Aircraft Engine Electrical Wiring Harnesses and Cable Assembly Market Size 2024-2028

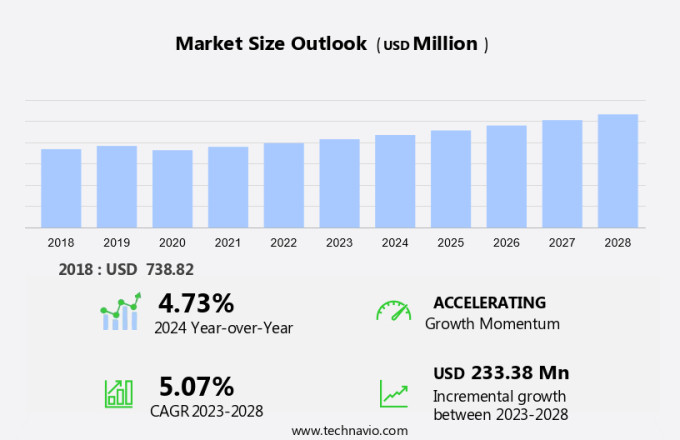

The aircraft engine electrical wiring harnesses and cable assembly market size is forecast to increase by USD 233.38 million at a CAGR of 5.07% between 2023 and 2028. The market is witnessing significant growth due to several driving factors. One of the primary growth factors is the increasing focus on the development and induction of new-generation fuel-efficient aircraft. This trend is leading to an increased demand for lightweight and efficient electrical wiring harnesses and cable assemblies, as well as the integration of solar panels to enhance energy efficiency and reduce fuel consumption. Another trend influencing the market is the development of CFRP-based electrical harnesses, which offer improved electrical conductivity, reduced weight, and enhanced durability. However, the market also faces challenges, particularly in the area of maintenance and repair. The complex nature of aircraft engine electrical systems and the high cost of replacement parts make it essential for manufacturers to develop reliable and long-lasting solutions. Additionally, the need for regulatory compliance and stringent safety standards further adds to the complexity of the market. Overall, the market is expected to witness steady growth in the coming years, driven by these trends and challenges.

The market is vital for ensuring reliable electrical power generation and distribution in modern aircraft. These systems facilitate mechanical energy conversion through alternators and generators, supporting various in-flight operations. Key components like voltage regulator, battery systems, and mobile ground power units enhance passenger comfort and operational efficiency. With a focus on sustainable energy and eco-friendly designs, manufacturers are prioritizing energy efficiency and smart power management. Redundancy in electrical systems, including backup systems and emergency procedures, is crucial for risk management and safety. Training and knowledge transfer ensure effective system diagnostics and proactive maintenance. As aircraft technology advances, modular design and system integration will shape the future outlook of the market, addressing electrical errors and enhancing overall performance. Portable power units, such as ground power unit (GPU), external power unit utilize starting engines driven mechanisms to convert engine RPM into electric current, providing both alternating current (AC) and direct current (DC) electrical output for battery charging and supporting various electrical systems through rectifiers and principles of electromagnetic induction.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Turbofan engine

- Turboprop engine

- End-user

- Commercial

- Military

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

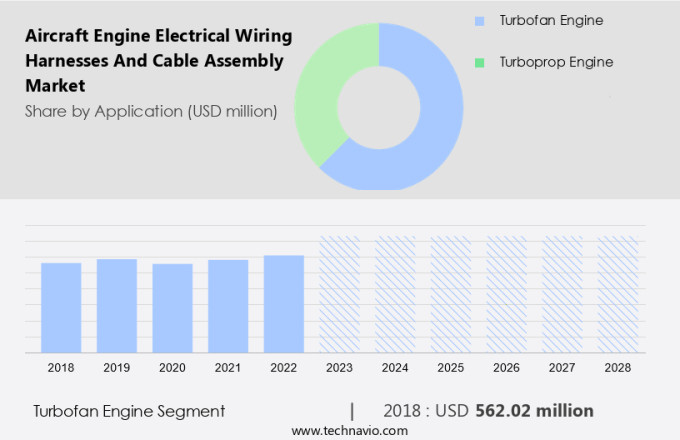

The turbofan engine segment is estimated to witness significant growth during the forecast period. The aerospace industry's advancement in aircraft technology has led to the widespread use of more efficient engine systems, such as turbofan engines, in both commercial and military aviation. Turbofan engines, also known as bypass jet engines, are utilized in high-speed fixed-wing aircraft and rotary wing aircraft, including UAVs. These engines are more fuel-efficient than turboprop or turbojet engines due to their ability to exhaust a portion of the air without passing it through the core, producing an additional thrust. The increasing adoption of turbofan engines necessitates the use of lightweight components, including electrical harnesses and cable assemblies, to optimize aircraft performance, safety, and fuel efficiency.

Further, engine wire harnesses are essential for data signal transmission between various engine systems and the aircraft's electrical systems. Composite materials are increasingly being used to manufacture these harnesses and cable assemblies due to their ability to withstand harsh operating conditions during flight. The aerospace industry's focus on reducing weight and improving fuel efficiency has led to the integration of advanced materials and technologies in aircraft design. Military and commercial airlines, as well as regional carriers, are investing in the latest aviation technologies to enhance aircraft capabilities, meet cargo transportation needs, and stay competitive. The aviation industry's continued growth, coupled with defense budgets, is driving the demand for advanced electrical systems and components, including engine wire harnesses and cable assemblies.

Get a glance at the market share of various segments Request Free Sample

The turbofan engine segment was valued at USD 562.02 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

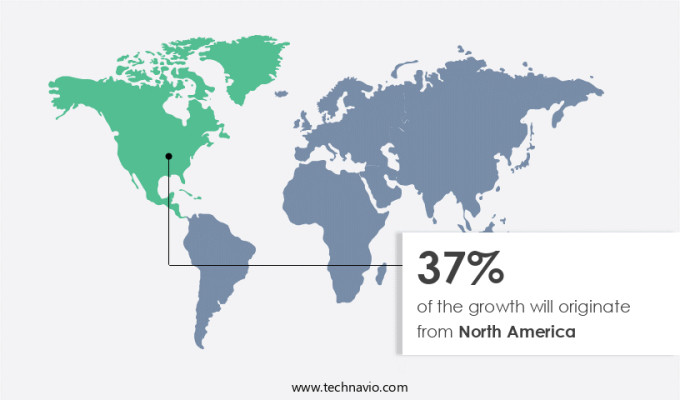

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The civil aircraft industry in North America is experiencing significant growth due to fleet modernization and a focus on environmental sustainability. This trend is driven by the large aviation market in the region, particularly in the United States, which manufactures a substantial portion of aircraft for customers in the Middle East and Asia-Pacific. The demand for aircraft engine electrical wiring harnesses and cable assemblies is consequently high, with applications ranging from fiber optic cables for in-flight connectivity and passenger experience enhancement, to high temperature cables for electric aircraft and fire resistance. Sustainability and environmental consciousness are key priorities, leading to the increased use of lightweight and electromagnetic interference (EMI) shielded cables. Unmanned aerial vehicles (UAVs) also require specialized wiring harnesses and cable assemblies for their complex electrical systems. Military aircraft procurement programs, such as the Joint Fighter and the KC-46A aerial refueling tanker, further fuel the demand for these components.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Aircraft Engine Electrical Wiring Harnesses and Cable Assembly Market Driver

Increasing focus on the development and induction of new-generation fuel-efficient aircraft is the key driver of the market. In the aerospace industry, the increasing focus on fuel efficiency and reducing ownership costs has led to significant advancements in aircraft technology. One such development is the integration of more electric and all electric aircraft (MEA and AEA) into existing fleets. This involves replacing pneumatic and hydraulic systems with electric solutions for actuation and air conditioning. Aircraft engines, such as Turbofan, Turboprop, and Turbojet, used in fixed-wing and rotary-wing aircraft, as well as Unmanned Aerial Vehicles (UAVs), are being electrified. The aerospace sector, including commercial aviation and military aviation, is witnessing the adoption of electrical systems to improve aircraft performance, safety, and fuel efficiency.

This shift towards electrification also benefits defense forces by reducing weight, improving reliability, and decreasing maintenance costs. Key applications include engine wire harnesses for Smart glasses and data signal transmission in engine systems. The aviation industry, including regional airlines and commercial and military fleets, is embracing these aerospace technologies to meet the demands of air travel and defense budgets.

Aircraft Engine Electrical Wiring Harnesses and Cable Assembly Market Trends

The development of CFRP-based electrical harnesses is the upcoming trend in the market. In the aerospace industry, aircraft engine electrical wiring harnesses and cable assemblies play a crucial role in ensuring the seamless functioning of engine systems in both commercial and military aircraft. These components are essential for transmitting data signals and power to various engine sub-systems, including those in Turbofan, Turboprop, and Turbojet engines. With the increasing focus on cargo transportation needs and air travel, the demand for fuel-efficient and lightweight aircraft is on the rise. Engine wire harnesses and cable assemblies made from advanced materials like composites are increasingly being used to meet these requirements. Composites, such as Carbon Fiber Reinforced Polymer (CFRP)-based parts and components, are transforming the aerospace industry by reducing the weight of aircraft while enhancing their performance and safety.

The use of these materials in manufacturing fans, turbine blades, and protective cases is contributing to the overall reduction in the weight of aircraft engines. In addition, the harsh operating conditions of aircraft, including flight in extreme temperatures and humidity levels, necessitate the use of reliable and durable electrical wiring harnesses and cable assemblies. The aerospace industry, including commercial aviation and military aviation, is continuously investing in aviation technologies to meet the evolving needs of airlines, defense forces, and aircraft fleets. The integration of smart glasses and advanced electrical systems, such as hydraulic systems, further enhances the capabilities of aircraft and supports the industry's efforts towards fuel efficiency and safety.

Aircraft Engine Electrical Wiring Harnesses and Cable Assembly Market Challenge

Maintenance and repair challenges associated with aircraft engine wire harness and cable assembly is a key challenge affecting the market growth. In the aerospace industry, aircraft engine electrical wiring harnesses and cable assemblies play a crucial role in ensuring the proper functioning of engine systems in both commercial and military aircraft. These components transmit data signals between various parts of the aircraft, including engine systems, hydraulic systems, and avionics. Aircraft engines, such as Turbofan, Turboprop, and Turbojet, in fixed-wing aircraft and rotary-wing aircraft, as well as Unmanned Aerial Vehicles (UAVs), require full electrical systems to meet the harsh operating conditions of flight. The aerospace industry, including commercial aviation and military aviation, relies on advanced cable assemblies and harnesses to enhance aircraft performance, improve safety, and increase fuel efficiency.

Regulatory bodies like the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) set stringent standards to ensure airworthiness, with a focus on safety and reliability. Aircraft fleets, including those used by airlines and defense forces, must adhere to these regulations to maintain air travel's integrity. The challenge for the aviation industry is to determine the optimal replacement or repair schedule for these essential components, balancing the need for weight reduction, space efficiency, and cost-effectiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AMETEK Inc. - The company offers aircraft engine electrical wiring harnesses and cable assembly for marine, land and aerospace applications.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Corp.

- Bel Fuse Inc.

- Carlisle Companies Inc.

- Consolidated Electronic Wire and Cable

- Eaton Corp. Plc

- ECI Inc.

- Glenair Inc.

- HarcoSemco LLC

- John Wood Group PLC

- kSARIA Corp.

- Lockheed Martin Corp.

- Melrose Industries Plc

- Miracle Electronics Devices Pvt. Ltd.

- Raytheon Technologies Corp.

- Rockford Components Ltd.

- Safran SA

- Silver Fox Ltd.

- TE Connectivity Ltd.

- W. L. Gore and Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is crucial for the efficient operation of turbine engines and related electrical systems. These assemblies ensure effective voltage regulation, circuit protection, and reliable power sources for essential components like lighting systems, instruments, and emergency systems. Monitoring tools such as voltmeters, ammeters, and loadmeters help manage battery charge and detect electrical spikes.

Features like trickle chargers and alternator switches enhance system simplicity and reliability. Strong designs incorporate fuses and circuit breakers to safeguard against electrical noise and potential alternator failure. In alignment with green initiatives, the market focuses on energy-efficient solutions, essential for meeting airman certification standards. Overall, these advancements support safe instrument approaches and improve operational efficiency in aircraft like the Piper Arrow.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.07% |

|

Market growth 2024-2028 |

USD 233.38 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.73 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, Canada, China, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AMETEK Inc., Amphenol Corp., Bel Fuse Inc., Carlisle Companies Inc., Consolidated Electronic Wire and Cable, Eaton Corp. Plc, ECI Inc., Glenair Inc., HarcoSemco LLC, John Wood Group PLC, kSARIA Corp., Lockheed Martin Corp., Melrose Industries Plc, Miracle Electronics Devices Pvt. Ltd., Raytheon Technologies Corp., Rockford Components Ltd., Safran SA, Silver Fox Ltd., TE Connectivity Ltd., and W. L. Gore and Associates Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch