Womens Health Diagnostics Market Size 2024-2028

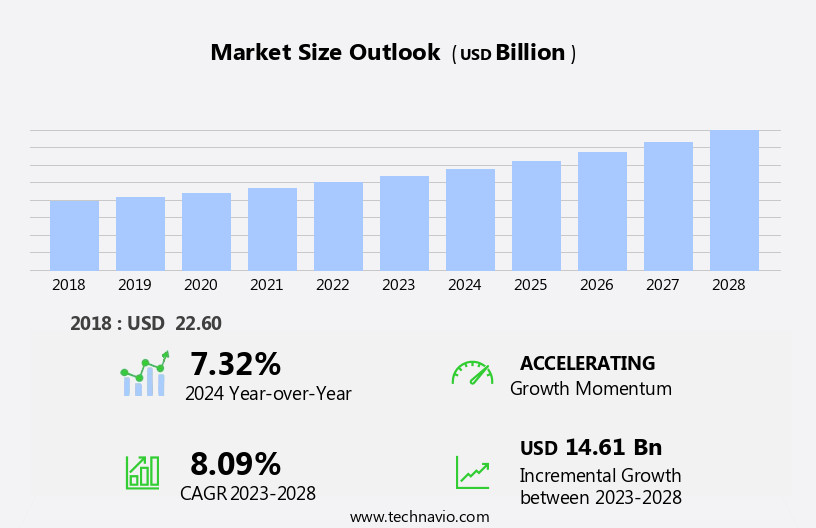

The womens health diagnostics market size is forecast to increase by USD 14.61 billion at a CAGR of 8.09% between 2023 and 2028.

- The women's health diagnostics market is experiencing significant growth due to several key factors. The increasing prevalence of breast cancer worldwide is driving market demand, as early and accurate medical diagnostics is crucial for effective treatment.

- Another trend is the global adoption of advanced diagnostic solutions, which offer improved accuracy and efficiency compared to traditional methods. Stringent regulatory bodies are also guiding manufacturers of in-vitro diagnostics to ensure product safety and quality, further boosting market growth. These factors are expected to continue shaping the women's health diagnostics market In the coming years.

What will be the Size of the Womens Health Diagnostics Market During the Forecast Period?

- The Women's Health Diagnostics Market encompasses a range of medical diagnostic devices and techniques aimed at detecting various conditions unique to women. Key diseases include breast, ovarian, and cervical cancers, as well as infectious diseases such as hepatitis and urinary tract infections. Diagnostic methods span imaging techniques like Breast MRI and ultrasound, bone density testing for osteoporosis, and breast cancer biopsy devices for cancer diagnosis.

- The geriatric female population is a significant market driver, given the increased prevalence of chronic conditions like cancer and osteoporosis. Medical science continues to advance, leading to the development of more sophisticated diagnostic tools and tests for pregnancy and menopause.

- The market also caters to infectious diseases, with a growing focus on HIV/AIDS and other sexually transmitted infections. Overall, the Women's Health Diagnostics market is a vital sector in healthcare, providing essential tools for early detection and effective treatment of various conditions.

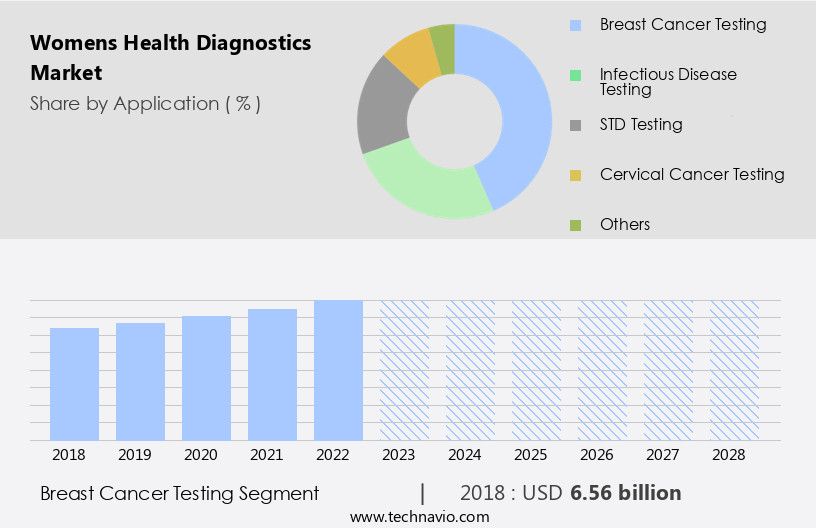

How is this Womens Health Diagnostics Industry segmented and which is the largest segment?

The womens health diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Breast cancer testing

- Infectious disease testing

- STD testing

- Cervical cancer testing

- Others

- End-user

- Hospitals and clinics

- Diagnostic and imaging centers

- Home care settings

- Geography

- North America

- Canada

- US

- Europe

- UK

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Application Insights

- The breast cancer testing segment is estimated to witness significant growth during the forecast period.

Women's health diagnostics encompass various medical tests and devices used to identify and manage conditions such as breast cancer, ovarian cancer, cervical cancer, menopause, pregnancy, and chronic conditions like osteoporosis and infectious diseases. Breast cancer diagnosis primarily relies on biopsy procedures, where a specialized needle and imaging techniques, such as mammography or ultrasound, guide the doctor to extract tissue samples for laboratory analysis. Biopsy devices, ultrasound devices, mammography systems, and diagnostic tests are essential medical diagnostics tools. The geriatric female population, hospitals and clinics, diagnostic centers, and home care settings utilize these devices. Diagnostic tests for breast cancer, cervical cancer, ovarian cancer, prenatal genetic screening, and infectious diseases like hepatitis, urinary tract infection, and HIV/AIDS are crucial.

Medical science advances continue to introduce new technologies, such as bone density testing, MRI, and genomic testing, to enhance diagnostic accuracy and patient care. Healthcare expenditure on diagnostic devices, accessories, and consumables is significant, with emerging countries increasingly investing in these technologies.

Get a glance at the Womens Health Diagnostics Industry report of share of various segments Request Free Sample

The Breast cancer testing segment was valued at USD 6.56 billion in 2018 and showed a gradual increase during the forecast period.

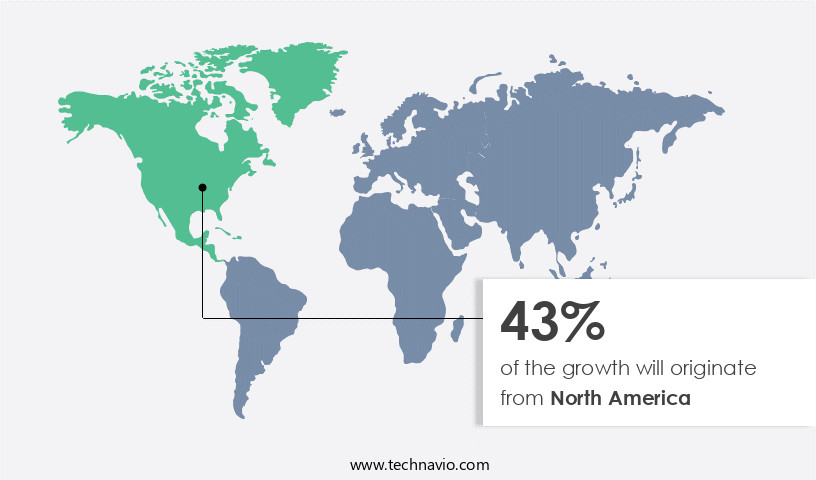

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In North America, the adoption of advanced diagnostic technologies for women's health has been on the rise due to increasing healthcare expenditure, growing awareness about chronic diseases such as breast, ovarian, and cervical cancer, and the availability of various diagnostic centers staffed with skilled professionals. Breast cancer, a common type of cancer among women In the US, is a significant contributor to this market growth. According to the CDC, it is the second leading cause of cancer deaths among women In the country. Medical diagnostics devices, including mammography systems, ultrasound devices, and biopsy devices, play a crucial role In the early detection and diagnosis of these conditions.

The geriatric female population, with a higher susceptibility to chronic diseases and cancers, also fuels market growth. Imaging techniques, such as breast MRI and bone density testing, are essential diagnostic tools for various conditions, including osteoporosis and cancer. The market for women's health diagnostics is further propelled by the increasing prevalence of infectious diseases, such as hepatitis, urinary tract infections, and STDs. The market is expected to continue growing due to emerging diagnostic devices, accessories, and consumables, as well as advancements in medical technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Womens Health Diagnostics Industry?

Increasing prevalence of breast cancer is the key driver of the market.

- Cancer continues to be a significant health concern worldwide, with breast cancer being one of the most prevalent types among women. The rising incidence of breast cancer is linked to the increasing geriatric female population. According to the International Agency for Research on Cancer (IARC), breast cancer surpassed lung cancer as the most frequently diagnosed cancer globally in December 2020. Medical diagnostics devices play a crucial role In the early detection and diagnosis of various types of cancers, including breast, ovarian, and cervical cancer. Biopsy devices, imaging techniques such as mammography systems and breast MRI, ultrasound devices, and bone density testing are some of the diagnostic tests used for breast cancer detection.

- The healthcare expenditure on diagnostic tests and medical devices is on the rise due to the growing demand for early and accurate diagnosis. Diagnostic centers staffed with skilled professionals and hospitals and clinics are major contributors to the market's growth. Emerging countries are also investing in diagnostic devices, accessories, and consumables to improve their healthcare infrastructure. The market for diagnostic devices is expanding, with ultrasound devices, mammography systems, and diagnostic tests for breast, cervical, and ovarian cancer being in high demand. In addition to cancer, diagnostic tests are also used for the detection of infectious diseases such as hepatitis, urinary tract infections, and sexually transmitted diseases (STDs), including HIV/AIDS.

- Medical science continues to advance, with genomic testing and fertility treatments gaining popularity. The market for diagnostic devices is expected to grow further due to the increasing prevalence of chronic conditions such as osteoporosis and cancer. The latest trends In the market include the development of portable and cost-effective diagnostic devices for home care settings. However, challenges such as regulatory approval and reimbursement policies remain. In conclusion, the diagnostic devices market is witnessing significant growth due to the increasing incidence of chronic diseases, the aging population, and the advancements in medical science. The market is expected to continue expanding, driven by the demand for early and accurate diagnosis, technological advancements, and the increasing healthcare expenditure.

What are the market trends shaping the Womens Health Diagnostics Industry?

Global adoption of advanced diagnostic solutions is the upcoming market trend.

- The Women's Health Diagnostics Market encompasses various diagnostic tests and medical devices used for the detection and diagnosis of breast cancer, ovarian cancer, cervical cancer, menopause, pregnancy, and other health conditions. The market is driven by the increasing prevalence of chronic conditions such as cancer and infectious diseases, including hepatitis, urinary tract infection, and HIV/AIDS. Advanced medical diagnostics devices, such as mammography systems, breast MRI, ultrasound, and bone density testing, play a crucial role in breast cancer diagnosis. Moreover, the emergence of new technologies like genomic testing and prenatal genetic screening is fueling market growth. The geriatric female population and the increasing healthcare expenditure are also contributing factors.

- Diagnostic centers, hospitals, clinics, and home care settings are the major end-users. Skilled professionals and diagnostic & imaging centers are the key players In the market. The market is witnessing significant growth due to the increasing demand for specialized testing in esoteric, pathology, and genetic testing areas. Companies are focusing on providing customized automation solutions to cater to the needs of patients. For instance, BD's new, fully automated, high-throughput infectious disease molecular diagnostics platform was launched in the US in May 2022. The market is expected to grow at a steady pace during the forecast period due to the increasing need for diagnostic products and advancements in medical science.

- However, challenges such as high costs and regulatory requirements may hinder market growth. Infectious diseases, including SARS, H1N1, Ebola, STDs, and Mycobacterium TB, are significant market opportunities. The prenatal segment and hospitals segment are also expected to witness significant growth during the forecast period.

What challenges does the Womens Health Diagnostics Industry face during its growth?

Stringent regulatory bodies guiding in-vitro diagnostics manufacturers is a key challenge affecting the industry growth.

- In-vitro diagnostic products play a crucial role In the detection and diagnosis of various health conditions, including breast cancer, ovarian cancer, cervical cancer, menopause, pregnancy, and infectious diseases such as hepatitis, urinary tract infection, and HIV/AIDS. These diagnostic tests are conducted using medical devices, including biopsy devices, ultrasound devices, mammography systems, and bone density testing equipment. The geriatric female population and pregnant women are significant consumer groups for these diagnostic tests. The market for in-vitro diagnostic devices is driven by the increasing prevalence of chronic conditions, particularly cancer, and the growing awareness and acceptance of early disease detection. Imaging techniques like Breast MRI and ultrasound are commonly used for breast cancer testing, while cervical cancer testing often involves Pap smears and HPV testing.

- Ovarian cancer testing typically involves CA-125 blood tests and transvaginal ultrasounds. Prenatal genetic screening is another significant segment of the in-vitro diagnostics market, with diagnostic centers and hospitals and clinics being the primary service providers. Home care settings and diagnostic & imaging centers are also emerging as key markets for in-vitro diagnostic devices, particularly In the context of the ongoing COVID-19 pandemic. Accessories and consumables, such as test kits and reagents, are essential components of in-vitro diagnostic devices. Companies that manufacture and market these devices and accessories face regulatory challenges, as stringent regulations are imposed to ensure the accuracy and reliability of these tests.

- The market for in-vitro diagnostic devices is expected to grow significantly In the coming years, driven by technological advancements and increasing healthcare expenditure. Infectious diseases, including SARS, H1N1, Ebola, STDs, Mycobacterium TB, and yeast infections, are also significant applications of in-vitro diagnostic devices. Genomic testing and fertility testing are other emerging areas of growth In the in-vitro diagnostics market. Overall, the market for in-vitro diagnostic devices is expected to grow significantly In the coming years, driven by increasing healthcare expenditure, technological advancements, and the growing need for early disease detection.

Exclusive Customer Landscape

The womens health diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the womens health diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, womens health diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The company specializes in diagnostics for women's health, providing solutions for various conditions. Notable offerings include Duphaston, a treatment for menstrual disorders, and Iberet folic 500, a folic acid supplement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Danaher Corp.

- Exact Sciences Corp.

- F. Hoffmann La Roche Ltd.

- FUJIFILM Corp.

- GE Healthcare Technologies Inc.

- Hologic Inc.

- Illumina Inc.

- Invitae Corp.

- Koninklijke Philips N.V.

- Myriad Genetics Inc.

- Natera Inc.

- Perkin Elmer Inc.

- QIAGEN NV

- Quest Diagnostics Inc.

- Quidelortho Corp.

- Siemens AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The women's health diagnostics market encompasses a range of medical tests and devices used to identify various conditions affecting females. This market is driven by several factors, including the increasing prevalence of chronic conditions such as cancer and infectious diseases, an aging population, and advancements in medical science. Chronic conditions, particularly cancer, continue to pose a significant health concern for women. According to the World Health Organization, breast, cervical, and colorectal cancers are the most common types among women worldwide. Early and accurate diagnosis is crucial for effective treatment and improving patient outcomes. As a result, the demand for diagnostic tests and devices for breast, cervical, and colorectal cancer is on the rise.

Moreover, the geriatric female population is growing, increasing the need for diagnostics related to menopause, osteoporosis, and other age-related conditions. Imaging techniques such as mammography systems, bone density testing, and breast MRI are commonly used for early detection and diagnosis of these conditions. Infectious diseases also represent a significant segment of the women's health diagnostics market. Conditions such as hepatitis, urinary tract infections, and sexually transmitted diseases (STDs) are prevalent among women, and early diagnosis is essential for effective treatment and prevention of complications. Diagnostic tests for these conditions include urinalysis, blood tests, and genomic testing. The healthcare expenditure on diagnostics is expected to increase as the demand for early and accurate diagnosis grows.

Diagnostic centers, hospitals, and clinics are the primary settings for women's health diagnostics, but home care settings are also gaining popularity due to their convenience and cost-effectiveness. The market for women's health diagnostics is dynamic, with emerging technologies and trends shaping its growth. For instance, the use of telemedicine and remote monitoring in diagnostics is becoming increasingly common, particularly in underserved areas and developing countries. Additionally, the integration of artificial intelligence and machine learning in diagnostics is expected to improve accuracy and efficiency. Accessories and consumables, such as biopsy devices and ultrasound probes, are essential components of the women's health diagnostics market.

These products ensure the proper functioning and accuracy of diagnostic devices and tests. In conclusion, the women's health diagnostics market is driven by the increasing prevalence of chronic conditions, an aging population, and advancements in medical science. The market is diverse, encompassing various diagnostic tests, devices, and technologies for the early and accurate detection of various conditions affecting women. The demand for diagnostics is expected to continue growing, driven by the need for early and accurate diagnosis and the integration of emerging technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 14.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, France, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Womens Health Diagnostics Market Research and Growth Report?

- CAGR of the Womens Health Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the womens health diagnostics market growth of industry companies

We can help! Our analysts can customize this womens health diagnostics market research report to meet your requirements.