Wood Packaging Market Size 2024-2028

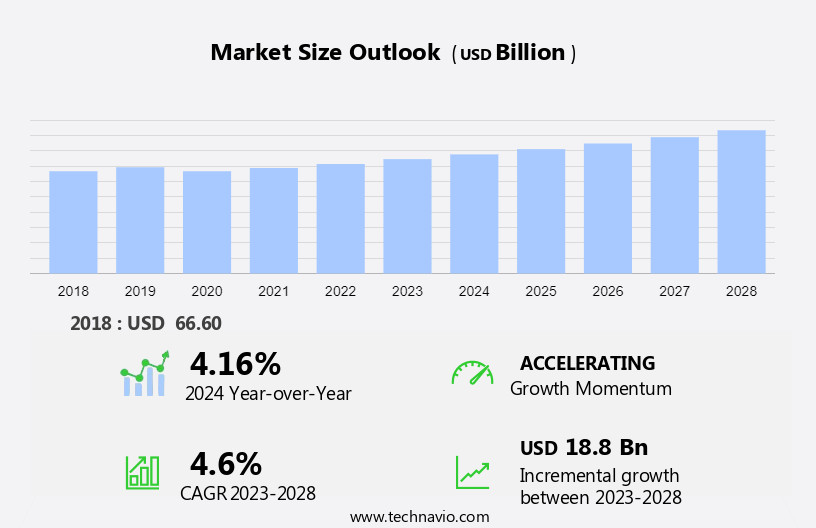

The wood packaging market size is forecast to increase by USD 18.8 billion at a CAGR of 4.6% between 2023 and 2028.

- The market is experiencing significant growth due to the cost benefits it offers over alternative materials. This sector is witnessing innovation In the design and production of wooden pallets, which is driving market expansion. However, fluctuating raw material prices pose a challenge to market growth. The use of wood packaging is increasingly popular due to its sustainability and versatility, making it a preferred choice for various industries. This market caters to various industries, with a significant focus on export-oriented packaging for e-commerce and food & beverages storage. The cost-effectiveness of wood packaging, particularly for bulk and heavy products, is a major factor contributing to its market growth. Furthermore, the continuous innovation in the design and engineering of wooden pallets is expanding their applications and enhancing their value proposition. Hardwood and softwood, as well as plywood, are popular choices for wood packaging, with their durability and strength making them suitable for transportation applications. Despite these growth factors, the market faces challenges from the volatility of raw material prices, which can impact the profitability of manufacturers. Overall, the market is expected to continue its growth trajectory, driven by its cost benefits and the ongoing innovation in wooden pallet design.

What will be the Size of the Wood Packaging Market During the Forecast Period?

- The market encompasses a diverse range of products, including wooden crates, pallets, boxes, bins, cases, spools, dunnage, and various types of wooden drums. The use of eco-friendly packaging materials and sustainable alternatives has gained considerable traction due to growing environmental concerns. However, concerns about deforestation and the ecological impact of wood packaging production and transportation have led to increased scrutiny.

- Efforts to reduce carbon emissions and transportation costs are driving innovation In the market, with research and development focused on improving the sustainability and efficiency of wood packaging solutions.

How is the Wood Packaging Industry segmented and which is the largest segment?

The wood packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Pallets

- Cases and boxes

- Application

- Food and beverages storage

- Transportation

- Industrial

- Shipping

- Others

- Geography

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

- Europe

- APAC

By Product Insights

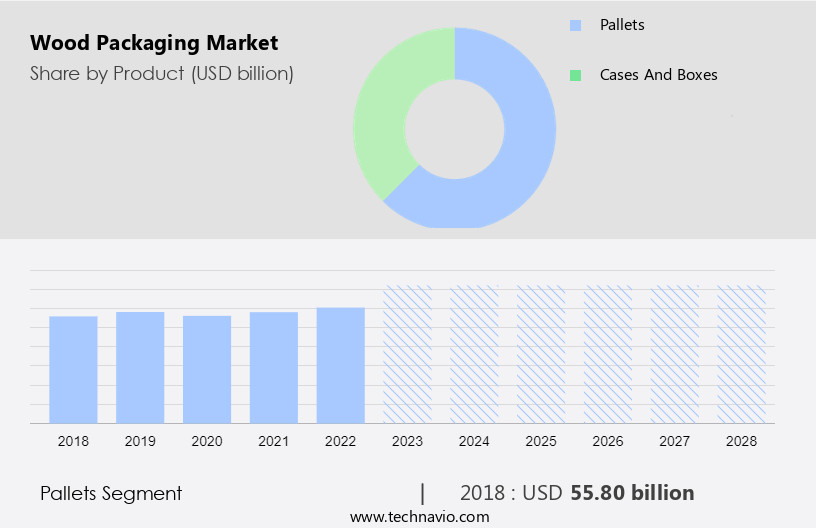

- The pallets segment is estimated to witness significant growth during the forecast period.

The market encompasses various product categories, including wooden crates, pallets, boxes, bins, cases, spools, and dunnage. Among these, pallets held the largest market share in 2023. This growth can be attributed to the construction industry's expansion, particularly in Asia Pacific, where urbanization and increasing disposable income are driving residential building construction. Wooden pallets offer higher load capacity compared to alternatives like plastic pallets, making them a preferred choice for transporting heavy construction materials. Ecofriendly packaging materials and sustainable practices are gaining traction In the market due to environmental concerns. Wooden packaging alternatives, such as hardwood and softwood pallets, crates, cases, boxes, and bins, are being adopted for their sustainability and circular economy initiatives.

Despite these benefits, concerns regarding deforestation and the ecological impact of transportation costs and carbon emissions persist. Sustainable sourcing and eco-friendly practices are essential to mitigate these concerns and ensure the market's long-term growth.

Get a glance at the market report of share of various segments Request Free Sample

The Pallets segment was valued at USD 55.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

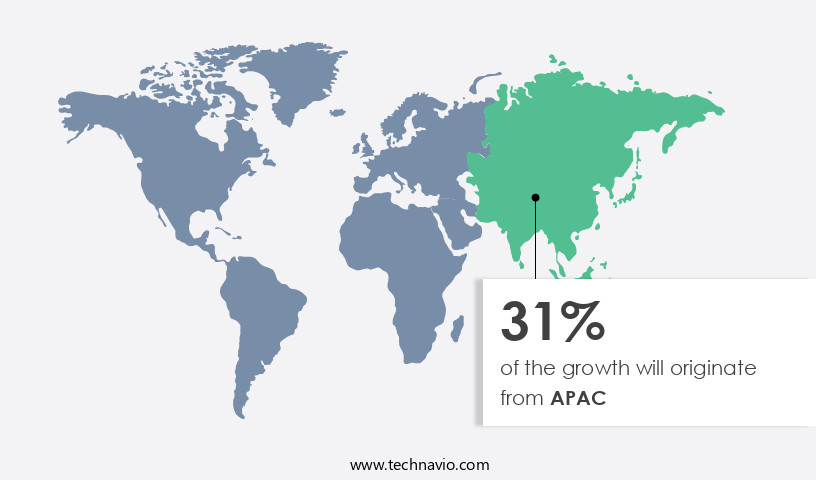

- APAC is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth, driven primarily by the e-commerce and retail industries. China and India are leading markets in this region, with the food and beverage sector being a major consumer of wooden crates, cases, boxes, and drums. The region's high GDP growth rate is a significant macroeconomic factor fueling the market's expansion. Countries such as Vietnam, Singapore, South Korea, Australia, and Malaysia are contributing to the growth of the packaging market, thereby boosting the demand for wood packaging. Sustainable sourcing, ecofriendly practices, and circular economy initiatives are increasingly influencing the market, with a focus on using sustainable alternatives such as hardwood, softwood, plywood, and other eco-friendly packaging materials.

Environmental concerns, including deforestation and ecological impact, are also being addressed through the use of sustainable practices and transportation cost reduction measures, such as optimizing pallet and crate designs to minimize carbon emissions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Wood Packaging Industry?

Cost benefits associated with wood packaging is the key driver of the market.

- Export-oriented businesses are seeking cost-effective and sustainable packaging solutions for shipping goods internationally. Wood packaging, including wooden crates, pallets, boxes, bins, spools, and dunnage, is a popular choice due to its affordability and ecofriendly attributes. Compared to plastic alternatives, wooden packaging solutions offer lower costs, with the average price of wooden pallets being half that of plastic pallets. Moreover, wooden packaging is 100% recyclable, reducing environmental concerns related to deforestation and ecological impact. As businesses prioritize sustainable sourcing and ecofriendly practices, circular economy initiatives In the manufacturing, construction, consumer goods, industrial, and logistics sectors are increasingly adopting wooden packaging. Transportation costs and carbon emissions are significant concerns, making the use of lightweight and stackable wooden pallets and boxes more efficient for shipping and storage.

- Wooden packaging materials, such as hardwood, softwood, and plywood, are renewable and biodegradable, making them a preferred choice for ecommerce and food & beverage storage applications.

What are the market trends shaping the Wood Packaging Industry?

Growing innovation in wooden pallets is the upcoming market trend.

- The market is characterized by a high degree of fragmentation, with companies continually introducing innovative products to maintain their competitive edge. One trend In the market is the production of smaller pallets for display-ready packaging in retail settings. These pallets, available in sizes such as half pallets (24 x 40 inches) and quarter pallets (24 x 20 inches), facilitate the safe transportation of goods from manufacturing units to retail stores. In addition, smarter pallets are being developed for use in automated supply chains, featuring uniform geometry and dimensions for easy handling by automated material handling equipment. As concerns about environmental impact grow, the use of ecofriendly packaging materials, including sustainably sourced hardwood and softwood, plywood, and other sustainable sourcing practices, is becoming increasingly important.

- Wooden packaging solutions, such as crates, cases, boxes, drums, pallets, bins, spools, and dunnage, offer advantages in terms of durability, cost-effectiveness, and sustainability for various industries, including food and beverages, construction, consumer goods, industrial manufacturing, and logistics. However, environmental concerns, including deforestation and carbon emissions, remain significant challenges for the market. Circular economy initiatives, such as the reuse and recycling of wooden packaging, are being explored to mitigate these concerns and promote a more sustainable future for the industry.

What challenges does the Wood Packaging Industry face during its growth?

Fluctuating raw material prices is a key challenge affecting the industry growth.

- Wood packaging, including pallets, crates, cases, drums, spools, and bins, is a significant market driven by various industries such as Food & Beverages Storage, Construction, Consumer Goods, Industrial, and Manufacturing. The primary materials used for manufacturing wood packaging products are softwood, hardwood, and plywood. Softwood, derived from gymnosperm trees like pines, accounts for approximately 84% of the market share. The price volatility of pine lumber, a major softwood component, can significantly impact the operating expenses of manufacturers. Consequently, fluctuations in raw material prices can affect profit margins. Low raw material prices may increase purchases for companies, but they can also lower the prices of final products (wooden pallets and boxes), potentially impacting profitability.

- Additionally, environmental concerns, including deforestation and ecological impact, are driving the demand for sustainable packaging alternatives and ecofriendly practices. Circular economy initiatives, such as sustainable sourcing and reusing or recycling wood packaging, are also gaining traction. Transportation costs and carbon emissions are other factors influencing the market dynamics.

Exclusive Customer Landscape

The wood packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wood packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wood packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arrington Lumber and Pallet Co.

- Brambles Ltd.

- C and K Box Co. Inc.

- Coxco Inc.

- Falkenhahn AG

- Greif Inc.

- InterAgra SC

- Kamps Inc.

- Millwood Inc.

- Mondi Plc

- NEFAB GROUP

- Ongna Wood Products

- Pacific Pallet Ltd.

- Palcon LLC

- Rowlinson Group Ltd.

- Shur-way Group Inc.

- Stora Enso Oyj

- Totre Industries

- UFP Industries Inc.

- United Pallet Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products, including wooden crates, pallets, boxes, bins, cases, spools, dunnage, and various types of drums. These packaging solutions cater to diverse industries such as ecommerce, export-oriented businesses, food and beverages storage, transportation, construction, consumer goods, industrial manufacturing, and logistics. Eco-friendliness and sustainability have emerged as significant trends In the packaging industry, with wooden packaging materials gaining popularity due to their natural origin and biodegradable nature. However, the ecological impact of wood packaging production and transportation is a growing concern. Deforestation, carbon emissions, and transportation costs are key issues that need to be addressed to ensure the sustainability of this market.

Sustainable sourcing and eco-friendly practices are essential for mitigating the environmental concerns associated with wooden packaging production. The use of certified wood and responsible forest management practices can help reduce the impact on forests and promote the circular economy. The transportation of wooden packaging contributes to significant carbon emissions, making it essential to explore alternative transportation methods and optimize logistics to minimize the carbon footprint. The adoption of electric or hybrid vehicles, rail transport, and intermodal transportation can help reduce the carbon emissions associated with wooden packaging transportation. The market comprises various types of woods, including hardwood and softwood, as well as plywood.

Hardwood is often preferred for its durability and strength, while softwood is known for its lightweight and cost-effective properties. The choice of wood type depends on the specific application and industry requirements. The demand for wooden packaging is driven by the need for protective packaging solutions for various industries. The food and beverage industry, for instance, relies heavily on wooden packaging for the transportation and storage of perishable goods. The construction industry also utilizes wooden packaging for the transportation and handling of building materials.

The growing focus on eco-friendliness and sustainability is driving the demand for sustainable sourcing, responsible forest management practices, and optimized logistics to minimize the environmental impact of wooden packaging production and transportation. The adoption of alternative transportation methods and the use of various types of woods, including hardwood and softwood, are key trends shaping the future of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 18.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.16 |

|

Key countries |

India, China, Japan, Iran, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wood Packaging Market Research and Growth Report?

- CAGR of the Wood Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, South America, North America, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wood packaging market growth of industry companies

We can help! Our analysts can customize this wood packaging market research report to meet your requirements.