Precision Fermentation Market Size 2025-2029

The precision fermentation market size is forecast to increase by USD 52.46 billion at a CAGR of 72.1% between 2024 and 2029.

- The market is experiencing significant growth due to several key drivers and trends. The increasing popularity of veganism and vegetarianism, fueled by ethical and environmental concerns, presents a substantial opportunity for this market. Additionally, rising health consciousness among consumers, particularly in developed economies, is leading to a shift towards healthier and more sustainable sources of protein. Conversely, the market faces challenges such as high production costs and regulatory hurdles. However, advancements in biotechnology and continuous innovation in the field are expected to drive down costs and streamline regulatory approvals. This market is witnessing notable growth, driven by the increasing popularity of health and wellness trends and the rising demand for plant-based alternatives in the food service industry.

- Companies seeking to capitalize on this market's potential should focus on developing cost-effective production processes and navigating regulatory frameworks to bring their precision fermentation products to market. Overall, the market offers significant opportunities for growth in the coming years, particularly in the areas of plant-based protein production and the development of sustainable alternatives to traditional animal-derived products. The increasing consumption of animal meat, particularly in North America, is further fueling the demand for precision fermentation-derived meat substitutes.

What will be the Size of the Precision Fermentation Market during the forecast period?

- Environmental impact and sustainability metrics are also critical considerations in this market, with a growing emphasis on microbial remediation and biodegradability. Consumer perception and supply chain optimization are also key factors influencing market growth. Overall, the market is experiencing significant growth and innovation, driven by the potential for biotechnology applications in various industries, including pharmaceuticals, agriculture, and materials science. This market is driven by the increasing demand for animal-free and sustainable alternatives to traditional protein sources, such as dairy and meat, fueled by trends like veganism, plant-based diets, and food allergies. Synthetic biology, a key technology enabler, is at the forefront of this development, enabling the production of various proteins, including whey protein, casein, and mycotechnology-derived ingredients, through microbial-based fermentation processes.

How is this Precision Fermentation Industry segmented?

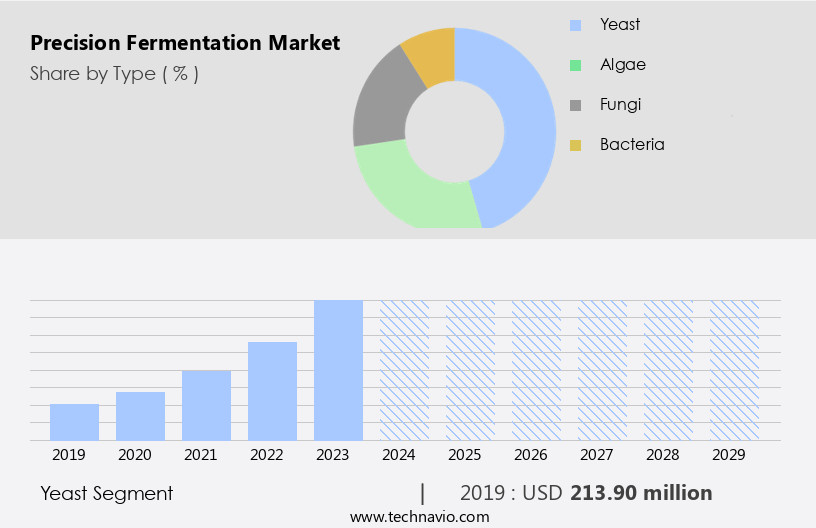

The precision fermentation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Yeast

- Algae

- Fungi

- Bacteria

- End-user

- Food and beverage

- Pharmaceuticals

- Cosmetics

- Others

- Source

- Collagen protein

- Whey and casein protein

- Egg white

- Heme protein

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Type Insights

The yeast segment is estimated to witness significant growth during the forecast period. The market, driven by advancements in microbial ecology, metabolic engineering, and protein engineering, is expected to witness significant growth. This growth can be attributed to the increasing demand for food ingredients derived from synthetic biology. The regulatory landscape is evolving to support this industry, with high-throughput screening and gene editing techniques enabling strain development. Consumer acceptance of functional foods and sustainable agriculture is driving the production of alternative proteins, such as those derived from microbial fermentation. Upstream processing, including microbial diversity and fermentation optimization, is a critical aspect of this industry. Bioprocess engineering, process automation, and bioprocess development are essential for the production of bio-based chemicals and microbial metabolism. This method uses microorganisms like yeast and fungus to produce proteins, insulin, vitamins, enzymes, and other pharmaceutical compounds.

The industry is focused on upstream processing, bioprocess engineering, and the development of precision fermentation platforms. The use of machine learning and data analytics is enabling process optimization and yield improvement. Ethical considerations are an essential aspect of the industry's development. Companies are using this technology to produce cultured milk and cheese, providing alternatives to traditional dairy products.

Get a glance at the market report of share of various segments Request Free Sample

The Yeast segment was valued at USD 213.90 billion in 2019 and showed a gradual increase during the forecast period.

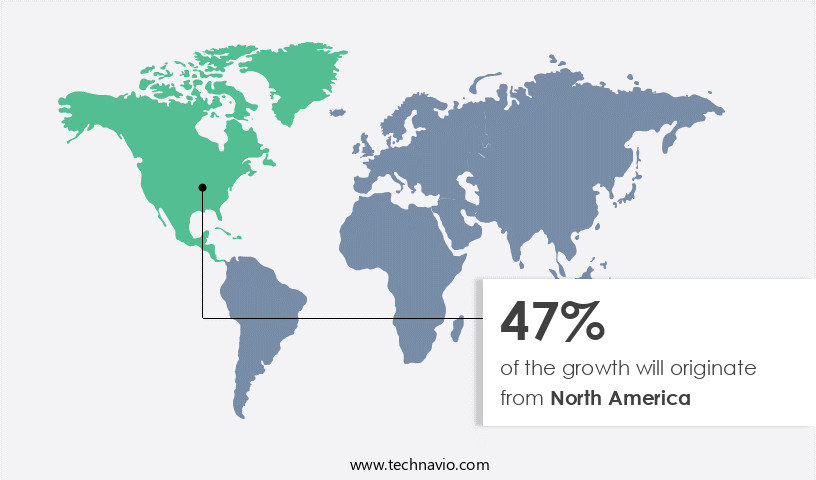

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Precision fermentation, a key aspect of industrial biotechnology, is experiencing significant growth due to the rising adoption of animal-free protein products and increasing consumer awareness of plant-based alternatives. Meticulously engineered microbial strains through metabolic and protein engineering are used to produce food ingredients, synthetic microbes, and bio-based chemicals. The regulatory landscape for precision fermentation is evolving, with high-throughput screening and gene editing techniques facilitating strain development. The market dynamics are influenced by the growing microbial diversity and metabolism research, which are essential for fermentation optimization and bioprocess engineering. The sustainable production of functional foods, sustainable agriculture, and alternative proteins, such as dairy alternatives and meat substitutes, are driving market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Precision Fermentation Industry?

- Increasing popularity of vegan lifestyle is the key driver of the market. The vegan food market is experiencing significant growth due to the increasing adoption of vegan diets worldwide. Veganism, defined as the practice of abstaining from consuming all animal products, has gained popularity for its numerous health benefits, including a reduced risk of obesity and improved heart health. According to research, the number of people following vegan diets has grown by approximately 300% over the last decade. This trend is further fueled by food service outlets offering a wider range of vegan options to cater to this consumer base. The health-conscious population's preference for plant-based diets is driving market growth, making it an attractive investment opportunity for businesses.

- Precision fermentation platforms, including synthetic microbes and microbial consortia, are revolutionizing the production of dairy alternatives and meat substitutes. Moreover, the circular economy and green chemistry are gaining importance, leading to the development of cell-based production and personalized nutrition. Machine learning and data analytics are being employed to optimize fermentation processes and improve yield. Ethical considerations, such as gene editing and synthetic microbes, are under scrutiny, requiring careful consideration in the development of new products. The market is experiencing significant growth due to advancements in microbial ecology, metabolic engineering, and protein engineering. The demand for food ingredients derived from synthetic biology, sustainable agriculture, and alternative proteins is driving this growth.

What are the market trends shaping the Precision Fermentation Industry?

- Increasing health consciousness is the upcoming market trend. The market is experiencing significant growth due to the increasing health consciousness among consumers. With the rising prevalence of obesity and related diseases worldwide, consumers are becoming more mindful of their dietary choices and are demanding natural, low-fat, and low-calorie food and beverage products. In response, market participants are introducing new animal-free alternatives that cater to these consumer preferences. The health and wellness trend is particularly popular among younger consumers aged 18-32 years. This shift in consumer behavior is driving market growth and is expected to continue during the forecast period. Companies are investing in research and development to produce precision-fermented products that meet the evolving needs of health-conscious consumers. This trend signifies a promising future for the market.

- Synthetic microbes and microbial communities, including microbial consortia, are being explored for their potential in personalized nutrition and circular economy applications. The precision fermentation platform is being integrated with advanced technologies like artificial intelligence, machine learning, data analytics, and green chemistry to enhance process automation and bioprocess development. Ethical considerations and consumer acceptance are crucial factors influencing market growth. Genome sequencing and upstream processing techniques are essential for microbial ecology and optimizing fermentation conditions. Downstream processing and the development of cell-based production methods are crucial for commercial-scale production. The market is expected to grow substantially due to these factors and the increasing demand for sustainable production and food security.

What challenges does the Precision Fermentation Industry face during its growth?

- Increasing consumption of animal meat is a key challenge affecting the industry growth. The market is experiencing significant growth due to the increasing demand for alternative sources of proteins. However, the rising consumption of animal-based meat may hinder market expansion during the forecast period. This trend is driven by factors such as a growing global population, increasing disposable income, and the demand for protein-rich food products. For instance, the consumption of meat varieties like pork, beef, and chicken is increasing in countries such as China, India, and Russia. In terms of volume, the US held the largest share in the global beef and veal market in 2024. The consumption of beef and veal in the US has been on the rise for over a decade. Despite this, the market continues to gain traction as consumers seek more sustainable and ethical protein sources. The market is expected to witness steady growth due to advancements in technology and increasing investments in research and development.

- The market encompasses the application of advanced technologies, including enzyme engineering, fermentation modeling, and microbial engineering, to produce bio-based products using fermentation processes. This market is driven by the growing demand for sustainable and eco-friendly alternatives to traditional chemical manufacturing processes. Key trends include the use of omics technologies for product characterization and process optimization, bioreactor design and process control for increased efficiency, and the development of synthetic pathways and metabolite profiling for the production of bio-based chemicals and biodegradable polymers. Additionally, there is a focus on microbial interactions, biotechnology research, and the use of digital twins for process simulation and predictive modeling.

Exclusive Customer Landscape

The precision fermentation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the precision fermentation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, precision fermentation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Better Diary Ltd. - The company specializes in producing precision fermentation items, including animal-free cheese, utilizing advanced biotechnology methods.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Better Diary Ltd.

- Change Foods

- Clara Foods Co.

- Eden Brew Pty Ltd.

- Formo Bio GmbH

- FUMI INGREDIENTS BV

- Geltor Inc.

- Ginkgo Bioworks Holdings Inc.

- Imagindairy Ltd.

- Impossible Foods Inc.

- Laurus Labs Ltd.

- Melt and Marble AB

- Mycorena AB

- New Culture

- Nourish Ingredients Pty Ltd.

- Perfect Day Inc.

- Remilk Ltd.

- Shiru Inc.

- Triton Algae Innovations

- Zero Cow Factory

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Precision fermentation is an innovative approach in the realm of industrial biotechnology that leverages advanced technologies such as metabolic engineering, protein engineering, and synthetic biology to produce various valuable products. This technique involves the manipulation of microbial ecology to optimize metabolic pathways and enhance microbial diversity, resulting in the production of food ingredients, bio-based chemicals, and alternative proteins. The regulatory landscape for precision fermentation is evolving, with an increasing focus on ensuring safety and sustainability. High-throughput screening and gene editing are essential tools in the development of new strains, while fermentation optimization and bioprocess engineering are critical for scaling up production.

The application of precision fermentation extends to various industries, including food and beverage, pharmaceuticals, and agriculture. In the food sector, this technology offers opportunities for the production of functional foods, sustainable agriculture, and alternative protein sources. Consumer acceptance of these products is a crucial factor, with personalized nutrition and ethical considerations playing significant roles. Upstream processing, including microbial diversity and genome sequencing, is a crucial aspect of precision fermentation. The use of microbial communities and synthetic microbes enables the production of a wide range of products. Machine learning and artificial intelligence are essential tools in optimizing production processes and improving product quality.

The circular economy is another area where precision fermentation plays a vital role. The production of bio-based chemicals and the optimization of microbial metabolism contribute to the reduction of waste and the development of sustainable production processes. Precision fermentation platforms are increasingly being adopted by industries to improve efficiency and reduce costs. These platforms enable the optimization of fermentation processes, bioprocess development, and downstream processing. The integration of data analytics and process automation further enhances the capabilities of these platforms. The production of plant-based proteins and dairy alternatives is a significant application of precision fermentation. These products offer sustainable and ethical alternatives to traditional animal-derived products, addressing concerns related to food security and environmental sustainability.

Microbial fermentation is a critical component of precision fermentation, with various microbial consortia and industrial strains being used for the production of different products. The optimization of fermentation conditions and the use of advanced bioprocessing techniques enable the production of high-quality products. Precision fermentation is a dynamic and evolving field that offers numerous opportunities for the production of valuable products in various industries. The application of advanced technologies, such as metabolic engineering, protein engineering, and synthetic biology, enables the optimization of microbial metabolism and the production of sustainable and ethical alternatives to traditional products. The regulatory landscape, consumer acceptance, and process optimization are critical factors in the adoption and success of precision fermentation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 72.1% |

|

Market growth 2025-2029 |

USD 52.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

52.4 |

|

Key countries |

US, Germany, China, UK, Canada, France, Japan, Italy, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Precision Fermentation Market Research and Growth Report?

- CAGR of the Precision Fermentation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the precision fermentation market growth of industry companies

We can help! Our analysts can customize this precision fermentation market research report to meet your requirements.