5G Enterprise Market Size 2024-2028

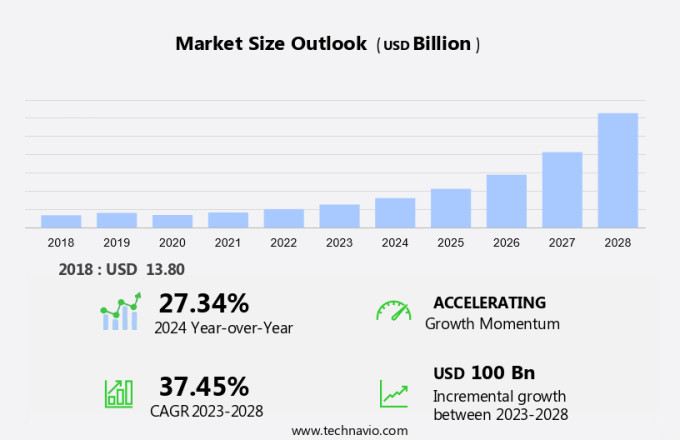

The 5G enterprise market size is forecast to increase by USD 100 billion, at a CAGR of 37.45% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption of 5G networks for smart city projects, including smart buildings, transportation, and utilities. Key trends include the deployment of 5G standalone services, end-to-end network slicing, and the development of new business models by service providers. The RAN and core network infrastructure are being upgraded to support the demands of 5G technology.

However, the high deployment cost of 5G networks remains a challenge for widespread adoption. Despite this, the potential benefits of 5G for enhancing citizen services and improving operational efficiency make it a worthwhile investment for enterprises and cities. The future of the market lies in the successful implementation of these advanced technologies and the creation of innovative use cases that leverage the unique capabilities of 5G networks.

Market Analysis

The market is experiencing significant growth due to the increasing demand for smart infrastructure and advanced technologies. 5G services, with their high-speed and low-latency connectivity networks, are revolutionizing various industries by enabling real-time data processing and communication. The network slicing technique is a key feature of 5G, allowing telecom providers to offer industry-specific solutions tailored to the unique requirements of different sectors. IoT devices, robotics, artificial intelligence, and edge computing are some of the technologies benefiting from 5G's capabilities. Smart cities, remote work, and virtual collaboration tools are also becoming more prevalent, as 5G enables seamless connectivity and edge-to-edge capabilities.

Wi-fi communication technology and 5G core network are working together to provide uninterrupted connectivity for wearable electronic devices and access equipment. Augmented reality and virtual reality applications are also gaining traction in the enterprise market, as 5G's high-speed and low-latency connectivity enables more great experiences. Private networks are becoming increasingly popular, allowing businesses to have more control over their network and ensure secure and reliable communication. Overall, 5G is transforming the enterprise landscape, offering new opportunities for innovation and growth. The 5th generation of mobile networks, 5G, is revolutionizing the enterprise market with its advanced capabilities. Smart infrastructure, IoT, robotics, artificial intelligence, and edge computing are some of the technologies benefiting from 5G's high-speed and low-latency connectivity networks.

The network slicing technique allows telecom providers to offer industry-specific solutions, while wi-fi communication technology and 5G core network provide seamless connectivity for wearable electronic devices and access equipment. Augmented reality and virtual reality applications are also gaining traction, and private networks offer more control and security. 3G and 4G networks pale in comparison to 5G's edge-to-edge capabilities, making it an essential technology for the future.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- Platform

- Software

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Service Insights

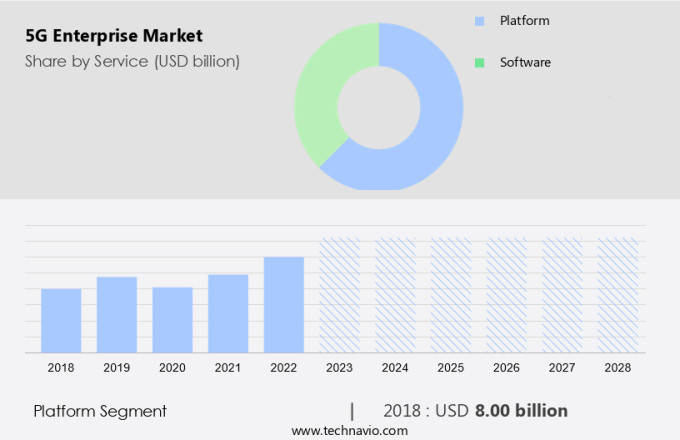

The platform segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the integration of advanced technologies such as the Internet of Things (IoT), edge computing, network slicing, and high-speed, low-latency connectivity networks. Telecom providers are offering industry-specific 5G solutions to cater to the unique requirements of various sectors. For instance, remote work and virtual collaboration tools in the healthcare industry can benefit immensely from 5G's uninterrupted connectivity. NVIDIA's NVIDIA EGX enterprise platform is an example of how 5G networks can be utilized to deploy AI-enabled applications over the cloud, enhancing organizational efficiency and enabling automation. Furthermore, the 5G platform facilitates the development of virtual network applications that can be integrated with IoT devices, creating a symbiotic relationship between the two technologies.

Edge computing and network slicing are other significant features of 5G networks that enable faster data processing and efficient resource allocation, respectively. Overall, the market is poised for substantial growth, with numerous opportunities for innovation and collaboration.

Get a glance at the market share of various segments Request Free Sample

The platform segment accounted for USD 8.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Internet of Things (IoT) technology is experiencing significant growth in industrial applications, particularly in North America, with the US and Canada leading the way. The US, as a major market in this region, is anticipated to witness notable expansion in the market due to the increasing adoption of wireless technologies. The high data traffic in North America, a result of the region's technological advancements, necessitates the deployment of high-speed, low-latency connectivity networks. In the enterprise sector, 5G technology is expected to revolutionize remote work and virtual collaboration tools, enabling seamless communication and real-time data processing. Furthermore, industry-specific 5G solutions are being developed to cater to various sectors, including healthcare, where real-time monitoring and telemedicine applications can greatly benefit from the technology's capabilities.

Telecom providers are investing heavily in 5G infrastructure to meet the growing demand for reliable and efficient connectivity solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing R&D and deployment of 5G network is the key driver of the market. The enterprise market for 5G technology is witnessing significant growth, driven by advancements in core network technology and the increasing investment in Research and Development (R&D) by key players. Service-level agreements (SLAs) and transport functions are becoming crucial aspects for Chief Information Officers (CIOs) in large enterprises as they seek to leverage the capabilities of 5G for their businesses. Software-Defined Networking (SDN) and cloud-native architecture are key enablers for 5G, allowing for more flexible and efficient communication service provider offerings. SD-WAN is also gaining traction as a solution for managing network traffic and ensuring optimal performance. In October 2019, Qualcomm Inc.

Announced USD 200 million in venture subsidies for organizations deploying 5G networks, while Ericsson has invested over USD 350 million in R&D for 5G since 2018. Huawei completed 5G New Radio testing using a 2.D GHz spectrum in January 2020, highlighting the progress being made in the 5G ecosystem. Communication service providers are increasingly focusing on licensed spectrum and mmWave technologies to expand their 5G offerings and meet the growing demand from enterprises.

Market Trends

The adoption of 5G networks for smart cities is the upcoming trend in the market. In the realm of enterprise markets, 5G technology is poised to revolutionize communication functions by offering advanced capabilities for service-level agreements (SLAs) and network reliability. Chief information officers (CIOs) in large enterprises are increasingly turning to 5G and related technologies, such as software-defined networking (SDN) and cloud-native architecture, to enhance their communication infrastructure. Communication service providers (CSPs) are investing in core network technology upgrades, including licensed spectrum and mmWave, to support the demands of 5G enterprise applications. 5G's ultra-reliable low-latency communication (URLLC) capabilities are particularly attractive to large enterprises, enabling real-time data transfer and enabling mission-critical applications such as remote surgery, autonomous vehicles, and industrial automation.

SD-WAN is also gaining traction as a complementary technology, providing optimized network connectivity and improving overall network performance. With the increasing adoption of 5G, smart cities are expected to become more efficient and interconnected, with extensive machine-type communication (MTC) applications such as smart metering, property monitoring, logistics management, and smart parking.

Market Challenge

The high deployment cost of 5G technology is a key challenge affecting the market growth. The market presents significant opportunities for transport functions, such as ultra-reliable low-latency communications and massive machine-type communications, enabling service-level agreements (SLAs) that cater to the unique requirements of large enterprises. However, the high acquisition cost of 5G technology, including the installation of small cellular networks and the limited security for outdoor power systems, poses challenges. Chief information officers (CIOs) in the telecommunications sector are under pressure to adhere to stringent regulations set by standard organizations.

Moreover, competition for pricing from customers has impacted the profit margins of communication service providers. Despite the high cost of new frequency spectrum releases, which is a challenge for the market, the adoption of software-defined networking (SDN) and cloud-native architecture can offer cost savings and improved flexibility.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AT and T Inc.: The company offers enterprises grade 5G for businesses of all sizes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- NEC Corp.

- Nokia Corp.

- Samsung Electronics Co. Ltd.

- SK Telecom Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is poised for significant growth due to the increasing demand for smart infrastructure and high-speed, low-latency connectivity networks. The 5G services, enabled by network slicing technique, are revolutionizing various industries such as IoT, robotics, artificial intelligence, smart cities, smart buildings, smart transportation, and smart utilities. The 5G core network, with its end-to-end network slicing capabilities, is enabling service providers to offer industry-specific 5G solutions to large enterprises. The 5G core network technology, including RAN and core network, is facilitating transport functions, service-level agreements, and SDN-based cloud-native architecture. The communication service providers are investing in licensed spectrum and mmWave to deliver 5G standalone services.

Further, the adoption of 5G is transforming business models in IT and telecommunications, with the integration of Wi-Fi communication technology, SD-WAN, and edge computing. The high-speed connectivity is facilitating remote work and virtual collaboration tools in sectors like healthcare, transportation, and education. The radio node segment, including massive MIMO, beamforming, and access equipment, is a key component of 5G networks. The technology is also enabling new applications like augmented reality, virtual reality, agriculture, telemedicine, and wearable electronic devices. In conclusion, the market is witnessing significant growth due to its ability to deliver high-speed, low-latency connectivity and enable new applications across various industries. The technology is transforming business models and facilitating the digital transformation of enterprises.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.45% |

|

Market Growth 2024-2028 |

USD 100 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

27.34 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AT and T Inc., Cisco Systems Inc., CommScope Holding Co. Inc., Fujitsu Ltd., Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., Juniper Networks Inc., NEC Corp., Nokia Corp., Samsung Electronics Co. Ltd., SK Telecom Co. Ltd., Telefonaktiebolaget LM Ericsson, Verizon Communications Inc., and ZTE Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.