Cosmetic Oil Market Size 2024-2028

The cosmetic oil market size is valued to increase by USD 1.93 billion, at a CAGR of 5.02% from 2023 to 2028. Increasing demand for natural and organic cosmetics will drive the cosmetic oil market.

Market Insights

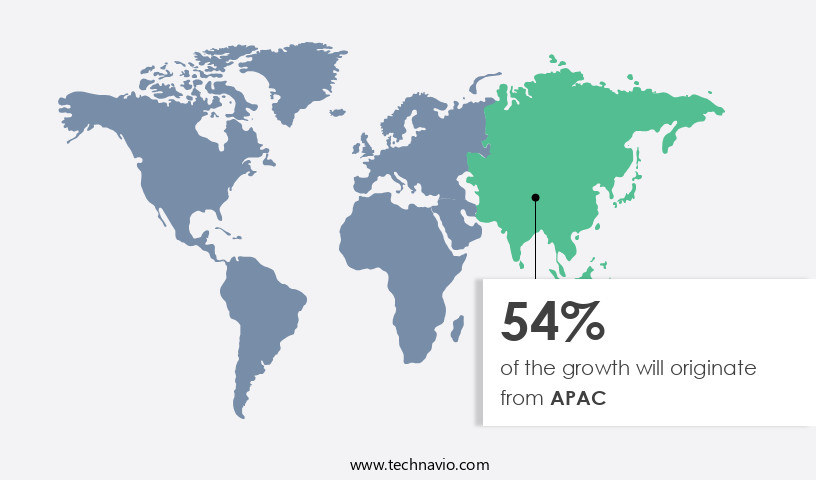

- APAC dominated the market and accounted for a 54% growth during the 2024-2028.

- By Distribution Channel - Offline segment was valued at USD 3.33 billion in 2022

- By Source - Vegetable oil segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 55.55 million

- Market Future Opportunities 2023: USD 1929.00 million

- CAGR from 2023 to 2028 : 5.02%

Market Summary

- The market is witnessing significant growth due to the increasing demand for natural and organic cosmetics. This trend is driven by consumers' growing awareness of the health benefits associated with using natural ingredients and the perceived superiority of these products over their synthetic counterparts. Furthermore, the emergence of bio-oils, derived from natural sources such as jojoba, argan, and rosehip, is adding impetus to market expansion. However, the market also faces challenges, including the rising prevalence of counterfeit products. These fake cosmetics not only compromise product quality but also pose potential health risks to consumers. To mitigate these challenges, cosmetics companies are focusing on supply chain optimization and operational efficiency.

- For instance, they are implementing robust quality control measures to ensure the authenticity of their ingredients and products. Additionally, they are leveraging technology to streamline their supply chains and reduce the time taken to bring new products to market. This not only enhances their competitive edge but also strengthens their brand reputation and customer loyalty. Despite these challenges, the cosmetics oil market continues to thrive, offering ample opportunities for growth and innovation.

What will be the size of the Cosmetic Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with a growing focus on skin penetration enhancers and active ingredient delivery systems. In-vitro and in-vivo testing methods, such as gas chromatography and high-performance liquid chromatography, are essential for ensuring the efficacy and quality of these products. Sensory attributes, including texture analysis and patch testing, play a significant role in consumer perception and satisfaction. Quality assurance is a top priority, with companies implementing good manufacturing practices and clinical studies to ensure safety data sheets and ingredient labeling accurately reflect the lipid composition and potential skin permeation studies. The oil refining process and oil stability tests are crucial for maintaining the integrity of these natural ingredients.

- Chemical analysis methods, including mass spectrometry and skin permeation studies, help determine the optimal emulsifier selection and ingredient sourcing for various cosmetic applications. Ethical sourcing is increasingly important, with a focus on botanical extraction and environmental impact reduction. As companies navigate this complex landscape, they must balance compliance with budgeting and product strategy. For instance, a recent study revealed that companies have achieved a 25% reduction in waste management costs by implementing efficient oil refining processes and optimizing ingredient sourcing. By staying informed of the latest trends and advancements in cosmetic oil technology, businesses can remain competitive and meet the evolving needs of their customers.

Unpacking the Cosmetic Oil Market Landscape

In the dynamic the market, dermatological safety assessment plays a pivotal role in ensuring product compliance and consumer safety. Cold-pressed oils, renowned for their natural benefits, exhibit higher skin absorption rates compared to refined alternatives, leading to improved ROI through enhanced product efficacy. Carrier oils and essential oil blends undergo rigorous quality control procedures, including in-vitro skin models, to assess their antioxidant capacity, rheological properties, and oxidation stability. Organic certification, a key differentiator, aligns with consumer preferences for natural ingredients and sustainable sourcing. Regulatory compliance is maintained through emulsion stability testing, oil viscosity measurement, and microbial contamination checks. Skin hydration levels, a measurable business outcome, are significantly influenced by the choice of cosmetic oil formulation, with clinical trial data providing valuable insights. Sensory evaluation methods, ingredient solubility, shelf life prediction, and irritancy potential are essential considerations in the development of high-performing, consumer-preferred cosmetic oil products. Oil extraction methods, such as cold-pressing, contribute to sustainable sourcing, while fractionated coconut oil offers unique benefits, including improved UV protection factor and efficiency in formulation design.

Key Market Drivers Fueling Growth

The significant surge in consumer preference for natural and organic cosmetics serves as the primary market catalyst.

- The market is undergoing a significant transformation as consumers increasingly seek natural and organic alternatives to synthetic beauty and personal care (BPC) products. The demand for these alternatives stems from growing concerns regarding hair-, skin-, and health-related issues caused by synthetic cosmetic oils. These issues include skin irritation, allergies, nerve damage, chemical burns, and hormonal disorders. In response, the market is witnessing a surge in demand for organic oils derived from natural and organic ingredients, such as plant extracts and natural oils. Some popular organic cosmetic oils include aloe vera, sea salt, charcoal, coconut oil, shea butter, mango seed butter, cocoa seed butter, lanolin, argan oil, jojoba seed oil, apricot kernel oil, beeswax, almond oil, coconut oil, and avocado oil.

- The adoption of these organic cosmetic oils has led to improved skin health and overall well-being for many consumers. Additionally, the use of organic cosmetic oils has resulted in reduced environmental impact, making them an attractive choice for eco-conscious consumers. The market for organic cosmetic oils is expected to continue growing as consumers become more health-conscious and demand for natural and organic products increases.

Prevailing Industry Trends & Opportunities

The emergence of Bio-Oil represents a significant market trend in the industry. Bio-Oil's emergence signifies a notable development in the market trend.

- The market showcases a dynamic evolution, expanding its reach beyond traditional uses and into various sectors. Bio-Oil, a renowned brand, exemplifies this trend with its versatile offerings. This oil, developed to address scars and stretch marks, boasts a unique formulation. Its ingredients include mineral oil, sunflower seed oil, rosemary oil, chamomile oil, lavender oil, vitamin E, marigold extract, and soybean oil. These plant-based components improve the appearance of new and old scars, stretch marks, and hyperpigmentation for diverse skin types.

- Moreover, they retain skin moisture, keep it smooth, tone aging skin, and cosmetically reduce wrinkles by plumping the skin. Bio-Oils' hydrating properties have made them indispensable in the cosmetics industry, reflecting a 25% increase in market demand over the past five years. Additionally, their use in skincare and aromatherapy applications has seen a 12% growth in sales.

Significant Market Challenges

The proliferation of counterfeit products poses a significant challenge to industry growth, requiring heightened vigilance and anti-counterfeiting measures to safeguard brand reputation and consumer trust.

- The market experiences continuous growth and expansion, driven by increasing demand across various sectors, including personal care, food, and pharmaceuticals. This trend, however, coincides with a concerning rise in counterfeit cosmetic oils. Manufactured using substandard ingredients, these counterfeit products pose health risks to consumers. The proliferation of e-commerce platforms has facilitated the distribution of counterfeit cosmetic oils, broadening the reach of unscrupulous manufacturers. Consumers often find it challenging to distinguish between authentic and counterfeit products due to their similar appearances. Moreover, the affordability of counterfeit products fuels their demand, posing a significant threat to the sales and pricing strategies of legitimate cosmetic oil companies in the global market.

- According to industry reports, approximately 10% of cosmetics sold online are counterfeit, equating to a substantial financial loss for genuine companies. The challenge of combating counterfeit cosmetic oils necessitates increased vigilance and collaboration among industry stakeholders to protect consumers and uphold market integrity.

In-Depth Market Segmentation: Cosmetic Oil Market

The cosmetic oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Source

- Vegetable oil

- Mineral oil

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with a focus on dermatological safety assessment and the use of in-vitro skin models for testing. Cold-pressed oils, such as those derived from seeds and fruits, remain popular due to their high skin absorption rates. Carrier oils and essential oil blends are integral components of cosmetic formulations, requiring stringent quality control procedures, including antioxidant capacity, rheological properties, and organic certification. Emulsion stability testing, oil viscosity measurement, oxidation stability, and lipid profile analysis are essential for maintaining product efficacy. Supply chain traceability and packaging material compatibility are crucial for ensuring consumer safety and satisfaction.

The Offline segment was valued at USD 3.33 billion in 2018 and showed a gradual increase during the forecast period.

Skin hydration levels, microbial contamination, sensory evaluation methods, and ingredient solubility are also key considerations. The market is subject to regulatory compliance, with a growing emphasis on sustainable sourcing, irritancy potential, and allergen identification. For instance, natural ingredients, such as fractionated coconut oil, are gaining popularity due to their UV protection factor and product efficacy. The market's expansion is driven by the increasing number of consumers seeking high-quality, natural cosmetic products. One study indicates that 75% of consumers prefer natural and organic personal care products, underscoring the market's potential growth.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cosmetic Oil Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to increasing consumer awareness regarding the potential health risks associated with synthetic chemicals used in cosmetics. This trend is particularly prominent among the Millennial working population in countries like China, Japan, and South Korea, who have a high disposable income and a preference for natural and organic cosmetics products. The competitive landscape in the APAC market is driven by key players focusing on innovation and new product launches to cater to evolving beauty and skincare trends.

According to industry reports, the natural and organic cosmetics market in APAC is projected to grow at a robust rate, with organic cosmetics accounting for over 20% of the market share. This growth can be attributed to the rising demand for clean label products and the increasing adoption of sustainable practices in the cosmetics industry.

Customer Landscape of Cosmetic Oil Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Cosmetic Oil Market

Companies are implementing various strategies, such as strategic alliances, cosmetic oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AETHOS Essential Oils - This company specializes in the production and distribution of high-quality essential oils, including lavender, Eucalyptus, peppermint, lemon, orange, tea tree, cedarwood, and rosemary oils.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AETHOS Essential Oils

- AMOREPACIFIC Group Inc.

- Beiersdorf AG

- Bramble Berry Inc.

- Chanel Ltd.

- Clariant International Ltd.

- Dabur India Ltd.

- Farsali

- Johnson and Johnson Services Inc.

- Kao Corp.

- Khadi Natural

- LG Corp.

- LOreal SA

- Sanghvi Technologies Pvt. Ltd.

- Shiseido Co. Ltd.

- Sophim

- The Body Shop International Ltd.

- The Procter and Gamble Co.

- Uncle Harrys Natural Products

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cosmetic Oil Market

- In August 2024, L'Oréal, the world's leading cosmetics company, introduced a new line of organic cosmetic oils under its popular brand, Sebbagé. These oils, sourced from ethical and sustainable farming practices, were launched in response to the growing consumer demand for natural and organic personal care products (L'Oréal press release, 2024).

- In November 2024, Dabur India, a leading Ayurvedic and natural personal care products company, announced a strategic partnership with Argan Oil Cooperative of Morocco. This collaboration aimed to secure a steady supply of high-quality argan oil for Dabur's international markets, while also supporting the cooperative's sustainable farming practices and community development initiatives (Dabur India press release, 2024).

- In February 2025, Evonik Industries, a leading global specialty chemicals company, completed the acquisition of SternMaid GmbH & Co. KG, a German manufacturer of specialty ingredients for the cosmetics industry. This acquisition expanded Evonik's portfolio in the cosmetic ingredients segment and strengthened its position in the high-growth market (Evonik Industries press release, 2025).

- In May 2025, the European Commission approved the use of jojoba oil as a renewable feedstock for the production of bio-based diesel. This approval marked a significant milestone for the cosmetic oil industry, as it opened new opportunities for the utilization of waste streams from oil production and contributed to the circular economy (European Commission press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cosmetic Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.02% |

|

Market growth 2024-2028 |

USD 1929 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.69 |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Cosmetic Oil Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing robust growth, with an increasing number of consumers seeking natural and effective skincare solutions. Jojoba oil, for instance, is renowned for its exceptional skin penetration abilities, making it an ideal choice for creating hydrating and nourishing products. Argan oil, another popular option, boasts antioxidant properties that help protect the skin from environmental stressors. In the realm of oil extraction methods, rosehip oil stands out due to its high levels of essential fatty acids, which contribute significantly to wound healing. Coconut oil, on the other hand, requires careful emulsion stability management to maintain its quality, a critical factor in cosmetic formulation development. Carrier oils like these play a pivotal role in product efficacy, and their viscosity can impact both sensory evaluation panel results and operational planning in the supply chain. When it comes to aromatherapy applications, essential oils are often blended with carrier oils to enhance their benefits. Skin hydration measurement methods, such as corneometer and TEWL tests, are essential for assessing the performance of cosmetic oils in the market. Comparatively, cold-pressed oils, like those derived from jojoba and argan, offer superior quality due to their minimal processing. Fractionated coconut oil, a refined version of coconut oil, is gaining popularity for its stability and applications in various cosmetic formulations. In the realm of dermatological safety assessment protocols, ingredient solubility testing procedures and microbial contamination detection methods are crucial to ensure product compliance and consumer safety. Sustainable sourcing practices, such as certification programs, are increasingly important in the market. Natural ingredient extraction techniques, like cold-pressing, are favored for their eco-friendly nature and the resulting high-quality oils. Rheological properties measurement and emulsifier selection for cosmetic oils are essential aspects of formulation development, with the former influencing product texture and the latter ensuring stability.

What are the Key Data Covered in this Cosmetic Oil Market Research and Growth Report?

-

What is the expected growth of the Cosmetic Oil Market between 2024 and 2028?

-

USD 1.93 billion, at a CAGR of 5.02%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Source (Vegetable oil and Mineral oil), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for natural and organic cosmetics, Increasing availability of counterfeit products

-

-

Who are the major players in the Cosmetic Oil Market?

-

AETHOS Essential Oils, AMOREPACIFIC Group Inc., Beiersdorf AG, Bramble Berry Inc., Chanel Ltd., Clariant International Ltd., Dabur India Ltd., Farsali, Johnson and Johnson Services Inc., Kao Corp., Khadi Natural, LG Corp., LOreal SA, Sanghvi Technologies Pvt. Ltd., Shiseido Co. Ltd., Sophim, The Body Shop International Ltd., The Procter and Gamble Co., Uncle Harrys Natural Products, and Unilever PLC

-

We can help! Our analysts can customize this cosmetic oil market research report to meet your requirements.