Wireless Fire Detection System Market Size 2024-2028

The wireless fire detection system market size is forecast to increase by USD 107.9 million at a CAGR of 5.7% between 2023 and 2028.

- The market is witnessing significant growth due to the integration of advanced digital solutions, such as the Internet of Things(IoT) and big data, for enhanced fire safety. Fully wireless systems and hybrid systems are gaining popularity in various industries, including healthcare, due to their ease of installation and maintenance. Repeaters are being extensively used to expand the coverage area of wireless fire detection systems, ensuring comprehensive fire safety. The advent of 3D fire and gas mapping tools is providing accurate and real-time information for effective fire risk assessment and management. However, the high installation and maintenance cost of wireless fire detection systems remains a challenge for market growth. Organizations must carefully evaluate the benefits and costs to ensure optimal fire safety and compliance with regulatory requirements.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for advanced fire safety solutions in both residential and commercial settings. Fire incidents continue to pose a threat to life and property, making it essential for businesses and homeowners to invest in reliable and efficient fire detection systems. Wireless fire detection systems are gaining popularity in the market due to their ease of installation and cost-effectiveness. These systems utilize IoT (Internet of Things) technology and artificial intelligence (AI) to provide digital solutions for detecting and alerting fire incidents. Smoke detectors and call points are integral components of wireless fire detection systems. These sensors/detectors are battery-powered and easy-to-install, making them an ideal choice for new installation and retrofit projects. Advanced sensor technologies, such as optical sensors, are integrated into these systems to ensure accurate and timely detection of fire incidents. Control panels and fire alarm panels serve as the central hub for wireless fire detection systems. These panels come with input/output modules that enable seamless integration with other smart building technologies.

- Fully wireless systems and hybrid systems are available in the market to cater to various installation requirements, including indoor, outdoor, industrial, and residential settings. The adoption of wireless fire detection systems is on the rise due to their numerous benefits. These systems offer flexibility, as they do not require extensive wiring, making them an attractive option for retrofit installations. Moreover, they provide real-time alerts, ensuring early detection and prompt response to fire incidents. The integration of AI and IoT technologies in wireless fire detection systems offers new opportunities for the industry. These technologies enable predictive maintenance, allowing businesses and homeowners to address potential issues before they escalate into major problems. Furthermore, they provide valuable insights into fire safety trends and patterns, enabling stakeholders to make informed decisions and improve overall fire safety.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The industrial segment is estimated to witness significant growth during the forecast period.

Wireless fire detection systems have gained significant traction in various industries and smart home ecosystems due to their false alarm immunity and ease of installation. In the industrial sector, facilities such as manufacturing plants in pharmaceuticals, oil and gas, petrochemicals, automotive, chemicals, and textiles are major users of these systems. The expansion of these industries, particularly in developing countries, is driving the demand for wireless fire detection systems. The US and China are key contributors to the market, being the manufacturing hubs for these systems. The smart home market is another significant segment for wireless fire detection systems. With the increasing adoption of smart home technologies, the integration of wireless fire detection systems into home security systems is becoming increasingly popular.

Further, the call points, sensors/detectors, and fire alarm panels in these systems can be easily integrated into existing smart home ecosystems. New installation and retrofit installation are the two primary methods of implementing wireless fire detection systems. New installations are common in new construction projects, while retrofit installations are used in existing structures. The flexibility and ease of installation of wireless systems make them an attractive option for both new and retrofit projects. In conclusion, the industrial and smart home markets are the primary segments driving the growth of the wireless fire detection system market. The increasing number of initiatives in capacity expansion and industrial manufacturing in developing countries, along with the integration of wireless sensors into smart home ecosystems, are key factors contributing to the market's growth. The US and China are the major contributors to the market, with the US being a significant manufacturing hub for these systems.

Get a glance at the market report of share of various segments Request Free Sample

The industrial segment was valued at USD 113.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

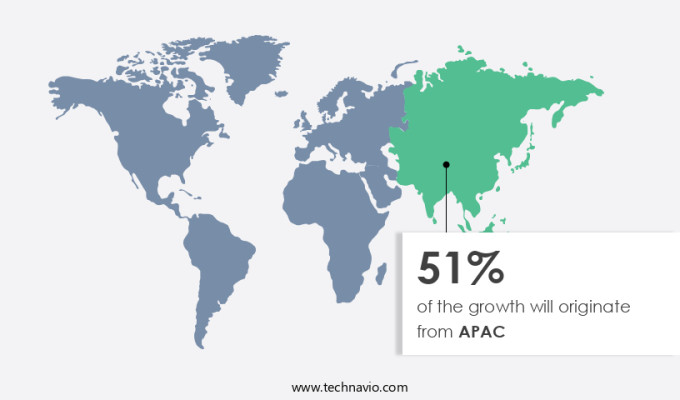

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing rapid expansion, making it the fastest-growing sector globally. Countries like China and India, which are in the development phase, dominate the APAC market. Strict regulatory mandates and heightened awareness towards fire safety compliance across various industries are significant factors fueling the market's revenue growth in this region. The commercial and industrial sectors are the primary contributors to the demand for wireless fire detection systems in APAC, with a relatively smaller number of residential users. The real estate sector's growth in APAC over the last decade has significantly impacted the sales of these systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Wireless Fire Detection System Market ?

Integration of smoke detectors with IoT and big data is the key driver of the market.

- In today's technological landscape, IoT-enabled wireless fire detection systems have gained significant traction due to their ability to prevent false alarms and provide advanced risk monitoring in both residential and commercial settings. These systems allow users to receive instant notifications and take action through their connected devices, ensuring a quick response in case of fire incidents. Additionally, the integration of wireless fire detectors with smartphones facilitates battery replacement reminders and enhances overall system adoption. The growing emphasis on safety and fire protection has led to the widespread use of photoelectric and ionization smoke detectors in homes. As the market continues to evolve, the integration of wireless systems with advanced alert systems and hybrid hardwired systems is expected to further drive growth in the fire detection industry.

What are the market trends shaping the Wireless Fire Detection System Market?

Advent of 3D fire and gas mapping tool is the upcoming trend in the market.

- The wireless fire detection market encompasses various systems, including Fully Wireless Systems and Hybrid Systems, that utilize repeaters for extended coverage. Digital solutions, such as smoke detectors and control panels, are integral components of these systems. The healthcare sector is a significant end-user of wireless fire detection systems due to the importance of safety in this industry. Three-dimensional fire and gas mapping software is a recent technological innovation in the safety instrumentation systems domain. This tool, widely adopted in industries like oil and gas and chemical and petrochemical, facilitates quick and dependable detection of gas/fire releases. Its implementation optimizes the placement and number of smoke detectors and fire and gas detectors in an industrial setup, ensuring safety and an additional protective layer for these industries.

What challenges does Wireless Fire Detection System Market face during the growth?

The high installation and maintenance cost of wireless fire detection systems is a key challenge affecting the market growth.

- Wireless fire detection systems have become essential components of modern building automation, providing real-time monitoring and early warning systems for potential fires. These systems consist of various components, including smoke detectors, alarms, panels, and sirens, which require significant upfront investments. The installation process is intricate, necessitating advanced tools and skilled labor, thereby increasing the overall cost. Moreover, companies must continually upgrade their solutions and innovate to meet the demands for more responsive, accurate, and advanced systems. This investment in research and development contributes to the high cost of procurement for both commercial and government entities. The Internet of Things (IoT) and Artificial Intelligence (AI) are revolutionizing the fire detection industry, enabling more efficient and intelligent systems

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Fire Detectors Ltd.

- BNB Security and Automation Solutions Pvt Ltd

- Carrier Global Corp.

- Ceasefire Industries Pvt. Ltd.

- Detectomat GmbH

- Electro Detectors Ltd.

- EMS-Chemie Holding Ag

- EuroFyre Ltd

- Halma Plc

- HOCHIKI Corp.

- Honeywell International Inc.

- Johnson Controls International Plc.

- JSE Infratech Pvt. Ltd.

- Keystone Fire Protection Co.

- Napco Security Technologies Inc.

- Robert Bosch GmbH

- Siemens AG

- Tyco International PLC

- VRF Ltd.

- Zeta Alarms Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wireless fire detection systems have gained significant traction in recent years due to their ease of installation and integration with IoT technologies. In contrast to hardwired hybrid systems, wireless systems offer flexibility and cost-effectiveness, making them an attractive option for various settings. Fire incidents in residential and commercial buildings continue to pose a threat, leading to the demand for advanced fire detection solutions. Wireless fire detection systems utilize IoT, AI, and building automation for real-time monitoring and alert systems. These systems consist of smoke detectors, panels, sirens, repeaters, and call points, all of which are wireless and battery-powered for easy installation.

Additionally, fully wireless systems and hybrid systems cater to diverse needs, with the latter offering the benefits of both wired and wireless technologies. Healthcare facilities, construction sites, and industrial settings are among the key sectors adopting wireless fire detection systems. Dependable data transmission, remote key access, and cellular technology ensure reliable system functionality. Advanced sensor technologies, including optical, thermal, and gas-detection sensors, provide false alarm immunity and enhance overall fire safety. Smart building technologies and AI integration further enhance the capabilities of wireless fire detection systems, enabling efficient management and response to fire incidents. The market for wireless fire detection systems is expected to grow as regulations continue to focus on the importance of fire safety and the demand for smart home ecosystems increases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2024-2028 |

USD 107.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, China, Japan, Germany, UK, India, South Korea, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch