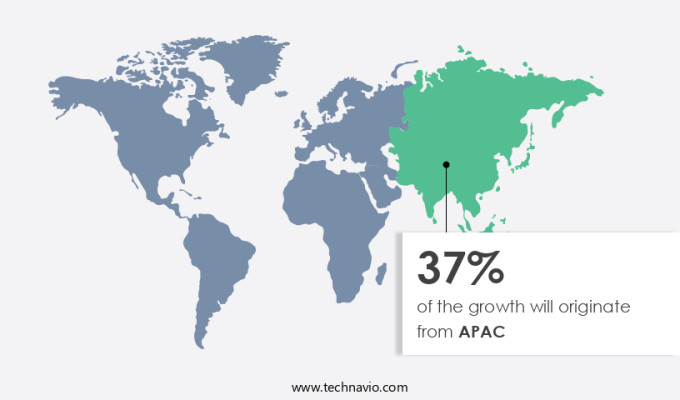

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market holds the largest share In the global industry, driven by its extensive applications in sectors such as dairy, bakery, confectionery, and cosmetics. Emulsifiers are essential In these industries for producing desirable textures in various food products, including cake mixes, chocolates, ice creams, mayonnaise, dressings, and margarine. In the bakery and confectionery segment, emulsifiers play a crucial role In the rising of cake batter/mixes. The European market's growth is attributed to the increasing consumer preference for convenience foods and premium products. Emulsifiers contribute to the stabilization properties, nutrition, and sensory characteristics of these items. As consumers seek healthier alternatives, there is a growing demand for natural food emulsifiers derived from plant-based sources like lecithin, fermented substances, and surfactants.

The market's expansion is also influenced by the need for product modernization, longer shelf-life, and improved nutrient delivery in response to lifestyle diseases and changing consumer preferences.

Market Dynamics

Our emulsifier market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Emulsifier Industry?

Growing demand from bakery and confectionery segments is the key driver of the market.

- Emulsifiers play a crucial role In the production of processed food, beverages, health and wellness products, cosmetics, and personal care items. Sourcing raw materials, such as fatty acids from agricultural products like palm oil, soybeans, and sunflowers, is essential for emulsifier manufacturing. However, concerns over deforestation and the environmental impact of palm oil production have led to an increased demand for plant-based emulsifiers and natural ingredients. Health-conscious consumers seek out health-conscious food options, leading to the development of alternatives to emulsifiers, such as fermented substances and surfactants. Product modernization and the fast-paced lifestyle of consumers have driven the demand for convenience foods, premium products, and natural food emulsifiers with multifunctional attributes.

- These emulsifiers offer benefits such as stabilization properties, improved shelf-life, and nutrient delivery, making them essential in low-fat food production and weight-gain products. Sensory characteristics are also important, as emulsifiers enhance texture and reduce fat in food preparation, making them valuable additives in processed foods. Clean-label products, bakery and confectionery, gluten-free products, and fine powder applications all benefit from the use of emulsifiers. Innovative emulsifiers, such as plant-based lecithin, offer functional benefits and premiumization opportunities. Animal-derived emulsifiers and veganism are also influencing the market, as health-conscious consumers seek out natural and ethical alternatives. Emulsifiers play a vital role in food processing, ensuring the uniformity and stability of baked goods, snack items, and beverages.

What are the market trends shaping the Emulsifier Industry?

Growing demand for emulsifiers from emerging economies is the upcoming market trend.

- The market is witnessing significant growth due to the increasing demand for processed foods and beverages, particularly in emerging markets. Consumers' preference for health and wellness, as well as the rise of plant-based diets, is driving the demand for natural ingredients in emulsifiers. Industrial manufacturers are responding by sourcing raw materials from agricultural products such as palm oil, soybeans, and sunflowers, while also exploring alternatives to traditional animal-derived emulsifiers. Processed foods' convenience and time-saving preparation are well-suited to the fast-paced lifestyle of modern consumers. However, concerns over nutrition, lifestyle diseases, and sustainability are leading to the development of health-conscious food options and clean-label products.

- Emulsifiers play a crucial role in food processing by enhancing texture, sensory characteristics, and nutrient delivery. They also provide stabilization properties and extend shelf-life. The market for food emulsifiers is diverse, encompassing various applications such as bakery and confectionery, beverages, cosmetics, and personal care. Natural food emulsifiers, such as plant-based lecithin, are gaining popularity due to their multifunctional attributes and health benefits. Innovative emulsifiers, such as fermented substances and surfactants, are also being explored to meet the evolving demands of consumers. The global emulsifiers market is highly competitive, with key players continuously innovating to meet consumer preferences and regulatory requirements.

What challenges does the Emulsifier Industry face during its growth?

Stringent government regulations on using emulsifiers in food and beverage products is a key challenge affecting the industry growth.

- Emulsifiers play a crucial role In the processed food, beverages, health and wellness, cosmetics, and personal care industries. These raw materials ensure product stability, texture enhancement, nutrient delivery, and sensory appeal. Sourced from various raw materials such as fatty acids, and agricultural products like palm oil, soybeans, and sunflowers, emulsifiers are essential for modern food processing. However, concerns over deforestation and sustainability have led to an increased focus on plant-based emulsifiers and natural ingredients. Health-conscious consumers demand health-conscious food options, leading to alternatives to traditional emulsifiers like fermented substances, surfactants, and multifunctional emulsifiers. Product modernization and the fast-paced lifestyle necessitate convenience foods, premium products, and clean-label criteria.

- Emulsifiers contribute to the stabilization properties, shelf-life, and gut microbiota in various applications, including bakery and confectionery, gluten-free products, and finely powdered food additives. Emulsifiers are also used in beverages, low-fat food, weight-gain products, and baked goods. Their multifunctional attributes cater to oxidative phenomena, texture enhancement, and fat reduction. In the cosmetics and personal care industries, they contribute to sensory characteristics and nutrient delivery. Strict regulations govern the usage of emulsifiers in food and beverage products, with the FDA, EFSA, and FSSAI setting guidelines for manufacturers In the US, EU, and India, respectively. Emulsifiers are integral to the food processing industry, catering to the demands of consumers seeking convenient, nutritious, and innovative food and beverage solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emulsifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emulsifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Archer Daniels Midland Co.

- BASF SE

- Cargill Inc.

- Clariant International Ltd

- Corbion NV

- Dow Inc

- Evonik Industries AG

- Gujarat Enterprise

- Ingredion Inc.

- Kerry Group Plc

- Koninklijke DSM NV

- Lonza Group Ltd.

- Palsgaard AS

- Puratos

- Solvay SA

- Spartan Chemical Co.

- Stepan Co.

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of ingredients used in various industries to create stable mixtures of otherwise immiscible substances. These substances, which include processed food, beverages, health and wellness products, cosmetics, and personal care items, require emulsifiers to ensure optimal texture, stability, and sensory qualities. Emulsifiers play a crucial role In the food industry by enabling the creation of convenient and time-saving food options. With the fast-paced lifestyle of modern consumers, the demand for processed foods and convenience items has grown significantly. Emulsifiers contribute to the stabilization properties of these products, extending their shelf-life and enhancing their texture and sensory characteristics.

Moreover, the health and wellness trend has led to an increased focus on natural ingredients in various industries. In the market, this has resulted In the development of plant-based emulsifiers derived from raw materials such as fatty acids, agricultural products like palm oil, soybeans, and sunflowers, and fermented substances. These natural alternatives offer health-conscious consumers a clean-label option, free from synthetic additives and animal-derived emulsifiers. The cosmetics and personal care industries also rely on emulsifiers to create stable formulations for various products. Emulsifiers help ensure the even distribution of water and oil-based ingredients, resulting in a smooth and consistent texture.

Furthermore, in the realm of health and wellness, clean-label criteria have become increasingly important, leading to the adoption of natural emulsifiers In these applications. The food industry's modernization has led to the development of innovative emulsifiers with multifunctional attributes. These emulsifiers offer additional benefits such as nutrient delivery, oxidative phenomena prevention, and texture enhancement. Low-fat food and weight gain products also benefit from emulsifiers, which help maintain the desired texture and mouthfeel. The bakery and confectionery industries utilize emulsifiers to create fine powders and enhance the texture of baked goods and snack items. In the realm of gluten-free products, emulsifiers help maintain the desired texture and stability, ensuring a consistent and enjoyable consumer experience.

|

Emulsifier Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market Growth 2024-2028 |

USD 2.93 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, Germany, UK, China, Canada, Italy, France, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emulsifier Market Research and Growth Report?

- CAGR of the Emulsifier industry during the forecast period

- Detailed information on factors that will drive the Emulsifier market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emulsifier market growth of industry companies

We can help! Our analysts can customize this emulsifier market research report to meet your requirements.