Alkyl Polyglycoside (APG) Market Size 2024-2028

The alkyl polyglycoside (APG) market size is forecast to increase by USD 531.43 million, at a CAGR of 6.89% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for consumer goods in developing countries. This trend is driven by the rising disposable income and changing consumer preferences towards eco-friendly and biodegradable personal care and cleaning products. APGs, as a key ingredient in these products, offer superior performance and safety benefits. However, the market faces challenges, primarily from the high production costs associated with the raw materials and complex manufacturing processes. Additionally, the strict regulatory requirements for APG production and the availability of alternative, cost-effective ingredients pose significant obstacles.

- Companies in the APG market must navigate these challenges by investing in research and development to improve production efficiency and explore new applications for APGs, ensuring their competitiveness and long-term growth in the market.

What will be the Size of the Alkyl Polyglycoside (APG) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ongoing quest for effective, eco-friendly surfactants in various sectors. APGs, a type of non-ionic surfactant, are derived from renewable resources, offering a sustainable alternative to traditional petroleum-based surfactants. Their unique micelle formation and technical specifications enable them to function as effective foaming agents in detergent formulations, mild surfactants in cleaning agents, and bio-based surfactants in cosmetics. APGs' hydrophilic-lipophilic balance (HLB) and energy efficiency make them a preferred choice for industrial cleaning applications, while their ability to reduce surface tension and enhance product formulations contributes to their popularity in home care products.

The evolving supply chain and ingredient labeling requirements further fuel market growth. Bio-based surfactants, such as APGs, are gaining traction due to their reduced environmental impact and alignment with consumer preferences for sustainable practices. The industry is also focusing on optimizing production methods, reducing waste, and minimizing carbon footprint through green chemistry and distribution channel innovations. However, the market dynamics are not without challenges. Cost analysis, pricing strategies, and glycoside hydrolysis are critical areas of focus for manufacturers to maintain product quality and competitiveness. The ongoing research and development in this sector aim to address these challenges, ensuring the continuous unfolding of market activities and evolving patterns.

How is this Alkyl Polyglycoside (APG) Industry segmented?

The alkyl polyglycoside (APG) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Manufacturing Type

- Acid catalysis

- Enzymatic catalysis

- Application

- Home care products

- Personal care

- Industrial cleaners

- Agricultural chemicals

- Others

- Product

- Fatty Alcohol

- Sugar

- Cornstarch

- Vegetable Oil

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Manufacturing Type Insights

The acid catalysis segment is estimated to witness significant growth during the forecast period.

Non-ionic surfactants, a key segment in the cleaning and detergent industry, are gaining popularity due to their mild nature and effectiveness. Purification techniques play a crucial role in ensuring the quality of these surfactants, particularly Alkyl Polyglycosides (APGs), which are derived from sugar surfactants. APGs are used in various applications, including home care products, industrial cleaning, and cosmetics, due to their foaming properties, technical specifications, and environmental sustainability. The production of APGs involves the reaction of sugars with alcohols, catalyzed by mineral acids such as sulfuric acid. The process results in the formation of micelles, which are essential for the surfactant's cleaning and emulsifying properties.

Renewable resources, such as plant-derived sugars, are increasingly being used to produce bio-based surfactants, aligning with consumer preferences for eco-friendly products. Packaging materials and waste management are critical aspects of the APG market. Sustainable practices, such as the use of biodegradable packaging and efficient energy utilization, are becoming increasingly important to reduce the industry's carbon footprint. Cost analysis and pricing strategies are also essential factors, with companies focusing on optimizing production methods and supply chain logistics to remain competitive. Product innovation, driven by advances in green chemistry and chemical synthesis, continues to shape the market. Application analysis and quality control are essential to ensure the effectiveness and safety of APGs in various industries.

The distribution channels for APGs are diverse, with global players dominating the market while local and regional players cater to specific niches. In conclusion, the APG market is driven by the demand for mild surfactants, the shift towards renewable resources, and the need for sustainable production methods. The market's dynamics are influenced by various factors, including consumer preferences, pricing strategies, and technical specifications. Companies must focus on innovation, efficiency, and sustainability to remain competitive in this evolving market.

The Acid catalysis segment was valued at USD 824.63 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

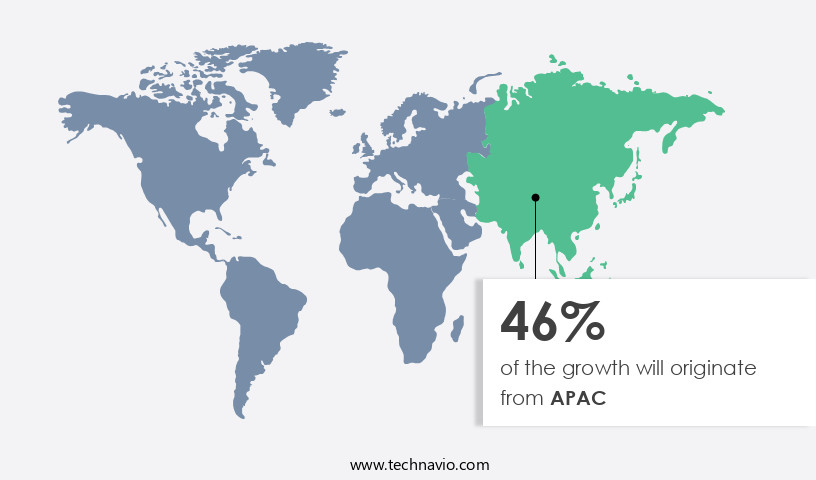

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing notable growth due to the region's rapid industrialization and increasing demand for various applications, including agrochemicals, cosmetic additives, food additives, and industrial cleaners. APG, a type of non-ionic surfactant, is derived from renewable resources, making it an attractive alternative to traditional petroleum-based surfactants. Purification techniques play a crucial role in the production of APG, ensuring the highest quality standards. Detergent formulations and cleaning agents incorporate APG for their mild foaming properties and excellent technical specifications. Consumer preferences towards eco-friendly and sustainable products have led to a rise in demand for bio-based surfactants like APG.

The environmental impact of APG production is minimal, as it is biodegradable and has a lower carbon footprint compared to petroleum-based surfactants. Sustainable practices, such as waste management and energy efficiency, are essential considerations in the APG supply chain. Packaging materials are a significant concern for the APG industry, with a focus on reducing packaging waste and promoting recycling. Product innovation and application analysis are essential for companies to remain competitive in the market. Industrial cleaning applications, cosmetics ingredients, and home care products are among the major sectors driving the growth of the APG market. Production methods, such as chemical synthesis and glycoside hydrolysis, are continually evolving to improve efficiency and reduce costs.

The hydrophilic-lipophilic balance (HLB) of APG is a critical factor in its performance, influencing its ability to form micelles and reduce surface tension. Cost analysis and pricing strategies are essential for companies to remain competitive in the market. In conclusion, the APG market in Asia Pacific is poised for significant growth, driven by the region's industrialization, consumer preferences, and the increasing demand for eco-friendly and sustainable products. The market's evolution is characterized by advancements in production methods, packaging materials, and product innovation, as well as a focus on sustainability and cost efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Alkyl Polyglycoside (APG) Industry?

- The significant surge in demand for consumer goods in developing countries serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand for mild surfactants in detergent formulations and cleaning agents. APG, a type of non-ionic surfactant, is derived from renewable resources such as sugar surfactants. The market dynamics are driven by consumer preferences for eco-friendly and biodegradable products, which have a minimal environmental impact. Purification techniques have been instrumental in enhancing the production efficiency and quality of APG. These techniques ensure the removal of impurities and improve the overall performance of APG in various applications. The market's growth is further propelled by the increasing adoption of APG in packaging materials due to its excellent emulsifying properties.

- The environmental impact of APG is a critical factor influencing its market growth. APG is biodegradable and free from heavy metals and phosphates, making it an attractive alternative to traditional surfactants. The market's pricing strategies are influenced by the cost of raw materials, production processes, and competition. The global market for APG is witnessing high growth due to the expanding consumer base and increasing purchasing power in developing economies, particularly in Asia Pacific and Latin America. The availability of raw materials, low labor costs, and favorable government policies in these regions are attracting OEMs to set up manufacturing facilities, further fueling market growth.

- The population growth and increasing income levels in these regions are expected to drive the demand for consumer goods, leading to a significant increase in the demand for APG. For instance, the population in India is projected to reach 1.43 billion by 2024, and the growing middle class in the country is expected to increase the demand for personal care and household products, leading to an increased demand for APG. In conclusion, the APG market is experiencing robust growth due to the increasing demand for eco-friendly and biodegradable surfactants, the availability of raw materials, and the expanding consumer base in developing economies.

- The market's growth is further driven by the adoption of advanced purification techniques and the increasing use of APG in packaging materials.

What are the market trends shaping the Alkyl Polyglycoside (APG) Industry?

- The professional and knowledgeable response to your inquiry is as follows: The personal care industry is currently experiencing a significant surge in demand, representing a notable market trend. This increasing need for personal care products underscores the growing importance consumers place on self-care and wellness.

- The market has experienced significant growth due to the increasing demand for bio-based surfactants in various industries, particularly in personal care applications. APG is known for its ability to form micelles, which enhances its foaming properties and makes it an ideal ingredient for cleansing products such as shampoos, shower gels, and hair conditioners. The mild nature of APG makes it gentle on the skin, making it a popular choice in personal care products. As consumers become more conscious of the environmental impact of their choices, there is a growing preference for renewable resources and sustainable ingredients. APG, derived from renewable resources, aligns with this trend.

- Furthermore, APG's production process is energy-efficient, adding to its appeal. Quality control is a crucial aspect of the APG market, with technical specifications ensuring consistency and reliability. The hydrophilic-lipophilic balance (HLB) of APG can be adjusted to suit various applications, making it a versatile ingredient. Ingredient labeling is essential in the personal care industry, and APG's clear labeling as a natural and biodegradable ingredient is a significant selling point. The supply chain for APG is well-established, ensuring a steady flow of product to meet the increasing demand. The market's growth is driven by the consumer's desire for environmentally friendly and ethically sourced products, making APG an essential ingredient in the personal care industry.

What challenges does the Alkyl Polyglycoside (APG) Industry face during its growth?

- Ensuring the safety of cleaning personnel is a critical issue that significantly impacts the growth of the industry. This challenge necessitates implementing stringent safety protocols and providing adequate training to mitigate risks and ensure a healthy and productive work environment.

- The market is witnessing significant growth due to its increasing application in various industries, including home care products, cosmetics, and industrial cleaning. APGs are plant-derived surfactants that offer numerous benefits, such as biodegradability, low toxicity, and excellent foaming properties. In the home care sector, APGs are used in the formulation of various cleaning products, such as dishwashing liquids, laundry detergents, and all-purpose cleaners. These products are known for their eco-friendly properties, making them a popular choice among consumers seeking sustainable practices. Moreover, APGs are also gaining popularity in the cosmetics industry as ingredients due to their mildness and biodegradability.

- They are used in various personal care products, such as shampoos, body washes, and facial cleansers. In the industrial cleaning sector, APGs are used to manufacture cleaning agents for heavy-duty applications, such as floor cleaning, vehicle washing, and oil field operations. APGs offer several advantages over traditional surfactants, including their ability to reduce water hardness and improve the cleaning efficiency. Furthermore, APGs play a crucial role in waste management by reducing the amount of packaging waste generated by the cleaning industry. The use of APGs in product formulations leads to the production of biodegradable packaging, which is an essential step towards a circular economy.

- In conclusion, the Alkyl Polyglycoside market is driven by the increasing demand for eco-friendly and sustainable product formulations in various industries. The use of APGs in home care products, cosmetics, and industrial cleaning offers numerous benefits, including improved cleaning efficiency, reduced water hardness, and biodegradability. Additionally, the reduction of packaging waste generated by the cleaning industry is a significant advantage of APGs, making them a preferred choice for companies seeking to adopt sustainable practices.

Exclusive Customer Landscape

The alkyl polyglycoside (APG) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alkyl polyglycoside (APG) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, alkyl polyglycoside (APG) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air Liquide SA - Seppic S.A., a subsidiary of the company, specializes in the production and supply of Alkyl polyglycosides (APGs), including Montanov 68 and Montanov 202.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- BASF SE

- Clariant International Ltd.

- Croda International Plc

- Dow Chemical Co.

- FENCHEM

- Huntsman International LLC

- IRO Group Inc.

- Kao Corp.

- Lamberti SpA

- LG Household and Health Care Ltd.

- Merck KGaA

- Pilot Chemical Co.

- Spec Chem Industry Inc.

- SpecialChem S.A.

- Yangzhou Chenhua New Materials Co. Ltd.

- Dadia Chemicals Industries

- Hugo New Materials Wuhi Co. Ltd.

- Libra Speciality Chemicals Ltd.

- Shanghai Fine Chemical Co. Ltd.

- Shiv shakti Trading Corp.

- Yixing Jinlan Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Alkyl Polyglycoside (APG) Market

- In January 2024, BASF SE, a leading chemical producer, announced the expansion of its production capacity for Alkyl Polyglycosides (APGs) at its site in Ludwigshafen, Germany. This expansion aimed to cater to the growing demand for sustainable surfactants in various industries (BASF press release, 2024).

- In March 2024, Croda International Plc, a specialty chemicals company, launched a new APG-based product, CrodaCare APG-Eco, designed for use in personal care applications. This product was marketed as a more sustainable alternative to traditional surfactants, aligning with consumer preferences for eco-friendly personal care products (Croda press release, 2024).

- In May 2024, Clariant AG, a specialty chemical company, entered into a strategic partnership with a leading Chinese APG producer to expand its presence in the Chinese market. This collaboration aimed to leverage Clariant's expertise in specialty chemicals and the partner's local market knowledge to offer innovative APG-based solutions to customers in China (Clariant press release, 2024).

- In April 2025, Evonik Industries AG, a German specialty chemicals company, received regulatory approval from the European Chemicals Agency (ECHA) for its new APG product, Evonik RHEOMOL Surfactin APG. This approval marked a significant milestone in the commercialization of this product, which was designed for use in various industries, including agriculture, construction, and oilfield (Evonik press release, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing demand for eco-friendly, bio-based alternatives to traditional anionic and cationic surfactants in various industries. APGs, derived from renewable resources such as fatty acids and sugars, offer advantages in terms of skin and eye irritation reduction, cleaning efficacy, and longer shelf life compared to their petroleum-based counterparts. UV-Vis spectroscopy and other analytical techniques, including infrared spectroscopy (IR) and mass spectrometry (MS), play a crucial role in understanding the degradation pathway and quality assessment of APGs. Packaging design is another critical factor influencing market trends, as consumers increasingly seek sustainable and eco-friendly solutions.

- Formulation optimization, utilizing non-ionic surfactant alternatives like propylene glycol, polyoxyethylene (POE), and polyethylene glycol (PEG), is essential for enhancing APG performance and consumer acceptance. Industry standards and regulations, such as those related to sustainability and bio-based content, are driving innovation in the development of palm oil alternatives and other renewable feedstocks. Future trends include the exploration of surfactant blends, amphoteric surfactants, and sustainable sourcing practices to address the evolving needs of consumers and industries. Brand awareness and consumer behavior continue to shape market dynamics, emphasizing the importance of continuous research and development in this dynamic and evolving market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Alkyl Polyglycoside (APG) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.89% |

|

Market growth 2024-2028 |

USD 531.43 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.46 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Alkyl Polyglycoside (APG) Market Research and Growth Report?

- CAGR of the Alkyl Polyglycoside (APG) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the alkyl polyglycoside (APG) market growth of industry companies

We can help! Our analysts can customize this alkyl polyglycoside (APG) market research report to meet your requirements.