Air Quality Monitor Market Size 2025-2029

The air quality monitor market size is forecast to increase by USD 2.29 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing awareness and necessity of monitoring indoor air quality in both residential and commercial sectors. This trend is further fueled by the rising adoption of green buildings, which prioritize energy efficiency and occupant health. However, the high cost of deploying air quality monitoring devices remains a significant challenge for market expansion. Despite this obstacle, companies can capitalize on the growing demand for indoor air quality solutions by offering cost-effective and efficient monitoring technologies.

- Additionally, partnerships with real estate developers and building management companies can provide lucrative opportunities for market growth. Overall, the market presents a promising landscape for companies seeking to address the growing need for indoor air quality monitoring while navigating the challenge of affordability.

What will be the Size of the Air Quality Monitor Market during the forecast period?

- The market continues to evolve, driven by growing health concerns and the need for real-time, data-driven solutions. Ambient air quality plays a significant role in public health, with health risks associated with air pollution levels. Remote monitoring through cloud-based platforms enables air quality management, allowing for proactive responses to changing conditions. Infrared sensors and machine learning algorithms are used for particle matter detection, while ultrasonic sensors measure sound levels. Energy efficiency is a key consideration, with sensor fusion and data analysis techniques improving sensor reliability and accuracy. Air filtration systems, nitrogen dioxide sensors, and mobile apps are integral components of air quality management.

- Laser particle counters and mass spectrometry are used for industrial emissions monitoring. Multi-sensor systems and predictive analytics enable compliance reporting and data visualization. Carbon monoxide, sulfur dioxide, and volatile organic compounds are among the gases monitored. The integration of artificial intelligence and smart cities enhances air quality management, with real-time monitoring and API integration facilitating building management and pollution control. Public awareness campaigns and occupancy monitoring further optimize ventilation systems. Regulatory standards continue to evolve, driving innovation in sensor technology and data analysis techniques. Overall, the market is a dynamic and evolving landscape, with ongoing advancements in sensor technology, data analysis, and regulatory standards shaping its future.

How is this Air Quality Monitor Industry segmented?

The air quality monitor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Indoor

- Outdoor

- Wearable

- End-user

- Government

- Commercial and residential

- Energy and pharmaceuticals

- Others

- Type

- Chemical pollutants

- Physical pollutants

- Biological pollutants

- Component

- Hardware

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

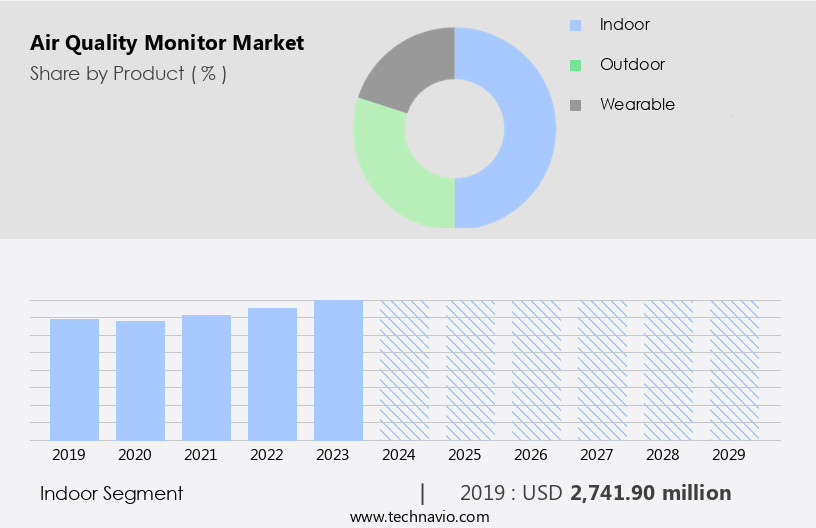

The indoor segment is estimated to witness significant growth during the forecast period.

Indoor air quality monitors are essential devices for assessing and maintaining healthy and comfortable environments within homes, offices, schools, hospitals, and other buildings. These monitors employ sensors and detectors to measure various parameters, such as temperature, humidity, carbon dioxide (CO2) levels, volatile organic compounds (VOCs), and particulate matter (PM), to evaluate indoor air quality. Real-time data and insights are provided through continuous monitoring, enabling building managers and occupants to address potential issues promptly. Advancements in technology have led to the integration of remote monitoring, cloud-based platforms, and the Internet of Things (IoT) in indoor air quality management.

These innovations facilitate real-time data analysis, predictive analytics, and compliance reporting. Sensor fusion, machine learning, and artificial intelligence are employed to enhance sensor reliability and accuracy, ensuring precise measurements. Indoor air quality is crucial for public health, as poor indoor air quality can lead to various health risks, including respiratory issues, headaches, and fatigue. Regulatory standards mandate specific air quality index (AQI) thresholds for various pollutants, making it essential for building managers to maintain optimal indoor air quality. Indoor air quality monitors utilize various sensors, including infrared, ultrasonic, electrochemical, metal oxide, and laser particle counters, to detect a wide range of pollutants.

Energy efficiency is a significant consideration in the design of these monitors, with many incorporating wireless connectivity and data logging for efficient data transfer and storage. Air filtration systems, ventilation systems, and air purification technologies are often integrated with indoor air quality monitors to ensure optimal air quality and maintain a healthy indoor environment. Multi-sensor systems and real-time monitoring enable early detection and mitigation of potential issues, reducing the risk of health hazards and ensuring regulatory compliance.

The Indoor segment was valued at USD 2.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

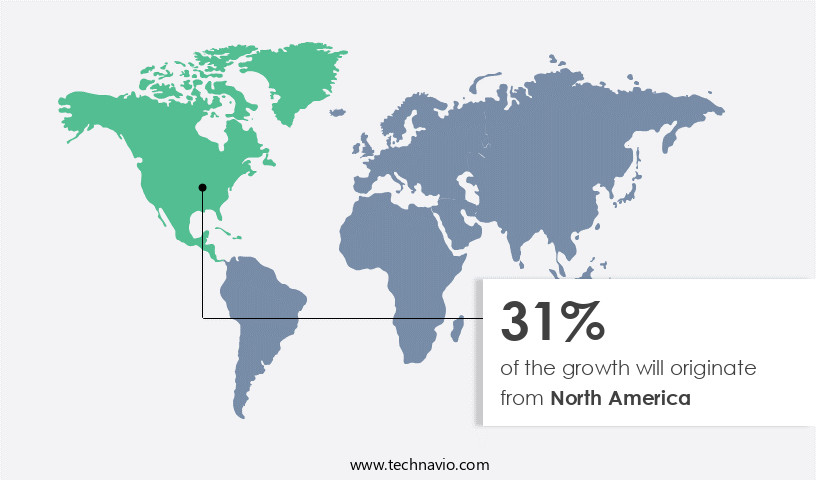

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global air quality control market is witnessing significant growth due to increasing health risks associated with ambient air pollution levels. The use of advanced technologies such as remote monitoring, cloud-based platforms, and sensor fusion with machine learning algorithms is driving the market. Infrared sensors and ultrasonic sensors are being extensively used for real-time monitoring of air quality index, particle matter, carbon monoxide, nitrogen dioxide, and sulfur dioxide. Energy efficiency is a key consideration in the market, with solutions that offer low power consumption and long sensor lifetime gaining popularity. Public awareness regarding indoor and outdoor air quality is on the rise, leading to the adoption of air quality management systems in buildings and smart cities.

Ventilation systems, air filtration, and air purification are essential components of these systems. Predictive analytics and data analysis are being used to identify patterns and trends in air quality data, enabling proactive measures to prevent health risks. Regulatory standards for air quality are becoming increasingly stringent, necessitating the use of reliable and accurate air quality sensors. Gas chromatography, mass spectrometry, and metal oxide sensors are commonly used for measuring various pollutants. Wireless connectivity and API integration enable easy data logging, compliance reporting, and data visualization. Industrial emissions and sound level are significant contributors to air pollution, leading to the adoption of industrial emissions monitoring systems and sound level monitors.

Multi-sensor systems are being used to measure multiple pollutants simultaneously, providing a comprehensive solution for air quality management. The US Environmental Protection Agency (EPA) is working to reduce air pollution in non-attainment areas by identifying areas that do not meet the national ambient air quality standards and developing plans to improve air quality. The Western parts of the US have experienced unprecedented wildfires, leading to increased demand for air quality monitoring systems. The Internet of Things (IoT) and artificial intelligence are being used to optimize air quality management, with solutions that offer real-time monitoring, predictive analytics, and data visualization.

Occupancy monitoring and ventilation systems are essential components of IoT-enabled air quality management solutions. The global air quality control market is expected to continue its growth trajectory, driven by increasing health risks associated with air pollution, regulatory requirements, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Air Quality Monitor Industry?

- The increasing recognition of the importance of indoor air quality in both residential and commercial sectors serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing awareness of the importance of maintaining healthy indoor environments. The adverse health effects of poor air quality, such as respiratory diseases, heart disease, and stroke, have become a major concern. In 2024, air pollution remained a critical global health issue, with the World Health Organization (WHO) reporting that millions of premature deaths occur annually due to air pollution. Despite ongoing efforts to improve air quality, 99% of the global population continues to breathe air that exceeds WHO guideline limits. Advanced technologies such as electrochemical sensors, smart cities, artificial intelligence, and multi-sensor systems are driving innovation in air quality monitoring.

- These technologies enable real-time monitoring of pollutants such as nitrogen dioxide, sound level, and mass spectrometry. Air filtration and air purification systems are also gaining popularity to mitigate the effects of indoor air pollution. Laser particle counters and industrial emissions monitoring are essential applications of air quality monitoring systems. These systems help in identifying and reducing the sources of air pollution, thereby improving overall air quality. Mobile apps and user-friendly interfaces make it easier for individuals and businesses to monitor and manage their air quality in real-time. In conclusion, the market is expected to grow significantly due to the increasing health concerns associated with poor air quality and the availability of advanced technologies for monitoring and mitigating air pollution.

- The need for cleaner and healthier indoor environments is a priority for individuals and businesses, making air quality monitoring a crucial investment.

What are the market trends shaping the Air Quality Monitor Industry?

- Green buildings are increasingly becoming the market trend due to their numerous benefits, such as energy efficiency and reduced carbon footprint. The adoption of green building practices is not only mandatory for organizations seeking sustainability but also for those aiming to stay competitive in the real estate industry.

- The market is experiencing significant growth due to the increasing emphasis on indoor environmental quality and regulatory compliance. Real-time monitoring of air quality is essential for ensuring health, comfort, and productivity in buildings. Regulations for outdoor air quality and pollution control are stringent in many countries, necessitating the use of advanced air quality monitoring technologies. Air quality sensors that detect sulfur dioxide, volatile organic compounds, and other pollutants are integral to these systems. Data visualization tools and API integration enable easy access to critical information, while metal oxide sensors provide accurate and reliable measurements.

- Compliance reporting is another key factor driving market growth, as organizations seek to meet regulatory standards and protect the health of their employees and customers. The trend towards green buildings is a significant market driver, as these structures prioritize air quality monitoring, ventilation management, humidity control, and indoor dust and gas level management. Air quality monitors are an essential component of these systems, helping to ensure the sustainability and high performance of green buildings. By investing in air quality monitoring technology, businesses can create healthier work environments, improve employee productivity, and enhance their reputation as environmentally responsible organizations.

What challenges does the Air Quality Monitor Industry face during its growth?

- The high cost of deploying air quality monitoring devices is a significant challenge impeding the growth of the industry.

- Air quality monitoring is a critical aspect for various sectors, including industrial, commercial, and residential buildings. Indoor and outdoor air quality needs to be monitored according to specific requirements. Advanced air quality sensors for continuous monitoring can be costly, with each station costing upwards of USD250,000 for a network around a facility. This high cost poses a challenge for widespread adoption. In developing countries, such as India, the lack of real-time air quality monitoring stations in cities has led to a demand for affordable monitoring solutions.

- Indoor air quality is particularly important, as it significantly impacts the health and satisfaction of building occupants. Industrial facilities, commercial buildings, and healthcare facilities prioritize indoor air monitoring to maintain optimal conditions. Despite the challenges, the importance of air quality monitoring continues to emphasize the need for innovative and cost-effective solutions.

Exclusive Customer Landscape

The air quality monitor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air quality monitor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air quality monitor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing advanced air quality monitoring solutions, featuring the EVM 7, EVM 4, and EVM 3 models. These innovative devices detect and analyze various pollutants, ensuring indoor environments maintain optimal air quality. By utilizing cutting-edge technology, these monitors elevate health and safety standards, providing real-time data for informed decision-making. The company's commitment to research and development drives continuous improvement, ensuring clients access the most accurate and reliable air quality solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ACOEM Group

- Aeroqual

- Agilent Technologies Inc.

- Airthinx Inc.

- Atmotech Inc.

- Emerson Electric Co.

- General Electric Co.

- HANGZHOU ZETIAN TECHNOLOGY CO. LTD.

- Honeywell International Inc.

- HORIBA Ltd.

- IQAir AG

- Merck KGaA

- Perkin Elmer Inc.

- Siemens AG

- Testo SE and Co. KGaA

- Thermo Fisher Scientific Inc.

- Tisch Environmental Inc.

- TSI Inc.

- Vaisala Oyj

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Quality Monitor Market

- In February 2024, Honeywell announced the launch of its new Air Quality Control System, integrating advanced air filtration technologies and real-time monitoring capabilities, aiming to cater to the increasing demand for indoor air quality solutions in commercial buildings (Honeywell Press Release, 2024).

- In July 2025, Sensirion AG, a leading sensor manufacturer, entered into a strategic partnership with Microsoft to develop and commercialize IoT-based air quality monitoring solutions. This collaboration is expected to accelerate the adoption of smart air quality monitoring systems in various industries (Microsoft News Center, 2025).

- In September 2024, Aclima, a pioneer in sensor technologies, raised USD30 million in a Series C funding round led by Breakthrough Energy Ventures. The funds will be used to expand their product offerings and scale their air quality monitoring solutions for various applications, including transportation and industrial emissions monitoring (Business Wire, 2024).

- In December 2025, the European Union passed the new Air Quality Directive, setting stricter limits for air pollutants and mandating the installation of real-time air quality monitoring systems in densely populated areas. This regulatory initiative is expected to drive significant growth in the European air quality monitoring market (European Commission, 2025).

Research Analyst Overview

The market is witnessing significant activity and trends as ambient monitoring becomes a priority for governments and businesses alike. Air quality policies and standards are driving the demand for advanced sensor networks to ensure compliance with regulations and green building certification. Energy conservation and sustainable development are also key factors, as air pollution mitigation efforts intersect with the need to reduce greenhouse gas emissions. Community engagement is crucial in addressing air quality concerns, leading to the rise of citizen science initiatives and open data platforms for air quality reporting. Cardiovascular disease and respiratory illnesses are major health issues linked to poor air quality, making air quality indexes and forecasting essential tools for public health.

Air quality legislation and regulations continue to evolve, with a focus on personal air quality and air quality alerts. Companies are responding by integrating real-time monitoring and reporting into their operations, reducing their carbon footprint and contributing to clean air initiatives. As climate change becomes a pressing concern, the importance of addressing air quality and its impact on the environment and public health is increasingly recognized. The integration of air quality data into building performance assessments and greenhouse gas emissions reporting is a promising development for the future of this market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Quality Monitor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 2289.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Germany, UK, Canada, France, India, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Quality Monitor Market Research and Growth Report?

- CAGR of the Air Quality Monitor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air quality monitor market growth of industry companies

We can help! Our analysts can customize this air quality monitor market research report to meet your requirements.