Middle East and Africa Adult Diapers Market Size 2024-2028

The Middle East and Africa adult diapers market size is forecast to increase by USD 123.5 million at a CAGR of 4.11% between 2023 and 2028.

- The market is witnessing significant growth due to increasing awareness and adoption in developing countries. Another trend driving market growth is the rise in online sales of personal hygiene products. However, volatility in raw material prices poses a challenge to market growth. Growing populations In these regions, particularly in countries like Egypt, South Africa, and Saudi Arabia, are leading to an increase In the number of elderly individuals and individuals with disabilities, thereby fueling demand for adult diapers. Absorbent materials, such as non-woven fabrics and fibers, are being used to enhance the product's absorbency and durability while minimizing the use of disposable materials. Additionally, the convenience and discretion offered by adult diapers are leading to their increasing popularity, especially among busy working professionals and individuals with active lifestyles. Despite these growth factors, market growth may be hindered by the volatility in raw material prices, particularly for materials like superabsorbent polymers and polypropylene, which are essential components of adult diapers.

What will be the size of the Middle East and Africa Adult Diapers Market during the forecast period?

- The market caters to the growing demand for incontinence absorbent products among the geriatric population and individuals with neurological disorders, overactive bladder, and chronic health conditions such as diabetes, obesity, and urinary incontinence. The region's older population is expanding due to changing demographics and increasing life expectancy, leading to a rise in demand for adult diapers. E-commerce giants are capitalizing on this trend by offering a wide range of incontinence products, including disposable diapers and panties, for convenient online purchasing. The market is also witnessing a shift towards biodegradable and eco-friendly adult diapers made from plant-based ingredients, such as wood pulp and cotton, to address environmental concerns.

- Absorbent materials and odor control are key features driving the market's growth, with advancements in technology leading to improved product performance and comfort. Additionally, the market is witnessing an increasing demand for adult diapers designed for fecal incontinence and bowel movements.

How is this market segmented and which is the largest segment?

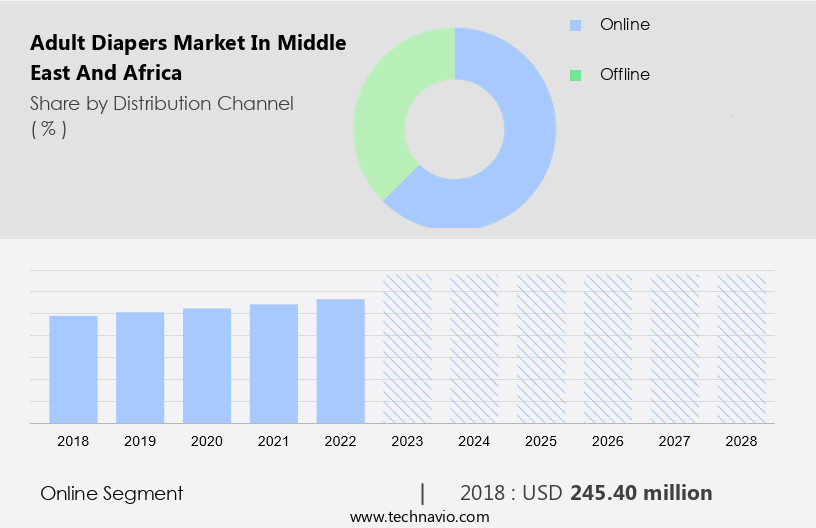

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Online

- Offline

- Product

- Pad type

- Flat type

- Pant type

- Geography

- Middle East and Africa

- Egypt

- Middle East and Africa

By Distribution Channel Insights

- The online segment is estimated to witness significant growth during the forecast period.

The market caters to the geriatric population and individuals with incontinence, neurological disorders, and mobility impairment. Incontinence absorbent products, including adult diapers, are in high demand due to chronic health conditions such as urinary incontinence, diabetes, and obesity. E-commerce giants have recognized this trend and are expanding their offerings to include adult diapers. Consumers prefer cash-on-delivery (COD) for online purchases due to concerns over online payment platforms. Key payment gateway service providers facilitate secure transactions. Biodegradable adult diapers made from plant-based ingredients and non-woven materials are gaining popularity due to environmental concerns.

The market includes various product types, such as tab-style briefs, pull-on underwear, booster pads, and adult diaper pants, catering to both male and female segments. Online sales channels offer convenience, hygiene, dignity, comfort, and confidence to adults dealing with incontinence.

Get a glance at the market share of various segments Request Free Sample

The online segment was valued at USD 245.40 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Middle East and Africa Adult Diapers Market?

Growing awareness and adoption in developing countries is the key driver of the market.

- The market caters to the growing needs of the geriatric population and individuals with neurological disorders, incontinence, and mobility impairment. Incontinence absorbent products, including disposable diapers and reusable diapers made from non-woven materials, are gaining popularity due to their ability to manage urinary and fecal incontinence effectively. The markets are witnessing growth due to changing lifestyles and the increasing prevalence of chronic health conditions such as diabetes, obesity, and dementia. E-commerce giants are capitalizing on the convenience and accessibility of online sales channels, making it easier for consumers to purchase adult diapers from the comfort of their homes.

- The market includes various product types, such as tab-style briefs, pull-on underwear, booster pads, and adult diaper pants. Absorbent materials like fluff pulp, fibers, and plant-based ingredients are used to ensure odor control, moisture-wicking fabrics, and leakage protection. The market is not limited to the elderly population but also includes individuals with urinary and fecal incontinence due to various causes, such as neurological disorders, dementia, diarrhea, and bedsores. The use of adult diapers is essential for maintaining personal hygiene, dignity, comfort, and confidence. However, environmental concerns regarding the disposal of waste from disposable diapers are a significant challenge.

What are the market trends shaping the Middle East and Africa Adult Diapers Market?

A rise in online sales of personal hygiene products is the upcoming trend In the market.

- The market caters to the needs of the geriatric population and individuals suffering from incontinence due to neurological disorders, mobility impairment, overactive bladder, and chronic health conditions such as diabetes and obesity. Incontinence absorbent products, including disposable diapers and reusable diapers made of non-woven materials like fluff pulp and fibers, are in high demand. E-commerce giants have expanded their reach in this market, offering a wide range of products, from tab-style briefs, pull-on underwear, booster pads, to adult diaper pants. Online sales channels have gained popularity due to their convenience, enabling customers to purchase discreetly and have the products delivered to their doorstep.

- The World Health Organization estimates that the older population In the MEA region is projected to double by 2050, further fueling the demand. However, environmental concerns have led to the development of eco-friendly alternatives, such as biodegradable adult diapers made of plant-based ingredients like wood pulp and cotton. Despite the growth, challenges persist, including leakage, odors, and skin irritations, leading to issues like infections, rashes, and bedsores. To address these concerns, absorbent materials with odor control, moisture-wicking fabrics, and smart technologies are being incorporated into adult diapers. Nonprofit organizations are also playing a crucial role in increasing awareness and accessibility of adult diapers, particularly in underserved communities.

What challenges does Middle East and Africa Adult Diapers Market face during the growth?

Volatility in raw material prices is a key challenge affecting the market growth.

- The market caters to the needs of the geriatric population and individuals with neurological disorders, incontinence, mobility impairment, and chronic health conditions such as diabetes and obesity. Incontinence absorbent products, including disposable diapers and reusable diapers made from non-woven materials, are in high demand due to their ability to manage urinary and fecal incontinence. The older population In the region is growing, leading to an increased need for adult diapers.

- Incontinence is a common issue among older adults, affecting approximately 20-50% of men and 30-70% of women over the age of 65. E-commerce giants have made it easier for consumers to purchase adult diapers online, with sales channels such as tab style briefs, pull-on underwear, booster pads, pants, and swim diapers available. However, environmental concerns have led to the production and use of biodegradable adult diapers made from plant-based ingredients, such as wood pulp, cotton, and other fibers. The market dynamics are influenced by factors such as changing lifestyles, increasing awareness of personal hygiene, and the availability of feminine care products.

Exclusive Middle East and Africa Adult Diapers Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abena UK Ltd.

- Chiaus (Fujian) Industrial Development Co. Ltd.

- Dentsply Sirona Inc.

- Domtar Corp.

- Essity AB

- Hayat Kimya San AS

- Hollister Inc.

- Kao Corp.

- Kimberly Clark Corp.

- Linette

- Medline Industries LP

- Ontex BV

- Paul Hartmann AG

- Principle Business Enterprises Inc.

- Rearz Inc.

- Shamsan Industry Group

- The Procter and Gamble Co.

- Tykables

- TZMO SA

- Unicharm Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the growing needs of an aging population and individuals with various chronic health conditions. This market encompasses a wide range of absorbent products designed to address urinary and fecal incontinence, overactive bladder, and neurological disorders. The geriatric population, particularly those suffering from mobility impairment or chronic health conditions such as diabetes, obesity, and neurological disorders, are the primary consumers of adult diapers. These conditions often result In the loss of bladder and bowel control, leading to the need for absorbent solutions. The market is experiencing significant growth due to changing lifestyles and increasing awareness of personal hygiene.

Moreover, incontinence is a common issue among adults, and the stigma surrounding its discussion and management is gradually decreasing. This shift in societal norms has led to an increase in demand for discreet and effective incontinence solutions. The market offers various types of adult diapers, including tab style briefs, pull-on underwear, pants, and booster pads. These products vary In their absorbency levels, designed to cater to different degrees of incontinence. The mid-range segment is particularly popular due to its balance between affordability and effectiveness. The e-commerce sector has emerged as a significant sales channel for adult diapers. E-commerce giants have recognized the growing demand for these products and have expanded their offerings to cater to this market.

Furthermore, online sales channels offer convenience, discreet shipping, and a wider selection of products compared to traditional retailing. The market for adult diapers is also driven by environmental concerns. Manufacturers are increasingly focusing on developing biodegradable and plant-based adult diapers to reduce waste and minimize the environmental impact. The market is not limited to urinary incontinence. Fecal incontinence, a less discussed yet prevalent issue, is also addressed by these products. Odor control and moisture-wicking fabrics are essential features for addressing fecal incontinence, ensuring dignity, comfort, and confidence for users.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.11% |

|

Market Growth 2024-2028 |

USD 123.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.88 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch