Food Stabilizers Market Size 2024-2028

The food stabilizers market size is forecast to increase by USD 725.8 million at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for convenience foods and the expanding utilization of food stabilizers in gluten-free products. Jellies, fillings, puddings, marmalades, ice cream, sauces, and soups are some of the major food categories that extensively use food stabilizers to enhance their texture and shelf life. Additionally, the rising trend towards low-calorie and dietetic foods is driving the demand for food stabilizers that help maintain the desired consistency and stability without adding excessive calories. However, ethical concerns surrounding the use of animal-derived food stabilizers are posing challenges to market growth. To cater to evolving consumer preferences, manufacturers are focusing on developing clean label products using plant-based stabilizers such as Hamilton.

The food stabilizers market is a significant sector in the food industry, focusing on the production and sales of food stabilizers used in various packaged food products. Food stabilizers play a crucial role in preserving foods, preventing ice crystal formation, and ensuring proper settling during manufacturing and storage. In the context of packaged food products, food stabilizers are essential additives that maintain the desired texture, appearance, and consistency. These additives are widely used in various food categories, including beverages, cakes, jellies, fillings, puddings, marmalades, ice cream, sauces, and soups. Fruit settling is a common issue in food processing, particularly in beverages and jams. Food stabilizers, such as hamulsion, alginate, agar, guar gum, cellulose, and cellulose derivatives, are employed to prevent fruit settling and maintain homogeneity in the final product. Ice crystal formation is another challenge in the food industry, particularly in frozen and chilled food products.

Additionally, food stabilizers, such as alginate, agar, and cellulose derivatives, are used to inhibit ice crystal growth and maintain the desired texture and quality. The food stabilizer market is driven by the increasing demand for extended shelf life, improved texture, and enhanced consumer experience in packaged food products. The market is segmented into bakery/confectionery, meat/poultry, sauces and dressings, and other food categories. Bakery/confectionery products, such as cakes and pastries, rely on food stabilizers to maintain their structure and texture. Alginate, agar, and guar gum are commonly used as food stabilizers in this segment. Meat and poultry products require food stabilizers to maintain their texture and prevent syneresis, a condition where water separates from the food product. Cellulose and cellulose derivatives are widely used as food stabilizers in this segment. Sauces and dressings, including beverages, require food stabilizers to prevent separation and maintain their consistency. Alginate, agar, and guar gum are commonly used as food stabilizers in this segment.

Market Segmentation

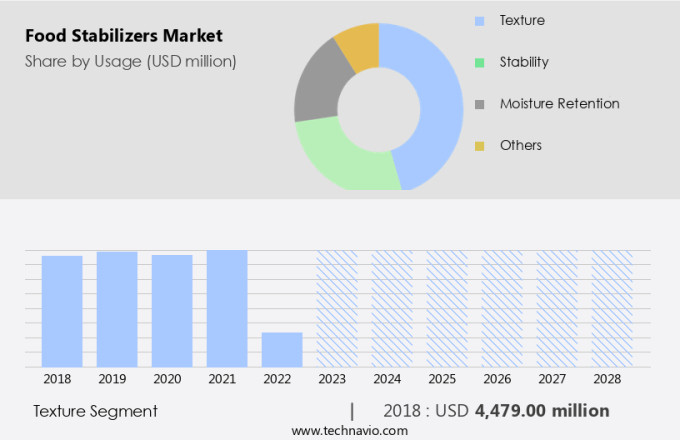

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Usage

- Texture

- Stability

- Moisture retention

- Others

- Application

- Dairy and dairy products

- Bakery

- Confectionery

- Beverages

- Sauces and dressings and others

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Usage Insights

The texture segment is estimated to witness significant growth during the forecast period. Food stabilizers play a pivotal role in maintaining the desired texture and consistency in various food products, enhancing their overall quality and shelf life. In the global market for food stabilizers, the texture segment holds a substantial position, accounting for a significant market share. Hydrocolloids, proteins, and starches are the primary stabilizers used in this segment, contributing to the creation and preservation of texture in dairy products, sauces, dressings, baked goods, and confectionery items. Hydrocolloids, in particular, are widely utilized due to their ability to form gels, thicken liquids, and stabilize emulsions. These stabilizers provide the desired texture and mouthfeel to food products, ensuring consumer satisfaction.

Pectin, a plant-derived hydrocolloid, is a popular choice for stabilizing acidified milk products, such as yogurt and cheese spreads. Leading food stabilizer manufacturers, including Tate & Lyle and Palsgaard, offer a diverse range of food stabilizer ingredients to cater to the varying texture requirements of different food products. The use of food stabilizers not only enhances the texture and mouthfeel of food products but also extends their shelf life, ensuring consumer satisfaction and trust in the brand.

Get a glance at the market share of various segments Request Free Sample

The texture segment accounted for USD 4.48 billion in 2018 and showed a gradual increase during the forecast period.

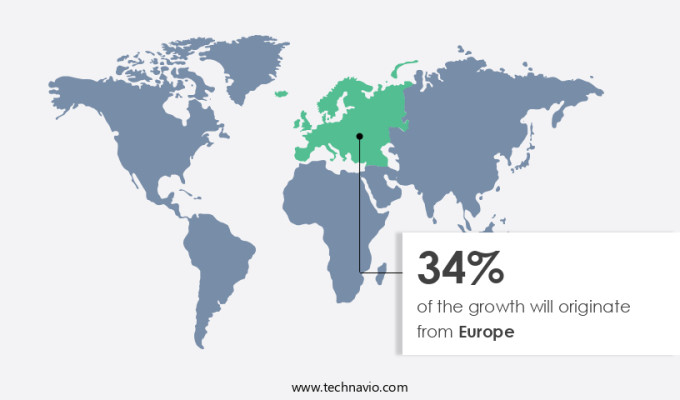

Regional Insights

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the European market, there is a significant increase in the consumption of ready-to-eat (RTE) food products and ready-to-drink (RTD) beverages in countries like Germany, the UK, and France. The popularity of baked goods, confectionery, instant foods, convenient meals, and dairy products is on the rise in this region. This trend is driven in part by the extensive use of food stabilizers, such as hydrocolloids, in these food and beverage items. The National Confectioners Association reports that gummy candies, a popular confectionery item, are a significant contributor to this market. Food stabilizers are essential in maintaining the desired aroma, color, texture, and flavor in these products.

Moreover, the HoReCa (Hotel, Restaurant, and Café) category is a significant consumer of food hydrocolloids due to the high demand for stable and consistent food products in the foodservice industry. For instance, the European foodservice market is expected to grow at a steady pace, with an increasing number of fast-food chains and restaurants opening in the region. According to Flavor and Fragrance, a leading market research firm, McDonald's plans to open 50 new restaurants across the UK during the forecast period, further increasing the demand for food hydrocolloids.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand for food stabilizers in convenience foods is the key driver of the market. The consumption of packaged food has experienced significant growth in both developed and emerging economies, leading to an increased demand for food stabilizers. Food stabilizers play a crucial role in preserving the texture, appearance, and shelf life of various food products. In particular, they help prevent ice crystal formation during freezing and fruit settling in beverages. With economic progress and rising disposable income levels, the food market demand for packaged food and processed items has been on the rise. Convenience foods, which are easy to consume, portion-controlled, and have extended shelf life, have gained popularity due to their time-saving and convenient packaging.

Technological advancements in the food industry have expanded the range of convenience foods, offering more options such as microwave-friendly packaging, prepared mixes, and various portion sizes. The global food stabilizer market is expected to continue its growth trajectory, driven by the increasing demand for packaged food and the need to preserve food quality and extend shelf life.

Market Trends

The growing utilization of food stabilizers in gluten-free products is the upcoming trend in the market. The market encompasses a range of applications including jellies, fillings, puddings, marmalades, ice cream, sauces, and soups. These food products require stabilizers to maintain their texture, consistency, and shelf life. Low-calorie and dietetic foods are also included in this market, as stabilizers help to preserve the nutritional value and mouthfeel of these items. Some common food stabilizers are pectin, carrageenan, and xanthan gum. In the US, the demand for gluten-free food products has grown significantly due to the increasing prevalence of Celiac disease. According to the US Department of Health and Human Services (HHS), approximately 2 million Americans have Celiac disease, and about 1% of the global population is affected.

This has resulted in the development and popularity of gluten-free alternatives to traditional food products, such as gluten-free jellies, fillings, puddings, and sauces. These food items often utilize alternative stabilizers, such as cornstarch or guar gum, to replace wheat-based stabilizers. Clean label products, which contain minimal processing and easily recognizable ingredients, are also gaining traction in the market.

Market Challenge

Ethical issues with animal-derived food stabilizers is a key challenge affecting the market growth. Food stabilizers, essential components in processed food products, include traditional hydrocolloids derived from animal sources. These raw materials, such as gelatin from cattle and pig bones, casein from milk, and chitosan from crustacean shells, have been subject to ethical debates due to concerns over animal welfare, environmental impact, and cultural and religious sensitivities. Gelatin, a significant animal-derived food hydrocolloid, is used in various applications, including dressings, sauces, and confectionery items. However, its production involves the utilization of animal byproducts, which can raise ethical questions. Food prices, energy prices, and raw material costs are critical factors influencing the food additives and ingredients industry, including the market for food stabilizers.

Low-income consumers' purchasing power also plays a role in market dynamics. Customized food products, such as beverages and cakes, require stabilizers to maintain their texture and consistency. As consumers demand more natural and sustainable food alternatives, the demand for plant-based food stabilizers is increasing. In conclusion, the use of animal-derived food stabilizers remains a topic of ethical debate due to concerns over animal welfare, environmental impact, and cultural and religious values. The food additives and ingredients industry, including the market for food stabilizers, is influenced by factors such as raw material costs, energy prices, food prices, and consumer preferences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co: The company offers food-grade emulsifiers and stabilizers such as polyol and lecithin.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arthur Branwell and Co. Ltd.

- Ashland Inc.

- Avlast Hydrocolloids

- Cargill Inc.

- Condio GmbH

- Crest Foods Co. Inc.

- DuPont de Nemours Inc.

- Fiberstar Inc.

- Givaudan SA

- Hydrosol GmbH and Co. KG

- Ingredion Inc.

- J M Huber Corp.

- Kerry Group Plc

- NEXIRA

- Palsgaard AS

- RPM International Inc.

- Superior sp. z o.o.

- Tate and Lyle PLC

- YOGIRAJ RESIN AND POLYCHEM PVT. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Food stabilizers are essential additives used in the production of various packaged food items to maintain their quality and extend their shelf life. The food stabilizer market has seen significant growth due to the increasing demand for preserving foods, especially in economically developing regions where scarce resources make it challenging to ensure food stability. Ice crystal formation and fruit settling are common issues addressed by food stabilizers in products like beverages, cakes, jellies, fillings, puddings, marmalades, ice cream, sauces, and soups. Food stabilizer sales have been influenced by factors such as raw material costs, energy prices, and food prices. Manufacturers have responded by producing customized food products using ingredients like pectin, phosphates, and gums and hydrocolloids derived from plant sources.

Further, the market demand for food stabilizers is driven by the production of processed food products, which include dairy and desserts, bakery/confectionery, meat/poultry, sauces and dressings, quick-service restaurants, savory snacks, gummy candy, and low-calorie or dietetic foods. Consumer preferences for clean label products and acidified milk products have also influenced the food stabilizer market. Texturants, emulsifiers, and stabilizers like hamulsion, alginate, agar, guar gum, cellulose, and cellulose derivatives are widely used to enhance food product quality, including aroma, color, texture, and shelf life. The World Health Organization has set guidelines for the safe use of food additives and food stabilizers, ensuring their continued use in the food industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 725.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, Germany, UK, China, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Archer Daniels Midland Co., Arthur Branwell and Co. Ltd., Ashland Inc., Avlast Hydrocolloids, Cargill Inc., Condio GmbH, Crest Foods Co. Inc., DuPont de Nemours Inc., Fiberstar Inc., Givaudan SA, Hydrosol GmbH and Co. KG, Ingredion Inc., J M Huber Corp., Kerry Group Plc, NEXIRA, Palsgaard AS, RPM International Inc., Superior sp. z o.o., Tate and Lyle PLC, and YOGIRAJ RESIN AND POLYCHEM PVT. LTD. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch