Dry Shampoo Market Size 2025-2029

The dry shampoo market size is forecast to increase by USD 3.66 billion, at a CAGR of 16.4% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing trend towards product innovation and premiumization. Brands are introducing advanced formulations, catering to diverse consumer needs and preferences, thereby expanding the market's reach and appeal. Furthermore, the rising adoption of personalized home salon services, particularly in the wake of the ongoing pandemic, is creating new opportunities for dry shampoo manufacturers. However, the market is not without challenges. Allergic reactions and other harmful effects of dry shampoo pose a significant threat, necessitating stringent regulatory compliance and consumer education efforts.

- Companies must navigate these challenges effectively to maintain consumer trust and loyalty. Innovation, personalization, and safety are the key strategic pillars for players in the market, offering ample opportunities for those who can successfully address these market dynamics.

What will be the Size of the Dry Shampoo Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer preferences for convenient and effective hair care solutions. Scalp health and hair texture are key considerations, leading to the exploration of various ingredients such as corn starch, tapioca starch, and wheat starch. Consumer behavior shapes usage occasions, with frequent travelers and those with busy schedules favoring dry shampoo for maintaining personal care between washes. Environmental impact and sustainability initiatives are increasingly important, with some brands turning to rice starch and other natural alternatives to reduce their carbon footprint. Ingredient labeling transparency is a priority for consumers, as they seek to avoid propylene glycol and other potentially harmful additives.

Brand loyalty is influenced by product safety, absorption rate, and product claims, with consumers seeking clean beauty and allergen information. Product development is ongoing, with innovations in packaging design, application methods, and product testing to cater to diverse hair types and lengths. Quality control and ingredient sourcing are crucial for maintaining consumer trust, as is product differentiation through unique features and claims. The market's dynamic nature reflects the ongoing quest for effective, sustainable, and health-conscious hair care solutions.

How is this Dry Shampoo Industry segmented?

The dry shampoo industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Regular dry shampoo

- Natural and organic dry shampoo

- Distribution Channel

- Offline

- Online

- End-User

- Women

- Men

- Unisex

- Hair Type

- Normal

- Oily

- Dry

- All Hair Types

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

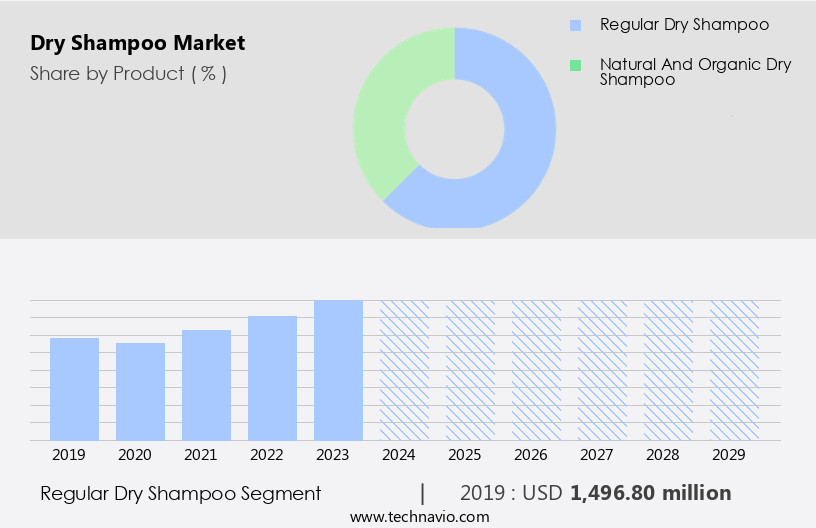

The regular dry shampoo segment is estimated to witness significant growth during the forecast period.

Dry shampoo is a popular solution for individuals seeking quick and easy hair refreshment between washes. These products absorb excess oil from the scalp, boosting volume and leaving hair feeling fresh. They also offer benefits for those dealing with dandruff caused by dry skin and scalp. However, overuse can potentially impact hair health by disrupting the natural oils on the scalp. Regarding production, manufacturers adhere to stringent regulations concerning ingredient safety, labeling, and eco-friendly packaging. Sustainability initiatives are increasingly important, with some brands using natural alternatives like wheat starch, rice starch, corn starch, and tapioca starch instead of synthetic absorbers.

Consumer feedback plays a crucial role in product development, with preferences leaning towards clean beauty and allergen-free, clean-label ingredients. Brands differentiate themselves through various application methods, usage occasions, and brand loyalty programs. Shelf life and product safety are essential considerations, with some brands opting for propylene glycol to extend shelf life and ensure microbial growth inhibition. Product testing, quality control, and product claims are essential for maintaining customer trust. Scalp sensitivity and hair type/length are essential factors in catering to diverse consumer needs. Manufacturers focus on product differentiation through various absorption rates, ingredient sourcing, and packaging design.

The Regular dry shampoo segment was valued at USD 1.5 billion in 2019 and showed a gradual increase during the forecast period.

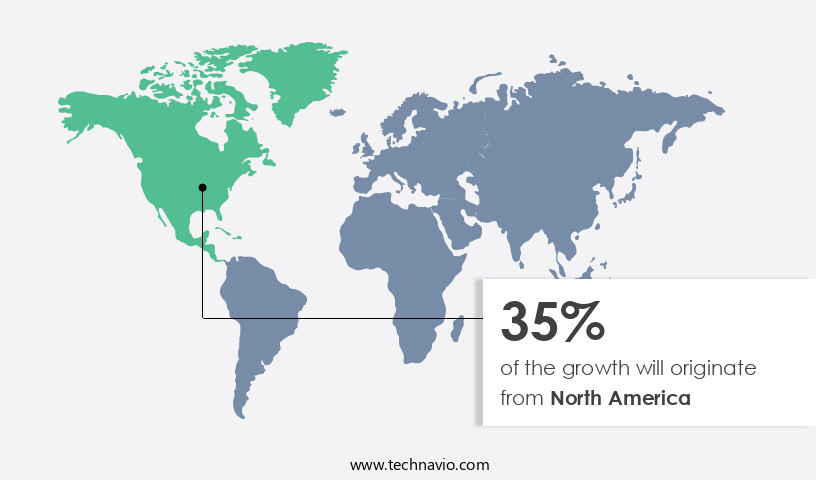

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market for dry shampoo products has experienced significant growth, particularly in the US, Canada, and Mexico. Fashion-conscious consumers are driving this trend, as they seek innovative solutions in the hair care industry. Dry shampoo's instant results and additional benefits, such as preventing dandruff and facilitating easy hair styling, have attracted a large consumer base. Millennials represent a significant market segment due to their fashion-forwardness and awareness of industry trends. Sustainability initiatives, such as the use of wheat starch, rice starch, and other natural starches, have become essential for manufacturers to meet evolving consumer preferences. Brands are focusing on reducing their carbon footprint through packaging design and production methods.

Consumer feedback and brand loyalty are crucial factors influencing product development and competitive advantage. Dry shampoo usage occasions vary, from quick touch-ups between washes to extended periods without shampooing. Ingredient labeling and safety concerns, including propylene glycol and product safety, are essential for consumer trust. Hair texture and length also impact the absorption rate and application methods. Product differentiation, including claims of scalp health, hair health, and product testing for scalp sensitivity, is essential for manufacturers to stand out in the market. Quality control, clean beauty, and allergen information are key considerations for consumers. Frequency of use and product development are ongoing priorities for manufacturers to cater to diverse consumer needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the ever-evolving world of personal care, the market continues to gain popularity among consumers seeking convenience and effectiveness. This market caters to individuals with busy lifestyles, offering a quick solution for refreshing hair between washes. Dry shampoos absorb oil, add volume, and revitalize lackluster locks, making them an essential addition to many beauty routines. Formulated with various ingredients like starch, clay, and essential oils, these innovative products can be applied directly to the scalp and massaged in. They come in various scents, including floral, fruity, and fresh, catering to diverse preferences. Dry shampoos are also accessible in various forms, such as aerosol sprays, powders, and mousses, providing consumers with choices based on their specific needs. Moreover, this market is inclusive, accommodating those with sensitive scalps, as well as those with specific hair types, such as curly or color-treated hair. Dry shampoos are also eco-friendly, with many brands offering biodegradable and organic options. The market continues to evolve, offering consumers a versatile and convenient solution for maintaining clean, fresh, and beautiful hair.

What are the key market drivers leading to the rise in the adoption of Dry Shampoo Industry?

- Product innovation plays a crucial role in the market by driving the premiumization of products. This process involves enhancing existing offerings with advanced features, superior quality, or unique value propositions, ultimately enabling companies to charge higher prices and capture a larger share of the market.

- Dry shampoo, a waterless hair care solution, is gaining popularity due to growing concerns over hair health. This innovative product absorbs excess oil from the scalp and hair, providing a refreshed appearance without the need for daily shampooing. Overuse of regular shampoo can strip natural oils from hair cuticles, potentially causing damage. Dry shampoo helps maintain hair volume by absorbing oil, making it an attractive alternative.

- Available in both spray and powder forms, dry shampoo caters to various hair types. Additionally, organic options with natural ingredients are available for those prioritizing sustainability initiatives and environmental impact. Customer feedback indicates a competitive advantage for dry shampoo in addressing hair care needs while preserving the integrity of hair.

What are the market trends shaping the Dry Shampoo Industry?

- The growing trend in the market is the increasing adoption of personalized home salon services. This emerging trend allows individuals to receive professional beauty treatments in the comfort of their own homes.

- The market has witnessed significant growth in developed regions, including North America and Europe, due to the increasing consumer preference for convenient personal care solutions. Over the last decade, the market has seen a surge in the number of players offering dry shampoo products. This trend can be attributed to the benefits of dry shampoo, such as scalp health preservation and the ability to refresh hair between washes without the need for water. Consumer behavior plays a crucial role in the market's growth. With busy schedules and the desire for on-the-go solutions, consumers are turning to dry shampoo as a frequent alternative to traditional hair washing.

- The market caters to various hair textures, with ingredients such as cornstarch and tapioca starch being commonly used for their absorbent properties. As consumers become more conscious of their personal care choices, there is an increasing demand for ingredient labeling and eco-friendly options. This has led to the development of dry shampoos with minimal carbon footprint and natural ingredients. The market's future growth is expected to be driven by these consumer preferences and the ongoing innovation in product offerings.

What challenges does the Dry Shampoo Industry face during its growth?

- The allergic reactions and other potential harmful effects posed by dry shampoo represent a significant challenge to the industry's growth trajectory. It is essential for manufacturers to prioritize research and development of safer formulations to mitigate these concerns and maintain consumer confidence in the product category.

- The market is experiencing significant consumer awareness regarding the use of harmful chemicals and preservatives in hair care products. Formaldehyde, synthetic fragrances, and sodium lauryl sulfate are some of the chemicals that are raising concerns among consumers. This increasing awareness is expected to impact the growth of the market during the forecast period. Consumers now have easy access to reliable information about the ingredients used in hair care products, thanks to digital media and other sources. This heightened awareness has led to a growing concern about the potential side effects of these chemicals, such as allergies and changes in hair texture.

- Packaging design plays a crucial role in dry shampoo's success, as it influences brand loyalty and application methods. Propylene glycol, a common ingredient in dry shampoo, is under scrutiny due to concerns about product safety and shelf life. Product differentiation through absorption rate and ingredient sourcing is essential to meet the varying needs and preferences of consumers. Brands must prioritize product safety and transparency to build trust and loyalty among consumers. As the market evolves, it is essential to stay informed about consumer preferences and trends to ensure the continued success of dry shampoo products.

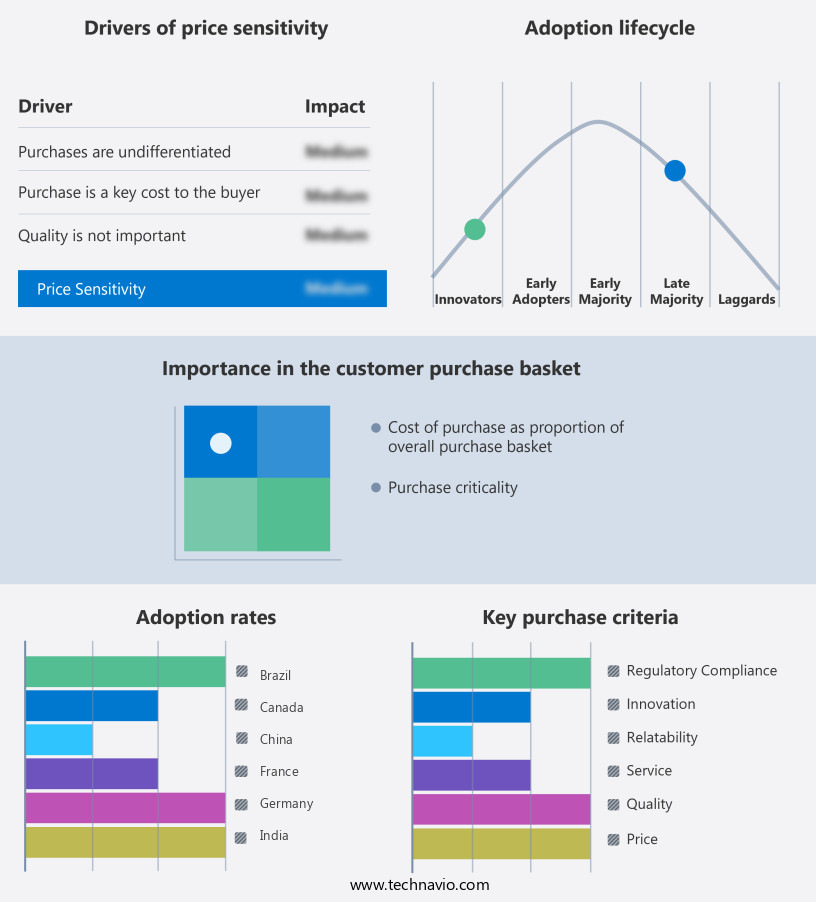

Exclusive Customer Landscape

The dry shampoo market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dry shampoo market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dry shampoo market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

L'Oréal S.A. - The company specializes in innovative dry shampoo solutions, including the Ambiance dry shampoo, applicator brush, and powder refills.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- L'Oréal S.A.

- Procter & Gamble Co.

- Unilever Plc

- Henkel AG & Co. KGaA

- Church & Dwight Co. Inc.

- Kao Corporation

- Shiseido Company Limited

- Estée Lauder Companies Inc.

- Revlon Inc.

- Coty Inc.

- Batiste (Church & Dwight)

- Drybar Holdings LLC

- Living Proof Inc.

- Moroccanoil

- Amika

- Ouai Haircare

- Not Your Mother's

- Klorane (Pierre Fabre)

- Briogeo

- IGK Hair

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dry Shampoo Market

- In January 2024, Unilever, a leading consumer goods company, announced the global launch of its new dry shampoo variant, "Fresh Up," infused with rosehip oil and biotin, aiming to cater to the growing demand for natural and nourishing personal care products (Unilever, 2024).

- In March 2024, L'Oréal and Procter & Gamble, two major players in the market, entered into a strategic partnership to co-create innovative dry shampoo technologies, combining their research and development capabilities to enhance product offerings and maintain market competitiveness (Reuters, 2024).

- In April 2025, Kao Corporation, a Japanese personal care company, completed the acquisition of Pureology, a US-based professional hair care brand known for its dry shampoo products, expanding its reach in the premium segment and strengthening its global market presence (Bloomberg, 2025).

- In May 2025, the European Commission approved the use of bio-based polymers in dry shampoo formulations, paving the way for more eco-friendly and sustainable product offerings, in line with increasing consumer demand for environmentally responsible personal care products (European Commission, 2025).

Research Analyst Overview

- The market is experiencing dynamic trends and evolving consumer preferences. Brands are employing various strategies to stay competitive, from product lifecycle management and pricing strategies to sales strategies and trend forecasting. Anti-static agents and botanical extracts are gaining popularity as conditioning ingredients, while safety standards and sustainable packaging are prioritized for consumer appeal. Subscription services and influencer marketing are effective tools for customer relationship management, enhancing brand awareness and equity. Industry regulations require strict quality assurance, with UV protection and color protection essential for effective formulations. Mineral oils and essential oils are used in different pricing strategies, while aerosol dispensing and spray nozzle technology ensure user convenience.

- Brand positioning is key, with waterless shampoo and product innovation driving new product development. Data analytics and search engine optimization are crucial marketing strategies, while customer loyalty programs engage consumers and retain business. Dry shampoo alternatives, such as shampoo bars, are emerging, challenging established brands. Social media marketing and content marketing are essential for reaching and engaging customers. Packaging materials, including recyclable and sustainable options, are crucial for eco-conscious consumers. Spray nozzle technology and industry regulations ensure safety and compliance. Ultimately, the market is a competitive landscape, requiring continuous innovation and adaptation to consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dry Shampoo Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.4% |

|

Market growth 2025-2029 |

USD 3656.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.7 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dry Shampoo Market Research and Growth Report?

- CAGR of the Dry Shampoo industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dry shampoo market growth of industry companies

We can help! Our analysts can customize this dry shampoo market research report to meet your requirements.