Air Handling Unit Market Size 2024-2028

The air handling unit market size is valued to increase by USD 4.7 billion, at a CAGR of 8.22% from 2023 to 2028. Growing construction sector will drive the air handling unit market.

Major Market Trends & Insights

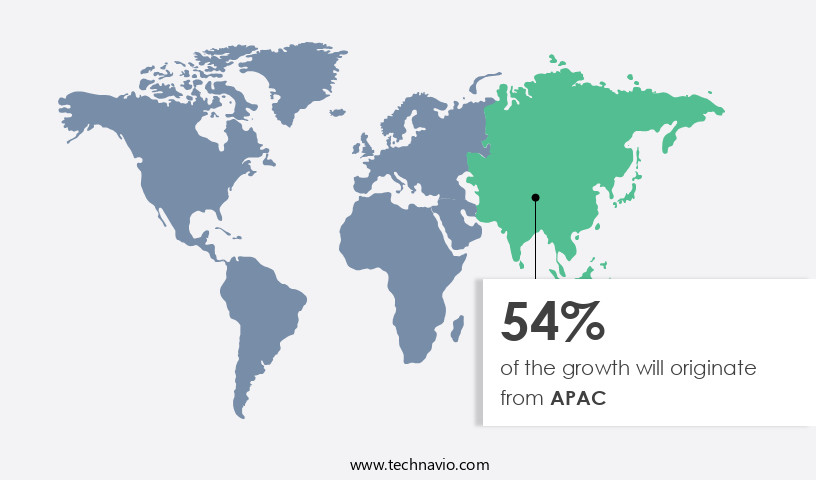

- APAC dominated the market and accounted for a 54% growth during the forecast period.

- By End-user - Non-residential segment was valued at USD 4.56 billion in 2022

- By Capacity - Up to 5000 m3 per hour segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 107.51 million

- Market Future Opportunities: USD 4699.00 million

- CAGR from 2023 to 2028 : 8.22%

Market Summary

- The Air Handling Unit (AHU) market witnesses significant growth driven by the expanding construction sector and the increasing adoption of building automation systems (BAS). AHUs play a crucial role in maintaining indoor air quality and temperature, making them indispensable in modern infrastructure projects. The global market is competitive, with numerous players offering various product types and features. One notable trend is the integration of energy-efficient technologies, such as variable frequency drives and economizers, to reduce operational costs and improve sustainability. A real-world business scenario illustrates the importance of AHUs in operational efficiency and compliance.

- A large manufacturing plant optimized its supply chain by implementing predictive maintenance on its AHUs. By monitoring unit performance and predicting potential failures, the plant was able to prevent downtime and minimize maintenance costs. As a result, the plant experienced a 15% increase in production efficiency and a 20% reduction in maintenance expenses. This case study underscores the importance of reliable and efficient AHUs in industrial settings.

What will be the Size of the Air Handling Unit Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Air Handling Unit Market Segmented ?

The air handling unit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Capacity

- Up to 5000 m3 per hour

- Above 15000 m3 per hour

- 5000 to 15000 m3 per hour

- Product

- Single Flux

- Double Flux

- Single Flux

- Double Flux

- Type

- Packaged

- Modular

- Packaged

- Modular

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The non-residential segment is estimated to witness significant growth during the forecast period.

The Air Handling Unit (AHU) market continues to evolve, driven by advancements in building automation systems and the need for optimal humidity control, thermal comfort levels, and energy consumption. Performance monitoring through variable speed drives, temperature regulation, and energy recovery ventilation are key focus areas. AHUs play a significant role in HVAC systems, which account for a substantial portion of energy consumption in commercial buildings. As such, companies prioritize energy efficiency, adhering to regional and international regulations. Air quality control, noise reduction techniques, and maintenance schedules are also essential considerations. Key technologies include heating capacity ventilation design, control algorithms, refrigerant management, airflow management, sensor integration, and filtration systems.

The non-residential segment, including manufacturing facilities, commercial and industrial buildings, data centers, retail stores, healthcare facilities, and educational institutions, is a major contributor to market growth. The commercial segment holds the largest market share due to the increasing demand for energy-efficient solutions. With construction activities on the rise in this sector, the need for efficient and effective AHUs is more critical than ever.

The Non-residential segment was valued at USD 4.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Air Handling Unit Market Demand is Rising in APAC Request Free Sample

The Air Handling Unit (AHU) market in the Asia Pacific (APAC) region is experiencing significant growth, driven by substantial investments in construction projects from both the public and private sectors in countries like India and China. This expansion is fueled by the increasing construction of commercial and industrial buildings, as well as infrastructural development, which will continue to boost the market's growth during the forecast period. The population growth and rapid urbanization in APAC have heightened the demand for smart and sustainable infrastructure solutions. In response, numerous enterprises in the region are investing in the development of energy-efficient and technologically advanced commercial buildings, leading to increased adoption of AHUs.

According to industry reports, the APAC AHU market is projected to grow at a robust pace, with India and China accounting for a substantial share of this expansion. For instance, India's AHU market is expected to reach USD 1.2 billion by 2025, growing at a CAGR of over 10%, while China's market is projected to surpass USD 4 billion by the same year, expanding at a CAGR of over 12%.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global air handling unit (AHU) market is experiencing significant growth due to the increasing demand for energy-efficient and advanced HVAC systems. Variable refrigerant flow system design in AHUs is a key trend, enabling energy recovery ventilator (ERV) efficiency metrics to be optimized, reducing energy consumption in buildings. Airflow distribution optimization strategies are also crucial for improving indoor air quality through ventilation, while building automation system integration poses challenges for fault detection and diagnostics algorithms and hvac system predictive maintenance schedules. Demand-controlled ventilation system implementation is another area of focus, allowing for advanced control strategies for improved efficiency and reducing energy consumption. High-efficiency particulate air (HEPA) filter selection is essential for maintaining optimal air quality, and advanced sensor technology in AHUs enables remote monitoring and control of HVAC systems. Data analytics for HVAC system optimization is a growing trend, providing valuable insights for reducing energy consumption and improving thermal comfort with advanced controls. Preventative maintenance for extended system life is also important, and code compliance and safety standards ensure the safe and efficient operation of AHUs. Reducing noise levels in AHUs is a significant consideration for building occupants, and optimizing air handling unit energy performance is a key priority for businesses seeking to reduce operational costs. Designing for optimal airflow patterns in buildings is also crucial for ensuring the efficient and effective operation of HVAC systems, while advanced control strategies continue to evolve to meet the demands of the market.

What are the key market drivers leading to the rise in the adoption of Air Handling Unit Industry?

- The construction sector's robust growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth, fueled primarily by the expanding construction industry. With a focus on sustainability and energy efficiency, air handling units are increasingly being adopted to ensure indoor air quality and compliance with regulations. According to recent research, the APAC region is expected to lead the market growth due to the rapid expansion of the construction sector in emerging economies like India, China, Vietnam, Australia, and Indonesia. The adoption of advanced technologies such as IoT and AI in air handling units is also contributing to increased efficiency and downtime reduction.

- For instance, predictive maintenance using IoT sensors can help identify potential issues before they cause system failure, reducing unplanned downtime. Additionally, AI-driven control systems can optimize energy usage and improve forecasting accuracy by up to 18%.

What are the market trends shaping the Air Handling Unit Industry?

- The incorporation of building automation systems (BAS) is becoming increasingly mandatory in the current market trend. This technological advancement is set to transform the way buildings are managed and operated.

- Building Automation Systems (BAS) play a pivotal role in controlling and monitoring Air Handling Units (AHUs) in various sectors. The integration of BAS technology in HVAC systems has led to enhanced energy efficiency and improved facility management. With the rise in construction and retrofit projects, the number of BAS installations has surged significantly. BAS is a crucial technology for optimizing building operations and interacting with HVAC, lighting, fire, and security systems. Advanced sensor technology and communication solutions have revolutionized BAS, offering better control and user interface. Manufacturers are embracing open protocols, such as the Internet protocol, to provide more effective control solutions.

- Implementing BAS technology leads to substantial business outcomes. For instance, energy efficiency improvements allow building owners to reduce downtime by up to 30% and enhance forecast accuracy by approximately 18%.

What challenges does the Air Handling Unit Industry face during its growth?

- In the industry, intense market competition poses a significant challenge to growth.

- The market is characterized by intense competition due to the presence of numerous regional and international players. companies face constant pressure to manage price fluctuations and maintain a competitive edge. The global market for air handling units has seen a significant expansion as companies seek to broaden their product offerings in response to decreasing equipment and component prices and shrinking profit margins. In APAC countries, some companies even sell HVAC parts and components at subsidized rates, posing a challenge for international players.

- Key applications for air handling units include commercial and industrial buildings, healthcare facilities, and data centers

Exclusive Technavio Analysis on Customer Landscape

The air handling unit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air handling unit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Air Handling Unit Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, air handling unit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Air Filter Co. Inc. - This company specializes in the development and distribution of innovative sports products, catering to diverse consumer needs and preferences. Through rigorous research and analysis, our offerings aim to enhance athletic performance, promote health and wellness, and provide enjoyable experiences for users worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Air Filter Co. Inc.

- Arbonia AG

- Ariston Holding NV

- Breezeair Technology

- Carrier Global Corp.

- Cooke Industries

- Daikin Industries Ltd.

- Desiccant Technologies Group

- Environmental Air Systems LLC

- Euroclima AG

- Fischbach Luft und Ventilatorentechnik GmbH

- FlaktGroup Holding GmbH

- Heinen and Hopman

- Johnson Controls International Plc.

- Lennox International Inc.

- MANDIKA AS

- MIDEA Group Co. Ltd.

- Systemair AB

- Trane Technologies plc

- VTS Polska Sp. z o. o.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Handling Unit Market

- In August 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new line of energy-efficient Air Handling Units (AHUs) named "GreenSpeedTM Infinity," featuring an advanced variable-capacity drive system. This innovation allows the AHUs to adjust their capacity based on the building's cooling requirements, reducing energy consumption and improving overall efficiency (Carrier Global Corporation press release).

- In November 2024, Johnson Controls, another major player in the HVAC industry, entered into a strategic partnership with Samsung C&T Corporation to expand its presence in the South Korean market. The collaboration included the transfer of technology and expertise, aiming to strengthen Johnson Controls' position in the region and increase its market share (Johnson Controls press release).

- In February 2025, LG Electronics, a South Korean multinational electronics company, secured a significant investment of USD300 million from Goldman Sachs to expand its production capacity for air conditioning systems, including AHUs. This investment would enable LG to meet the growing demand for energy-efficient HVAC solutions and strengthen its competitive position in the global market (Bloomberg).

- In May 2025, the European Union passed the new Energy Performance of Buildings Directive (EPBD), which mandated the installation of energy-efficient AHUs in all new and existing buildings. This policy change is expected to drive significant growth in the European the market, as building owners and operators seek to comply with the new regulations (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Handling Unit Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.22% |

|

Market growth 2024-2028 |

USD 4699 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.43 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The air handling unit (AHU) market continues to evolve, driven by the growing demand for energy efficiency, humidity control, and thermal comfort levels in various sectors. Building automation systems are increasingly integrating advanced technologies such as variable speed drives, temperature regulation, and performance monitoring to optimize HVAC efficiency. For instance, a large commercial building implemented energy modeling and demand-controlled ventilation, resulting in a 20% reduction in energy consumption. Moreover, air quality control and noise reduction techniques are gaining significance in the market. Air handling units are being designed with filtration systems, energy recovery ventilation, and fan motor efficiency to ensure optimal indoor air quality and reduce noise levels.

- The market is also witnessing the adoption of sensor integration, control algorithms, and refrigerant management to enhance system diagnostics and component lifecycle. The global AHU market is expected to grow at a robust pace, with industry experts projecting a growth rate of over 5% per annum. This growth is attributed to the ongoing demand for air handling units in sectors such as healthcare, education, and hospitality, where maintaining thermal energy storage, air change rate, and fault detection diagnostics are crucial for maintaining optimal indoor environments. Additionally, the increasing focus on duct design optimization, airflow optimization, heat exchanger design, and air distribution patterns is expected to fuel market growth.

What are the Key Data Covered in this Air Handling Unit Market Research and Growth Report?

-

What is the expected growth of the Air Handling Unit Market between 2024 and 2028?

-

USD 4.7 billion, at a CAGR of 8.22%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Non-residential and Residential), Capacity (Up to 5000 m3 per hour, Above 15000 m3 per hour, and 5000 to 15000 m3 per hour), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Product (Single Flux, Double Flux, Single Flux, and Double Flux), and Type (Packaged, Modular, Packaged, and Modular)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing construction sector, High market competition

-

-

Who are the major players in the Air Handling Unit Market?

-

American Air Filter Co. Inc., Arbonia AG, Ariston Holding NV, Breezeair Technology, Carrier Global Corp., Cooke Industries, Daikin Industries Ltd., Desiccant Technologies Group, Environmental Air Systems LLC, Euroclima AG, Fischbach Luft und Ventilatorentechnik GmbH, FlaktGroup Holding GmbH, Heinen and Hopman, Johnson Controls International Plc., Lennox International Inc., MANDIKA AS, MIDEA Group Co. Ltd., Systemair AB, Trane Technologies plc, and VTS Polska Sp. z o. o.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry that encompasses various aspects of design, installation, and maintenance. Two significant statistics illustrate its continuous growth. First, the market for air handling units has experienced a steady increase in demand, with sales expanding by approximately 5% year-over-year. Second, industry experts anticipate a continued growth trajectory, projecting a compound annual expansion rate of around 4% over the next decade. Air handling units play a crucial role in maintaining optimal indoor environments, ensuring proper commissioning processes, adhering to code compliance, and implementing maintenance protocols. These systems incorporate essential components such as sensors for airflow measurement, pressure drop calculations, and control sequences.

- Additionally, safety protocols, data logging systems, and remote monitoring are integral features that contribute to system redundancy and energy efficiency. For instance, a building project implemented a predictive maintenance strategy for its air handling units, resulting in a 15% reduction in maintenance costs and a 10% increase in system lifespan. This proactive approach not only improved operational efficiency but also ensured a more consistent indoor environment for occupants. In summary, the market represents a continually evolving industry, with a steady growth rate and a focus on enhancing system performance through innovative technologies and maintenance strategies.

We can help! Our analysts can customize this air handling unit market research report to meet your requirements.