Aerosol Whipped Cream Market Size 2024-2028

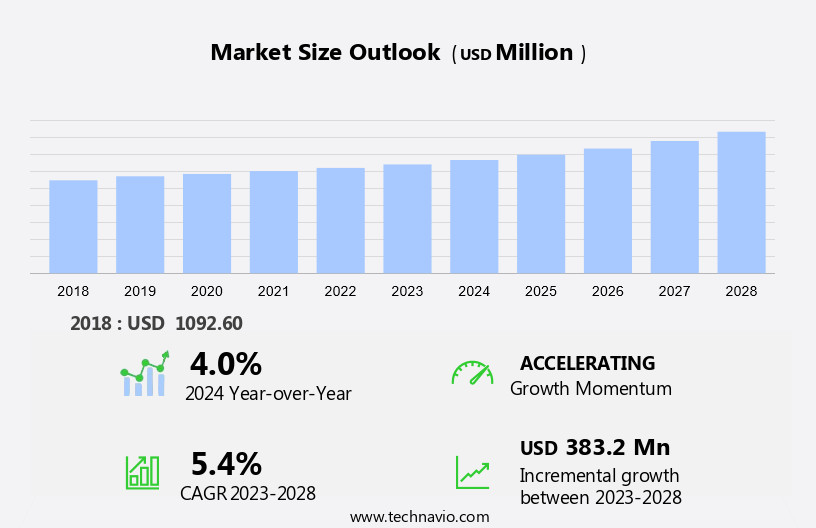

The aerosol whipped cream market size is forecast to increase by USD 383.2 million, at a CAGR of 5.4% between 2023 and 2028.

- The market is experiencing significant growth, driven by the launch of unique flavors and the strong expansion of vegan options. Consumers' increasing preference for plant-based products, coupled with their growing health and wellness consciousness, is fueling this trend. Consumers can easily swirl the cream on their frozen desserts or beverages without the need for utensils such as a whisk or fork. The market analysis also reveals that the demand for convenient and portable whipped cream dispensers is on the rise, particularly In the foodservice industry. Furthermore, the market is witnessing advancements in aerosol technology, enabling the production of high-quality whipped cream with improved texture and stability. These factors collectively contribute to the market's positive growth trajectory.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and distribution of pressurized containers filled with fine particles that create an airy foam-like consistency for use as a topping on various food and beverage items. This market caters to consumer demand for convenience and ease of use, offering ready-to-use alternatives to traditional methods such as whisking heavy whipping cream with a fork or whisk. It is popular for its ability to create intricate designs like rosettes and swirls, making it a preferred choice for desserts and beverages. The market's growth is driven by the increasing popularity of aerosol-dispensed whipped cream as a versatile and convenient alternative to traditional methods.

- Furthermore, the use of stabilizers, flavourings, and sugar in aerosol whipped cream enhances its taste and texture, while the long shelf life and preservative-free options cater to health-conscious consumers. The invention has revolutionized the way consumers enjoy their desserts and beverages, offering a quick and easy solution for adding a fluffy topping without the need for additional tools or equipment.

How is this Aerosol Whipped Cream Industry segmented and which is the largest segment?

The aerosol whipped cream industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Non-dairy-based

- Dairy-based

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

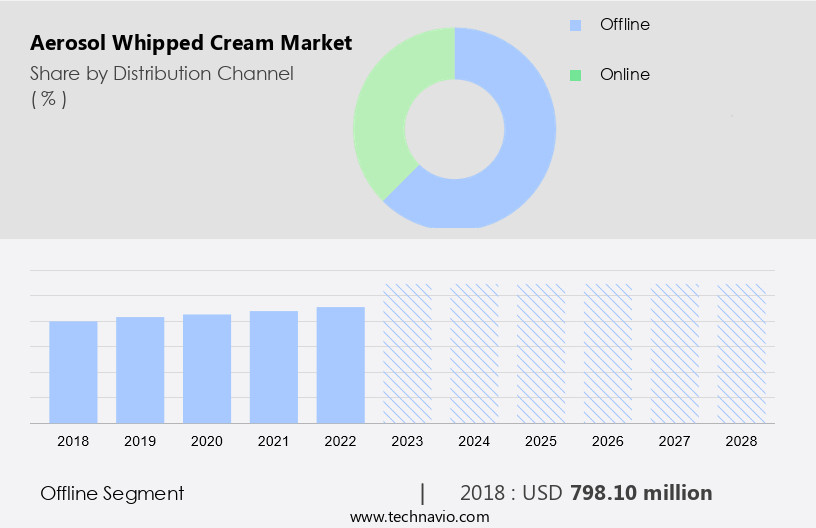

- The offline segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the convenience and ease of use offered by pressurized containers. These canisters dispense fine particles that form an airy foam-like consistency, ideal for use as a fluffy topping on desserts, beverages, and cakes. Traditional retail channels, including supermarkets, hypermarkets, convenience stores, and specialty food outlets, continue to dominate the market due to their extensive reach and the tangible advantages they provide consumers, such as product inspection and immediate purchase decisions. Retailers effectively merchandise whipped cream products near complementary items to drive impulse purchases and cross-selling opportunities. Seasonal promotions, in-store demonstrations, and bundled offerings further boost sales during peak periods.

Get a glance at the Aerosol Whipped Cream Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 798.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

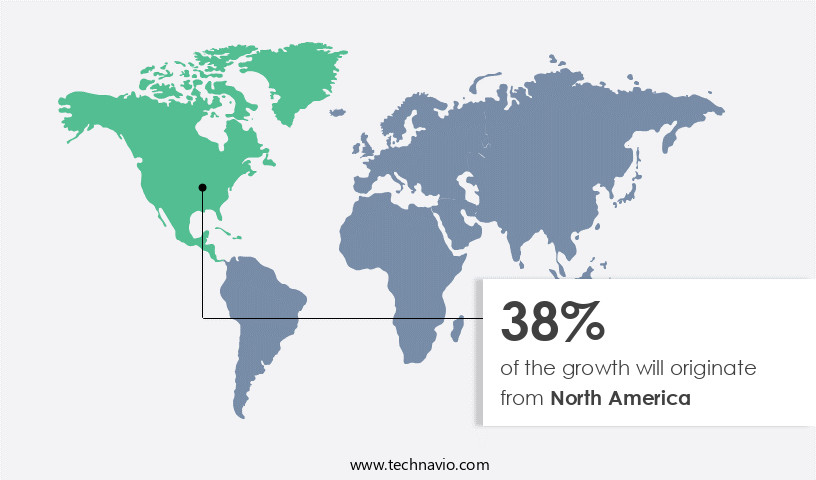

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for aerosol whipped cream is witnessing notable growth due to increasing consumer preference for convenience and the introduction of new product innovations. Alamance Foods, a leading player, recently announced a USD42 million investment to expand its North Carolina facility, focusing on enhancing aerosol whipped cream production. This investment underscores the market's potential and North America's strategic importance In the global aerosol whipped cream industry. The expansion is expected to boost production capacity, streamline supply chains, and facilitate the launch of new product lines. Aerosol whipped cream, a fine particles dispensation in a pressurized canister, offers an airy foam-like consistency, making it a popular choice for desserts, beverages, and as a topping for various foods.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aerosol Whipped Cream Industry?

Launch of unique flavors is the key driver of the market.

- The market is undergoing significant growth due to the increasing popularity of aerosol-dispensed, ready-to-use food toppings. These convenient products offer an airy foam-like consistency with fine particles, making them an ideal choice for various desserts and beverages. Brands are focusing on innovation by introducing new flavors, such as Apple Crisp and Peppermint Mocha, to cater to evolving taste preferences and attract consumers. These unique offerings not only enhance consumer interest but also encourage trial and repeat purchases, contributing to market expansion. The convenience of using a pressurized container with a nozzle or valve system allows for easy application, swirling, and creating a fluffy topping without the need for whisking or forks.

- Furthermore, preservative-free, low-fat options are also available, extending the market's appeal. The whipping process involves beating air into milk proteins, forming lipid crystals and partial coalescence, resulting in a stiff-foamed product. Proper processing parameters, such as heat treatment, pasteurization, homogenization, and creaming, are crucial to ensure a stable and desirable texture and shelf life. Emulsifiers and stabilizers play a vital role in preventing separation and coarse foam formation, while maintaining the taste and taste experience. Overall, the market is revolutionizing the dessert and beverage industry with its ease of use, long shelf life, and diverse offerings.

What are the market trends shaping the Aerosol Whipped Cream Industry?

Strong growth of vegan whipped cream is the upcoming market trend.

- The market is undergoing notable advancements due to the rising preference for food toppings that offer convenience and an airy, foam-like consistency. Pressurized containers filled with heavy whipping cream, sugar, flavorings, and stabilizers are driven from canisters through a valve system, creating fine particles that easily swirl atop desserts and beverages. This luxury product, which revolutionized the way we apply whipped cream, provides a taste and texture that rivals traditional whisking or forking methods. Recently, the market has witnessed significant growth, particularly In the vegan segment, as consumers prioritize health, sustainability, and ethical considerations. In response to this trend, leading producers, such as Alamance Foods In the US, have introduced vegan options with bases derived from oat, coconut, and almond.

- In addition, these innovations offer consumers a wide range of choices while maintaining the ease of use and convenience associated with aerosol-dispensed whipped cream. The whipping process involves the formation of lipid globules, air bubbles, and milk proteins, which can be influenced by processing parameters such as heat treatment, pasteurization, homogenization, and creaming. Emulsifiers and stabilizers play crucial roles in preventing separation and coalescence, ensuring the desired overrun and foam stability. By catering to the evolving consumer preferences and maintaining the convenience and versatility of aerosol whipped cream, this market is poised for continued success.

What challenges does the Aerosol Whipped Cream Industry face during its growth?

Growing health consciousness among consumers is a key challenge affecting the industry growth.

- The market is experiencing shifts due to evolving consumer preferences. Health consciousness is driving demand for alternatives to traditional whipped creams in pressurized containers. These products, which often contain heavy whipping cream, sugar, flavorings, stabilizers, and propellants, are under scrutiny for their high saturated fat content and artificial additives. Consumers are increasingly critical of preservatives, stabilizers, and artificial sweeteners found in aerosol whipped creams. In response, there is a growing trend towards natural and clean-label alternatives. Furthermore, the rising prevalence of lactose intolerance and dairy allergies is limiting market potential. The whipping process for aerosol whipped cream involves homogenization, lipid crystallization, and partial coalescence to create fine particles with an airy foam-like consistency.

- However, these processes can result in mechanical damage to milk proteins and the formation of lipid crystals, which may affect taste and texture. To cater to this changing landscape, manufacturers are focusing on developing preservative-free, low-fat, and non-dairy alternatives. These innovations are expected to revolutionize the market by offering convenience and ease of use without compromising on taste and texture. The new generation of aerosol-dispensed whipped creams is ready-to-use and swirls effortlessly onto desserts, beverages, and even as a topping for fruits. The valve system ensures consistent overrun and the emulsifiers maintain the foam's stability, making it a luxury product for consumers seeking a fluffy, stiff-foamed topping for their favorite desserts, cakes, and beverages.

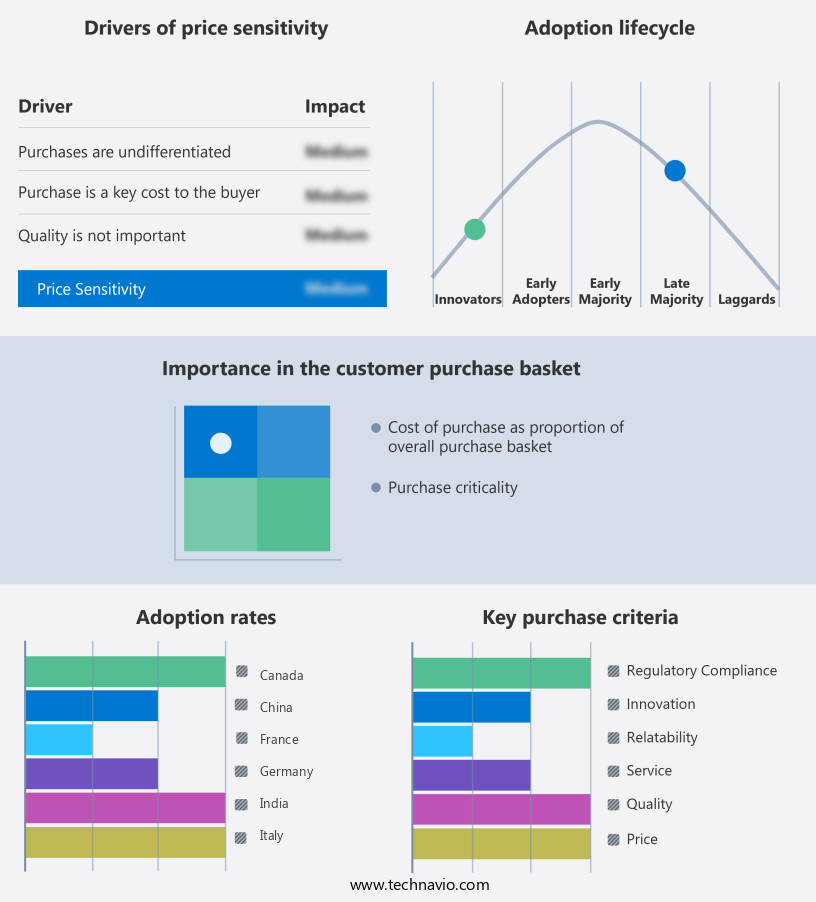

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Carmen Desserts

- CLOVER S.A. Pty Ltd.

- Conagra Brands Inc.

- Dairy Farmers of America Inc.

- Fayrefield Foods AS

- Fonterra Cooperative Group Ltd.

- Gay Lea Foods Co operative Ltd.

- Hannaford Bros. Co. LLC

- Hiland Dairy

- Kemps LLC

- Land O Lakes Inc.

- Producers Dairy Foods Inc.

- Staple Dairy Products Ltd.

- Uhrenholt AS

- US Foods Holding Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment withIn the broader food industry, characterized by the production and distribution of ready-to-use, aerosol-dispensed whipped toppings. These products offer consumers the convenience of a fine, airy foam-like consistency that adds a luxurious touch to various desserts and beverages. The core components of aerosol whipped cream include heavy whipping cream, sugar, flavorings, food stabilizers, and a propellant. The cream undergoes a specialized whipping process, which involves the incorporation of air bubbles to create a stiff-foamed product. The use of a pressurized container, equipped with a nozzle, facilitates the dispensing of the whipped cream in a controlled manner.

In addition, the convenience offered by aerosol whipped cream is a primary driver for its popularity. Moreover, the long shelf life of these products ensures their availability for extended periods, making them a reliable choice for both commercial and domestic use. The production process for aerosol whipped cream involves several stages, including homogenization, pasteurization, and heat treatment. These processes contribute to the standardization of the cream's fat content and ensure a consistent texture and taste. However, the use of preservatives and additives, such as emulsifiers and stabilizers, may be a concern for some consumers seeking preservative-free, low-fat alternatives.

Furthermore, the invention of aerosol whipped cream revolutionized the way consumers enjoy their desserts and beverages by offering a convenient, ready-to-use alternative to traditional whipped cream. The valve system employed In these containers allows for precise control over the dispensing of the foam, ensuring that each serving maintains its airy consistency. Despite the convenience and luxury appeal of aerosol whipped cream, there are challenges associated with its production. Mechanical damage during processing can lead to the separation of lipid globules and the formation of coarse foam. Partial coalescence and the serum phase can also impact the final product's texture and taste.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2024-2028 |

USD 383.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.0 |

|

Key countries |

US, Canada, Mexico, UK, China, Germany, Japan, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aerosol Whipped Cream Market Research and Growth Report?

- CAGR of the Aerosol Whipped Cream industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aerosol whipped cream market growth of industry companies

We can help! Our analysts can customize this aerosol whipped cream market research report to meet your requirements.