3D-Printed Composite Materials Market Size 2024-2028

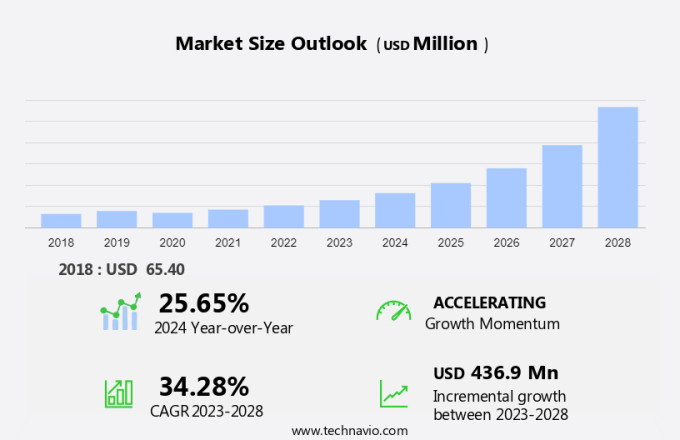

The 3D-printed composite materials market size is forecast to increase by USD 436.9 million at a CAGR of 34.28% between 2023 and 2028.

- The market is experiencing significant growth due to the superior properties of these materials, including a high strength-to-weight ratio, excellent thermal stability, and corrosion resistance. Another key trend driving market growth is the increased demand for carbon fiber composites in various industries, such as automotive, aerospace, and construction. However, the easy availability of substitutes, such as traditional composite materials and metals, poses a challenge to market growth. To stay competitive, market players are focusing on developing cost-effective production methods and improving the printability of composite materials. Overall, the market is expected to witness steady growth in the coming years, driven by advancements in technology and increasing applications in various industries.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a diverse range of materials, including carbon fiber-reinforced polymers, that are gaining significant traction in various industries due to their unique properties. Traditional composite manufacturing techniques, such as hand layup, vacuum infusion, and compression molding, have long been the norm. However, the advent of additive manufacturing technology, also known as 3D printing, is revolutionizing the production process. In the aerospace and defense sector, the demand for lightweight and high-strength materials is paramount. Composite materials, particularly carbon fiber, have become indispensable due to their ability to meet these requirements. The conflict in Ukraine, with its significant impact on conventional composite manufacturing sources, has further accelerated the adoption of 3D-printed composite materials in this industry.

- Residential construction is another sector witnessing a rise in the use of composite materials. The trend towards sustainable and energy-efficient buildings is driving the demand for lightweight, yet durable materials. Additive manufacturing technology allows for the creation of complex geometries and intricate designs, making it an attractive option for architects and builders. Raw materials used in composite manufacturing, such as powders, filaments, and liquids, are essential components of the production process. The availability and cost of these raw materials can significantly impact the market dynamics. The global markets for composite materials are influenced by various factors, including technological advancements, regulatory frameworks, and economic conditions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Carbon fiber

- Glass fiber

- Others

- Type

- Polymer matrix composites

- Metal matrix composites

- Ceramic matrix composites

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Material Insights

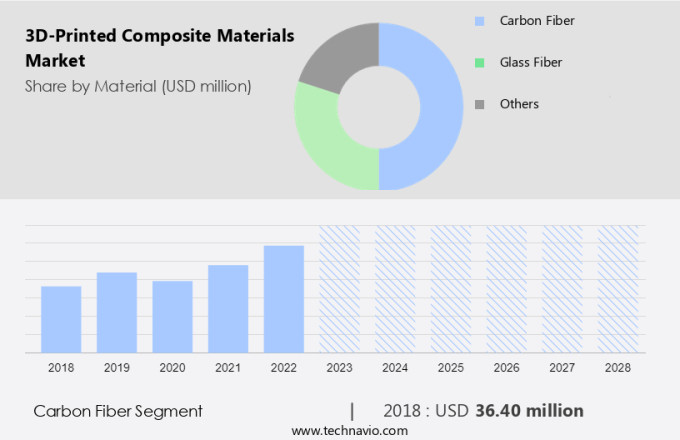

- The carbon fiber segment is estimated to witness significant growth during the forecast period.

The 3D printing of composite materials, particularly those utilizing carbon fiber, has gained significant traction in various industries. This innovation offers numerous advantages, including increased design flexibility, the production of stronger parts, and the ability to create complex geometries. The market is projected to expand substantially over the forecast period, driven primarily by the increasing demand from sectors like aerospace and automotive. The aerospace industry, in particular, benefits from the lighter weight and enhanced strength of these materials. The use of carbon fiber in 3D printing enables the creation of intricate structures and complex shapes, making it a preferred choice for manufacturing advanced components.

Furthermore, the cost-effectiveness and speed-to-market of this technology further add to its appeal. As designers continue to explore new applications for 3D-printed composite materials, the market is poised for continued growth.

Get a glance at the market report of share of various segments Request Free Sample

The carbon fiber segment was valued at USD 36.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

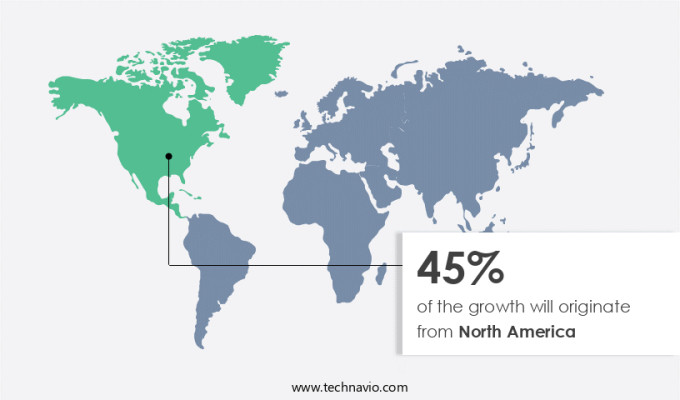

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth due to increasing investments in additive manufacturing and the increasing demand from industries such as aerospace and defense, consumer electronics, and medical. In North America, the market is thriving, driven by government investments in research and development. The use of lightweight materials in various industries, including residential construction, is also contributing to market expansion. Despite challenges such as the Ukraine conflict disrupting raw material supply chains, the market is expected to continue growing due to the benefits of 3D printing, including reduced production time and costs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of 3D-Printed Composite Materials Market?

Superior properties of composite materials is the key driver of the market.

- The market is experiencing significant growth due to its increasing adoption in various industries, including aerospace and defense, automotive, marine, electronics, and consumer goods. These materials offer superior properties compared to conventional manufacturing methods, such as a high strength-to-weight ratio, improved fire resistance, increased tear and wear resistance, chemical resistance, and design flexibility. Composites, like glass fibers and carbon fibers, have lower specific gravity than traditional metals and other substitutes, making them ideal for reducing weight in industrial applications. Additive manufacturing technology, specifically 3D printing, enables the fabrication of complex geometries and unique parts that are difficult or impossible to produce using traditional manufacturing methods.

- Thermosetting polymers and thermoplastic polymers are commonly used as the polymer matrix in 3D-printed composite materials. The manufacturing process involves the use of powders, filaments, or liquids, depending on the specific manufacturing method. Current trends in the market include the expansion of composite materials into new applications, such as isolation wards, and the use of innovative breakthrough technologies, such as lasers and heat, to improve manufacturing practicality and speed-to-market. The future of the market is expected to see continued growth in the use of additive manufacturing in the industrial sector, with an increasing focus on cost reduction and product acceptance.

What are the market trends shaping the 3D-Printed Composite Materials Market?

Increased demand for carbon fiber composites is the upcoming trend in the market.

- The market is experiencing significant growth as global industries, particularly those in the automotive and aerospace sectors, increasingly adopt this innovative technology. Carbon fiber composites, a type of composite material, are gaining popularity due to their superior strength, stiffness, and durability compared to conventional materials. These lightweight materials offer a high strength-to-weight ratio, making them ideal for reducing the weight of vehicles and improving fuel efficiency. Previously, carbon fiber composites were primarily used in the defense industry. However, their use is expanding to commercial aerospace and other sectors due to their fuel efficiency and cost savings. The aerospace industry is particularly benefiting from 3D-printed carbon fiber composites, as they enable the production of complex parts with high dimensional precision.

- Additive manufacturing technology, including 3D printing, is revolutionizing the manufacturing industry by enabling the production of unique parts with intricate designs that would be difficult or impossible to create using traditional manufacturing methods. This technology also offers design flexibility, enabling manufacturers to quickly prototype and test new products before production. Raw material suppliers are responding to the growing demand for 3D-printed carbon fiber composites by developing new products and improving existing ones. Thermosetting polymers and thermoplastic polymers are commonly used as the matrix material in composite production, while carbon fiber materials serve as the reinforcing material. The use of 3D-printed carbon fiber composites is not limited to the industrial sector.

What challenges does 3D-Printed Composite Materials Market face during its growth?

The easy availability of substitutes is a key challenge affecting the market growth.

- The market is experiencing significant growth due to the increasing adoption of additive manufacturing technology in various industries. Composite materials, including carbon fiber materials, are gaining popularity due to their superior strength, stiffness, and durability. These materials are widely used in the aerospace and defense sectors for manufacturing lightweight and fuel-efficient parts. However, the market growth is challenged by the availability of conventional composite manufacturing methods. Additive manufacturing technology, such as 3D printing, enables the fabrication of complex geometries and unique parts with high dimensional precision. The technology is also used extensively in the industrial sector for prototyping tools and manufacturing equipment components.

- Thermosetting polymers, such as epoxy and polyurethane, are commonly used as matrix materials in composite materials for 3D printing. Raw materials used in 3D-printed composite materials include powders, filaments, and liquids. Thermoplastic polymers, such as acrylonitrile butadiene styrene, polylactic acid, polyvinyl alcohol, and polyethylene terephthalate, are widely used as feedstock in 3D printing. The market is expected to expand further with the increasing trend towards innovation and breakthrough technologies in the manufacturing industry. The current trends in the market include the use of composite materials in the automotive, energy, electronics, and consumer goods industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Systems Corp.

- 3DXTech

- AREVO Inc.

- Arkema Group.

- BASF SE

- Cosine Additive Inc.

- CRP Technology Srl

- Desktop Metal Inc.

- EOS GmbH

- General Electric Co.

- Graphite Additive Manufacturing Ltd.

- Hoganas AB

- Koninklijke DSM NV

- Markforged Holding Corp.

- MATERIALISE NV

- Sandvik AB

- SLM Solutions Group AG

- Solvay SA

- Stratasys Ltd.

- Treed Filaments

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Composite materials, a class of engineered materials composed of reinforcing materials, such as carbon fibers, embedded in a polymer matrix, have gained significant attention in various industries due to their superior mechanical qualities, including strength, stiffness, and durability. The shift from conventional composite manufacturing methods to additive manufacturing (AM) technology has opened new possibilities for this material class. The aerospace and defense sector has long been a pioneer in utilizing composite materials for their lightweight properties and fuel efficiency. However, the residential construction industry is also increasingly adopting these materials for their cost-effectiveness and ease of fabrication.

Moreover. the raw materials used in composite manufacturing include thermosetting polymers, metals, ceramics, and various polymers (plastics). The workforce involved in composite manufacturing has been evolving with the introduction of AM technology. AM processes, such as powder bed fusion, filament fabrication, and binder jetting, allow for the creation of complex geometries and unique parts, which were previously challenging with traditional manufacturing methods. The global markets for composite materials have been impacted by various factors, including the Ukraine conflict and its effect on raw material supplies, as well as the increasing demand for lightweight materials in various industries. The current trends in composite manufacturing include the use of additive manufacturing technology, the development of new reinforcing materials, and the expansion into new markets, such as the electronics sector and consumer goods.

Furthermore, additive manufacturing technology has revolutionized the manufacturing industry by enabling the production of complex parts with high dimensional precision. The innovation and breakthrough technologies in this field have significantly reduced the speed-to-market for new products and prototypes. Designers and engineers can now create digital files of their intended object's configuration and bring the link to life as a finished thing using 3D printing technology. The industrial sector has been quick to adopt AM technology for manufacturing titanium parts and other components with intricate geometries. The mechanical qualities of these parts, such as strength and stiffness, are comparable to those produced using conventional manufacturing methods.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.28% |

|

Market Growth 2024-2028 |

USD 436.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

25.65 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch