Forklift Trucks Market Size 2025-2029

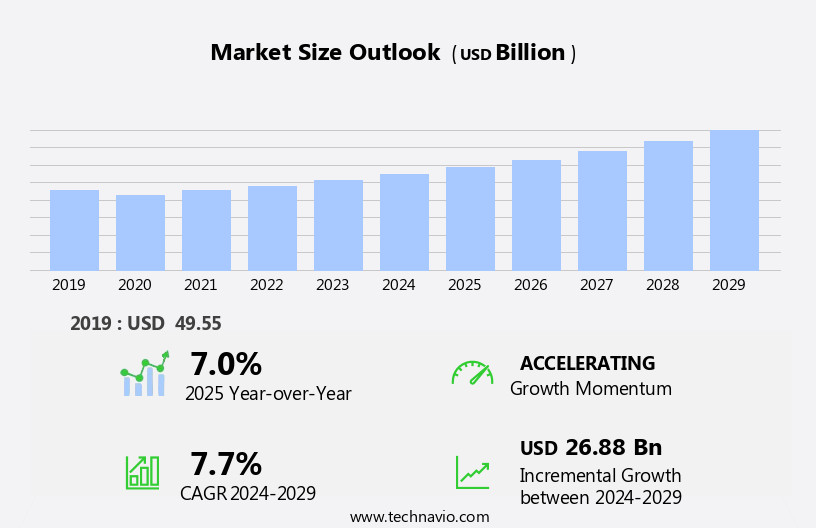

The forklift trucks market size is forecast to increase by USD 26.88 billion at a CAGR of 7.7% between 2024 and 2029.

- The market is experiencing significant growth, particularly in the construction sector, driven by the increasing demand for material handling equipment in infrastructure development projects. A notable trend in the market is the adoption of fuel cell-powered forklift trucks, which offer improved efficiency and reduced emissions, aligning with the growing emphasis on sustainability and environmental concerns. However, the market faces a significant challenge in the form of a shortage of skilled operators. As the industry continues to evolve, companies must invest in training programs to address this issue and ensure a steady supply of competent workforce to operate the advanced machinery.

- Effective workforce planning and development strategies will be crucial for businesses seeking to capitalize on the market opportunities and navigate the challenges presented by the evolving landscape.

What will be the Size of the Forklift Trucks Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and shifting industry demands. Forklift durability remains a key focus, with data analytics playing a crucial role in optimizing performance and predicting maintenance needs. Operator safety is paramount, leading to the integration of advanced safety features and remote monitoring systems. Warehouse logistics relies heavily on forklifts, with various mast types catering to different lifting heights and load handling requirements. Forklift financing and leasing solutions offer flexibility for businesses, while forklift efficiency and fuel consumption are critical factors in fleet management. Internal combustion forklifts dominate the market, but electric and fuel cell models are gaining traction due to their environmental benefits.

- Forklift parts and tire types are essential components of forklift maintenance, ensuring optimal performance and longevity. Operator training and fleet management systems enable businesses to maximize productivity and minimize downtime. Forklift customization and attachments cater to specific industry needs, enhancing versatility and adaptability. The ongoing pursuit of forklift reliability and performance drives innovation in forklift technology, including autonomous models and advanced load handling capabilities. The market's continuous evolution reflects the dynamic nature of material handling and the diverse needs of various sectors.

How is this Forklift Trucks Industry segmented?

The forklift trucks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Class Type

- Class III

- Class V

- Class I

- Class II

- Class IV

- Type

- Electric

- Internal combustion engine

- Load Capacity

- 0- 5 Ton

- 6-15 Ton

- Above 16 Ton

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

- End User

- Industrial

- Construction

- Manufacturing

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Class Type Insights

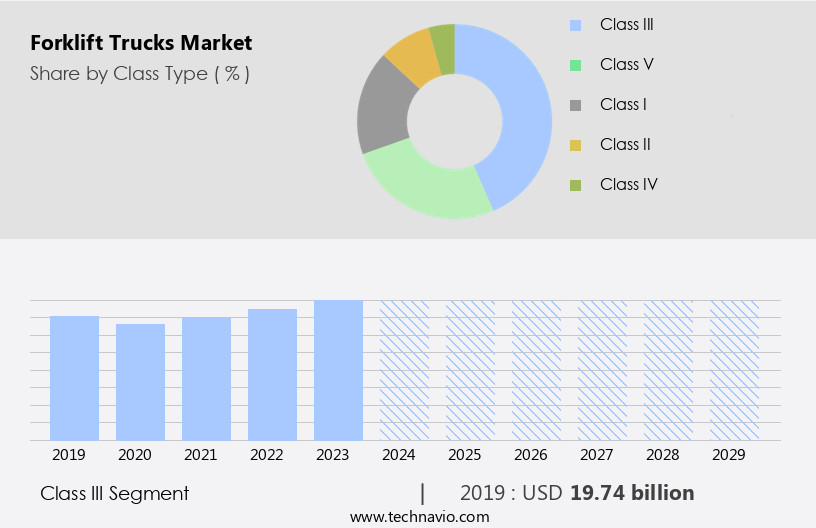

The class iii segment is estimated to witness significant growth during the forecast period.

The Class III segment of the market encompasses electric hand rider trucks and pallet jacks, which are characterized by their ability to lift materials just a few inches above the ground. These forklifts are commonly used for quick unloading of deliveries from trailers and are controlled by a steering tiller, available as counterbalanced or straddle-type walk-behind stackers. With a load capacity of approximately 5 tons, they are well-suited for short distances and small warehouses. Class III forklift trucks can be powered by lithium-ion batteries or fuel cell engines, expanding their application in warehouses and production plants requiring intermediate logistics solutions between unloading and storage operations.

Data analytics plays a crucial role in optimizing warehouse logistics by monitoring forklift performance, fuel consumption, and operating costs. Operator safety is ensured through mast types, remote monitoring, and safety features. Forklift service, fleet management, and operator training are essential for maintaining forklift durability and reliability. Forklift attachments, capacity, and customization cater to varying material handling needs. Autonomous forklifts and electric and fuel cell forklifts are emerging trends in the market, offering increased efficiency and sustainability. Engine power, lifting height, tire types, and forklift financing are other significant factors influencing the market. Predictive maintenance and forklift leasing provide cost-effective solutions for businesses.

Distribution centers rely on forklift technology to streamline material handling and improve overall productivity.

The Class III segment was valued at USD 19.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

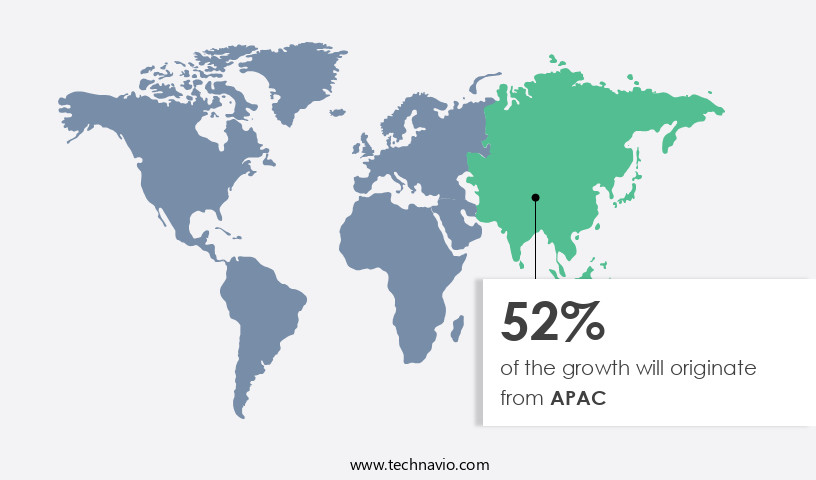

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth, driven by the expanding construction and e-commerce industries in emerging economies. Japan, a traditional leader in forklift truck usage, continues to contribute notably to the market. In India and China, construction activity is on the rise, leading to increased demand for forklifts in material handling and load transportation. Government initiatives like Make in India and China Belt Road Initiative (BRI) are promoting industrial and infrastructural development, further boosting the construction sector and forklift market. South-East Asian countries, including Singapore, Indonesia, and Vietnam, are investing heavily in infrastructure development, leading to high residential and commercial construction growth.

Warehouse logistics is another sector benefiting from the increasing adoption of forklift trucks. Engine power and forklift efficiency are crucial factors in the market, with electric and internal combustion forklifts catering to varying needs. Forklift attachments, safety features, and fleet management solutions enhance productivity and operator safety. Forklift rental, financing, and leasing options offer flexibility to businesses. Lifting height, tire types, and forklift capacity are essential considerations in forklift selection. Predictive maintenance and performance monitoring technologies improve forklift reliability and reduce operating costs. The market is also witnessing the emergence of autonomous forklifts and fuel cell forklifts, adding to the technological advancements in the material handling industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Forklift Trucks Industry?

- The construction sector's robust expansion serves as the primary catalyst for market growth.

- The market has experienced significant growth due to the increasing construction activity across various regions. The Energy Efficiency Directive (EED) in Europe has led to the renovation of public buildings, aiming for zero building emissions by 2025, driving the expansion of the European construction and renovation sectors. Additionally, emerging economies in Asia Pacific, such as India, China, and countries in South-East Asia, have shown rapid growth in construction activity. Over the last five years, the accumulated building value in countries like Singapore, Malaysia, Indonesia, the Philippines, Thailand, Vietnam, and Hong Kong experienced nearly a 50% increase. Forklift trucks play a crucial role in pallet handling and material transportation in the construction industry.

- Forklift performance, capacity, and fuel types are essential factors in determining the operating costs. Forklift accessories, such as attachments for handling various types of loads, also impact the overall efficiency and productivity. Autonomous forklifts are gaining popularity due to their ability to reduce fuel consumption and labor costs. Fuel types include electricity, LPG, diesel, and compressed natural gas, each with its unique advantages and disadvantages. Understanding these factors can help businesses make informed decisions when selecting the right forklift trucks for their operations.

What are the market trends shaping the Forklift Trucks Industry?

- Fuel cell-powered forklift trucks are gaining popularity in the material handling industry as the new market trend. These trucks offer several advantages, including zero emissions, increased efficiency, and longer run times compared to traditional forklifts.

- Forklift trucks are essential tools in warehouse logistics, and manufacturers continue to prioritize innovation to enhance their durability and efficiency. One significant development in this field is the adoption of fuel cell-powered forklifts. With the growing emphasis on reducing carbon emissions and increasing operational efficiency, these forklifts are gaining popularity. Fuel cell-powered forklifts offer several advantages, including less downtime due to refueling and zero carbon emissions. Data analytics plays a crucial role in optimizing the performance of forklifts by providing insights into their usage patterns, maintenance requirements, and operator safety. Mast types, remote monitoring, engine power, forklift efficiency, and attachments are other essential factors driving the evolution of forklift trucks.

- Companies like Toyota and KION GROUP are leading the way in this technology, offering fuel cell-powered models to meet the demands of the market. In conclusion, the forklift truck market is witnessing a shift towards fuel cell-powered models, driven by the need for increased efficiency, operator safety, and environmental sustainability.

What challenges does the Forklift Trucks Industry face during its growth?

- The lack of adequately skilled operators poses a significant challenge to the industry's growth trajectory.

- In the dynamic business landscape of material handling and logistics, the importance of forklift trucks cannot be overstated. These versatile machines play a crucial role in streamlining operations and enhancing productivity in various industries. However, ensuring the safe and efficient use of forklifts is a significant challenge due to the complex nature of their operation. To address this challenge, several safety features have been integrated into modern forklifts, including load backrests, seatbelts, and load stabilizers. Additionally, forklift rental services offer a cost-effective solution for businesses with fluctuating demands, providing access to well-maintained equipment and trained operators. When it comes to selecting the right forklift, tire types and lifting height are essential considerations.

- Internal combustion forklifts, with their high lifting capacity and long runtimes, are popular choices for heavy-duty applications. Fleet management systems and forklift financing options help businesses optimize their forklift investments and minimize downtime. Operator training is a critical aspect of forklift safety and efficiency. With the increasing demand for skilled operators, businesses are exploring forklift customization and automation to improve productivity and reduce reliance on human operators. Forklift parts and maintenance are essential for ensuring the longevity and optimal performance of these machines. In conclusion, the material handling industry's ongoing evolution necessitates a focus on safety, efficiency, and productivity.

- By understanding the various aspects of forklift trucks, including safety features, rental options, tire types, lifting height, financing, operator training, fleet management, forklift parts, and customization, businesses can make informed decisions and optimize their operations.

Exclusive Customer Landscape

The forklift trucks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the forklift trucks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, forklift trucks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anhui Heli Co. Ltd. - The company provides cutting-edge forklift trucks, engineered with advanced technology for optimal operating performance and superior standard capabilities. These trucks ensure a comfortable driving experience and prioritize safety with their user-friendly design. By incorporating the latest innovations, we deliver exceptional value to our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anhui Heli Co. Ltd.

- BYD Co. Ltd.

- Cargotec Corp.

- Caterpillar Inc.

- CLARK Material Handling Co.

- Crown Equipment Corp.

- CVS FERRARI Spa

- Dana Inc.

- EP Equipment Co. Ltd.

- Hoist Material Handling Inc.

- Hyster Yale Materials Handling Inc.

- Jungheinrich Group

- KION GROUP AG

- Komatsu Ltd.

- Konecranes

- Manitou BF SA

- Mitsubishi Heavy Industries Ltd.

- Royal Terberg Group BV

- Sany Group

- Toyota Industries Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Forklift Trucks Market

- In February 2024, Toyota Material Handling Europe announced the launch of its new electric forklift truck series, the Toyota Tonero EV, marking a significant advancement in the electrification of forklift trucks (Toyota Press Release, 2024). This development comes as part of the global trend towards sustainable and eco-friendly industrial equipment.

- In October 2024, Kion Group and Volvo Group signed a strategic partnership to collaborate on the development of autonomous and electric forklift trucks. This collaboration aims to combine Kion's expertise in material handling and Volvo's knowledge in autonomous technologies, creating innovative solutions for the future of intralogistics (Kion Group Press Release, 2024).

- In March 2025, Crown Equipment Corporation, a leading forklift manufacturer, announced a USD100 million investment in its new manufacturing facility in Huntsville, Alabama, USA. This expansion is expected to create over 500 new jobs and increase the company's production capacity by 50% (Crown Equipment Press Release, 2025).

- In June 2025, the European Union introduced new regulations for forklift trucks, mandating the installation of rearview cameras and pedestrian warning systems to enhance workplace safety. This initiative is part of the EU's ongoing efforts to improve industrial safety standards across member states (European Parliament Press Release, 2025).

Research Analyst Overview

In the dynamic the market, various segments, including side loaders, order pickers, reach trucks, tow tractors, counterbalance forklifts, high-lift forklifts, and narrow aisle forklifts, continue to evolve. Forklift dealers expand their networks to cater to diverse industries, ensuring easy access to these essential materials handling solutions. Forklift regulations play a crucial role in market compliance, driving the demand for forklift training programs and certification. Innovations in forklift technology advancements, such as forklift automation solutions and AI, are revolutionizing operations and optimizing productivity. Forklift retrofit and upgrade services enable businesses to extend the life cycle of their existing equipment, while forklift maintenance schedules and repair services ensure uninterrupted operations.

Compliance with safety standards is paramount, with forklift safety regulations driving the need for advanced safety features and continuous improvement. Heavy-duty forklifts, forklift integration, and forklift customization cater to specific industry requirements, enhancing overall efficiency and productivity. Forklift innovation continues to push boundaries, with forklift robotics and forklift optimization leading the charge towards a more streamlined and efficient materials handling landscape. Forklift spare parts availability and forklift industry trends further influence market dynamics, ensuring a vibrant and ever-evolving market landscape for business readers.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Forklift Trucks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 26.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

China, US, Germany, Japan, UK, India, Canada, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Forklift Trucks Market Research and Growth Report?

- CAGR of the Forklift Trucks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the forklift trucks market growth of industry companies

We can help! Our analysts can customize this forklift trucks market research report to meet your requirements.