Zero-Waste Shampoo Market Size 2025-2029

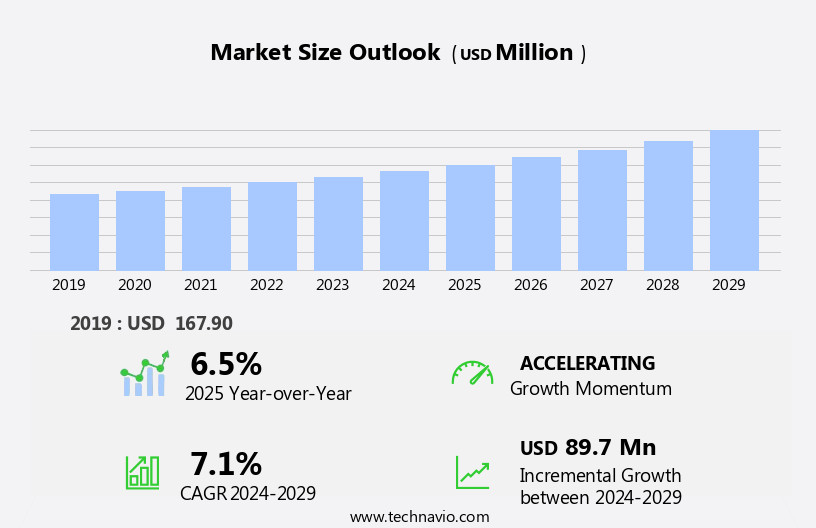

The zero-waste shampoo market size is forecast to increase by USD 89.7 million, at a CAGR of 7.1% between 2024 and 2029.

- The market is driven by the increasing awareness and concerns regarding the environmental impact of plastic consumption. This trend is particularly prominent among eco-conscious consumers who are seeking sustainable alternatives to traditional shampoo bottles. Another key driver is the growing popularity of personalized home salon services, which offer customized shampoo experiences and eliminate the need for frequent store visits and associated packaging waste. However, the market faces challenges as well. The availability of counterfeit zero-waste shampoo products poses a significant threat, as these products may not deliver the promised benefits and could potentially harm consumers. Moreover, the e-commerce market has facilitated the accessibility of these eco-friendly products, enabling consumers to make environmentally conscious choices from the comfort of their homes.

- Additionally, the high upfront cost of zero-waste shampoo solutions, such as shampoo bars and refillable bottles, may deter some consumers from making the switch. Manufacturers and retailers can capitalize on these opportunities by focusing on product innovation, transparency, and consumer education. Offering a wide range of personalized zero-waste shampoo solutions and providing clear information about the benefits and sustainability aspects can help attract and retain customers. Collaborating with influencers and thought leaders in the sustainability space can also help build brand credibility and trust. Battle Green, a key company, offers zero-waste shampoos such as natural vegan shampoo bars, vegan conditioner bars, and natural dry shampoo powder. Moreover, partnerships with salons and spas offering home services can expand the reach of zero-waste shampoo products and create a loyal customer base.

What will be the Size of the Zero-Waste Shampoo Market during the forecast period?

- The market is experiencing significant activity and trends, driven by consumer demand for sustainable and eco-friendly personal care products. Product performance and consumer reviews play a crucial role in market growth, as buyers seek assurance of effectiveness and reduced environmental impact. Sustainable investment in water-saving irrigation, vertical farming, and renewable energy is a key trend, as companies strive to minimize their carbon footprint. Social media marketing and influencer partnerships are essential tools for reaching consumers, who value transparency in ingredient labeling, fair trade sourcing, and non-GMO ingredients. Independent lab testing and green packaging design, using compostable films, recycled paper, and upcycled materials, further enhance product credibility.

- Hydroponic and biodynamic farming methods, as well as the use of hair oil, solid conditioner bars, and hair masks, cater to diverse consumer preferences. Sustainable logistics and carbon offset programs complete the circular economy approach, ensuring a minimal environmental impact from production to disposal. Environmental advocacy and community trade initiatives are shaping the industry, as companies prioritize ethical sourcing and social responsibility. The market continues to evolve, with innovation in ingredient selection and product formats, as well as a focus on reducing waste through reusable containers and refillable systems.

How is this Zero-Waste Shampoo Industry segmented?

The zero-waste shampoo industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Online channel

- Offline channel

- Product

- Zero waste-shampoo bars

- Zero waste-liquid shampoo

- Source

- Natural ingredients

- Organic ingredients

- Vegan ingredients

- Chemical-free ingredients

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

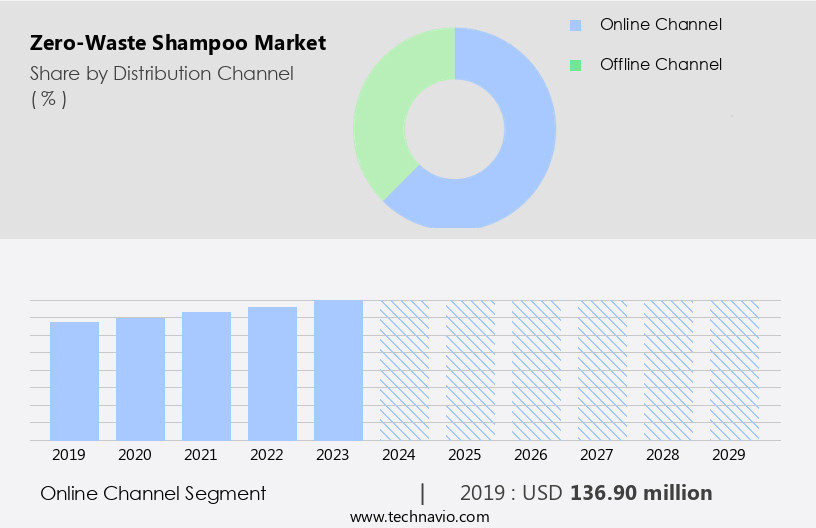

The online channel segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing consumer awareness and preference for eco-friendly and sustainable personal care products. This trend is driven by the rising demand for organic ingredients, compostable packaging, and plant-based ingredients, as well as the growing popularity of solid shampoo bars. Energy efficiency is another key factor fueling market growth, as consumers seek to reduce their carbon footprint. Manufacturers are responding to this demand by incorporating natural ingredients such as jojoba oil, herbal extracts, aloe vera, and essential oils into their formulations. They are also focusing on ethical and sustainable sourcing, using biodegradable surfactants and plant-derived surfactants, and adopting eco-friendly manufacturing processes.

Zero-waste shampoo bars offer several benefits, including hair conditioning, scalp care, and frizz control. They also come with refill programs and are often packaged in recyclable or refillable containers, making them a popular choice among eco-conscious consumers. The market is also witnessing the emergence of subscription services and the circular economy, which enable consumers to reduce waste and save money by receiving regular deliveries of shampoo bars and other zero-waste products. Additionally, the use of biodegradable packaging and sustainable supply chains is becoming increasingly important to consumers, who are seeking to minimize their environmental impact. The market for zero-waste shampoo is expected to continue growing, as consumers become more conscious of the social and environmental impact of their purchasing decisions.

Companies that prioritize sustainability, fair trade, and cruelty-free ingredients are likely to succeed in this market, as they align with consumer values and preferences.

The Online channel segment was valued at USD 136.90 million in 2019 and showed a gradual increase during the forecast period.

The Zero-Waste Shampoo Market is gaining traction as consumers seek eco-friendly alternatives. Shampoo powder is emerging as a water-efficient solution, reducing plastic waste and supporting water conservation efforts. Brands are adopting zero-waste packaging and refillable packaging, minimizing environmental impact while promoting sustainable consumption. The rise of eCommerce platforms enhances accessibility, allowing global reach for ethical beauty products. A well-structured sustainable supply chain ensures responsible sourcing and production practices. Companies are striving for sustainability certification, reinforcing their commitment to ethical standards and transparency. As sustainable beauty continues to reshape industry trends, zero-waste shampoos are becoming the preferred choice, blending innovation with environmental responsibility.

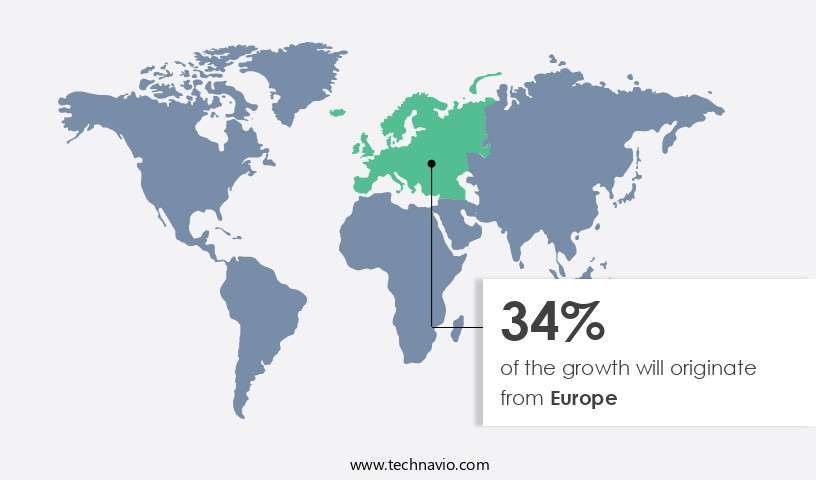

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth in 2024, fueled by increasing consumer consciousness towards environmental sustainability and the detrimental impact of plastic waste. Approximately 26 million tons of plastic waste are generated annually, leading the European Commission to mandate a 100% plastic-free packaging target by 2030. Brands are responding to this demand by introducing eco-friendly solutions, such as compostable or recyclable packaging for zero-waste shampoo bars. Germany is a key market, with a rising preference for organic haircare products, particularly those containing natural ingredients like essential oils, jojoba oil, and herbal extracts. The trend towards chemical-free formulations and sustainable packaging is part of a broader shift towards a zero-waste lifestyle.

Natural beauty products, including shampoo powders and biodegradable detergents made from plant-derived surfactants, are gaining popularity. Brands are also focusing on ethical and sustainable sourcing, fair trade, and cruelty-free ingredients. Additionally, e-commerce platforms and subscription services are facilitating the convenience of zero-waste shampoo adoption. The circular economy principle is driving innovation, with refill programs, recyclable packaging, and sustainable production methods. Consumer awareness of the environmental impact of traditional shampoo bottles and the social impact of the beauty industry is further propelling the market forward. Brands are also focusing on frizz control, hair growth, moisture retention, volume enhancement, and color protection using botanical extracts, castor oil, shea butter, olive oil, and other natural ingredients.

Sustainability certifications and eco-friendly manufacturing processes are becoming essential for brands to differentiate themselves in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Zero-Waste Shampoo market drivers leading to the rise in the adoption of Industry?

- The consumption of plastics comes with significant disadvantages, serving as the primary motivator for the growth of markets seeking to mitigate these issues. Plastic pollution is a significant global concern, with an estimated 460 million metric tons produced annually. The environmental consequences of this issue are severe, as approximately 20 million metric tons of plastic waste enter ecosystems each year. This pollution negatively impacts land, freshwater, and marine environments, leading to biodiversity loss, ecosystem degradation, and climate change. Moreover, the health implications of plastic pollution are alarming. Microplastics, tiny plastic particles, have been detected in human blood, placentas, food, beverages, and even tap water. These particles can enter living organisms, potentially posing health risks. The market is gaining traction as a solution to reduce plastic waste.

- Zero-waste shampoo bars, which are solid shampoo alternatives to traditional liquid shampoo in plastic bottles, offer a sustainable alternative. These bars are packaged in biodegradable or reusable materials, significantly reducing plastic waste. Furthermore, they are often made from natural and organic ingredients, making them a healthier choice for consumers. The market's growth is driven by increasing consumer awareness of the environmental and health risks associated with plastic waste and traditional shampoo products. Additionally, the convenience and cost-effectiveness of zero-waste shampoo bars make them an attractive option for consumers looking to reduce their environmental footprint. The market presents a promising solution to the plastic pollution crisis.

What are the Zero-Waste Shampoo market trends shaping the Industry?

- The growing trend in the market is the increasing adoption of personalized home salon services. This trend signifies a shift towards convenience and customization in the beauty industry. The market is experiencing significant growth due to increasing consumer awareness and preference for eco-friendly personal care products. This trend is particularly prominent in developed regions, including North America and Europe. One innovative solution gaining popularity is the use of organic, plant-based shampoo bars with compostable packaging. These products offer several benefits, such as energy efficiency in production and reduced carbon footprint. Key ingredients in zero-waste shampoo bars include natural and herbal extracts, such as jojoba oil, aloe vera, and herbal extracts, which provide hair conditioning benefits. Ethical and sustainable sourcing of these ingredients is also a priority for many brands.

- Solid shampoo bars offer a more sustainable alternative to traditional liquid shampoos, which often come in large plastic bottles. The market is expected to continue growing, driven by consumer demand for products that minimize waste and promote environmental sustainability. Moreover, the use of zero-waste shampoo bars aligns with the broader trend towards natural and organic personal care products. This shift is likely to be a long-term trend, as consumers become increasingly conscious of the impact of their purchasing decisions on the environment and their health. The market is experiencing significant growth due to increasing consumer demand for eco-friendly personal care products. The use of organic, plant-based shampoo bars with compostable packaging is a key trend in this market, offering benefits such as energy efficiency, reduced carbon footprint, and natural ingredients. The trend towards natural and organic personal care products is expected to continue, making zero-waste shampoo bars a viable and sustainable solution for consumers.

How does Zero-Waste Shampoo market face challenges during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry, impeding its growth and undermining consumer trust. Zero-waste shampoos have gained popularity among eco-conscious consumers in the US and globally, driven by the demand for scalp care products that minimize waste. This market encompasses various offerings, including shampoo powders and liquids made with biodegradable surfactants, essential oils, and plant-derived ingredients. Cruelty-free and fair trade practices are also essential factors for many buyers. However, the market faces challenges, particularly from counterfeit zero-waste shampoos. These products, often sold at lower prices on e-commerce platforms, can pose health risks due to substandard or harmful ingredients. Their packaging, frequently made from non-biodegradable materials, contradicts the sustainability ethos of zero-waste shampoos.

- The rise of e-commerce has intensified this issue, as it's harder to regulate online sales compared to physical retail stores. Brands and regulatory bodies are addressing this challenge through stricter regulations, increased consumer awareness, and improved authentication measures. Consumers are encouraged to research brands and verify their certifications, such as those guaranteeing cruelty-free ingredients and sustainable production methods. The market continues to grow, driven by consumer preferences for eco-friendly and effective personal care solutions. However, it's crucial for buyers to be vigilant against counterfeit products and ensure they're purchasing from reputable sources to maintain the integrity of this market and protect their health.

Exclusive Customer Landscape

The zero-waste shampoo market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the zero-waste shampoo market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, zero-waste shampoo market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Battle Green - This company specializes in eco-friendly personal care solutions, providing zero-waste alternatives to traditional shampoo and conditioner.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Battle Green

- Beauty and the Bees

- Biome

- Butter Me Up Organics

- Chagrin Valley Soap and Salve Co.

- Dirty Hippie Ltd

- EcoRoots

- Emerson Soaps LLC

- etee

- Ethique Ltd.

- Friendly Soap Ltd.

- Hibar

- J R Liggett Ltd.

- Katie Mae Naturals LLC

- Lush Internet Inc

- Plaine Products LLC

- Rocky Mountain Soap Co.

- The Refill Shoppe Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Zero-Waste Shampoo Market

- In March 2023, L'Oréal, the global cosmetics company, introduced Seed Phytonutrients Zero Waste Wash, a new line of shampoos in refillable aluminum bottles, marking a significant stride in the market (BusinessWire). This launch underscores the growing consumer preference for sustainable personal care products.

- In June 2024, Unilever, another major player, announced a strategic partnership with TerraCycle, a recycling solutions company, to launch a refillable shampoo system called "Loop" (BusinessWire). This collaboration signifies a commitment to reducing plastic waste in the beauty industry and reinforces the trend towards circular business models.

- In October 2024, The Body Shop, a well-known ethical beauty brand, secured a â¬10 million investment from L'Oréal to expand its zero-waste product offerings, including shampoos in refillable containers (Reuters). This funding round underscores the growing investor interest in sustainable personal care brands.

- In February 2025, the European Union passed the Single-Use Plastics Directive, banning the sale of single-use plastic packaging for cosmetics, including shampoo bottles, from 2027 (EU Commission). This regulatory development is expected to significantly boost the growth of the market.

Research Analyst Overview

The market continues to evolve, driven by the increasing demand from eco-conscious consumers for sustainable and ethical hair care solutions. Scalp care is at the forefront of this movement, with essential oils, herbal extracts, and aloe vera gaining popularity for their nourishing properties. E-commerce platforms facilitate the accessibility of these products, allowing consumers to reduce their carbon footprint by minimizing the need for physical store visits. Biodegradable surfactants derived from renewable sources, such as coconut oil and plant-derived surfactants, are replacing traditional, synthetic alternatives. Cruelty-free ingredients and fair trade practices are also essential considerations for consumers, who seek ethical sourcing and sustainable production.

The circular economy is a significant trend in the market, with refill programs and biodegradable packaging gaining traction. Shampoo powders and biodegradable detergents offer reduced water usage and energy efficiency, further enhancing the sustainability of these products. The natural beauty sector is embracing zero-waste principles, with companies incorporating botanical extracts, jojoba oil, olive oil, and shea butter into their formulations. Sustainability certifications, such as B Corporation and eco-friendly manufacturing, add credibility to brands' claims of sustainability. Volume enhancement, frizz control, color protection, and hair growth are all addressed through these innovative, eco-conscious solutions. The social impact of zero-waste shampoo extends beyond personal care, with companies focusing on sustainable supply chains and reducing their environmental impact.

The Zero-Waste Shampoo Market is reshaping hair care with eco-conscious solutions. Consumers are embracing hair masks formulated for deep nourishment while supporting sustainability. Brands prioritize recycled paper packaging, reducing plastic waste and promoting a circular economy. Sourcing ingredients through organic farming and hydroponic farming ensures responsible and resource-efficient production. Companies are enhancing product transparency, offering detailed information on formulations and ethical practices. Rigorous product performance testing guarantees efficacy, ensuring quality meets environmental standards. The rise of influencer marketing amplifies awareness, driving demand for zero-waste shampoos among sustainability-focused consumers.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Zero-Waste Shampoo Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 89.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Germany, UK, Japan, France, India, Canada, Spain, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Zero-Waste Shampoo Market Research and Growth Report?

- CAGR of the Zero-Waste Shampoo industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the zero-waste shampoo market growth of industry companies

We can help! Our analysts can customize this zero-waste shampoo market research report to meet your requirements.