Aircraft Ejection Seats Market Size 2024-2028

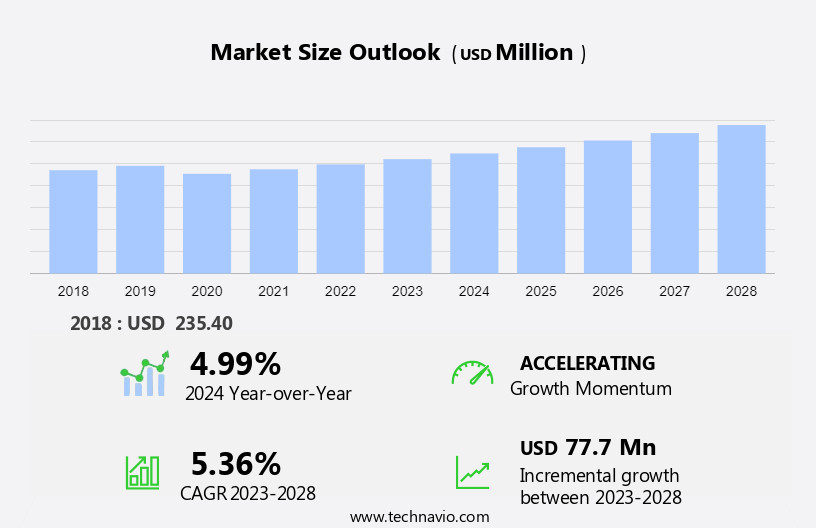

The aircraft ejection seats market size is forecast to increase by USD 77.7 mn at a CAGR of 5.36% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for military helicopters and aircraft worldwide. The importance of aviation safety, particularly in military applications, is driving the market's expansion. Moreover, recent advancements in ejection seat technology, such as the integration of parachutes, are enhancing the safety and survivability of pilots. The market is evolving with advancements in safety technology, as Unmanned Aerial Vehicles(UAV) developments influence design innovations for enhanced crew protection in both manned and unmanned aircraft. However, cost constraints remain a challenge for market growth. Despite these challenges, the market is expected to continue its upward trajectory, fueled by the need for advanced safety systems in aviation.

What will be the Size of the Aircraft Ejection Seats Market During the Forecast Period?

- The market encompasses the production and supply of ejection seats for various types of aircraft, including combat aircraft, trainer aircraft, and helicopters, used by both defense and civil aviation sectors. The market's growth is driven by the increasing focus on pilot safety, particularly In the context of military operations and combat situations. The demand for ejection seats is influenced by safety standards set by aviation authorities, military exercises, and fleet modernization programs. The market includes both single-seat and twin-seat ejection seats, with the former being more commonly used in combat aircraft and the latter in trainer aircraft.

- The ejection seats utilize rocket motors to propel crew members out of the cockpit In the event of an air crash or during battlefield operations. The arms race among military forces for enhanced military strength continues to fuel the market's expansion, with applications extending to light commercial aircraft as well.

How is this Aircraft Ejection Seats Industry segmented and which is the largest segment?

The aircraft ejection seats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Combat aircraft

- Training aircraft

- Type

- Single seat

- Twin seat

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- Middle East and Africa

- South America

- Europe

By Application Insights

- The combat aircraft segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the increasing demand for advanced combat capabilities in defense forces. With ongoing geopolitical conflicts and the need for pilot safety in combat operations, the market for aircraft ejection seats is expected to grow significantly. Combat aircraft, including fighter planes and combat helicopters, account for a large share of the market due to their critical role in military strength. Modernization of aircraft fleets is a priority for many defense forces, leading to an increase In the demand for new ejection seats In these aircraft. Safety standards and crew member survival rates are crucial considerations In the design and development of ejection seats.

Moreover, flight instructors and pilot training programs also play a significant role in ensuring the effective use of ejection seats in various aircraft, including single-seat and twin-seat trainer aircraft. Cockpit equipment, such as catapults, rollers, restraint systems, headrests, and canopies, are essential components of ejection seats. Advanced technologies, including rocket motors, explosive charges, and parachutes, are used to ensure a quick and safe ejection for pilots In the event of an airplane crash or terminal failure of aircraft systems. Military sector investments in combat operations, military exercises, and arms race continue to fuel the demand for advanced ejection seats. Civil aviation authorities also play a role in ensuring the safety and certification of ejection seats for commercial aircraft. The parachute activation time and safety of pilots are critical factors In the design and development of ejection seats. Overall, the market for aircraft ejection seats is expected to grow significantly due to the increasing demand for advanced safety features in both the military and civil aviation sectors.

Get a glance at the Aircraft Ejection Seats Industry report of share of various segments Request Free Sample

The Combat aircraft segment was valued at USD 194.80 mn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Another region offering significant growth opportunities to companies is Europe. The European market is experiencing significant growth due to increasing military expenditures, geopolitical tensions, and the expanding aviation industry. Key European countries, including the UK, France, Germany, Italy, and Russia, with substantial military forces, require a large fleet of military aircraft. The market is further fueled by the predicted demand for 39,490 new passenger and freighter aircraft over the next two decades, as per Airbus. Additionally, factors such as rising airport numbers, increasing air traffic, and the need for advanced safety features in both military and civilian aircraft are driving market growth. Aircraft ejection seats are essential safety equipment for pilots and crew members in combat aircraft, trainer jets, single-seat and twin-seat fighter planes, combat helicopters, and light commercial aircraft.

These seats utilize various technologies, such as rocket motors, explosive charges, and catapults, to safely eject the pilot or crew members In the event of an air crash or terminal failure. Safety standards and cockpit equipment continue to evolve, with improvements in parachute activation time, canopy design, rollers, restraint systems, headrests, and catapults. Military exercises and the arms race for military strength further boost market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aircraft Ejection Seats Industry?

Increasing demand for military aircraft globally is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for advanced military aircraft in response to geopolitical tensions and security concerns worldwide. Military spending is on the rise as countries prioritize the acquisition of combat aircraft, fighter planes, combat helicopters, and trainer aircraft to maintain military strength and ensure national security. The market is driven by the need for crew members and pilot safety In the event of aircraft crashes or terminal failure of aircraft systems. Safety standards are a critical consideration In the design and implementation of aircraft ejection seats. These seats use various mechanisms, such as rocket motors, catapults, and parachutes, to ensure the safety of pilots and crew members during battlefield operations.

- The market is also witnessing the development of advanced ejection seats with shorter parachute activation times and improved restraint systems for better survival rates. Military exercises and fleet modernization programs are further driving the demand for aircraft ejection seats. For instance, the F-35 aircraft, a single-seat, twin-engine, multirole fighter, is equipped with an advanced ejection seat system. Similarly, Rafale jets and other combat aircraft are also integrating advanced ejection seat systems to enhance the safety of pilots and crew members during combat operations. The market for aircraft ejection seats is not limited to military aircraft but also extends to civil aviation.

What are the market trends shaping the Aircraft Ejection Seats Industry?

A growing number of recent developments related to aircraft ejection seats is the upcoming market trend.

- Aircraft ejection seats have experienced significant advancements, driving market expansion In the defense and military sectors. These developments underscore the importance of ejection seats in ensuring the safety of pilots and crew members during combat operations and pilot-related crashes. Safety standards continue to evolve, with faster parachute activation times, advanced cockpit equipment, and improved catapult and restraint systems.

- Furthermore, fleet modernization and geopolitical conflicts fuel the demand for these critical components in combat helicopters, fighter planes, trainer aircraft, and single/twin-seat airplanes. Military exercises and the arms race for military strength further contribute to the market's growth. Ejection seats are essential military equipment, enabling pilots to safely exit their aircraft during terminal failure or battlefield operations. The market encompasses various components, including rocket motors, parachutes, canopies, and catapult guns. Aircraft systems manufacturers continue to innovate, ensuring the highest safety standards for pilots and crew members in both military and civil aviation.

What challenges does the Aircraft Ejection Seats Industry face during its growth?

Cost constraints associated with aircraft ejection seats is a key challenge affecting the industry growth.

- The market faces significant cost constraints, which can negatively affect both buyers and manufacturers. These advanced safety systems necessitate substantial investments in research, development, and manufacturing. The expenses related to designing, engineering, and producing ejection seats, especially for advanced models featuring innovative technologies and materials, can be considerable. Strict safety regulations, rigorous testing, and certification processes also contribute to the high costs. For instance, Martin Baker, a prominent market participant, offers ejection seats priced between USD 140,000 and USD 400,000. These costs can impact competition within the market. Armed forces worldwide prioritize crew members' safety, particularly in pilot-related crashes and combat operations.

- Safety standards for ejection seats are rigorous, ensuring high survival rates for pilots and flight instructors during air crashes. Geopolitical conflicts and fleet modernization initiatives in defense forces necessitate the use of combat aircraft, fighter planes, Rafale jets, trainer aircraft, single-seat, and twin-seat aircraft. Ejection seats are essential for crew members' safety during terminal failure or aircraft system malfunctions. The market dynamics involve military sector investments in combat helicopters, light commercial aircraft, canopy, catapult gun, rollers, restraint systems, headrest, catapult, rocket, and parachute technologies. The military exercises, arms race, and military strength requirements further fuel the demand for advanced ejection seats.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft ejection seats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airborne Systems

- BAE Systems Plc

- EDM Ltd.

- Jet Art Aviation

- Martin-Baker Aircraft Co. Ltd.

- Rostec

- RTX Corp.

- RUAG International Holding Ltd.

- Survival Equipment Services

- ZLIN AERO a.s.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a critical segment of the aerospace industry, focusing on the design, production, and integration of ejection seats into various types of aircraft. These safety systems are essential for ensuring the survival of crew members and pilots In the event of an aircrash or other catastrophic incidents. Safety standards have been a primary driving force behind the development and continuous improvement of aircraft ejection seats. With the increasing complexity of modern combat aircraft and the escalating geopolitical conflicts, the need for reliable and effective ejection seats has become more crucial than ever. Pilot-related crashes have been a significant concern for the military sector, leading to extensive research and investment in advanced ejection seat technologies.

Moreover, the safety of pilots and crew members is paramount, and ejection seats play a pivotal role in minimizing fatalities and injuries during combat operations or training exercises. Fleet modernization programs have led to a growing demand for ejection seats, as defense forces worldwide seek to upgrade their aircraft with the latest safety features. The market is seeing growth due to the increasing demand for advanced safety features in military multirole aircraft, which require highly specialized ejection systems to ensure crew safety during critical missions. Combat aircraft, including fighter planes and combat helicopters, are primary users of these safety systems. The military sector's arms race has fueled the development of advanced ejection seat technologies, with various countries investing heavily in research and development. The integration of ejection seats into trainer aircraft, single-seat, and twin-seat aircraft has become a standard requirement for military forces.

Furthermore, the market is characterized by continuous innovation, with manufacturers focusing on reducing parachute activation time, improving survival rates, and enhancing the safety of pilots during ejection. The market is being revolutionized by the integration of IoT and artificial intelligence, enabling real-time monitoring and predictive analytics to enhance safety and performance during ejection events. The integration of rocket motors, catapult guns, rollers, restraint systems, headrests, and other advanced features has significantly improved the effectiveness of ejection seats. Civil aviation authorities have also recognized the importance of ejection seats in enhancing the safety of air travel. The integration of ejection seats into light commercial aircraft has become increasingly common, with manufacturers focusing on reducing size, weight, and cost while maintaining safety and reliability. The market is subject to various challenges, including the need for stringent safety standards, increasing competition, and the high cost of research and development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.36% |

|

Market Growth 2024-2028 |

USD 77.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.99 |

|

Key countries |

US, France, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Ejection Seats Market Research and Growth Report?

- CAGR of the Aircraft Ejection Seats industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft ejection seats market growth of industry companies

We can help! Our analysts can customize this aircraft ejection seats market research report to meet your requirements.