Yoga Accessories Market Size 2025-2029

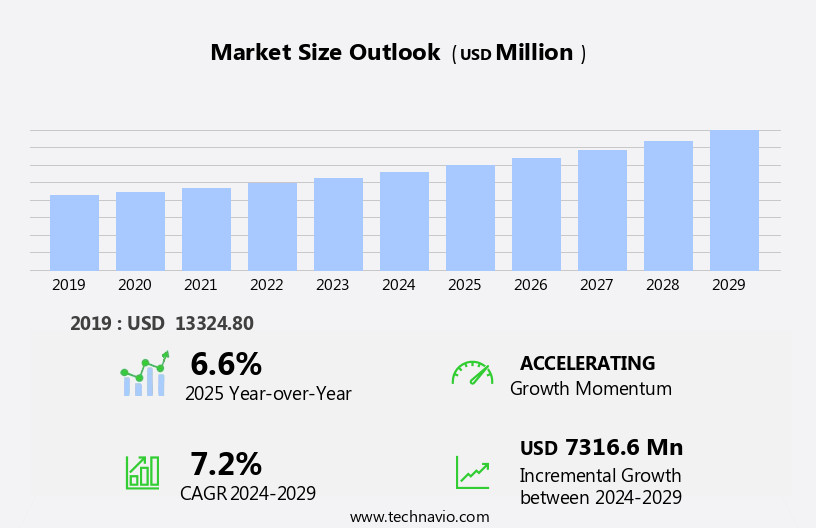

The yoga accessories market size is forecast to increase by USD 7.32 billion at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing product premiumization and innovation in the sector. With a focus on enhancing the overall yoga experience, consumers are willing to invest in high-quality and functional accessories. This trend is further fueled by the growing enrolment in fitness and health and wellness clubs, where yoga classes continue to gain popularity. However, the market is not without challenges.

- Fluctuating raw material prices pose a significant obstacle, requiring manufacturers to adapt and find cost-effective solutions to maintain profitability. As the market evolves, companies must stay agile and responsive to consumer demands while navigating the price volatility to capitalize on opportunities and remain competitive.

What will be the Size of the Yoga Accessories Market during the forecast period?

- The market continues to evolve, reflecting the dynamic nature of yoga practice and culture. Yoga cushions, beginner yoga aids such as bricks and bolsters, and sustainable materials like recycled and natural fibers, are increasingly popular. These accessories cater to various sectors, including vinyasa yoga, restorative yoga, and prenatal yoga. Sustainability is a key trend, with eco-friendly options like biodegradable materials gaining traction. Yoga teachers and practitioners seek out innovative tools for stress relief and injury prevention, leading to the emergence of non-toxic materials and yoga wheels. Online yoga and virtual yoga workshops expand accessibility, while yoga apps and videos offer convenience.

- The market also includes a wide range of clothing options, from yoga shorts and shirts to bras and leggings. The yoga lifestyle encompasses a diverse community of practitioners, fostering connections through yoga studios, retreats, and workshops. As the market continues to unfold, we can expect further developments in materials, design, and functionality, reflecting the ongoing evolution of yoga practice.

How is this Yoga Accessories Industry segmented?

The yoga accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Yoga mats

- Yoga straps

- Yoga blocks

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

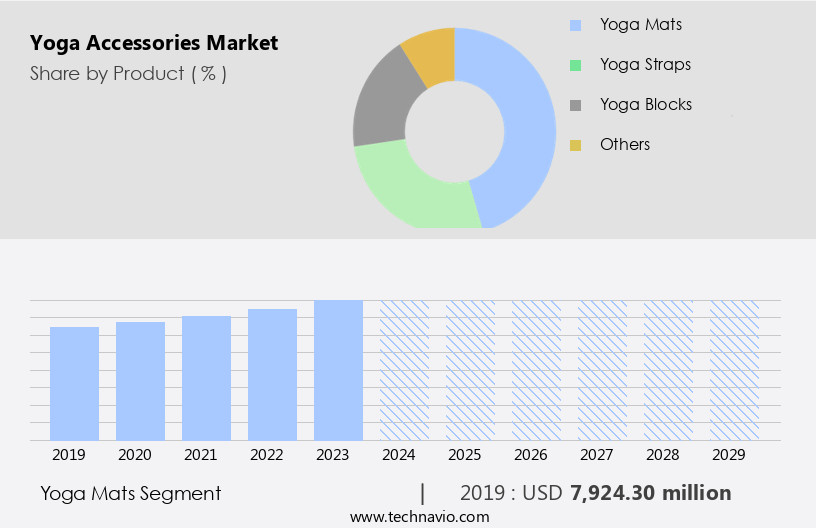

The yoga mats segment is estimated to witness significant growth during the forecast period.

Yoga mats are essential accessories for yoga practitioners to maintain a firm grip and provide insulation during their practice. The market for yoga mats is witnessing steady growth due to the increasing awareness of the benefits of yoga for stress relief and overall wellness. Eco-friendly options made from biodegradable materials, such as natural fibers and recycled materials, are gaining popularity among consumers. Yoga culture is evolving, with advanced practices like hot yoga, prenatal yoga, and virtual yoga classes offered through apps and online platforms. Yoga communities and studios provide workshops and retreats to deepen the mind-body connection.

Yoga accessories sets, including blocks, bricks, bolsters, straps, and wheels, cater to various levels of expertise, from beginner to advanced. Non-toxic materials are prioritized to ensure a safe and healthy practice. Yoga lifestyle encompasses a range of products, from yoga pants and tops to shorts and bras, all designed to enhance the experience. Sustainable materials, such as cork and jute, are increasingly used to create eco-friendly and long-lasting yoga mats. The yoga industry continues to innovate, with new practices like hatha, vinyasa, ashtanga, yin, and restorative yoga gaining traction. Injury prevention is a key focus, with props like cushions and meditation cushions designed to support the body during practice.

The market for yoga mats reflects the dynamic and evolving nature of the yoga industry.

The Yoga mats segment was valued at USD 7.92 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

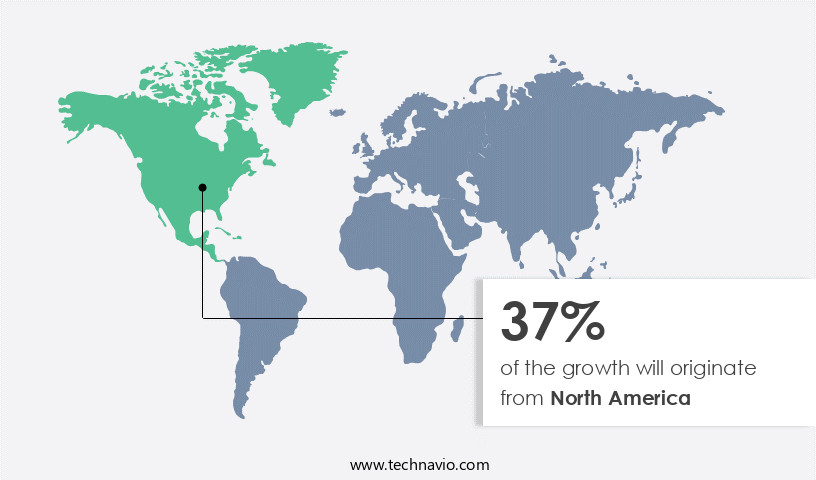

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing popularity of yoga as a fitness activity. Yoga practitioners seek various accessories to enhance their practice, including eco-friendly yoga blankets, biodegradable yoga mats, and sustainable yoga blocks made from natural fibers. Yoga culture continues to evolve, with advanced yoga styles like vinyasa, hatha, yin, and ashtanga gaining traction. Yoga teachers offer workshops and classes, while yoga studios and retreats provide immersive experiences. Virtual yoga and online classes have become increasingly popular, with yoga apps and videos offering convenience and accessibility. Yoga lifestyle brands cater to the needs of practitioners, offering yoga pants, tops, shorts, and bras, as well as yoga accessories sets, meditation cushions, and injury prevention tools like straps and bricks.

The market also prioritizes non-toxic and recycled materials, reflecting the growing awareness of sustainability. Prenatal yoga and hot yoga practices have specific accessory needs, such as prenatal yoga bolsters and hot yoga towels. Restorative yoga and mind-body connection practices benefit from the use of yoga wheels and meditation cushions. Despite the challenges posed by competition from other fitness activities, the market in the US remains highly competitive and innovative, with new offerings and trends emerging regularly. Yoga communities continue to thrive, fostering a harmonious and supportive environment for practitioners.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Yoga Accessories Industry?

- The market's growth is primarily driven by product premiumization resulting from increased innovation in yoga accessories. This trend reflects the industry's commitment to enhancing user experience and providing high-quality tools for practitioners.

- The market is driven by innovation, which sets products apart from competitors and enhances user experience. Companies are introducing a range of yoga accessories, such as mats with unique colors, patterns, and designs. Some manufacturers are focusing on eco-friendly options, using biodegradable materials like jute and rubber for their mats. For example, lululemon athletica offers The Reversible Mat 5mm, which is made from natural rubber and features an antimicrobial additive to prevent mold and mildew.

- Such innovations cater to the growing needs of yoga practitioners and teachers, who seek high-performance and sustainable yoga accessories. The emphasis on stress relief and the immersive nature of yoga culture further fuels the demand for these accessories.

What are the market trends shaping the Yoga Accessories Industry?

- The increasing popularity of fitness and health clubs represents a significant market trend. Enrolment numbers continue to grow in this sector, reflecting a strong consumer demand for wellness and fitness services.

- The market is experiencing significant growth due to the increasing popularity of yoga as a lifestyle choice and the expansion of health and fitness clubs worldwide. Yoga apps and digital tools are enhancing the practice experience, while natural fibers and non-toxic materials are prioritized for eco-conscious consumers. Advanced yoga practices, such as prenatal yoga and hot yoga, require specialized accessories like yoga wheels and supportive yoga bras. The yoga lifestyle and communities continue to grow, with an emphasis on immersive and harmonious experiences.

- The expanding number of health and fitness club memberships is fueling the demand for yoga accessories, with brands like Planet Fitness, YMCA of the USA, Lifetime Fitness, Anytime Fitness, and ClubCorp catering to this need. Overall, the market is poised for continued growth as more individuals seek to integrate yoga into their health and wellness routines.

What challenges does the Yoga Accessories Industry face during its growth?

- The volatility of raw material prices poses a significant challenge to the industry's growth trajectory.

- The market faces challenges due to the volatile pricing of raw materials, particularly synthetic fibers used in producing yoga mats and clothing. For instance, the cost of polyester fibers, a common material for yoga shirts and shorts, has been rising due to supply shortages. This price instability negatively impacts market competitors' profit margins, as they struggle to adjust product prices accordingly. Moreover, the increasing demand for sustainable and eco-friendly materials, such as recycled materials, adds complexity to the market landscape. While this trend presents opportunities for manufacturers using sustainable materials like cork, jute, and natural rubber in their yoga cushions, bricks, and bolsters, it also necessitates higher production costs.

- To mitigate these challenges, some market participants are focusing on offering yoga workshops and online classes, providing customers with a more immersive and harmonious yoga experience. By doing so, they can diversify their revenue streams and reduce their reliance on raw material prices. The market is influenced by the volatility of raw material prices and the growing demand for sustainable materials. Market competitors must navigate these challenges to maintain profitability and cater to the evolving needs of yoga practitioners.

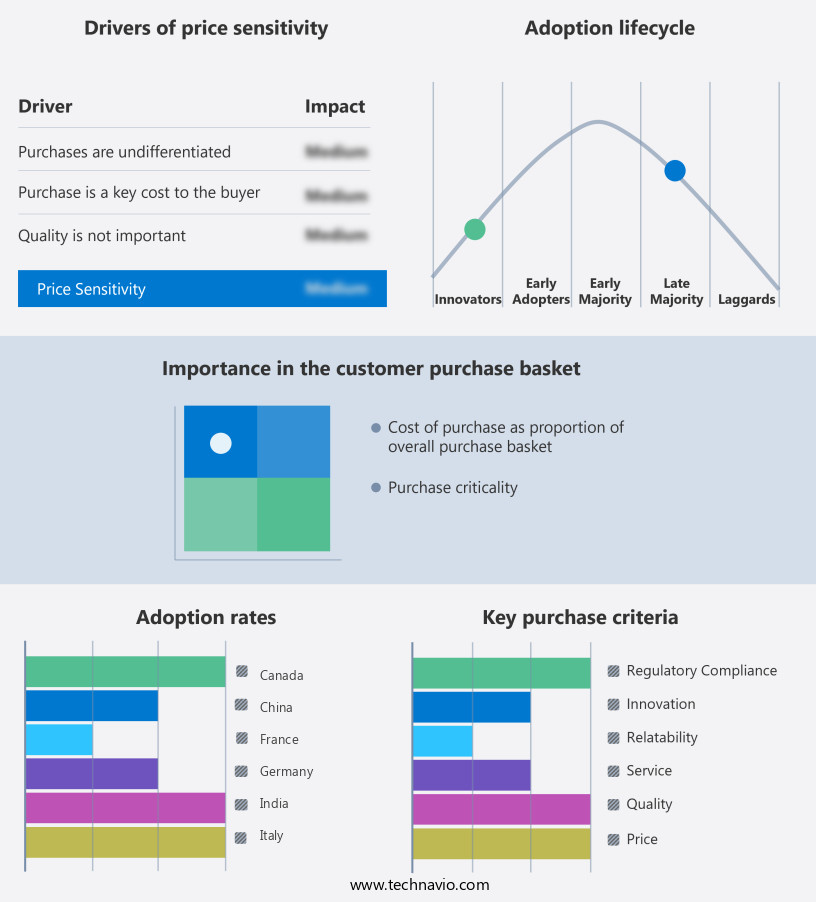

Exclusive Customer Landscape

The yoga accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the yoga accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, yoga accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in providing a range of yoga accessories to enhance your practice.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Barefoot Yoga Co.

- Body Solid Inc.

- Decathlon SA

- Hugger Mugger Yoga Products LLC Inc.

- JadeYoga

- La Vie Boheme Yoga

- Liforme Ltd.

- lululemon athletica Inc.

- Manduka LLC

- Merrithew International Inc.

- New Balance Athletics Inc.

- Nike Inc.

- NoCoast Beer Co.

- OPTP

- Padma Seat

- Trimax Sports Inc.

- Yoga Direct LLC

- Yogamatters Ltd.

- YogiKuti Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Yoga Accessories Market

- In February 2023, Lululemon Athletica, a leading athletic apparel company, expanded its product offerings by launching a new line of premium yoga accessories, including mats, blocks, and straps (Lululemon Press Release). This strategic move aimed to cater to the growing demand for high-quality yoga accessories from its customer base.

- In May 2024, Manduka, a well-known yoga accessories brand, announced a major partnership with Down Dog, a popular digital yoga platform. This collaboration allowed Manduka to offer customized yoga mats with Down Dog branding, providing an enhanced user experience for the platform's subscribers (Down Dog Press Release).

- In August 2024, Jade Yoga, a leading yoga mat manufacturer, secured a significant investment of USD 15 million in a Series C funding round. This funding will be used to accelerate product innovation, expand its global reach, and strengthen its market position (Crunchbase).

- In December 2025, the Indian government announced the "Yoga for All" initiative, which included the promotion of Made-in-India yoga accessories in international markets. This policy change aimed to boost the Indian yoga accessories industry and increase exports (India Brand Equity Foundation).

Research Analyst Overview

The market caters to a diverse range of consumers, with offerings tailored to various demographics and health conditions. Yoga for arthritis and seniors gains popularity as an effective low-impact workout. Yoga for athletes and men enhances flexibility and performance. Yoga teacher training and certification equip individuals to lead classes. Yoga gear, props, and studio equipment are essential for practitioners. Yoga for beginners, kids, and everyone else fosters mind-body wellness. Yoga for diabetes, menopause, pregnancy, fertility, migraines, depression, anxiety, osteoporosis, and sciatica address specific health concerns. Meditation supplies complement yoga practice for deeper relaxation. Yoga therapy integrates yoga and modern medicine for holistic healing.

Yoga apparel ensures comfort during practice. Yoga for sleep and men addresses sleep disorders. Yoga for women and yoga for pregnancy cater to unique needs. Yoga for depression and anxiety alleviates stress and promotes mental well-being. The market's growth is driven by the expanding awareness of yoga's health benefits and the increasing availability of specialized offerings.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Yoga Accessories Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 7316.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, China, Japan, UK, India, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Yoga Accessories Market Research and Growth Report?

- CAGR of the Yoga Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the yoga accessories market growth of industry companies

We can help! Our analysts can customize this yoga accessories market research report to meet your requirements.