Women Intimate Care Products Market Size 2025-2029

The women intimate care products market size is forecast to increase by USD 900.3 million at a CAGR of 7.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing awareness of personal hygiene, consumer healthcare, and the desire for effective solutions to combat germs, bacteria, and odor, all of which align with the growing focus on health and wellness. The product premiumization trend resulting from innovative offerings and portfolio extensions. Consumers are increasingly seeking high-quality, effective, and personalized intimate care solutions, leading companies to invest in research and development to meet these demands. Another key trend is the emergence of sustainable women intimate care products, as consumers become more conscious of the environmental impact of their purchases. However, the market faces challenges, including the availability of counterfeit products. The proliferation of counterfeit items can undermine brand reputation and consumer trust, requiring companies to implement robust anti-counterfeit measures to protect their intellectual property and maintain the integrity of their products.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on innovation, sustainability, and brand protection.

What will be the Size of the Women Intimate Care Products Market during the forecast period?

- The market continues to evolve, driven by shifting consumer preferences and advancements in technology. Vaginal health remains a primary focus, with an increasing emphasis on addressing conditions such as urinary tract infections and yeast infections. Product innovation is a key trend, as companies introduce new offerings such as vaginal wipes, intimate deodorants, and menstrual cups. Natural ingredients and sustainable packaging are also gaining favor among consumers, particularly those with skin sensitivity. Data analytics plays a crucial role in understanding consumer behavior and preferences, informing marketing strategies and product development. Awareness campaigns are increasingly common, promoting open dialogue around menstrual health, body positivity, and menstrual cycle education.

- Subscription services and online retailers are disrupting traditional sales channels, while influencer marketing and digital marketing efforts expand reach and engagement. The market caters to diverse demographics, including young adults, menstruating women, and postmenopausal women, with varying needs and preferences. Period underwear, menstrual pain relief, and connected devices are among the emerging categories. The ongoing dynamism of the market underscores the importance of staying attuned to evolving patterns and consumer demands.

How is this Women Intimate Care Products Industry segmented?

The women intimate care products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

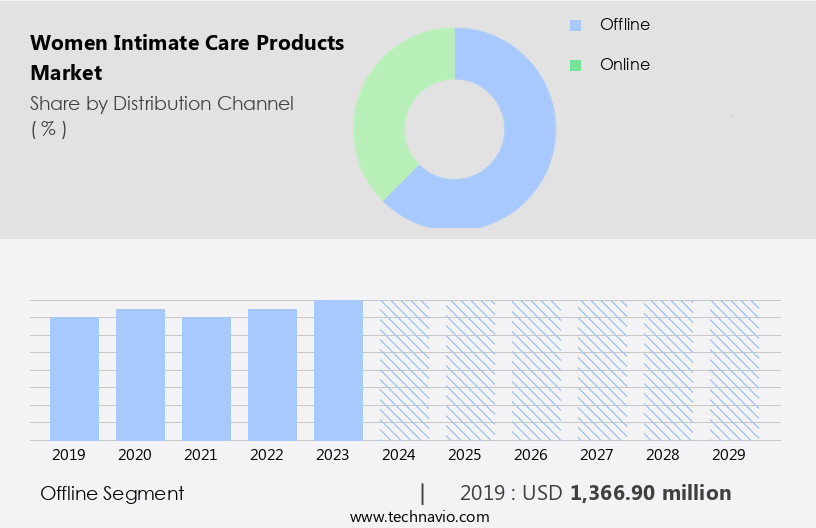

- Distribution Channel

- Offline

- Online

- Product

- Pads

- Intimate wipes

- Intimate lubricants

- Cleansing liquid

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic market, various distribution channels cater to diverse consumer segments. Brick-and-mortar retail outlets, including supermarkets, pharmacies, specialty stores, and convenience stores, serve as primary channels, providing immediate access to a wide range of products. Department stores and beauty retailers showcase premium and luxury brands, offering personalized shopping experiences for discerning customers. Healthcare facilities, such as clinics and hospitals, recommend specific products for intimate health concerns, instilling consumer confidence. Social media marketing and influencer collaborations have emerged as influential platforms, reaching young adults and promoting body positivity and menstrual health awareness. Menstrual cups and organic cotton products cater to the increasing demand for eco-friendly and sustainable options.

Connected devices and smart technology integrate data analytics to enhance consumer experience and provide customized solutions for vaginal health issues, such as premenstrual syndrome, vaginal dryness, urinary tract infections, and bacterial vaginosis. Period underwear, intimate deodorant, and vaginal wipes cater to specific needs, while subscription services offer convenience and cost savings. Mass merchandisers and online retailers cater to the growing demand for affordable and accessible products. Product innovation and natural ingredients, such as aloe vera and chamomile, address skin sensitivity and cater to consumers seeking gentle solutions. Sustainable packaging and open dialogue foster consumer trust and support the growing trend towards eco-consciousness and transparency.

Period pain relief and menstrual cycle tracking apps provide digital solutions, while menstrual cycle education and awareness campaigns promote overall menstrual health and wellness. The market continues to evolve, addressing the unique needs of postmenopausal women and expanding the scope of intimate care products to encompass a holistic approach to vaginal health.

The Offline segment was valued at USD 1366.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the US being the leading market in the region. Innovative product launches, such as menstrual cups and organic cotton menstrual pads, are gaining popularity among young adults and those with sensitive skin. The use of connected devices and digital marketing strategies, including social media and influencer marketing, are driving sales. Consumer awareness campaigns about feminine hygiene and menstrual health are also increasing, leading to the adoption of period underwear and other eco-friendly alternatives. Data analytics is being utilized to understand consumer preferences and tailor product offerings, with a focus on natural ingredients and sustainable packaging.

Conditions like premenstrual syndrome, urinary tract infections, yeast infections, and bacterial vaginosis continue to drive demand for intimate care products. Period pain relief and vaginal health are key concerns for postmenopausal women, further expanding the market. The market is witnessing product innovation, with the introduction of smart technology and subscription services, catering to the diverse needs of consumers. Despite economic challenges, the market is expected to continue growing due to the increasing demand for organic and eco-friendly products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Women Intimate Care Products Industry?

- Product innovation and portfolio extension are primary factors driving the market through the process of product premiumization. This strategy enhances the value proposition of offerings and broadens the scope of the company's product line.

- The market is witnessing significant growth due to increasing consumer awareness and the introduction of innovative technologies. Companies are focusing on developing products that cater to various women's health concerns, such as bacterial vaginosis and menstrual cycle management. Smart technology is increasingly being integrated into intimate care products, offering features like temperature control and odor neutralization. Postmenopausal women represent a growing market segment, with companies developing products specifically designed for their unique needs. Product reviews and open dialogue are essential in this market, as women seek reliable and effective solutions. Sanitary pads continue to dominate the market, but companies are expanding their product lines to include a wider range of offerings.

- Innovation is key in this market, with companies investing in new materials and technologies to differentiate themselves from competitors. Consumers are willing to pay a premium for products with added benefits, such as natural ingredients and soothing aromas. Companies are constantly innovating to meet evolving customer needs and preferences. For instance, some brands offer products with advanced functionality, such as moisture-wicking technology and adjustable fit. Overall, the market is dynamic and competitive, with companies continually seeking to provide women with high-quality, effective, and innovative solutions.

What are the market trends shaping the Women Intimate Care Products Industry?

- The emergence of sustainable intimate care products represents a significant market trend. These products prioritize eco-friendly materials and ethical manufacturing processes, catering to growing consumer demand for environmentally conscious and socially responsible options.

- The market is witnessing significant advancements, with a focus on sustainability, innovation, and inclusivity becoming increasingly prominent. Companies are responding to consumer demands by introducing eco-friendly options, such as biodegradable and compostable menstrual products, which align with the growing trend towards reducing waste and minimizing environmental impact. Reusable products, including menstrual cups and period underwear, are gaining popularity due to their cost-effectiveness and environmental benefits. Recent innovations in this space include Harper Hygienics' introduction of Naturals Hemp Intimate Wipes, which incorporate hemp seed extract to maintain the natural balance of the microbiome. These wipes undergo rigorous testing to ensure safety and quality.

- Another development is the rise of connected devices, such as menstrual tracking apps and intimate deodorants, which cater to young adults and those experiencing premenstrual syndrome, menstrual cramps, yeast infections, and vaginal dryness. Additionally, there is a growing demand for organic cotton and other natural ingredients in intimate care products, reflecting consumers' increasing awareness of the importance of using gentle and non-toxic products for their intimate health.

What challenges does the Women Intimate Care Products Industry face during its growth?

- The proliferation of counterfeit intimate care products poses a significant challenge to the industry's growth and reputation, requiring heightened vigilance and regulatory measures to ensure consumer safety and trust.

- The market exhibits significant growth, driven by the increasing awareness of vaginal health and the demand for product innovation. Data analytics reveals that consumers prioritize skin sensitivity and natural ingredients in their intimate care choices. In response, companies are focusing on product development using sustainable packaging and natural ingredients to cater to this demand. Urinary tract infections and other health concerns continue to be major factors driving the market. Brands are launching sensitive skin-friendly products to address these issues, ensuring customer satisfaction and loyalty. However, the counterfeit personal care products industry poses a challenge. These products, often made with toxic and low-quality raw materials, can harm consumers' health and erode the market share of genuine players.

- The penetration of e-commerce and lack of price standardization further fuels the sales of counterfeit products, leading to market fragmentation and uneven competition. Despite these challenges, the market remains dynamic, with companies focusing on innovation and consumer education to maintain brand equity and differentiate themselves.

Exclusive Customer Landscape

The women intimate care products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the women intimate care products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, women intimate care products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BK Naturals LLC - This company specializes in providing women with a range of high-quality intimate care solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BK Naturals LLC

- BYD Co. Ltd.

- CCA Industries Inc.

- Combe Inc.

- Essity AB

- Healthy Hoohoo

- MidasCare Pharmaceuticals Pvt. Ltd.

- Namyaa Skincare

- Prestige Consumer Healthcare Inc.

- Rael Inc.

- Reckitt Benckiser Group Plc

- Sanofi SA

- Sliquid LLC

- SweetSpot Labs Inc.

- The Honey Pot Co. LLC

- The Procter and Gamble Co.

- Unicharm Corp.

- Victorias Secret and Co.

- Walgreens Boots Alliance Inc.

- WellSpring Pharmaceutical Corp.

- Wet and Dry Personal Care Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Women Intimate Care Products Market

- In February 2024, leading feminine care brand Tampax unveiled its new line of organic cotton tampons, marking a significant shift towards more eco-friendly and natural offerings in the women's intimate care products market (Tampax Press Release, 2024).

- In July 2024, Procter & Gamble's (P&G) acquisition of Billie, a direct-to-consumer female shaving brand, expanded P&G's reach in the shaving segment and strengthened its foothold in the women's intimate care market (Reuters, 2024).

- In October 2025, the European Union approved new regulations mandating clearer labeling and increased transparency for ingredients used in intimate care products, driving innovation and consumer trust within the sector (European Parliament, 2025).

- In November 2025, Thinx, a socially conscious period underwear brand, secured a strategic partnership with Walmart, significantly expanding its market presence and making eco-friendly period solutions more accessible to a broader audience (Thinx Press Release, 2025).

Research Analyst Overview

The women's intimate care products market is experiencing significant trends and dynamics, with a focus on ethical sourcing, consumer reviews, and supply chain transparency. Period tracking apps and maternity care solutions cater to the needs of women during their menstrual cycle and postpartum recovery. Comfort and support, moisture control, and odor control remain key product features, while sexual health and pelvic floor health are gaining importance. Brands are differentiating themselves through product safety, hormonal imbalance management, and probiotics for women.

Postmenopausal health and intimate health education are also emerging areas of interest. Environmental sustainability and regulatory compliance are essential for maintaining brand reputation and customer loyalty. Skin irritation and vaginal microbiome balance are concerns addressed by innovative solutions. Convenience, portability, discretion, and privacy continue to be crucial factors influencing consumer preferences. Competitive advantage lies in addressing hormonal imbalances, pelvic floor health, and offering eco-friendly alternatives.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Women Intimate Care Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 900.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, UK, China, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Women Intimate Care Products Market Research and Growth Report?

- CAGR of the Women Intimate Care Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the women intimate care products market growth of industry companies

We can help! Our analysts can customize this women intimate care products market research report to meet your requirements.