Organic Yeast Market Size 2025-2029

The organic yeast market size is forecast to increase by USD 446.6 million, at a CAGR of 10.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing awareness and recognition of the health benefits associated with organic products. Consumers are increasingly seeking out organic food and beverage alternatives to conventional yeast, leading to increased demand for organic yeast in various applications. Furthermore, the market is witnessing a surge in mergers and acquisitions, as companies look to expand their organic yeast offerings and strengthen their market positions. However, the market is not without challenges. Stringent certification and regulatory standards pose significant obstacles for market entrants, requiring substantial investment in resources and expertise to meet these requirements. Companies must navigate these challenges effectively to capitalize on the market's potential and meet the growing demand for organic yeast.

- To succeed in this dynamic market, strategic planning and operational agility are essential, with a focus on innovation, sustainability, and regulatory compliance. Companies that can effectively address these challenges and meet the evolving needs of consumers will be well-positioned for success in the market.

What will be the Size of the Organic Yeast Market during the forecast period?

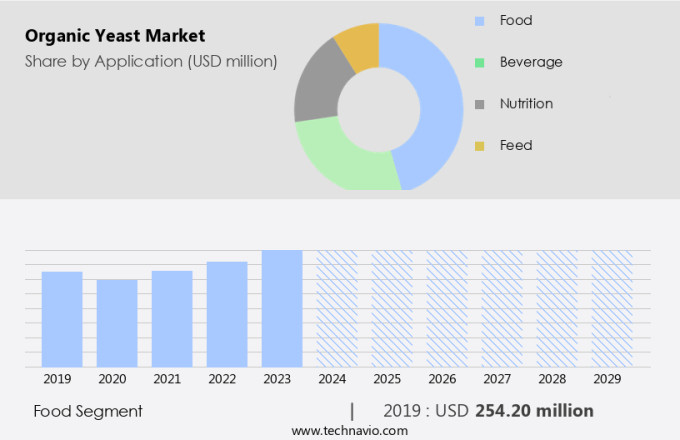

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for natural and sustainable ingredients in various sectors. Food-grade yeast and yeast-derived nutrients play a crucial role in enhancing food quality and extending shelf life. Quality control methods, such as beta-glucan extraction and phosphorus uptake, ensure the nutrient bioavailability of these products. In animal feed additives, yeast extract production and waste biomass valorization contribute to improving animal health and reducing environmental impact. The brewing process benefits from yeast's ability to optimize fermentation and produce desirable flavors. Organic yeast extract finds applications in soil amendment, offering potential for crop yield enhancement through its nutrient content and microbial activity.

Microbial cell lysis and enzyme activity release valuable proteins and metabolites, while protein hydrolysate and mannoprotein content contribute to plant immune response and metabolite profiling. The circular economy approach to organic yeast production and utilization is gaining momentum, with sensory evaluation and fermentation optimization essential for ensuring consistent product quality. Microbial community analysis and growth promotion mechanisms further enhance the value of organic yeast in sustainable agriculture. Beyond food and agriculture, organic yeast extract offers probiotic effects and gut microbiome modulation, making it a valuable ingredient in human nutrition. Its antioxidant properties and nitrogen utilization efficiency contribute to overall health benefits.

How is this Organic Yeast Industry segmented?

The organic yeast industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food

- Beverage

- Nutrition

- Feed

- Type

- Yeast extracts

- Yeast derivatives

- Inactive dry yeast

- Nutritional yeast

- End-User

- Baker's Yeast

- Brewer's Yeast

- Nutritional Yeast

- Others

- Form

- Powder

- Flakes

- Liquid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The food segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, primarily in the food sector. Organic yeast is a vital component in various food applications, including bakery products, sauces, soups, snacks, and ready-meals. Its role extends beyond fermentation, contributing to enhanced flavors and providing essential nutrients like B vitamins and proteins. In the baking industry, organic yeast is indispensable for producing bread, pastries, and other baked goods. It ensures proper dough rising and contributes to the final product's flavor and texture. Beyond food, organic yeast finds applications in animal feed additives, waste biomass valorization, and sustainable agriculture. It plays a role in the brewing process, yeast extract production, and soil amendment applications.

Microbial cell lysis and enzyme activity are essential in the production of protein hydrolysate, a nutrient-rich ingredient. Organic yeast also influences plant immune response and metabolite profiling, contributing to circular economy initiatives. Fermentation optimization and microbial community analysis are crucial for enhancing crop yield and improving human nutrition. Organic yeast extract is a valuable source of antioxidant properties and nitrogen utilization efficiency. Mannoprotein content in organic yeast is gaining attention for its potential probiotic effects, gut microbiome modulation, and biofilm formation. The versatility and benefits of organic yeast make it a dynamic player in various industries.

The Food segment was valued at USD 254.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Europe is experiencing notable growth, fueled by the increasing consumer preference for health, wellness, and sustainable food options. With the organic food market volume reaching an estimated €15.3 billion in 2023, the demand for organic yeast, a crucial component in various food and beverage applications, is on the rise. A significant trend driving this growth is the increasing number of individuals adopting vegan and vegetarian lifestyles, estimated to be around 2.5 million in Europe, or 3% of the population. This shift towards plant-based diets has led to a substantial increase in demand for organic yeast, which is a key ingredient in numerous vegan and vegetarian food products.

Quality control methods are essential in the production of food-grade yeast, ensuring the purity and safety of the final product. Beta-glucan extraction from yeast is a valuable process, as it leads to the production of yeast-derived nutrients with enhanced nutrient bioavailability. These nutrients can serve as animal feed additives, contributing to improved animal health and productivity. Additionally, waste biomass valorization through yeast extract production and soil amendment applications offers environmental benefits, aligning with the principles of sustainable agriculture. Microbial cell lysis and enzyme activity play a crucial role in the production of protein hydrolysates, which can be used in various applications, including plant immune response modulation and metabolite profiling.

The market also encompasses the production of organic yeast extract, which offers benefits in baking applications, probiotic effects, and gut microbiome modulation. Furthermore, biofilm formation and crop yield enhancement are potential applications of organic yeast, contributing to human nutrition and antioxidant properties. Nitrogen utilization efficiency and mannoprotein content are essential factors in optimizing the fermentation process and microbial community analysis, ensuring the growth promotion mechanism of organic yeast remains effective. The circular economy is a growing focus in the market, with a strong emphasis on sensory evaluation and fermentation optimization to minimize waste and maximize resource efficiency.

Organic yeast extract production, as a byproduct of the brewing process, is an excellent example of this circular economy approach. The market is expected to continue its growth trajectory, driven by these trends and the evolving consumer preferences for healthier, more sustainable food options.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B yeast supply strategies utilize clean-label yeast technologies for baking industries. Organic yeast prospects 2025 include organic baker's yeast for bakeries and nutritional yeast products, driving demand. Yeast logistics analytics optimize distribution, while organic yeast benchmarks spotlight Lesaffre. Sustainable yeast sourcing aligns with organic baking trends. Yeast regulations 2025-2029 guide organic yeast demand in North America 2025. Premium yeast offerings and organic yeast forecasts enhance growth. Yeast for artisanal breads and custom yeast formulations target niches. Organic yeast hurdles and innovations address fermentation consistency, with yeast supplier networks and yeast cost tactics boosting margins. Organic yeast insights and clean-label fermentation breakthroughs accelerate momentum.

What are the key market drivers leading to the rise in the adoption of Organic Yeast Industry?

- The significant growth in the market can be attributed to the heightened recognition and understanding of the advantages of using organic yeast.

- The market is witnessing notable expansion due to the escalating consumer preference for food grade yeast and yeast derived nutrients. Organic yeast offers several advantages, including improved quality control methods, enhanced beta-glucan extraction, and increased phosphorus uptake. These factors contribute to the superior nutrient bioavailability of organic yeast, making it a desirable ingredient in various applications. Moreover, organic yeast serves as an effective animal feed additive, contributing to the growth of livestock and poultry industries. Additionally, waste biomass valorization through organic yeast production is gaining traction as a sustainable solution for reducing food waste and generating value-added products.

- The nutritional benefits of organic yeast are a significant factor driving its demand in the food and health industries. Organic yeast is rich in essential nutrients, such as B vitamins, proteins, and minerals, which contribute to overall health and well-being. This nutritional profile is fueling the adoption of organic yeast in dietary supplements, functional foods, and other health-focused products. In conclusion, the market is poised for continued growth due to its numerous advantages, including its nutritional benefits, sustainability, and versatility across various industries. Organic yeast's growing popularity is a testament to its potential as a valuable ingredient in the food, health, and animal feed sectors.

What are the market trends shaping the Organic Yeast Industry?

- The mergers and acquisitions market is experiencing a significant upward trend. This trend is anticipated to continue as businesses seek growth opportunities through strategic acquisitions and consolidation.

- The market is witnessing an increase in strategic mergers and acquisitions, with key players seeking to extend their shelf life and enhance their capabilities in sustainable agriculture, brewing process, yeast extract production, and soil amendment applications. One notable transaction occurred on December 21, 2023, when Lallemand, a leading industrial biotechnology company, completed the acquisition of Swiss biotech firm Evolva AG through its subsidiary, Danstar Ferment AG. This acquisition, which was initially announced on November 21, 2023, and subsequently approved by Evolva Holding AG shareholders, is a significant milestone for Lallemand.

- The merger is expected to boost Lallemand's portfolio and provide synergies through the combined expertise in microbial cell lysis, enzyme activity, and protein hydrolysate production. This trend underscores the industry's focus on innovation and growth, as companies seek to capitalize on the increasing demand for organic yeast in various industries.

What challenges does the Organic Yeast Industry face during its growth?

- The stringent certification and regulatory standards pose a significant challenge to the industry's growth, requiring companies to invest heavily in compliance and adherence to complex rules and guidelines.

- The market is shaped by stringent certification and regulatory standards, which are crucial for organic product labeling. Authorities such as the USDA and the EU set guidelines on farming practices, prohibiting synthetic fertilizers, pesticides, and GMOs. Producers must source organic substrates, like molasses and grains, and maintain organic handling throughout production. Metabolite profiling and microbial community analysis are crucial for fermentation optimization and growth promotion mechanisms. Sensory evaluation is essential to ensure the desired flavor and aroma profiles. The circular economy is gaining importance, with organic yeast extract being a valuable byproduct of the brewing industry.

- These trends offer opportunities for growth in the market. Moreover, preserving the microbial diversity of organic yeast strains is vital for maintaining the authenticity and consistency of organic fermentation processes. As research advances in plant immune response and yeast metabolism, the market is expected to continue evolving.

Exclusive Customer Landscape

The organic yeast market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic yeast market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic yeast market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Mauri UK Ltd. - This company specializes in providing a range of organic yeast options, including cream, compressed, and dry varieties, for the baking industry. Their offerings cater to the growing demand for natural and authentic ingredients in food production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Mauri UK Ltd.

- Angel Yeast Co. Ltd.

- Bioven Ingredients

- Cargill Inc.

- Keliffs

- Kerry Group Plc

- Lallemand Inc.

- Lesaffre and Cie

- Marroquin Organic International

- Martin Braun-Gruppe

- Naturata AG

- Prosol Spa

- Yeastup AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Organic Yeast Market

- In January 2024, Lallemand Inc., a leading organic yeast producer, announced the launch of their new organic yeast strain, Saccharomyces cerevisiae CBC-1, specifically designed for craft brewers to enhance beer flavor and aroma (Lallemand Inc. Press release).

- In March 2024, Danisco A/S, a Danish biotech company, entered into a strategic partnership with OrganicBrewery, a German organic beer producer, to develop and commercialize organic yeast strains for the European craft beer market (Danisco A/S press release).

- In May 2024, Lesaffre, a global yeast and fermentation solutions provider, completed the acquisition of Bio-Techne Corporation's yeast business, expanding its presence in the market and adding new yeast strains to its portfolio (Lesaffre press release).

- In April 2025, the European Commission approved the use of organic yeast in organic food production, paving the way for increased demand and investment in the market (European Commission press release).

Research Analyst Overview

- The market is characterized by continuous research and development in the area of root development and soil health improvement. Yeast strains with biostimulant properties are gaining popularity due to their ability to enhance microbial diversity and promote nutrient cycling in the soil. Glucan characterization and amino acid profile analysis are crucial in understanding the role of yeast in soil health improvement and vegetable growth. Stress tolerance and growth kinetics are key factors influencing the performance of yeast strains under various conditions. Microbial biomass and mineral composition analysis provide insights into the contribution of yeast to the overall soil health.

- Disease resistance and biofertilizer production are additional benefits of using organic yeast in agriculture. Cell wall degradation and mannan characterization are essential for optimizing yeast autolysis and maximizing water use efficiency. Polysaccharide analysis and vitamin content are critical parameters in assessing the quality of organic yeast for use in fruit production and grain quality enhancement. Fruit production and plant biomass yield stability are significantly impacted by the use of organic yeast in agriculture. Fermentation kinetics and yeast metabolism studies are ongoing to improve the efficiency and sustainability of organic yeast production.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Organic Yeast Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market growth 2025-2029 |

USD 446.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, Japan, UK, France, India, Italy, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Yeast Market Research and Growth Report?

- CAGR of the Organic Yeast industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic yeast market growth of industry companies

We can help! Our analysts can customize this organic yeast market research report to meet your requirements.