Europe Advanced Ceramics Market Size 2025-2029

The Europe advanced ceramics market size is forecast to increase by USD 442.6 million, at a CAGR of 3.7% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing use of medical implants and devices. The high customization requirement for end-use applications is another key factor driving market expansion. However, the high cost compared to metals and alloys remains a major challenge for market growth. The demand for advanced ceramics is expected to increase due to their superior properties such as high strength, excellent thermal shock resistance, and biocompatibility.

- The market trends also indicate the growing adoption of advanced ceramics in various industries including electronics, automotive, and aerospace. Despite the challenges, the market is expected to grow steadily due to the increasing demand for lightweight and durable materials. The customization possibilities and the ability to meet specific application requirements are also expected to provide significant opportunities for market participants.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant and dynamic sector within the broader ceramics industry. This market encompasses a diverse range of high-performance ceramic materials, each with unique properties that cater to various industries and applications. High-performance ceramics are renowned for their exceptional thermal conductivity, mechanical strength, and resistance to corrosion and abrasion. These properties make advanced ceramics indispensable in numerous sectors, including aerospace, automotive, electronics, and biomedical engineering. The production costs of advanced ceramics have been a subject of continuous research and development. Ceramic manufacturing processes have evolved significantly, with a focus on increasing efficiency and reducing waste.

- The implementation of advanced technologies, such as automated production lines and computer-aided design, has streamlined the manufacturing process and improved overall product quality. Ceramic composites have emerged as a promising area of research and development in the market. These materials combine the desirable properties of multiple ceramic phases, resulting in enhanced performance and functionality. Ceramic coatings, another subsector of the market, offer protection against wear, corrosion, and high temperatures. The increasing adoption of electric vehicles has created new opportunities for the market. Ceramic components, such as batteries and fuel cells, are essential in the production of electric vehicles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

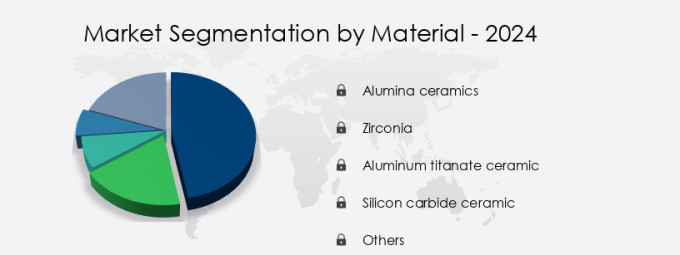

- Material

- Alumina ceramics

- Zirconia

- Aluminum titanate ceramic

- Silicon carbide ceramic

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Material Insights

- The alumina ceramics segment is estimated to witness significant growth during the forecast period.

Advanced ceramics, including alumina and titanate, are utilized extensively in various industries due to their unique properties. Alumina, also known as aluminum oxide, is a widely used ceramic material recognized for its electrical and mechanical attributes. Its high electrical insulating properties make it suitable for electronic devices, such as dielectric resonators and high-voltage semiconductor parts. Furthermore, its exceptional strength, wear, and corrosion resistance make it an ideal choice for mechanical components. Alumina ceramics are manufactured in various purities and with added elements to cater to specific end-uses. Processing techniques like slip casting, extrusion, and injection molding enable the creation of diverse shapes and sizes to meet specific application requirements.

Advanced ceramics also find applications in gas sensors, such as those used for detecting carbon monoxide and other greenhouse gases (GHG). Titanate ceramics, for instance, are used in these sensors due to their excellent piezoelectric properties. Additionally, bioceramics, a subset of advanced ceramics, are used in medical applications due to their biocompatibility and ability to mimic the properties of natural bone. Advanced ceramics play a crucial role in wireless communication technology, particularly in high-frequency applications, due to their high dielectric constants and loss tangents. Their high-temperature resistance makes them suitable for use in thermal applications, such as thermal insulators and heat exchangers.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of the market?

The use of advanced ceramics in medical implants and devices is the key driver of the market.

- Advanced ceramics, including alumina, zirconia, and silicon carbide, play a pivotal role in various industries due to their unique properties such as high-temperature resistance, chemical stability, and non-toxicity. In the energy sector, advanced ceramics are used in the production of fuel cells, solar panels, and energy-efficient components for wind turbines and electrical equipment. Space exploration relies on advanced ceramics for lightweight materials with high-strength and magnetic properties, such as ferrite and titanate, for use in electronics and structural components. The electronics sector benefits from advanced ceramics in the form of dielectric resonators, capacitor ceramics, and piezoelectric ceramics, which enhance the efficiency, speeds, and functionality of electronic devices.

- The automotive industry incorporates advanced ceramics in high-voltage semiconductor parts, engine parts, and wear parts for improved performance and durability in EVs and commercial vehicles. In the medical field, advanced ceramics are used in bioceramics, dental implants, heart pumps, joint implantation, and pacemakers, due to their biocompatibility, flexibility, and chemical resistance. Nanoceramics and nanocomposites are increasingly used in medical devices, drug delivery devices, and 3D printing for enhanced functionality and sustainability. Advanced ceramics also find applications in the military and aerospace industries for their high-tech properties, including temperature resistance, wear resistance, and chemical resistance. These materials are used in armor, circuit carriers, and engine parts, contributing to the development of more efficient and effective military and aviation technologies.

What are the market trends shaping the market?

High customization requirement for end-use application is the upcoming trend in the market.

- Advanced ceramics play a significant role in various industries, including space exploration, energy, and the electronics sector. OEMs in these industries often require customized technical ceramics for their components to enhance performance and meet specific requirements. However, the production of customized components can increase energy costs due to the additional efforts required during molding and formulation stages. For instance, in the automotive industry, high-performance ceramic components like piezoceramics and ceramic matrices are used in engine parts, bearings, and ultrasonic sensors. These materials offer high-temperature resistance, chemical stability, and excellent wear resistance. However, their production can be costly and time-consuming, limiting their widespread use in mass-produced vehicles.

- Similarly, in the medical field, bioceramics like zirconia and alumina are used in dental implants, pacemakers, and heart pumps due to their biocompatibility and high flexural strength. Nanoceramic particles and nanocomposites are also used in drug delivery devices and medical implantation due to their small size and enhanced properties. Technological advancements in ceramics, such as 3D printing and nanotechnology, have led to the production of high-tech ceramics like piezoelectric ceramics, dielectric resonators, and high-voltage semiconductor parts. These materials are used in various applications, including wireless communication, circuit carriers, and military aviation. Moreover, the increasing focus on sustainability and environmental rules has led to the use of advanced ceramics in energy and power applications like ceramic filters, furnace tubes, and wind turbines.

What challenges does the market face during the growth?

High cost compared with metals and alloys is a key challenge affecting the market growth.

- The advanced ceramics market encompasses a range of technical ceramic products utilized in various end-user industries, including defense, power and energy, aerospace, medical, and electronics. The chemical industry's expansion and Europe's continuous economic growth fuel this market's competitiveness. Commercial considerations dominate decision-making in this sector, with capital and operating costs being the primary factors. Advanced ceramics offer enhanced design and efficiency in aircraft, yet they can increase production costs. For instance, silicon carbide costs USD 36 per kg, nickel alloy USD 6.1 per kg, and lead USD 1 per kg. In the aerospace industry, lightweight materials like magnesium oxide and zirconia ceramics reduce energy consumption and improve space exploration capabilities.

- High-temperature resistance ceramics, such as alumina and titanate, are essential in high-voltage semiconductor parts and electronics sector. Sustainability is a significant trend, with advanced ceramics used in environmental rules compliance, such as ceramic filters in wind turbines and electrical equipment. Bioceramics, like dental implants and biocompatible materials, cater to the medical sector. Nanotechnology innovations, like nanoceramic particles and nanocomposites, are revolutionizing industries, from 3D printing and high-tech ceramics to piezoceramics and engine parts. The electronics sector benefits from dielectric resonators and capacitor ceramics, while the energy and power sector relies on piezoelectric ceramics in ultrasonic sensors and temperature resistance furnace tubes.

- The military aviation, commercial aviation, and passenger cars industries use advanced ceramics for armor, bearings, and engine parts. In the medical field, advanced ceramics are used in heart pumps, joint implantation, and drug delivery devices. The technological advancements in advanced ceramics offer chemical stability, biocompatibility, and fine ceramics, making them ideal for various applications. The future of advanced ceramics lies in their ability to cater to the demands of various industries while ensuring sustainability, efficiency, and cost-effectiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Blasch Precision Ceramics Inc. -The company offers advanced ceramics products such as OXYTRON 015XDII, ALTRON Alumina Bonded Silicon Carbide, and NITRON Nitride Bonded Silicon Carbide.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- BCE Special Ceramics GmbH

- CeramTec GmbH

- COI Ceramics Inc.

- Compagnie de Saint-Gobain SA

- CoorsTek Inc.

- Corning Inc.

- Dyson Technical Ceramics Ltd.

- Elan Technology Inc.

- Kyocera Corp.

- McDanel Advanced Ceramic Technologies LLC

- Momentive Performance Materials Inc.

- Morgan Advanced Materials Plc

- Nishimura Advanced Ceramics Co. Ltd.

- OC Oerlikon Corp. AG

- Ortech Advanced Ceramics

- Paul Rauschert GmbH and Co. KG

- Superior Technical Ceramics

- Vesuvius Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Advanced ceramics have gained significant attention in various industries due to their unique properties and potential applications. These materials offer high energy costs efficiency, making them an ideal choice for energy-intensive applications in sectors such as space exploration and electric vehicles (EVs). One of the key areas where advanced ceramics are making a mark is in the electronics sector. The lightweight nature of these materials makes them suitable for use in high-reliability applications, such as high-temperature resistance semiconductor parts and dielectric resonators. In addition, the magnetic properties of certain ceramics are being explored for use in electronic devices, such as resonators and magnetic sensors.

Advanced ceramics are also finding applications in the energy and power sector. For instance, they are being used in the production of high-efficiency ceramic filters for use in electrical equipment and power generation systems. Ceramic matrials are also being used in the manufacturing of fuel cells and solar panels, providing improved thermal stability and chemical resistance. Another area where advanced ceramics are making a significant impact is in the medical field. Bioceramics, such as zirconia and alumina, are being used in dental implants, pacemakers, and joint implantation due to their biocompatibility and non-toxicity. Nanocomposites and nanoceramic particles are being explored for use in drug delivery devices and medical sensors.

Further, the market is growing rapidly, driven by innovations in ceramic technology and increasing demand across various industries. Key ceramic applications in healthcare include the use of biomedical materials such as bioactive ceramics for orthopedic implants and tissue engineering. Ceramic materials science plays a crucial role in developing biomedical devices with enhanced abrasion resistance. The ceramic industry trends highlight the shift toward sustainability, with ceramic recycling and the use of green alternatives gaining importance. Ceramic engineering and ceramic design are essential for producing components for electronics, energy, automotive, aerospace, and defense sectors. Additionally, ceramic membranes and ceramic powders are vital in environmental and construction applications. As ceramic properties continue to evolve, the market is poised for significant growth, with advancements in ceramic processing and ceramic characterization setting the stage for future developments.

In addition, the use of advanced ceramics in wind turbines and photovoltaic systems is helping to reduce greenhouse gas (GHG) emissions and promote sustainability. The use of advanced ceramics in various industries is also being driven by the need for improved efficiency and speeds. For example, in the EV industry, advanced ceramics are being used in battery components and fuel cells to improve energy density and charging times. In the electronics sector, advanced ceramics are being used in high-voltage semiconductor parts and circuit carriers to improve the speed and reliability of electronic devices. In conclusion, advanced ceramics are a versatile class of materials with a wide range of applications in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2025-2029 |

USD 442.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

Germany, Italy, UK, France, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch