Yoga Mat Market Size 2025-2029

The yoga mat market size is forecast to increase by USD 3.13 billion at a CAGR of 5.7% between 2024 and 2029.

- The market is witnessing significant growth, driven by the trend of product premiumization due to the increasing innovation in yoga accessories. This premiumization is leading to the introduction eco-friendly and sustainable yoga mats made from raw materials like jute, cork, and rubber.

- However, the inconsistent pricing of raw materials poses a challenge for manufacturers, as they strive to maintain profitability while meeting consumer demand for eco-friendly and high-quality products. Additionally, there is a growing focus on using sustainable raw materials to produce yoga mats, as consumers become more environmentally conscious. This shift towards sustainability will continue driving market growth in the coming years.

What will be the Yoga Mat Market Size During the Forecast Period?

- The market caters to the growing demand for exercise equipment that supports various fitness activities, including stretching movements and body position adjustments essential for practicing yoga. This market experiences continuous growth due to the increasing awareness of health benefits associated with yoga, such as stress reduction, anxiety alleviation, and injury prevention. Yoga mats come in various materials, including PVC-free natural rubber and jute, catering to diverse consumer preferences. Advancements in technology have led to the integration of artificial intelligence and digital connectivity in yoga mats, offering features like body warmth, energy loss tracking, and yoga assistant apps.

- These innovations enable users to optimize their practice by providing real-time feedback on body position and flexibility, enhancing the overall yoga experience. In addition, the market includes yoga mats for travel, designed for convenience, and sticky yoga mats that ensure a secure grip during intense workouts. The market is widely distributed through channels such as hypermarkets & supermarkets, gyms and health clubs, and households, catering to a diverse range of consumers. Overall, the market is driven by the increasing popularity of yoga as a fitness activity and the desire for innovative, technology-driven solutions to enhance the practice.

How is this Yoga Mat Industry segmented and which is the largest segment?

The yoga mat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Personal

- Health clubs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Distribution Channel Insights

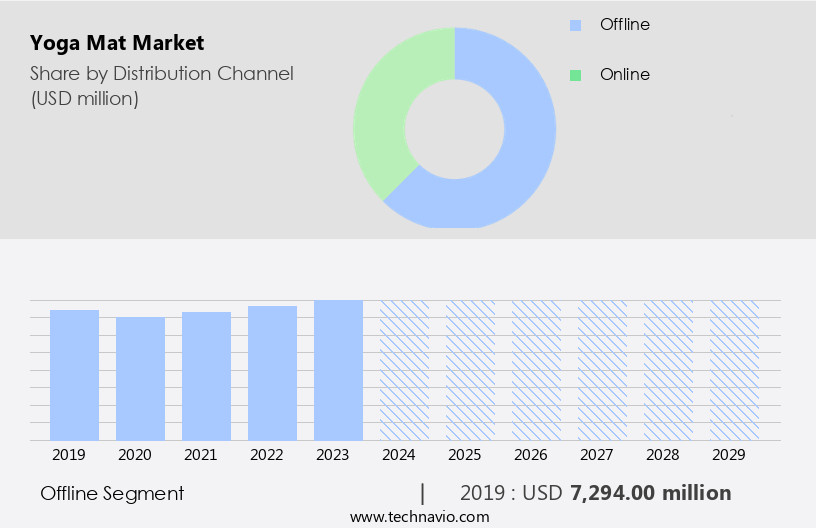

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various retail channels, including pharmacies, monobrand stores, department stores, hypermarkets, supermarkets, and specialty stores. Monobrand stores, which are independently owned retail establishments selling products under the same brand, have seen an increase in yoga mat sales due to their upscale image. North American companies in the health and fitness industry are expanding their reach by investing in monobrand stores to boost direct-to-customer sales. Yoga mats are essential equipment for fitness activities, including stretching movements, body positioning, and injury prevention. They come in various materials, such as PVC-free natural rubber and jute, catering to diverse customer preferences.

Further, AI technology and digital connectivity are emerging trends in the market, with offerings like YogiFi, a yoga assistant app, providing personalized coaching and flexibility tracking. The health benefits of yoga, including stress reduction and anxiety alleviation, have made it a popular practice in modern spirituality and Dharmic traditions.

Get a glance at the Yoga Mat Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 7.29 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

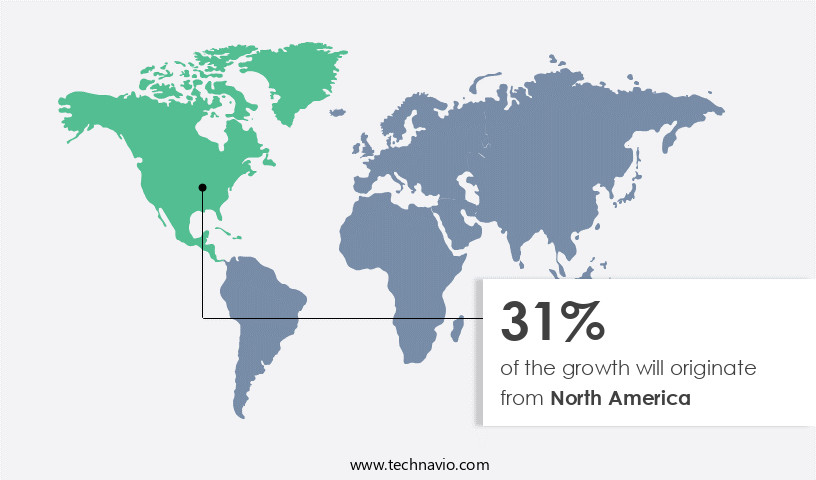

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to experience continuous growth during the forecast period. Manufacturers are focusing on utilizing eco-friendly, sustainable materials, such as natural rubber, cotton, and jute, for producing yoga mats. These materials can biodegrade in landfills or be recycled for other products. However, PVC mats, which are the least expensive option in the region, contain harmful chemicals like phthalates, making them undesirable due to potential health risks. Toxins in these mats may off-gas and leach, negatively impacting air quality when practicing certain poses. In response to consumer demand for healthier alternatives, companies are investing in AI technology and digital connectivity to create yoga assistant apps.

These tools offer body position guidance, flexibility and strength tracking, and injury prevention. Additionally, yoga mats made of TPE and rubber are gaining popularity due to their superior grip and durability. Overall, the health benefits of yoga, including stress and anxiety reduction, obesity management, and cardiovascular health improvement, are driving the growth of the market in North America.

Market Dynamics

Our yoga mat market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Yoga Mat Industry?

Product premiumization owing to more innovation in yoga accessories is the key driver of the market.

- The market is witnessing innovation with the introduction of advanced technologies and eco-friendly materials. Energy loss during yoga exercises is a concern for many practitioners, leading to the development of body-warming mats infused with AI technology for digital connectivity. Yoga assistants provide real-time feedback on body position and flexibility, ensuring proper form and reducing the risk of injuries. PVC-free mats made of natural rubber, cotton/jute, and TPE are gaining popularity due to their health benefits. These mats offer superior grip and are more sustainable than traditional PVC mats. Brands provide a range of yoga equipment, including sticky mats and travel mats.

- The health and fitness industry's increasing focus on flexibility, strength, and stress relief through yoga and spirituality practices has led to a rise in demand for yoga mats. Yoga practices such as Asana, Pranayama, Meditation, Chanting, and Ayurveda offer numerous health benefits, including obesity management, cardiac arrest prevention, and hypertension and hypotension relief. Incorporating modern yoga practices into households and fitness clubs has led to an increase in sales of yoga mats. Online coaching and physical coaching have also contributed to the market's growth. Despite the competition, premium mats with unique features continue to attract customers due to their durability and superior performance.

What are the market trends shaping the Yoga Mat Industry?

Increasing focus on using sustainable raw materials is the upcoming market trend.

- The market in the health and fitness industry has experienced significant growth due to the rising trend of yoga and fitness activities. To cater to the increasing demand for eco-friendly products, manufacturers focus on utilizing natural and recyclable raw materials, such as natural rubber, polymer environmental resin (PER), jute, and cotton, in the production of yoga mats. These materials offer health benefits by reducing energy loss during exercise and keeping the body warm. Moreover, they help prevent injuries by providing a stable and non-slip surface for stretching movements and maintaining proper body position. Eco-friendly yoga mats made from natural rubber, cotton, and jute are biodegradable and decompose easily in landfills, making them a sustainable choice for customers.

- In contrast, PER mats can be recycled into new yoga mats and towels, reducing waste. Companies prioritize sustainability and eco-friendliness in their manufacturing processes. The use of AI technology and digital connectivity in yoga mats, such as YogiFi, offers additional benefits like tracking flexibility, strength, and body position during yoga practices. These features enable online coaching and physical coaching, making yoga more accessible to a wider audience. Incorporating yoga into spiritual practices and Dharmic traditions also contributes to the market's growth. Yoga equipment, including hands and feet protectors, can be made from various materials like PVC, TPE, rubber, and cotton/jute, catering to diverse customer preferences and needs.

What challenges does the Yoga Mat Industry face during its growth?

Inconsistent pricing of raw materials is a key challenge affecting the industry's growth.

- Yoga mats are essential equipment in the health and fitness industry, with over 36 million Americans practicing yoga as of 2020. Energy loss during exercise can be mitigated by using a body-warming mat, which retains heat and enhances the effectiveness of stretching movements. Injuries can be prevented by choosing the correct body position and mat material. AI technology and digital connectivity have introduced yoga assistants like YogiFi, which provide real-time feedback on body position and flexibility. PVC-free mats made of natural rubber, cotton/jute, or TPE are gaining popularity due to their health benefits and alignment with spiritual practices rooted in Dharmic traditions.

- The health problems addressed by yoga, such as obesity, cardia arrest, hypertension, and hypotension, have led to a growing demand for yoga equipment. Manufacturers face challenges in maintaining profitability due to fluctuations in the prices of raw materials like natural rubber and plastic. In 2025, the approximate wholesale price range for China natural rubber is between USD 0.47 and USD 0.70 per pound. Asana, Pranayama, and Meditation practices require a non-slipping surface, making sticky yoga mats a popular choice. Travel yoga mats and jute mats cater to the diverse fitness activities of consumers.

Exclusive Customer Landscape

The yoga mat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the yoga mat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, yoga mat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - The company provides a selection of yoga mats, including 8mm thick EVA and TPE variants, catering to diverse preferences and practice styles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barefoot Yoga Co.

- Body Solid Inc.

- Decathlon SA

- Everyday Yoga

- Hugger Mugger Yoga Products LLC Inc.

- JadeYoga

- Liforme Ltd.

- lululemon athletica Inc.

- Manduka LLC

- Merrithew International Inc.

- New Balance Athletics Inc.

- Nike Inc.

- NoCoast Beer Co.

- OPTP

- Second Earth Pty Ltd.

- Trimax Sports Inc.

- Yoga Direct LLC

- Yogamatters Ltd.

- YogiKuti Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by the increasing popularity of yoga as a fitness activity and a holistic approach to health and wellness. This market caters to various segments, including fitness enthusiasts, spiritual practitioners, and individuals seeking to improve their flexibility, strength, and overall well-being. Yoga mats serve as essential tools for practicing various yoga poses, or asanas, and complementary practices such as pranayama and meditation. The market offers a diverse range of yoga mats, catering to different preferences and requirements. These include PVC-free options made of natural rubber or jute, travel mats, and sticky mats designed for optimal grip.

Furthermore, the market is influenced by several factors, including consumer preferences, health trends, and technological advancements. One key trend is the growing preference for eco-friendly and sustainable materials, such as natural rubber and jute, over traditional PVC mats. Another trend is the integration of digital connectivity and AI technology, which enables users to track their progress and receive personalized coaching through yoga apps and online platforms. Moreover, the market is expanding beyond traditional brick-and-mortar retailers, with a growing presence in online channels and health & fitness clubs. Households have also emerged as a significant market segment, as more individuals opt for home practice due to the convenience and privacy it offers.

Moreover, the health benefits associated with yoga practice, such as stress reduction, anxiety alleviation, and improved flexibility, have contributed to the market's growth. Additionally, yoga has been shown to address various health issues, including obesity, cardiac arrest, hypertension, hypotension, and diabetes. Despite the numerous advantages, the market faces challenges, such as the risk of injuries due to incorrect body positioning and slipping during practice. Modern yoga practices, including Ashtanga, Power, and Bikram, require a high degree of precision and stability, making it essential for yoga mats to provide adequate support and grip.

|

Yoga Mat Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market Growth 2025-2029 |

USD 3.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Canada, Germany, UK, India, Brazil, Japan, France, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Yoga Mat Market Research and Growth Report?

- CAGR of the Yoga Mat industry during the forecast period

- Detailed information on factors that will drive the Yoga Mat market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the yoga mat market growth of industry companies

We can help! Our analysts can customize this yoga mat market research report to meet your requirements.